XRP On The Verge Of A Breakthrough: ETF Applications, SEC Case Update, And Future Predictions

Table of Contents

The Ripple-SEC Lawsuit: A Turning Point for XRP?

The Ripple-SEC lawsuit has cast a long shadow over XRP, creating uncertainty for investors. However, recent developments suggest a potential turning point. The case's outcome will significantly influence XRP's price, regulatory landscape, and future adoption.

Recent Developments and Legal Arguments:

The lawsuit centers around the SEC's claim that XRP is an unregistered security. Recent court filings have included:

- Expert witness testimonies: Both sides have presented expert witnesses to support their arguments regarding XRP's classification. These testimonies offer crucial insights into the legal arguments.

- Key legal arguments: Ripple argues that XRP is a currency and not a security, highlighting its decentralized nature and widespread use. The SEC maintains that XRP sales constituted unregistered securities offerings.

- Significant rulings: Judge Analisa Torres' rulings on certain aspects of the case have provided some clarity, though the final decision remains pending. [Link to relevant news article 1] [Link to relevant news article 2] [Link to court document excerpt]

Analyzing these developments, a favorable ruling for Ripple could dramatically boost XRP's price and pave the way for greater regulatory clarity. Conversely, an unfavorable ruling could lead to further price declines and prolonged uncertainty.

Potential Outcomes and Their Implications for XRP:

Several scenarios are possible:

- Complete dismissal: A complete dismissal of the SEC's case would likely trigger a significant price surge for XRP, as it would eliminate a major regulatory hurdle.

- Partial victory for Ripple: A partial victory could still positively impact XRP's price, depending on the specifics of the ruling. It might lead to increased regulatory clarity, but perhaps not a complete exoneration.

- Settlement: A settlement between Ripple and the SEC is also a possibility, though the terms would significantly affect XRP's future. A favorable settlement could still result in positive price movement.

Each scenario carries distinct implications for XRP's price, trading volume, and market capitalization. A positive outcome would likely increase investor confidence, leading to higher demand and potentially a substantial price increase. A negative outcome, however, could damage investor sentiment and negatively impact XRP's market position. This outcome would also set a precedent for other cryptocurrencies facing similar legal challenges.

The Rise of XRP ETFs: A Catalyst for Growth?

The potential approval of XRP exchange-traded funds (ETFs) could be a game-changer. Several companies have filed applications, signifying growing institutional interest.

Current ETF Applications and Their Significance:

Several firms are vying to launch XRP ETFs:

- [Company A]: Proposes an XRP ETF focusing on [strategy details].

- [Company B]: Aims to create a diversified ETF including XRP and other cryptocurrencies.

- [Company C]: Focuses on [specific niche, e.g., XRP's use in cross-border payments].

ETF approval would significantly enhance XRP's accessibility and liquidity, attracting institutional investors who are often hesitant to invest directly in cryptocurrencies. This increased institutional participation would boost XRP's market adoption.

The Impact of ETF Approval on XRP's Price and Market Position:

ETF approval is predicted to significantly impact XRP:

