Uber Stock Forecast: Assessing The Impact Of Autonomous Vehicle Technology

Table of Contents

The Potential Upsides of Autonomous Vehicles for Uber's Stock

The integration of autonomous vehicles holds immense potential for transforming Uber's business model and boosting its stock value. Several key advantages stand out:

Reduced Operational Costs

One of the most significant potential benefits of AV technology is the drastic reduction in operational costs. This is primarily due to:

- Elimination of driver salaries: This is a massive cost-saving measure, potentially freeing up billions of dollars annually.

- Increased vehicle utilization rates: Optimized scheduling algorithms can maximize the time each vehicle spends generating revenue, minimizing downtime.

- Lower insurance premiums: Autonomous vehicles, theoretically, could lead to fewer accidents, resulting in lower insurance premiums for Uber.

- Improved efficiency leading to higher profit margins: By streamlining operations and reducing expenses, Uber can significantly improve its profitability and shareholder returns. This increased efficiency translates directly into a more attractive Uber stock forecast.

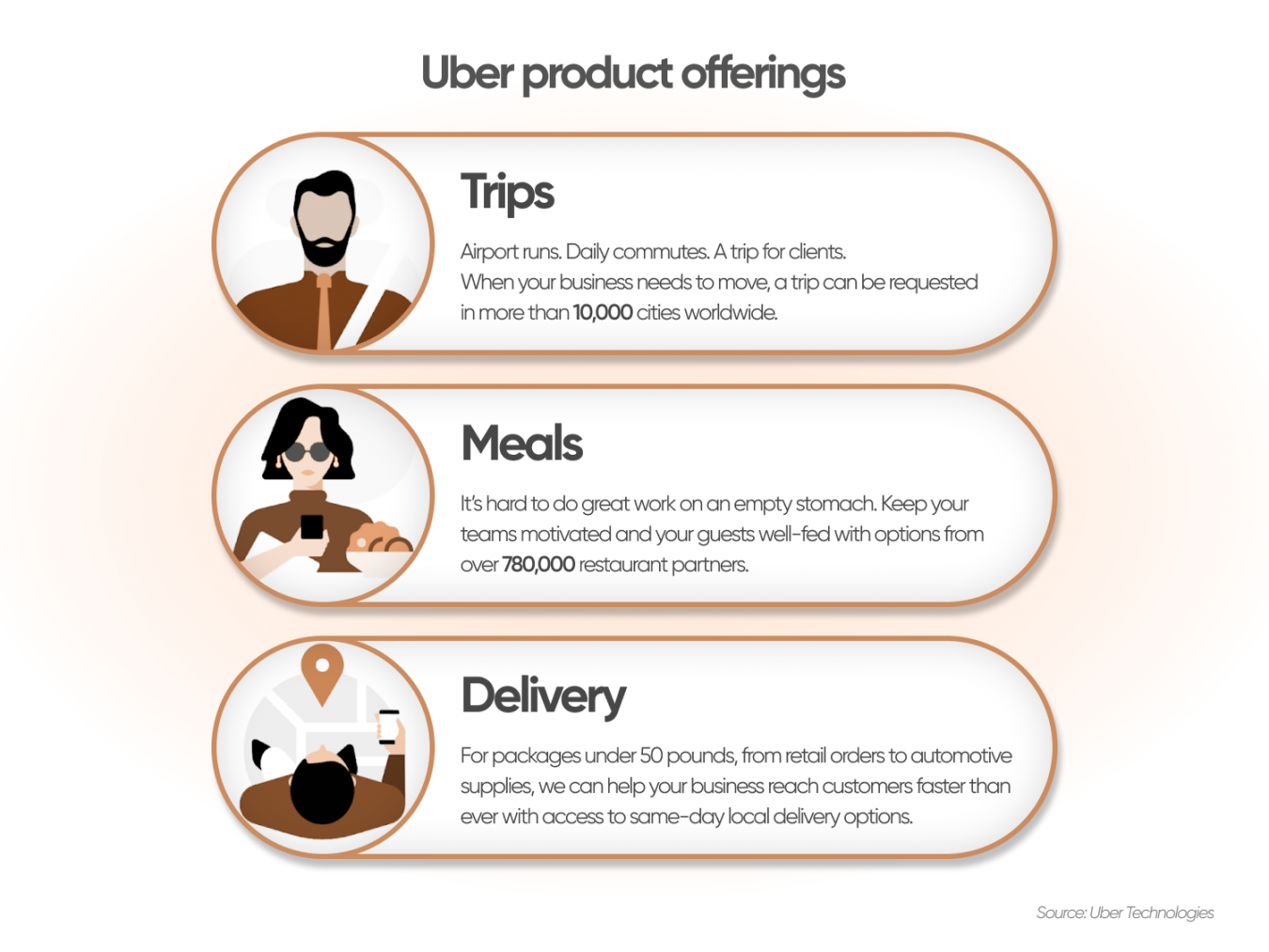

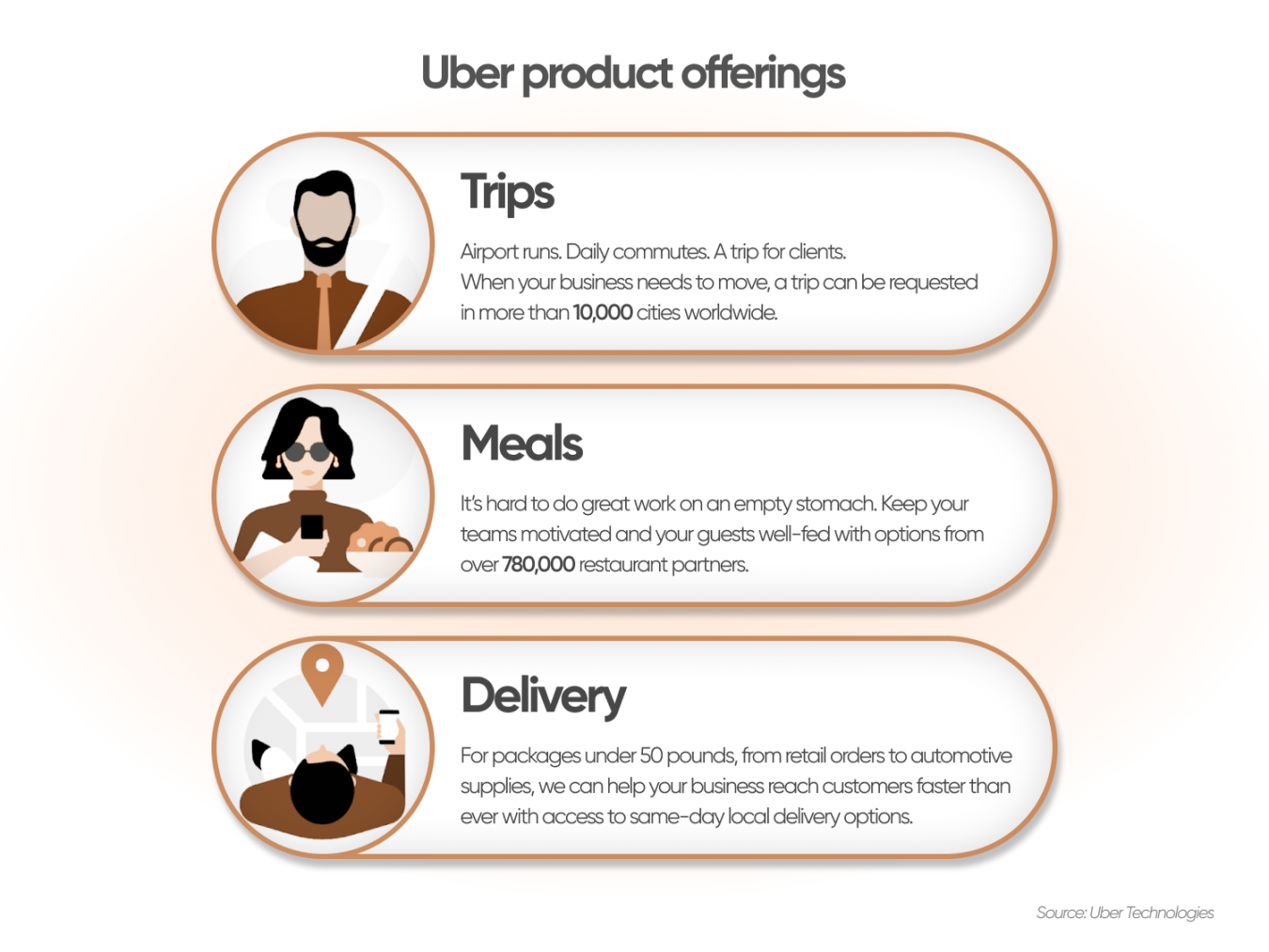

Expanded Market Reach and Revenue Streams

Autonomous vehicles open doors to new markets and revenue streams previously inaccessible to Uber:

- Access to underserved markets: Areas with limited public transportation or high labor costs become viable targets for autonomous ride-sharing services.

