XRP Surges Past Bitcoin: SEC Acknowledges Grayscale XRP ETF Application

Table of Contents

The Grayscale XRP ETF Application and its Implications

Grayscale Investments, a prominent digital currency asset manager, has submitted an application for an XRP ETF. This application holds significant weight, as Grayscale has a history of successfully navigating the complexities of the regulatory landscape to bring Bitcoin and other crypto assets to the mainstream investment market. The SEC's acknowledgment of the application signifies a noteworthy step forward, indicating that the regulatory body is at least considering the possibility of an XRP ETF. This is a stark contrast to previous rejections of similar applications and represents a potential shift in the SEC’s approach to cryptocurrencies.

- Timeline of the application: The exact date of application submission and the timeline of the SEC's review process are yet to be publicly disclosed, but market speculation suggests a relatively quick acknowledgment.

- Key features of the proposed ETF: The specifics of Grayscale's proposed XRP ETF remain largely undisclosed, but we can expect details concerning the ETF's structure, management fees, and investment strategy to be revealed during the SEC’s review process.

- Potential impact on XRP liquidity and accessibility: The approval of an XRP ETF would drastically increase XRP liquidity, making it more accessible to a wider range of investors, including institutional investors who may have been hesitant to directly invest in XRP due to regulatory uncertainty.