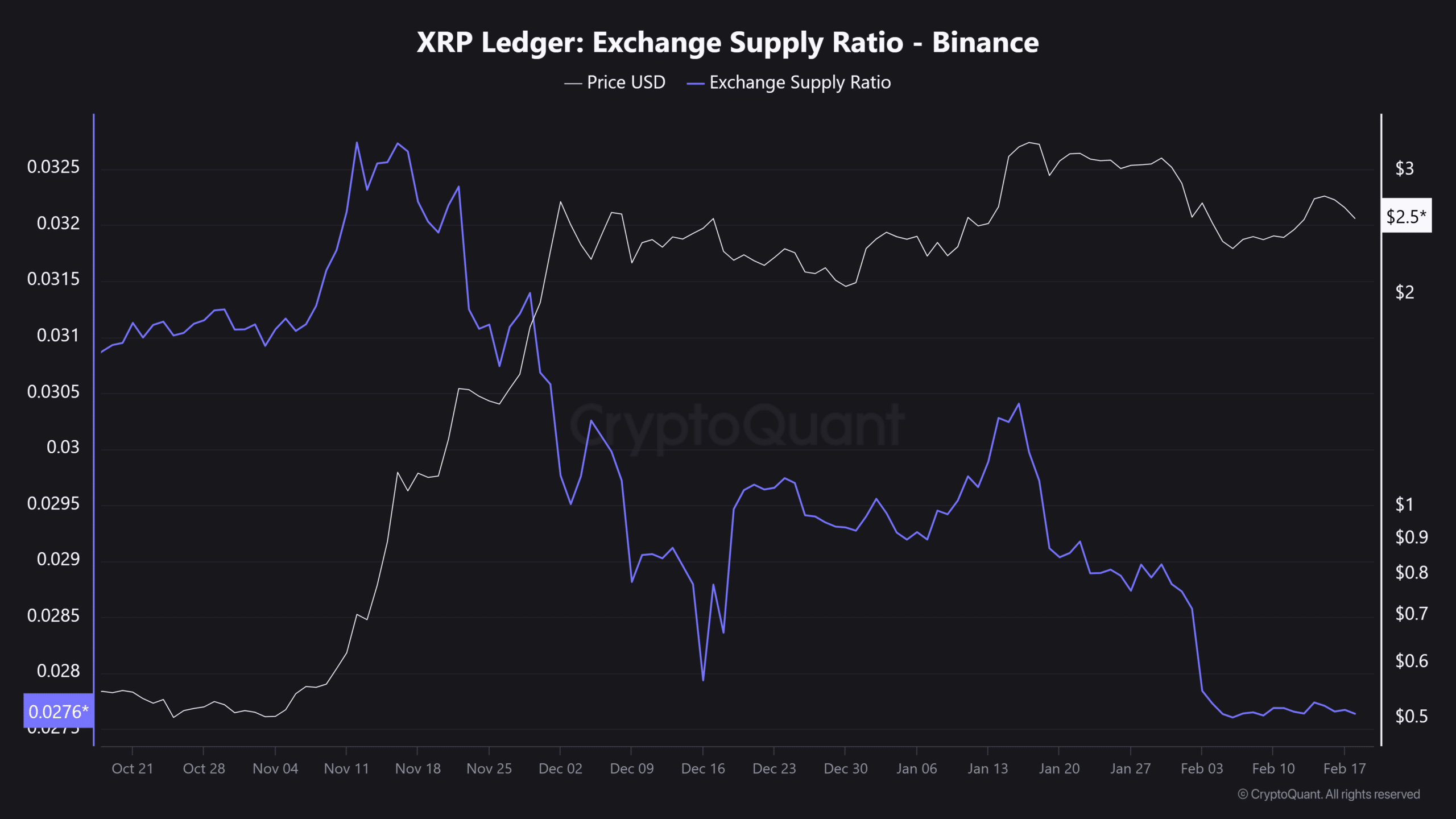

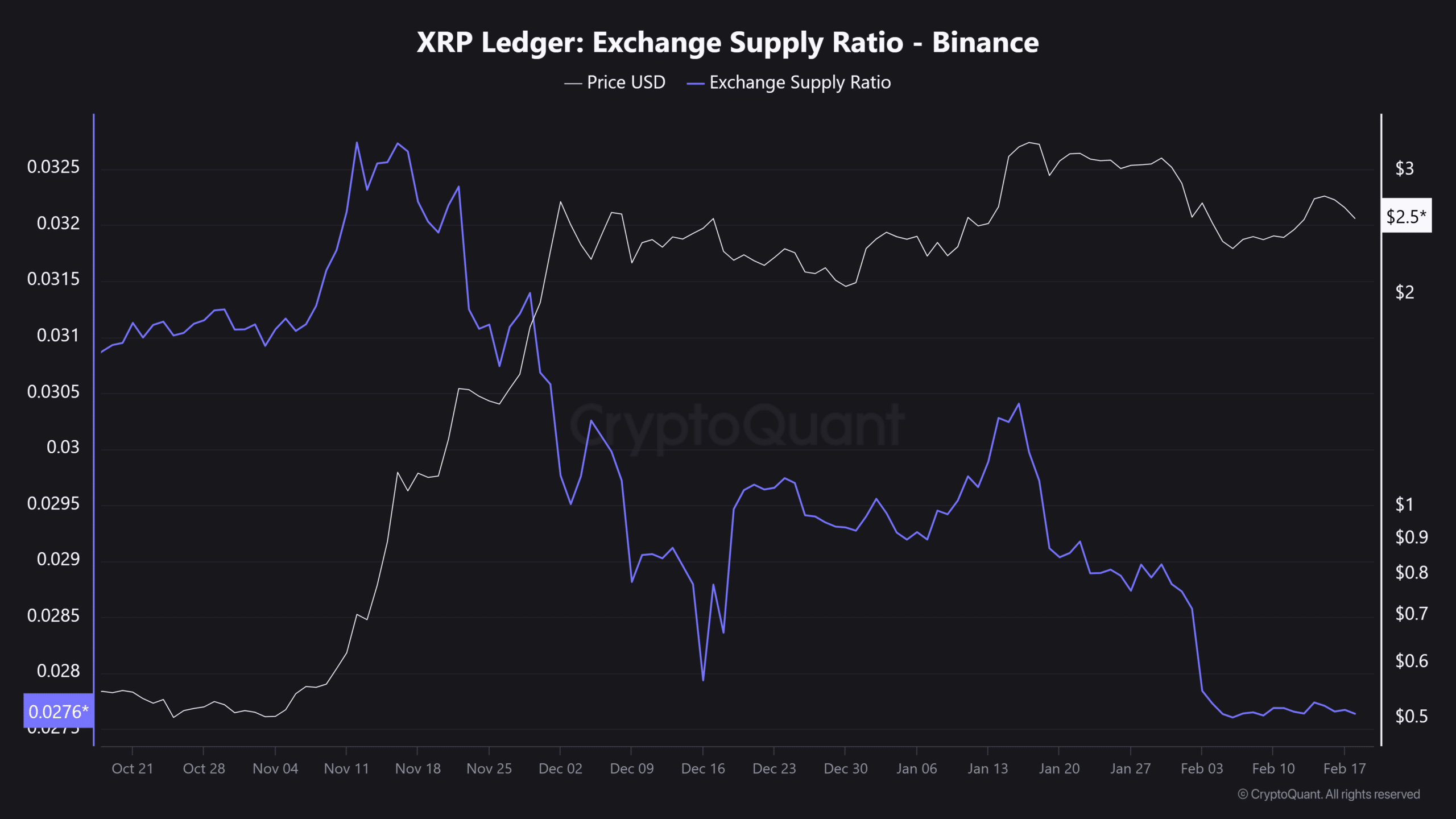

- Price increase: Based on historical data from other crypto ETFs, approval could lead to a substantial price increase for XRP. [Include chart/graph showing potential price increase].

- Increased trading volume and liquidity: ETFs usually increase trading volume and liquidity, making XRP more accessible to a wider range of investors.

- Market share gains: Increased liquidity and institutional interest could help XRP gain market share against its competitors.

However, the actual price increase would depend on several factors including market conditions and the overall regulatory landscape.

Future Predictions for XRP: A Bullish Outlook?

While predicting future prices is inherently speculative, analyzing current trends and potential developments provides valuable insights.

Price Predictions and Market Analysis:

Based on technical analysis and the factors discussed above, we can outline potential price scenarios:

- Bullish scenario (SEC victory + ETF approval): XRP could reach [price prediction] within [timeframe].

- Neutral scenario (SEC settlement + delayed ETF approval): XRP could trade sideways within the range of [price range].

- Bearish scenario (unfavorable SEC ruling): XRP could experience further price declines.

[Include charts, graphs, and data-driven insights to support the predictions. Clearly state any assumptions or limitations].

Adoption and Use Cases for XRP in the Future:

XRP's future success hinges on its adoption in various sectors:

- Cross-border payments: XRP's speed and low transaction fees make it a promising solution for facilitating international payments.

- Decentralized finance (DeFi): XRP could be integrated into DeFi platforms, expanding its utility.

- Other applications: Further exploration could unlock new applications for XRP in areas such as supply chain management and digital asset trading.

The long-term prospects for XRP are positive, contingent on successful navigation of regulatory hurdles and continued development of its underlying technology.

Conclusion:

The future of XRP is intertwined with the outcome of the SEC lawsuit and the success of ETF applications. A positive resolution in both areas could propel XRP to new heights. However, it's crucial to conduct thorough research before making any investment decisions. The potential for XRP's breakthrough is significant, but investing involves risks. Stay informed about the latest developments in the XRP ecosystem and consider the opportunities this cryptocurrency presents. Keep up-to-date on the latest news about XRP and make informed decisions about your investment in this potentially game-changing cryptocurrency.

