Is XRP A Commodity? SEC Classification And The Ongoing Debate

Table of Contents

The SEC's Case Against XRP: A Security, Not a Commodity

The SEC contends that XRP is a security, not a commodity. Their argument hinges primarily on the application of the Howey Test, a legal framework used to determine whether an investment constitutes a security.

The Howey Test and its Application to XRP

The Howey Test establishes four criteria for an investment contract to be classified as a security:

- Investment of money: The SEC argues that purchasing XRP involved an investment of money.

- Common enterprise: They claim a common enterprise existed due to the interconnectedness of XRP holders and Ripple's actions.

- Expectation of profits: The SEC believes purchasers expected profits derived from Ripple's efforts.

- Profits derived from the efforts of others: This is a central point of contention. The SEC argues that XRP's value and potential for profit are largely dependent on Ripple's efforts in developing and promoting the cryptocurrency.

The SEC's Argument: XRP Sales as Unregistered Securities Offerings

The SEC further alleges that Ripple's sales of XRP constituted unregistered securities offerings, violating federal securities laws. Their claims include:

- Focus on institutional sales: The SEC scrutinized Ripple's sales to institutional investors, arguing these sales were more akin to traditional securities offerings.

- Allegations of manipulative market practices: The SEC also alleged manipulative market practices related to XRP trading.

- Lack of proper regulatory disclosures: A significant part of the SEC's case rests on Ripple's alleged failure to make proper regulatory disclosures before offering XRP to the public.

Ripple's Defense: XRP as a Decentralized Digital Asset – A Commodity

Ripple vehemently denies that XRP is a security. Their core defense centers on XRP's decentralized nature and its functionality within the XRP Ledger.

Decentralization as a Key Argument

Ripple argues that XRP's decentralized characteristics differentiate it from a security:

- Open-source nature of XRP Ledger: The XRP Ledger is open-source, meaning its code is publicly available and not controlled solely by Ripple.

- Absence of central control by Ripple: Ripple claims it does not control XRP's price or market operations.

- Comparison with other cryptocurrencies considered commodities: Ripple points to other cryptocurrencies, like Bitcoin, that are generally considered commodities, arguing XRP shares similar characteristics.

Programmatic Sales vs. Investment Contracts

Ripple challenges the SEC's claim of unregistered securities offerings, highlighting the nature of their XRP sales:

- Emphasis on programmatic sales mechanisms: Ripple emphasizes that many XRP sales were conducted through programmatic mechanisms, lacking direct investor relationships.

- Lack of direct investment relationship with Ripple: They argue there wasn't a direct investment relationship between Ripple and XRP purchasers.

- Focus on XRP's utility and market functionality: Ripple highlights XRP's utility in facilitating cross-border payments and its function within the XRP Ledger as a key argument against its classification as a security.

The Implications of the Classification Debate

The ongoing uncertainty surrounding XRP's classification has significant implications for the cryptocurrency market as a whole.

Impact on XRP's Price and Market

The legal battle has caused considerable volatility in XRP's price and trading volume:

- Price volatility: XRP's price has experienced significant fluctuations due to the ongoing legal uncertainty.

- Delisting from exchanges: Some cryptocurrency exchanges delisted XRP during the height of the legal battle, limiting trading access.

- Investor sentiment: The legal uncertainty has negatively impacted investor sentiment and confidence in XRP.

Broader Implications for the Crypto Market

The SEC's actions and the Ripple case have broader consequences for the entire cryptocurrency industry:

- Regulatory uncertainty: The case highlights the significant regulatory uncertainty facing the cryptocurrency market.

- Investor protection: The case underscores the need for clearer regulatory frameworks to protect investors.

- Innovation in the crypto space: The outcome of the case could significantly impact innovation and development within the cryptocurrency sector.

Conclusion

The debate over whether XRP is a commodity or a security underscores the challenges of regulating the dynamic cryptocurrency market. The SEC's case against Ripple, and Ripple's defense, have profound implications for the future of crypto regulation and investor protection. Understanding the Howey Test and the arguments presented by both sides is critical for navigating this complex landscape. The final classification of XRP will undoubtedly influence the regulatory framework for other digital assets. Stay informed about developments in this pivotal case to make well-informed decisions regarding your XRP investments and participation in the cryptocurrency market. Continue monitoring the ongoing classification debate concerning XRP to remain informed in this ever-evolving digital asset landscape.

