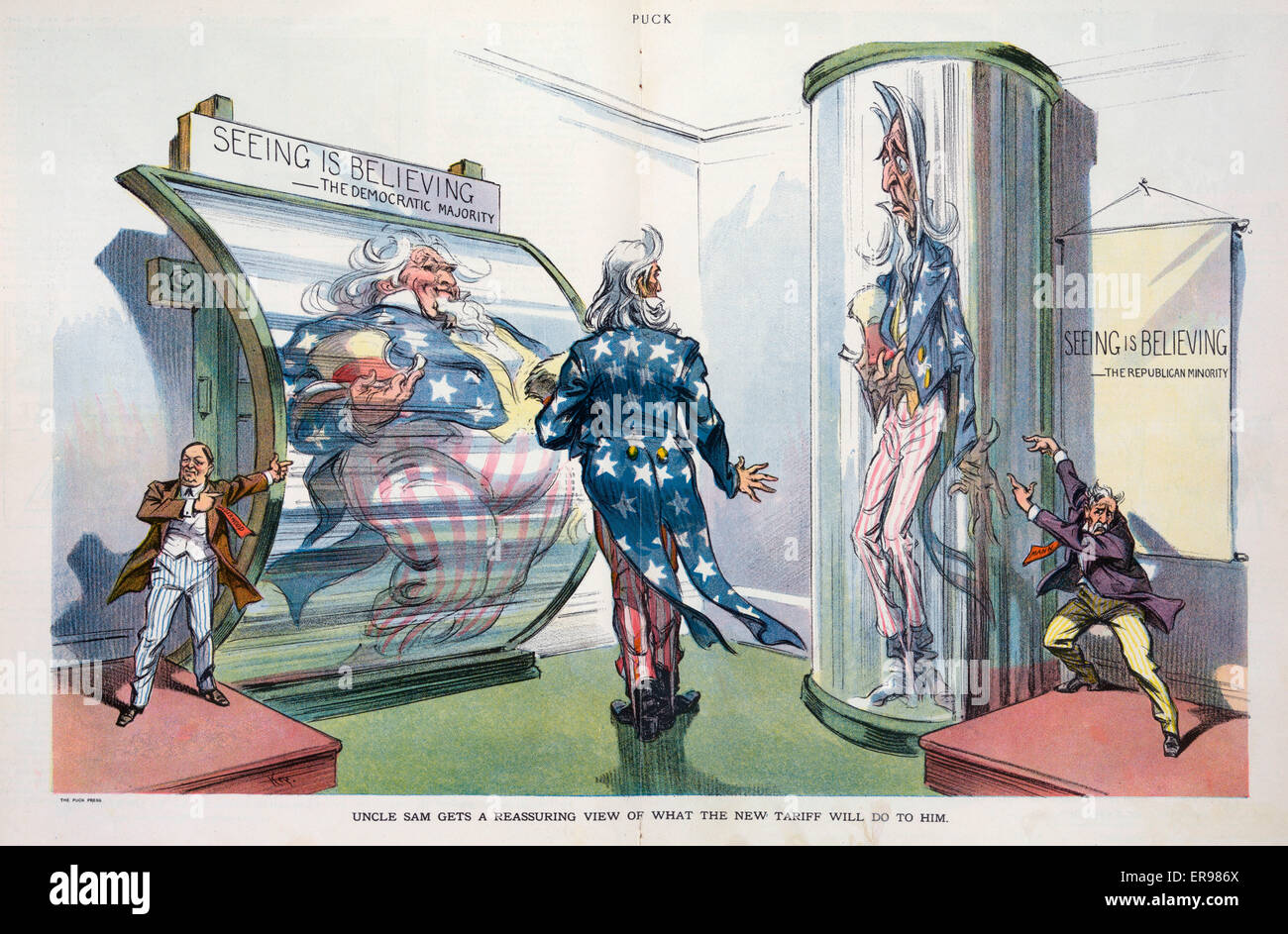

High Stock Market Valuations: A BofA Analyst's Reassuring View

Table of Contents

Understanding Current High Stock Market Valuations

High valuations aren't always a red flag. Several factors contribute to the current market dynamics, making a nuanced understanding crucial for investors.

The Role of Low Interest Rates

Historically low interest rates significantly impact stock market valuations. This impacts the cost of borrowing and the attractiveness of investments.

- Lower discount rates increase the present value of future earnings. When interest rates are low, the future earnings of companies are discounted less heavily, leading to higher present values and thus, higher stock prices.

- Comparison of current interest rates to historical averages: Current interest rates remain significantly lower than historical averages, creating a favorable environment for equity investments. This makes stocks a more attractive alternative to bonds, which offer lower yields.

- Impact of quantitative easing on market liquidity and valuations: Central banks' policies, such as quantitative easing (QE), inject liquidity into the market, increasing demand for assets and pushing up prices, including stock valuations.

The Impact of Technological Innovation

The rapid pace of technological advancement fuels significant growth and justifies higher valuations, particularly within the technology sector.

- Examples of high-growth tech companies and their valuations: Companies like Apple, Microsoft, and Google (Alphabet) consistently command high valuations due to their innovative products and services, substantial growth potential, and dominance in their respective markets. These valuations reflect investor confidence in their continued innovation and future earnings.

- The role of disruptive innovation in driving future earnings: Disruptive technologies create new markets and reshape existing ones, leading to exponential growth opportunities. Investors are willing to pay a premium for companies positioned to benefit from these technological shifts.

- Long-term growth potential versus short-term market volatility: While short-term market fluctuations can impact stock prices, long-term growth prospects driven by technological advancements often justify higher valuations.

Analyzing Earnings Growth and Profitability

A critical aspect of understanding high stock market valuations involves analyzing the relationship between earnings growth, profitability, and market capitalization. Are earnings keeping pace with stock prices?

