Thailand's Negative Inflation: Implications For Monetary Policy

Table of Contents

Causes of Negative Inflation in Thailand

Several interconnected factors contributed to the period of negative inflation experienced in Thailand. These can be broadly categorized into global economic trends, domestic currency strength, and improvements in supply-chain efficiency.

Global Economic Slowdown

The global economic slowdown, particularly impacting key export markets for Thailand, played a significant role in dampening demand for Thai goods and services. This reduced demand directly translated into lower prices, a characteristic of deflation.

- Impact on specific sectors: The tourism sector, a major contributor to Thailand's GDP, experienced a sharp decline in visitor numbers, impacting related industries like hospitality and transportation. Similarly, reduced global demand affected exports in the electronics and automotive sectors.

- Statistical evidence: Data from the Ministry of Commerce revealed a significant decline in export values during the period of negative inflation, highlighting the impact of weakened global demand on Thailand's economy. For example, [insert specific statistic on export decline, e.g., "Exports fell by X% in Q[quarter] of [year]"].

Stronger Thai Baht

A strengthening Thai Baht against major currencies made imports cheaper, exerting additional deflationary pressure. This appreciation of the currency increased the purchasing power of the Thai baht in international markets.

- Impact on import prices: The stronger Baht resulted in lower prices for imported goods, impacting consumer prices across various sectors.

- Examples of affected goods: The prices of electronics, automobiles, and certain food items decreased due to the stronger Baht.

- Government interventions: The Thai government may consider interventions to manage the exchange rate, such as buying foreign currencies to weaken the Baht and support domestic exporters.

Supply Chain Improvements and Technological Advancements

Increased efficiency and technological advancements within several Thai industries led to reduced production costs, resulting in lower prices for consumers. This positive development, while generally beneficial, also contributed to deflationary pressures in the short term.

- Examples of affected industries: Significant improvements in agricultural practices and manufacturing processes reduced costs and subsequently prices in these sectors.

- Long-term implications: While contributing to negative inflation in the short run, these advancements enhance Thailand's long-term competitiveness in global markets.

Consequences of Negative Inflation in Thailand

Negative inflation, while seemingly beneficial due to lower prices, carries several adverse consequences for the Thai economy.

Impact on Consumer Spending

The anticipation of further price drops can lead consumers to postpone purchases, delaying spending and dampening economic activity.

- Decreased consumer confidence: Negative inflation can erode consumer confidence, creating a vicious cycle of reduced spending and further deflation.

- Data on consumer spending: [Insert data on consumer spending trends during the period of negative inflation. For instance, "Consumer spending decreased by Y% in [period], according to [source]."]

Debt Burden Increase

Negative inflation increases the real value of debt, making it more difficult for both households and businesses to repay their loans.

- Impact on corporate and household debt: The increased real value of debt can strain household budgets and hinder corporate investment.

- Policy responses: The government may need to consider measures to alleviate the debt burden, such as debt restructuring programs or targeted financial assistance.

Challenges for Businesses

Falling prices can squeeze profit margins, leading to reduced investment and potential job losses, impacting businesses of all sizes.

- Impact on different business sectors: Small and medium-sized enterprises (SMEs) are particularly vulnerable to deflationary pressures due to their limited financial buffers.

- Effects on investment and employment: Reduced profitability can discourage investment and lead to layoffs, impacting overall employment rates.

Monetary Policy Responses to Negative Inflation

Addressing Thailand's negative inflation requires a coordinated approach involving monetary policy adjustments, fiscal policy coordination, and structural reforms.

The Bank of Thailand's Role

The BOT's primary mandate is to maintain price stability and support sustainable economic growth. However, combating deflation presents unique challenges.

- Limitations of monetary policy: Monetary policy tools, such as interest rate adjustments, might be less effective in combating deflation than in addressing inflation.

- BOT's measures: The BOT may utilize various measures, including lowering interest rates to stimulate borrowing and investment, or even considering unconventional policies like quantitative easing.

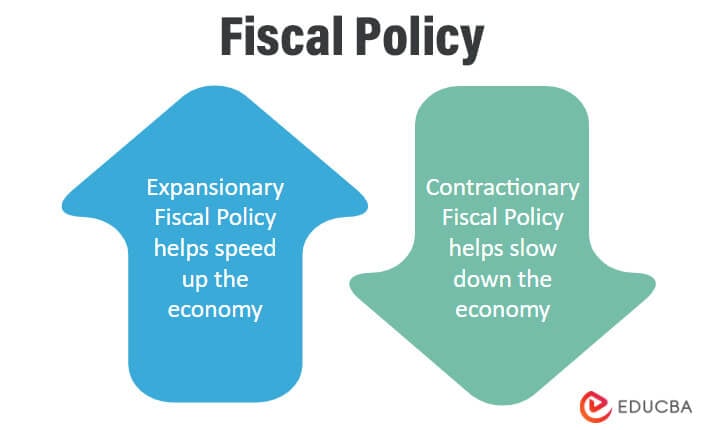

Fiscal Policy Coordination

Fiscal policy, encompassing government spending and taxation, plays a crucial role in complementing monetary policy efforts.