Featured Posts

-

Remembering The Stars Of Dallas Another 80s Soap Legend Gone

May 02, 2025

Remembering The Stars Of Dallas Another 80s Soap Legend Gone

May 02, 2025 -

New Fortnite Icon Skin Release Date Price And More

May 02, 2025

New Fortnite Icon Skin Release Date Price And More

May 02, 2025 -

Southern California Donkey Roundup Tradition And Community

May 02, 2025

Southern California Donkey Roundup Tradition And Community

May 02, 2025 -

Nom De La Boulangerie Son Poids En Chocolat Pour Le Premier Bebe De L Annee En Normandie

May 02, 2025

Nom De La Boulangerie Son Poids En Chocolat Pour Le Premier Bebe De L Annee En Normandie

May 02, 2025 -

Discover Italys Little Tahiti A Dream Beach Escape

May 02, 2025

Discover Italys Little Tahiti A Dream Beach Escape

May 02, 2025

Latest Posts

-

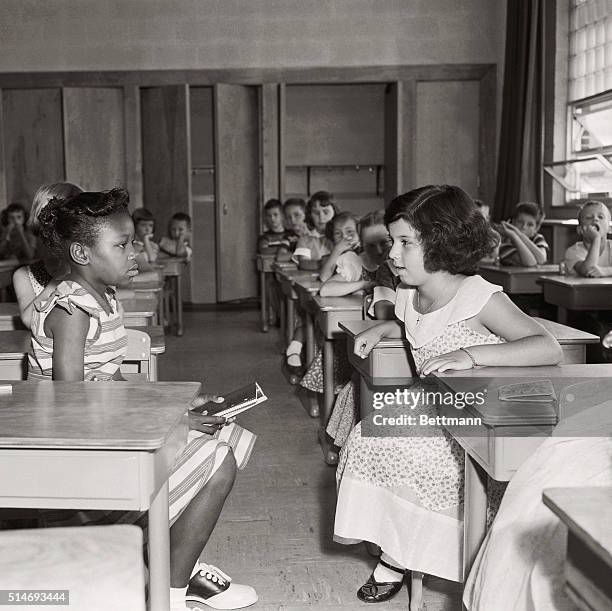

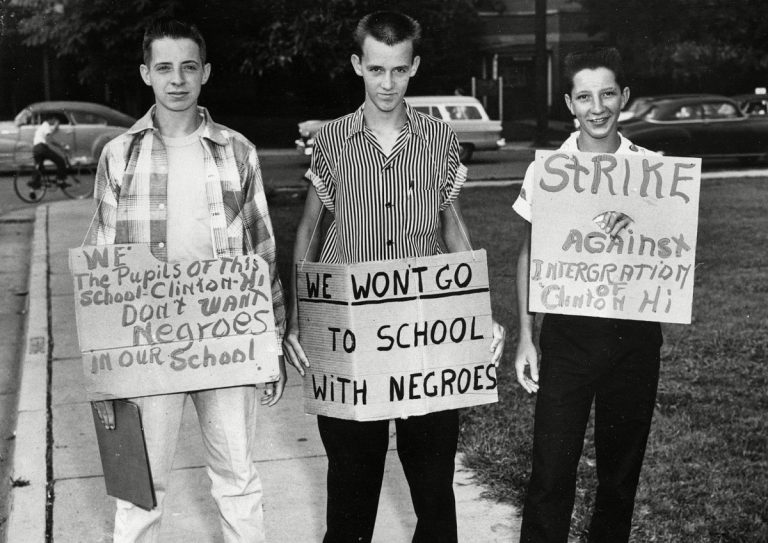

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025 -

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025 -

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025 -

End Of School Desegregation Order Implications For Other Districts

May 02, 2025

End Of School Desegregation Order Implications For Other Districts

May 02, 2025