XRP (Ripple) Price Prediction And Investment Strategy

Table of Contents

Understanding XRP's Current Market Position and Future Potential

XRP, the native cryptocurrency of Ripple, distinguishes itself through its innovative technology and real-world applications. Let's delve into its strengths and the forces shaping its market position.

Analyzing XRP's Technological Advantages

RippleNet, Ripple's payment network, is a game-changer for international transactions. Unlike many cryptocurrencies solely focused on speculation, XRP facilitates fast, low-cost cross-border payments, directly addressing a significant pain point in the global financial system.

- Speed: XRP transactions are significantly faster than those on Bitcoin or Ethereum, often settling in a matter of seconds.

- Low Transaction Fees: The cost of sending XRP is minimal compared to traditional banking fees or other cryptocurrencies, making it attractive for large-scale transactions.

- Partnerships and Institutional Adoption: Ripple has forged partnerships with numerous financial institutions globally, signifying growing acceptance and potential for widespread adoption. This institutional backing is a key factor influencing XRP's long-term prospects.

These technological advantages position XRP as a strong contender in the increasingly competitive landscape of digital assets. However, regulatory uncertainty remains a significant challenge.

Factors Influencing XRP Price

Several factors significantly impact XRP's price volatility. Understanding these is crucial for informed investment decisions.

- SEC Lawsuit and Regulatory Uncertainty: The ongoing SEC lawsuit against Ripple has created considerable uncertainty around XRP's regulatory status. A positive resolution could lead to a price surge, while a negative outcome might trigger a decline. Staying informed about legal developments is paramount.

- Market Sentiment and Cryptocurrency Market Trends: Like other cryptocurrencies, XRP's price is sensitive to overall market sentiment. Positive news about Bitcoin or the broader altcoin market can positively influence XRP's price, while negative news can cause a downturn.

- Supply and Demand: The interplay of supply and demand dictates XRP's market capitalization and price. Increased demand, driven by adoption and investment, typically pushes prices higher, while increased supply can lead to price decreases.

XRP Price Predictions: A Balanced Perspective

Predicting the future price of any cryptocurrency, including XRP, is inherently speculative. While various sources offer predictions, it's essential to approach them with caution.

Short-Term Price Predictions

Numerous websites and analysts provide short-term price forecasts for XRP using technical analysis. However, these predictions are highly susceptible to market volatility and unexpected events. News announcements, regulatory updates, and broader market trends can significantly impact short-term price fluctuations. It is crucial to understand that these are predictions, not guarantees.

Long-Term Price Predictions

Long-term XRP price predictions are even more uncertain. Potential scenarios depend on several factors:

- Technological Advancements: Further improvements to RippleNet and the integration of XRP into new financial systems could significantly boost its value.

- Market Adoption: Widespread adoption by financial institutions and businesses would undoubtedly impact XRP's price positively.

- Fundamental Analysis: Focusing on Ripple's underlying technology, partnerships, and real-world utility provides a more robust basis for long-term projections than solely relying on technical analysis.

Developing a Sound XRP Investment Strategy

Investing in XRP, like any cryptocurrency, carries inherent risks. A well-defined investment strategy is vital to mitigate these risks.

Risk Assessment and Diversification

- Cryptocurrency Risk: The cryptocurrency market is inherently volatile. XRP's price can fluctuate dramatically in short periods.

- Investment Risk: Always invest only what you can afford to lose. Never invest borrowed money in cryptocurrencies.

- Diversification: Spread your investments across different asset classes to reduce overall portfolio risk. Don't put all your eggs in one basket. Consider diversifying into other cryptocurrencies, stocks, bonds, etc.

- Investment Strategies: Dollar-cost averaging (DCA) – investing a fixed amount regularly – and long-term holding are often recommended strategies for mitigating risk in volatile markets.

Setting Realistic Goals and Managing Expectations

Avoid emotional decision-making. Develop a clear investment plan with realistic goals and stick to it. Market fluctuations are inevitable; avoid panic selling or impulsive buys based on short-term price swings.

Secure Storage and Exchange Selection

Securely storing your XRP is crucial.

- XRP Wallet: Use a reputable and secure XRP wallet. Options range from software wallets to hardware (cold storage) wallets. Cold storage is generally considered more secure.

- Cryptocurrency Exchange: Choose a reputable and secure cryptocurrency exchange to buy and sell XRP. Research the platform's security measures and reputation before using it.