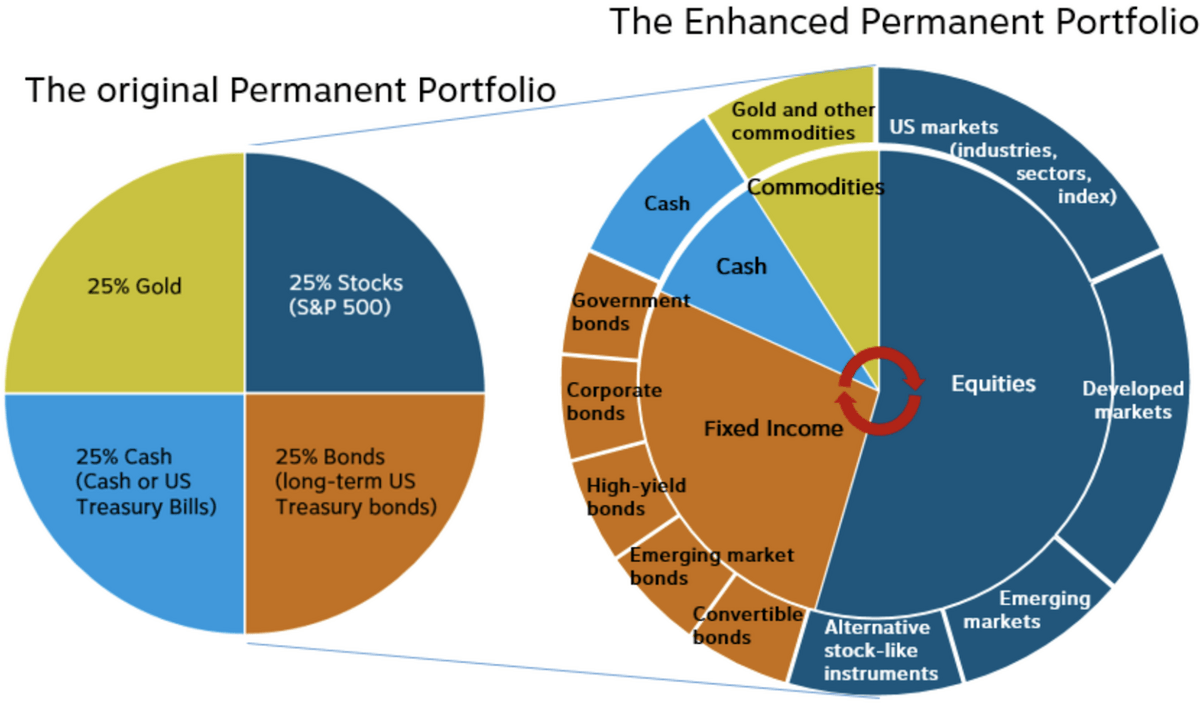

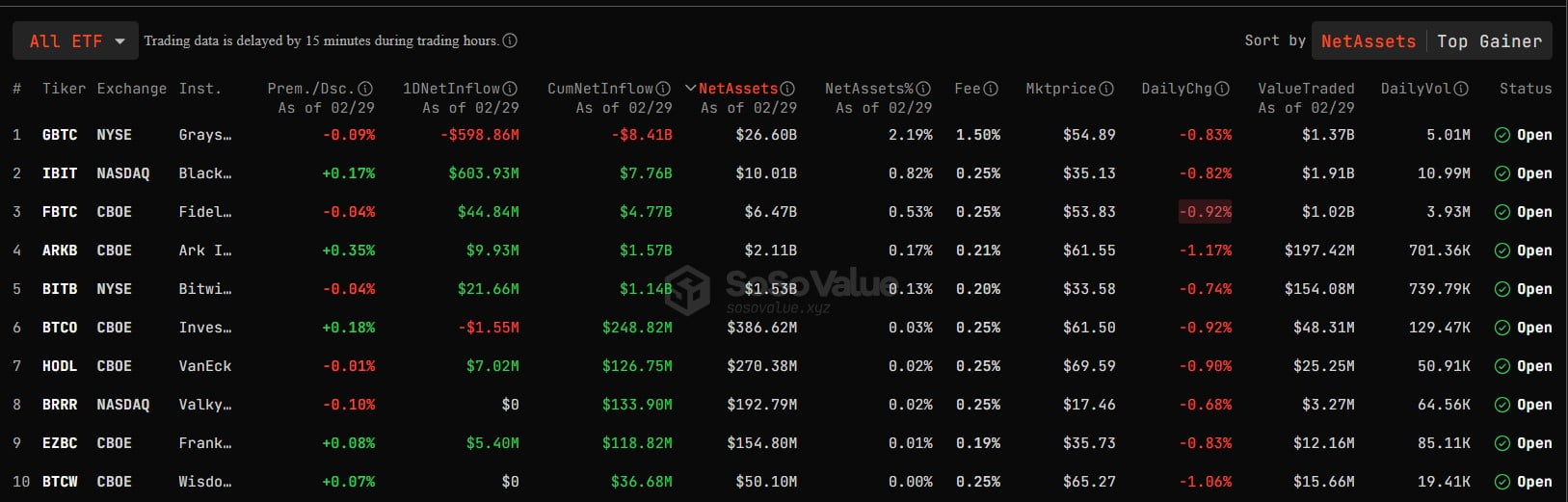

- Comparison to other approved crypto ETFs: While Bitcoin ETFs have gained traction in recent years, an XRP ETF would be a significant milestone, marking the entry of another major cryptocurrency into the regulated investment market. The comparison would focus on the similarities and differences in regulatory hurdles faced.

XRP Price Volatility and Market Reaction

XRP's price has shown remarkable volatility in recent days, surging significantly after the SEC's acknowledgment. This surge has overshadowed Bitcoin's performance, showcasing the market's enthusiasm for the potential of an XRP ETF. While the SEC news is a primary driver, other contributing factors fuel this price increase. Ripple's ongoing legal battle with the SEC, and recent positive developments in that case, have created a positive market sentiment.

- Price charts illustrating the surge: [Insert a relevant chart showing XRP's price increase].

- Trading volume changes: Trading volume has increased considerably, indicating a heightened level of investor activity and enthusiasm for the potential approval.

- Analysis of social media sentiment regarding XRP: Social media platforms reveal a largely positive sentiment, with many investors expressing optimism about XRP's future prospects.

- Expert opinions on the sustainability of the price increase: Experts remain divided, with some believing the surge is sustainable, supported by the SEC's action, while others caution against excessive exuberance and warn of potential corrections.

