XRP Up 400% In Three Months: A Detailed Market Analysis And Investment Advice.

Table of Contents

Factors Contributing to XRP's Price Surge

XRP's remarkable 400% increase isn't simply random; several interconnected factors have fueled this impressive rally. Let's explore the key elements driving this price surge and the impact they've had on XRP investment opportunities.

Ripple's Legal Victory: A Turning Point for XRP

The partial legal victory for Ripple Labs against the Securities and Exchange Commission (SEC) acted as a significant catalyst for XRP's price increase. The ruling, while not a complete exoneration, significantly shifted investor sentiment and market confidence.

- Clarity on Regulatory Uncertainty: The court's decision provided much-needed clarity regarding the classification of XRP, reducing the regulatory uncertainty that had previously plagued the cryptocurrency.

- Positive Impact on Exchanges: Many exchanges that had previously delisted XRP reinstated it following the ruling, increasing liquidity and accessibility for investors.

- Restored Investor Confidence: The positive outcome boosted investor confidence, leading to a significant influx of capital into the XRP market. The price of XRP increased by approximately 30% within 24 hours of the initial ruling.

This positive court ruling significantly altered the narrative surrounding XRP, marking a pivotal moment for both the cryptocurrency and its investment prospects. The "Ripple SEC lawsuit" had previously weighed heavily on the XRP price, and its partial resolution created a wave of positive momentum.

Increasing Institutional Adoption: A Sign of Growing Legitimacy

Institutional adoption is another key driver of XRP's price appreciation. Large-scale investment from institutional players signifies a growing acceptance of XRP as a legitimate asset within the broader financial landscape.

- Increased Participation from Hedge Funds: Several prominent hedge funds have reportedly increased their XRP holdings, reflecting a growing belief in its long-term potential.

- Integration into Payment Platforms: The integration of XRP into various payment platforms and remittance systems is expanding its utility and attracting more institutional interest.

- Strategic Partnerships: Ripple's strategic partnerships with financial institutions worldwide are further bolstering institutional confidence and driving demand for XRP.

The rise of institutional investment in XRP signals a shift towards greater legitimacy and mainstream acceptance, adding another layer of support to its price.

Growing Utility and Ecosystem: Beyond Payments

XRP's utility extends beyond its initial application as a payment facilitator. The development of new use cases within the expanding XRP ecosystem is further driving its value.

- Decentralized Finance (DeFi): XRP is increasingly being integrated into decentralized finance applications, broadening its use cases and attracting a new wave of investors.

- Non-Fungible Tokens (NFTs): The use of XRP in the NFT space is also gaining traction, expanding its overall utility and creating new investment opportunities.

- Cross-border Payments: XRP's speed and low transaction costs continue to make it an attractive option for cross-border payments, further solidifying its position in the global financial system.

The continuous development and expansion of XRP's use cases fuel its growth and contribute to its rising price.

Overall Market Sentiment: Riding the Bull Market Wave

The positive sentiment in the broader cryptocurrency market has also contributed to XRP's performance. A general recovery in the crypto market, coupled with positive news for other cryptocurrencies, created a favorable environment for XRP's price to surge.

- Market Recovery: The recent recovery in the overall cryptocurrency market has lifted the boats of many cryptocurrencies, including XRP.

- Positive News Cycle: Positive news and developments within the wider crypto space have helped boost overall market sentiment, benefiting XRP.

- Investor Optimism: A growing sense of investor optimism towards cryptocurrencies in general has undoubtedly played a role in XRP's upward trajectory.