Conclusion: Navigating the XRP Landscape: A Call to Action

XRP's price is influenced by a complex interplay of technological advancements, regulatory developments, market sentiment, and supply and demand. Building a successful XRP investment strategy requires careful risk assessment, diversification, and a realistic understanding of the inherent volatility of the cryptocurrency market. Conduct thorough research, understand your risk tolerance, and never invest more than you can afford to lose. Start your journey towards understanding XRP price predictions and building a strategic investment plan today!

Featured Posts

-

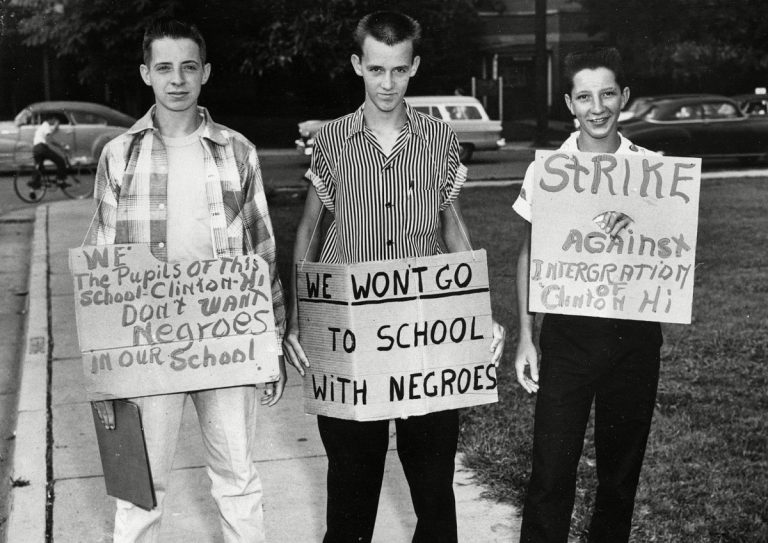

End Of School Desegregation Order Implications For Other Districts

May 02, 2025

End Of School Desegregation Order Implications For Other Districts

May 02, 2025 -

Exclusive Offer 1 500 Flight Credit For Agents Selling Paul Gauguin Via Ponant

May 02, 2025

Exclusive Offer 1 500 Flight Credit For Agents Selling Paul Gauguin Via Ponant

May 02, 2025 -

Decades Long School Desegregation Order Rescinded Implications For Education

May 02, 2025

Decades Long School Desegregation Order Rescinded Implications For Education