Featured Posts

-

Sec Vs Ripple Xrps Future After The Court Ruling

May 08, 2025

Sec Vs Ripple Xrps Future After The Court Ruling

May 08, 2025 -

Wzart Qanwn Ka Nwtyfkyshn Lahwr Ky 5 Ahtsab Edaltyn Khtm

May 08, 2025

Wzart Qanwn Ka Nwtyfkyshn Lahwr Ky 5 Ahtsab Edaltyn Khtm

May 08, 2025 -

Us Tariffs And Gms Canadian Footprint A Critical Analysis

May 08, 2025

Us Tariffs And Gms Canadian Footprint A Critical Analysis

May 08, 2025 -

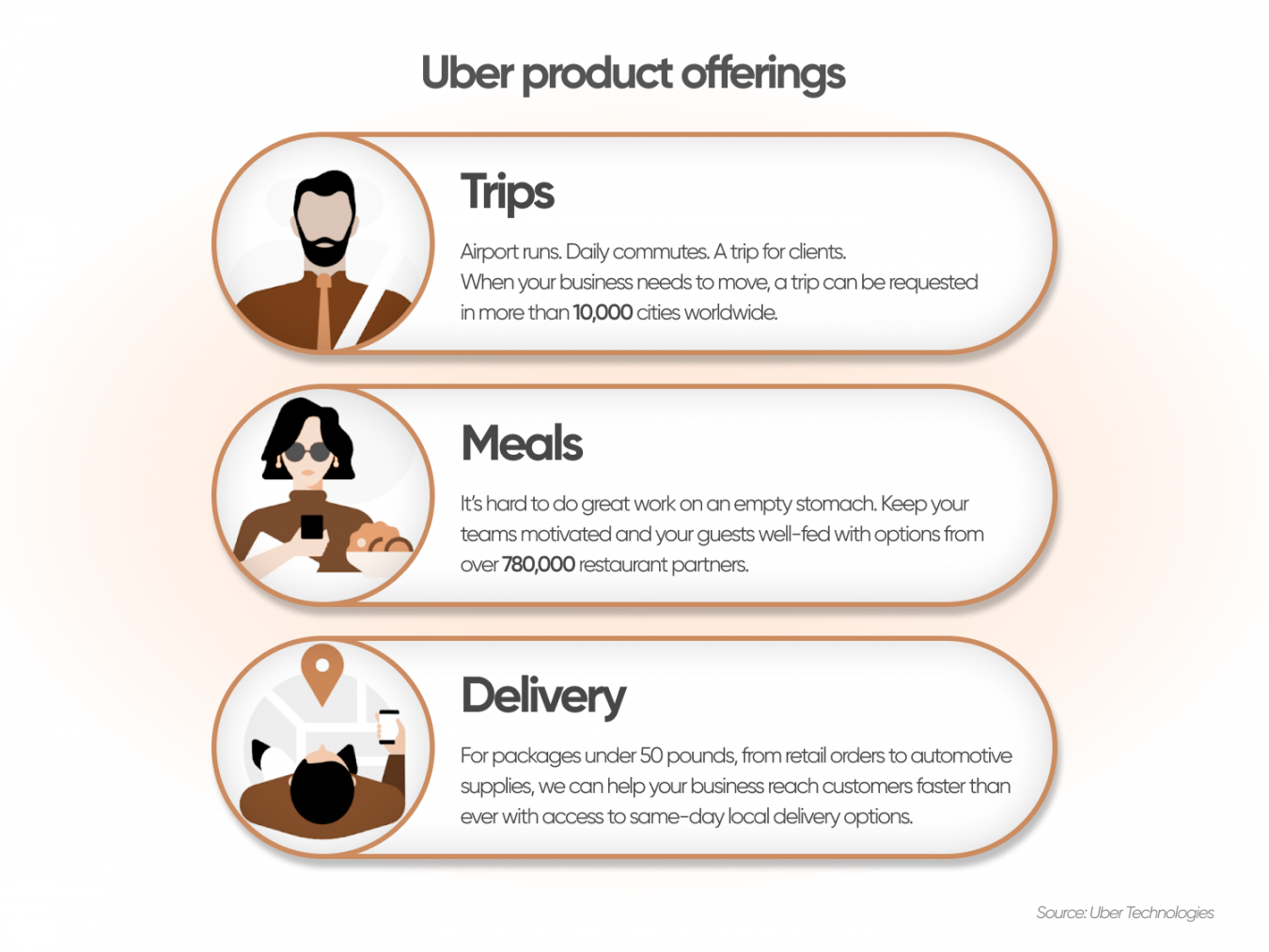

Uber Stock Forecast Assessing The Impact Of Autonomous Vehicle Technology

May 08, 2025

Uber Stock Forecast Assessing The Impact Of Autonomous Vehicle Technology

May 08, 2025 -

Oscars Snubs A Look Back At The Academys Most Controversial Decisions

May 08, 2025

Oscars Snubs A Look Back At The Academys Most Controversial Decisions

May 08, 2025