The SEC's Stance on Crypto ETFs and its Potential Impact on XRP

The SEC has historically taken a cautious approach towards crypto ETFs, citing concerns about market manipulation, investor protection, and the overall regulatory landscape of cryptocurrencies. However, the acknowledgment of the Grayscale XRP ETF application could signal a potential shift in the SEC's stance, perhaps influenced by growing institutional interest in cryptocurrencies and the maturing of the market. Many believe that a favorable outcome would encourage further regulatory clarity and could unlock significant potential within the crypto market.

- Summary of past SEC decisions on crypto ETF applications: The SEC has previously rejected several applications for crypto ETFs, citing various concerns. This acknowledgment is unusual and may point to a change in strategy.

- Potential reasons for the SEC's change in approach (if any): Potential reasons may include pressure from the industry, increased market maturity, and a desire to maintain the US's global competitiveness in the fintech space.

- Discussion of remaining regulatory challenges for XRP ETFs: Even with the acknowledgment, significant regulatory hurdles remain. The SEC will scrutinize the proposed ETF for compliance with securities laws and regulations.

- Possible timelines for final approval or rejection: Predicting the timeline for final approval or rejection is challenging; it will likely depend on the depth of the SEC's review and any unforeseen complications.

Future Outlook and XRP Price Predictions

Predicting XRP's future price is inherently speculative, with several factors influencing the outcome. A positive decision regarding the Grayscale XRP ETF would likely lead to further price increases, while a rejection could trigger a sharp decline. Delayed approval would likely lead to fluctuating prices depending on investor sentiment and overall market conditions.

- Short-term price predictions: Short-term predictions are highly volatile and depend heavily on market reactions to any further SEC news.

- Long-term price predictions (with caveats): Long-term predictions require a broader perspective, considering factors like market adoption, technological advancements, and overall regulatory developments. Any prediction should be taken with a significant degree of caution.

- Potential impact on XRP adoption and market share: An approved ETF would significantly boost XRP's adoption, potentially leading to increased market share in the cryptocurrency ecosystem.

- Risks and opportunities associated with investing in XRP: Investing in XRP, like any cryptocurrency, carries inherent risks. However, the potential rewards, particularly if the ETF is approved, could be significant.

Conclusion: Navigating the XRP Surge and the Future of XRP ETFs

The recent XRP price surge, triggered by the SEC's acknowledgment of the Grayscale XRP ETF application, marks a pivotal moment in the cryptocurrency market. The SEC's decision, however it ultimately unfolds, will have significant implications for XRP's future and could reshape the broader crypto landscape. The potential for increased liquidity, accessibility, and institutional investment makes this development crucial for the cryptocurrency community. Stay informed about the evolving landscape of XRP and the potential approval of the Grayscale XRP ETF. Continue to follow our updates for the latest news and analysis on XRP price movements and regulatory developments. Remember to conduct your own thorough research before making any investment decisions related to XRP or other cryptocurrencies.

Featured Posts

-

White Lotus Season 3 Oscar Winning Guest Star Appears

May 07, 2025

White Lotus Season 3 Oscar Winning Guest Star Appears

May 07, 2025 -

Cleveland Cavaliers Blowout Win Mitchell Mobleys Stellar Performance

May 07, 2025

Cleveland Cavaliers Blowout Win Mitchell Mobleys Stellar Performance

May 07, 2025 -

Mariners Vs Tigers Mlb Game Prediction Odds Comparison And Expert Picks

May 07, 2025

Mariners Vs Tigers Mlb Game Prediction Odds Comparison And Expert Picks

May 07, 2025 -

Arozarena And Mariners Triumph Over Reds In Extra Innings

May 07, 2025

Arozarena And Mariners Triumph Over Reds In Extra Innings

May 07, 2025 -

Draymond Greens Night Night Celebration What Steph Curry Said

May 07, 2025

Draymond Greens Night Night Celebration What Steph Curry Said

May 07, 2025

Latest Posts

-

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025