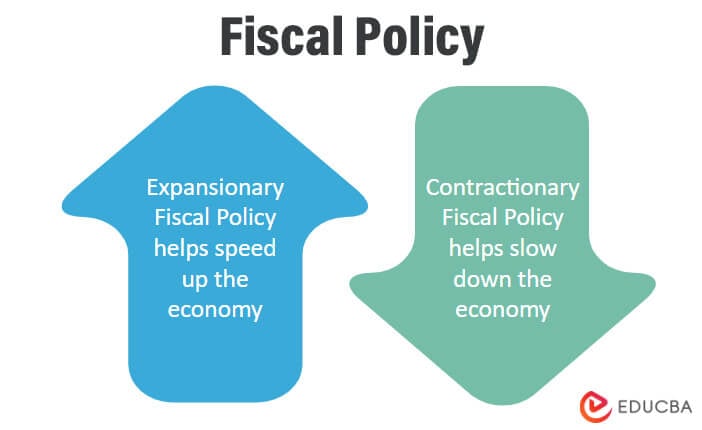

Risk Assessment and Investment Strategies

While XRP's recent performance has been impressive, it's crucial to acknowledge the inherent volatility of the cryptocurrency market and the risks associated with investing in XRP.

Volatility and Risk: A Necessary Consideration

Investing in XRP, or any cryptocurrency, involves significant risk. The market is highly volatile, and prices can fluctuate dramatically in short periods.

- Diversification: Diversifying your investment portfolio is crucial to mitigate risk. Don't put all your eggs in one basket.

- Risk Tolerance: Only invest what you can afford to lose. Understand your own risk tolerance before investing in volatile assets like XRP.

- Due Diligence: Conduct thorough research and understand the potential risks before investing in any cryptocurrency.

Investment Strategies for XRP: Navigating the Volatility

Several strategies can help you navigate the volatility of the XRP market and potentially maximize your returns.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, can help mitigate risk and potentially improve your average cost basis.

- Stop-Loss Orders: Setting stop-loss orders can limit your potential losses if the price of XRP drops significantly.

- Long-Term vs. Short-Term Investment: Consider your investment timeline. A long-term investment approach can be more suitable for weathering market fluctuations.

Conclusion

XRP's 400% price surge in three months is a testament to the confluence of several positive factors, including Ripple's partial legal victory, increased institutional adoption, growing utility, and overall positive market sentiment. However, it's vital to remember the inherent volatility of the cryptocurrency market and the risks involved in investing in XRP. Before investing in XRP or any other cryptocurrency, conduct thorough research, assess your risk tolerance, and consider employing various investment strategies such as dollar-cost averaging and stop-loss orders. Learn more about XRP investment and weigh the risks and rewards carefully before making any decisions. Conduct your own research before investing in XRP and make informed decisions about XRP.

Featured Posts

-

Khokkey Rekordsmen Po Silovym Priemam Zavershaet Kareru

May 07, 2025

Khokkey Rekordsmen Po Silovym Priemam Zavershaet Kareru

May 07, 2025 -

Thailands Negative Inflation Implications For Monetary Policy

May 07, 2025

Thailands Negative Inflation Implications For Monetary Policy

May 07, 2025 -

Warriors Aim To Accelerate Against Veteran Rockets

May 07, 2025

Warriors Aim To Accelerate Against Veteran Rockets

May 07, 2025 -

Addressing The Privilege Dilemma In The Wto Accession Process

May 07, 2025

Addressing The Privilege Dilemma In The Wto Accession Process

May 07, 2025 -

Lewis Capaldi Back After Two Years New Music And Tour

May 07, 2025

Lewis Capaldi Back After Two Years New Music And Tour

May 07, 2025

Latest Posts

-

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025 -

Assessing The Options Finding A Seasoned Veteran To Replace Taj Gibson

May 08, 2025

Assessing The Options Finding A Seasoned Veteran To Replace Taj Gibson

May 08, 2025 -

De Andre Carter Browns Land Experienced Wide Receiver From Bears

May 08, 2025

De Andre Carter Browns Land Experienced Wide Receiver From Bears

May 08, 2025 -

Counting Crows Downtown Indianapolis Show Venue Tickets And More

May 08, 2025

Counting Crows Downtown Indianapolis Show Venue Tickets And More

May 08, 2025 -

Counting Crows Indianapolis Concert Summer 2024 Dates And Tickets

May 08, 2025

Counting Crows Indianapolis Concert Summer 2024 Dates And Tickets

May 08, 2025