May 02, 2025 -

Is Xrp A Commodity Sec Classification And The Ongoing Debate

May 02, 2025

Is Xrp A Commodity Sec Classification And The Ongoing Debate

May 02, 2025 -

Secure A Brighter Future Investing In Early Childhood Mental Health Support

May 02, 2025

Secure A Brighter Future Investing In Early Childhood Mental Health Support

May 02, 2025

Latest Posts

-

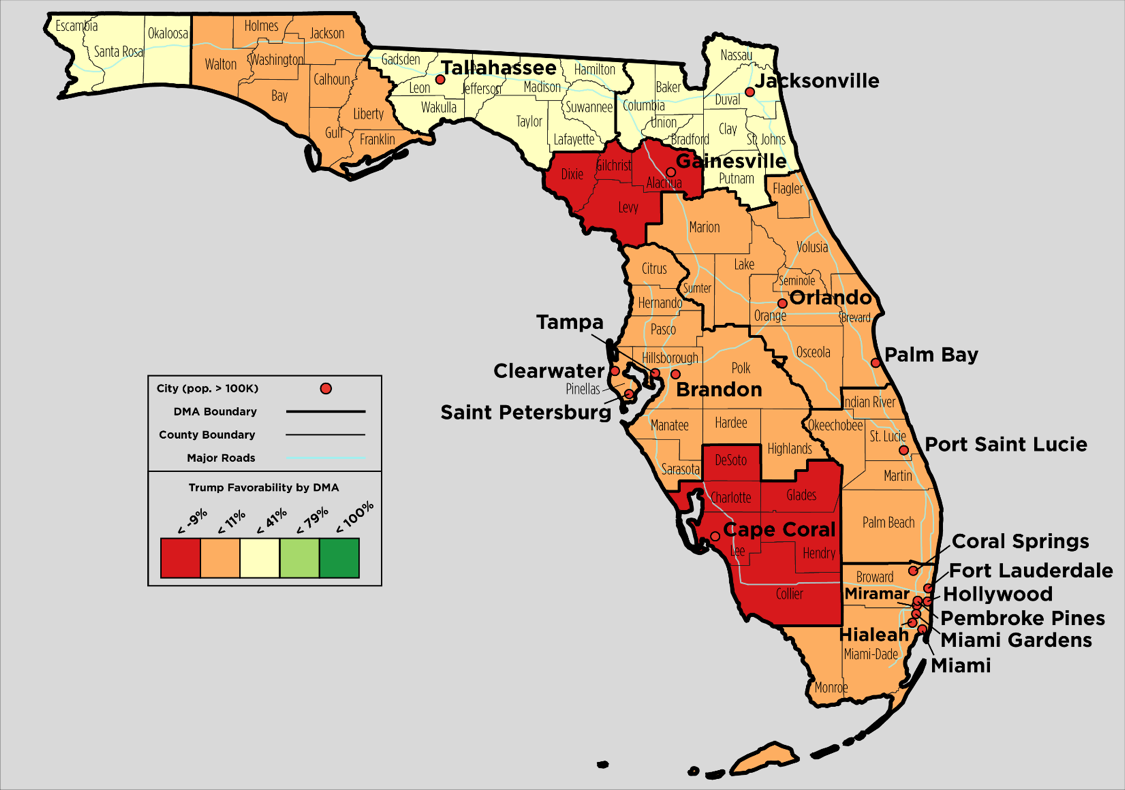

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Landscape

May 02, 2025 -

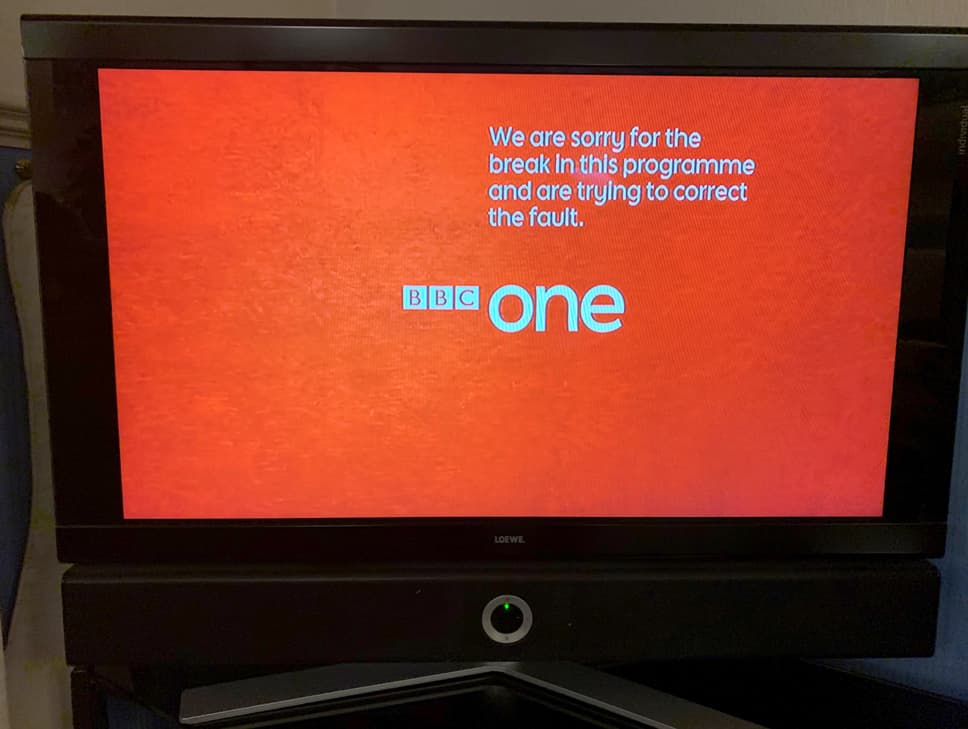

Bbcs 1 Billion Revenue Loss Unprecedented Impact On Broadcasting

May 02, 2025

Bbcs 1 Billion Revenue Loss Unprecedented Impact On Broadcasting

May 02, 2025 -

Significant Bbc Funding Cut Unprecedented Challenges Loom

May 02, 2025

Significant Bbc Funding Cut Unprecedented Challenges Loom

May 02, 2025 -

Bbc Issues Warning Unprecedented Difficulties After 1bn Revenue Loss

May 02, 2025

Bbc Issues Warning Unprecedented Difficulties After 1bn Revenue Loss

May 02, 2025 -

Unprecedented Problems For Bbc Following 1bn Income Reduction

May 02, 2025

Unprecedented Problems For Bbc Following 1bn Income Reduction

May 02, 2025