- Data on corporate earnings growth and its correlation with market valuations: While some sectors might show slower growth, overall corporate earnings growth has been positive in many areas, supporting current market valuations to some extent. This correlation needs to be carefully evaluated on a sector-by-sector basis.

- Analysis of profit margins and their sustainability: Examining profit margins helps determine the sustainability of current earnings. High and stable profit margins suggest a strong underlying business model and support higher valuations.

- Discussion of potential risks to earnings growth: It’s crucial to acknowledge potential risks, such as supply chain disruptions, inflation, or geopolitical instability, which could impact future earnings growth and thus, valuations.

The BofA Analyst's Perspective on High Stock Market Valuations

The BofA analyst's report offers a unique perspective on current high stock market valuations, mitigating some common concerns.

Key Arguments Presented by the Analyst

The BofA analyst's core argument centers around the long-term growth potential fueled by technological innovation and the impact of low interest rates.

- Direct quotes or paraphrases from the BofA report: (Note: This section would include direct quotes or paraphrased summaries of the BofA analyst's report, citing the source appropriately. This would require access to the original report.)

- The analyst's assessment of risk factors: The analyst likely acknowledges various risks, such as inflation and geopolitical uncertainty, but perhaps argues that these risks are either manageable or already priced into the market.

- The analyst's long-term outlook for the market: The analyst likely projects continued, albeit possibly moderate, growth, suggesting that current valuations are not inherently unsustainable in the long term.

Factors Considered by the BofA Analyst

The analyst's assessment likely considered several crucial macroeconomic and microeconomic factors.

- Details on the methodology used in the analyst's report: Understanding the methodology employed (e.g., discounted cash flow analysis, comparable company analysis) is key to evaluating the validity of the analyst's conclusions.

- Comparison of the BofA analyst's view with other market analyses: Comparing this analysis to other prominent market analyses helps provide a broader picture and identify potential divergences in opinion.

- Potential limitations or biases in the analyst's perspective: It is essential to acknowledge potential limitations or biases inherent in any single analyst's view.

Navigating the Market with High Stock Market Valuations

Even with a reassuring perspective, navigating the market requires a strategic approach.

Strategies for Investors

Investors should adopt a proactive and informed strategy when dealing with potentially high stock market valuations.

- Importance of diversification: Diversifying across asset classes (stocks, bonds, real estate, etc.) helps mitigate risk associated with high valuations in any single sector.

- Considering value investing strategies: Value investing focuses on identifying undervalued companies, offering potential upside even in a market with high overall valuations.

- The role of long-term investment horizons: A long-term investment horizon helps weather short-term market volatility and benefit from the long-term growth potential of well-chosen investments.

Risk Management and Due Diligence

Thorough research and risk management are paramount.

- Importance of understanding individual company fundamentals: Focus on understanding the individual financial health and growth prospects of companies, rather than solely relying on market indices.

- Using valuation metrics (P/E ratio, etc.) to assess investment opportunities: Utilize valuation metrics to assess whether individual stocks are appropriately priced relative to their earnings and growth potential, even within a broadly valued market.

- The benefits of professional financial advice: Consulting a qualified financial advisor can provide personalized guidance tailored to your specific risk tolerance and investment goals.

Conclusion

High stock market valuations remain a key concern, yet the BofA analyst's perspective offers a valuable counterpoint, highlighting factors supporting current levels. Understanding the influence of low interest rates and technological innovation, coupled with robust risk management strategies and diligent due diligence, is vital for navigating this market. Remember to stay informed about market analyses, adjust your investment strategy accordingly to manage your exposure to high stock market valuations effectively, and consult financial professionals for personalized guidance. Don't let apprehension about high valuations paralyze you; continue learning about current market trends and make informed investment decisions.

Featured Posts

-

Vatikan Pered Vyborom Preemnik Papy Frantsiska

May 07, 2025

Vatikan Pered Vyborom Preemnik Papy Frantsiska

May 07, 2025 -

Xrp Up 400 In Three Months A Detailed Market Analysis And Investment Advice

May 07, 2025

Xrp Up 400 In Three Months A Detailed Market Analysis And Investment Advice

May 07, 2025 -

Is John Wick 5 Happening Keanu Reeves Latest Update

May 07, 2025

Is John Wick 5 Happening Keanu Reeves Latest Update

May 07, 2025 -

The Trump Effect How His Xrp Support Impacts Institutional Investors

May 07, 2025

The Trump Effect How His Xrp Support Impacts Institutional Investors

May 07, 2025 -

Understanding The Allure Of The Glossy Mirage

May 07, 2025

Understanding The Allure Of The Glossy Mirage

May 07, 2025

Latest Posts

-

Crucial Lessons From The Celtics Rivalry A Cavaliers Stars Analysis

May 07, 2025

Crucial Lessons From The Celtics Rivalry A Cavaliers Stars Analysis

May 07, 2025 -

Cavaliers Defeat Bulls Claim Eastern Conference Lead

May 07, 2025

Cavaliers Defeat Bulls Claim Eastern Conference Lead

May 07, 2025 -

Cleveland Cavaliers Blowout Win Mitchell Mobleys Stellar Performance

May 07, 2025

Cleveland Cavaliers Blowout Win Mitchell Mobleys Stellar Performance

May 07, 2025 -

Orlando Magic Upset Cavaliers Ending 16 Game Streak

May 07, 2025

Orlando Magic Upset Cavaliers Ending 16 Game Streak

May 07, 2025 -

142 105 Blowout Mitchell And Mobley Fuel Cavaliers Victory Over Knicks

May 07, 2025

142 105 Blowout Mitchell And Mobley Fuel Cavaliers Victory Over Knicks

May 07, 2025