- Potential fiscal policy interventions: Increased government spending on infrastructure projects or targeted tax cuts can stimulate demand and counteract deflationary pressures.

- Effectiveness of coordinated policies: The success of addressing negative inflation hinges on the effective coordination between monetary and fiscal policies.

Structural Reforms

Addressing the underlying structural issues contributing to deflation is vital for achieving long-term sustainable growth.

- Examples of structural reforms: Investment in infrastructure development, education, and technological innovation are crucial for enhancing productivity and competitiveness.

Conclusion

Thailand's negative inflation presents a multifaceted challenge demanding a comprehensive response. Understanding its causes—ranging from global economic slowdowns and currency fluctuations to technological advancements—is crucial for developing effective solutions. While monetary policy by the BOT plays a vital role, coordinated fiscal policies and strategic structural reforms are equally important for stimulating sustainable economic growth and mitigating the adverse consequences of Thailand's negative inflation. Continued monitoring of Thailand's economic indicators and proactive policy adjustments are essential to navigating this economic climate. Stay informed about developments in Thailand's monetary policy and its impact on Thailand's negative inflation for better economic decision-making.

Featured Posts

-

Alex Ovechkin And Dmitry Orlovs Miami Reunion Dolphins And 4 Nations Face Off

May 07, 2025

Alex Ovechkin And Dmitry Orlovs Miami Reunion Dolphins And 4 Nations Face Off

May 07, 2025 -

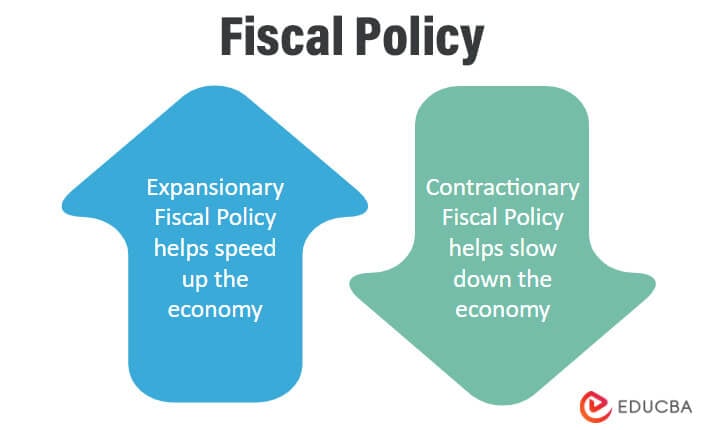

The Karate Kid Exploring Mr Miyagis Wisdom And Training Methods

May 07, 2025

The Karate Kid Exploring Mr Miyagis Wisdom And Training Methods

May 07, 2025 -

New A24 Horror Movie Marks The End Of Jenna Ortegas Five Year Career Trend

May 07, 2025

New A24 Horror Movie Marks The End Of Jenna Ortegas Five Year Career Trend

May 07, 2025 -

Mlb Betting Tigers Vs Mariners Predictions And Best Odds Today

May 07, 2025

Mlb Betting Tigers Vs Mariners Predictions And Best Odds Today

May 07, 2025 -

Podcast Creation Ai Simplifies The Transformation Of Repetitive Scatological Documents

May 07, 2025

Podcast Creation Ai Simplifies The Transformation Of Repetitive Scatological Documents

May 07, 2025

Latest Posts

-

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025 -

Arsenal V Psg Champions League Semi Final Key Players And Predictions

May 08, 2025

Arsenal V Psg Champions League Semi Final Key Players And Predictions

May 08, 2025 -

Arsenal Vs Psg Champions League Semi Final Preview A Tactical Breakdown

May 08, 2025

Arsenal Vs Psg Champions League Semi Final Preview A Tactical Breakdown

May 08, 2025 -

Arsenal Vs Ps Zh Barselona Vs Inter Rozklad Ta Prognoz Matchiv 1 2 Finalu Ligi Chempioniv

May 08, 2025

Arsenal Vs Ps Zh Barselona Vs Inter Rozklad Ta Prognoz Matchiv 1 2 Finalu Ligi Chempioniv

May 08, 2025 -

Liga Chempioniv 2024 2025 Peredmatcheviy Oglyad Pivfinaliv Arsenal Ps Zh Ta Barselona Inter

May 08, 2025

Liga Chempioniv 2024 2025 Peredmatcheviy Oglyad Pivfinaliv Arsenal Ps Zh Ta Barselona Inter

May 08, 2025