- Potential for new services like autonomous delivery (Uber Eats expansion): The same technology used for passenger transport can be easily adapted to deliver food and other goods, significantly expanding Uber Eats' reach and profitability.

- Opportunities for partnerships with other companies integrating AV technology: Collaboration with automotive manufacturers and tech companies could lead to innovative solutions and expanded market penetration.

- Increased demand driven by the convenience and affordability of autonomous rides: The convenience and potential cost savings of autonomous rides could create a surge in demand, driving revenue growth and positive impacts on the Uber stock forecast.

Enhanced Customer Experience

Beyond cost savings and market expansion, AV technology offers a significant upgrade to the customer experience:

- Improved safety through reduced human error: Autonomous vehicles have the potential to drastically reduce accidents caused by human error, leading to increased customer trust and safety.

- More consistent and reliable service: Eliminating human factors like traffic violations and fatigue results in a more predictable and reliable service.

- Potentially lower fares due to reduced operational costs: The cost savings from autonomous driving could translate into lower fares for customers, boosting demand and market share.

- Opportunities for in-car entertainment and personalized experiences: Autonomous vehicles can offer passengers entertainment options, personalized comfort settings, and increased productivity during their journeys.

The Challenges and Risks Associated with Autonomous Vehicle Technology for Uber

Despite the significant potential upsides, several challenges and risks need careful consideration when forecasting Uber's stock:

High Development and Implementation Costs

The transition to a fully autonomous fleet requires substantial investment:

- Significant investment required for research, development, and deployment: Developing, testing, and deploying autonomous vehicle technology is an extremely expensive endeavor.

- Integration challenges with existing infrastructure and systems: Seamless integration with existing Uber systems and urban infrastructure requires significant engineering expertise.

- Potential for delays and unforeseen technical difficulties: Technological development is rarely linear; unexpected delays and setbacks are inevitable.

- Competition from other companies investing heavily in AV technology: Uber faces intense competition from established automakers and tech giants vying for dominance in the autonomous vehicle market.

Regulatory Hurdles and Public Acceptance

Navigating the regulatory landscape and gaining public trust are critical:

- Navigating complex and evolving regulations regarding autonomous vehicles: Regulations surrounding self-driving cars are still developing and vary widely across jurisdictions.

- Addressing public concerns about safety and job displacement: Addressing public concerns about safety and the potential displacement of human drivers is crucial for widespread adoption.

- Dealing with potential legal liabilities in case of accidents: Establishing clear legal frameworks and insurance policies to manage liability in case of accidents involving autonomous vehicles is crucial.

- Varying regulatory landscapes across different regions and countries: This creates significant complexity for Uber’s global operations.

Cybersecurity and Data Privacy Concerns

The inherent technological complexities introduce new security and privacy risks:

- Protecting autonomous vehicle systems from cyberattacks and hacking: Autonomous vehicles are vulnerable to hacking, requiring robust cybersecurity measures.

- Ensuring the privacy and security of passenger data collected by AVs: Protecting passenger data is paramount and requires adherence to stringent data protection regulations.

- Meeting stringent data protection regulations and standards: Compliance with GDPR and other data protection laws is essential.

- Building trust with consumers regarding data handling practices: Transparency and trust are crucial to reassure passengers about data privacy.

Analyzing Current Market Trends and Competitive Landscape

A realistic Uber stock forecast requires an in-depth understanding of current market trends:

- Current Uber stock performance and analyst predictions: Analyzing current stock performance and reviewing analyst ratings provides crucial context.

- Comparison with competitors like Lyft and Waymo in the autonomous vehicle space: Assessing Uber's competitive positioning against key rivals is essential.

- Impact of economic factors and global events on Uber's AV investments: Macroeconomic conditions significantly influence investment decisions and market dynamics.

- Analysis of public sentiment towards autonomous driving technologies: Public opinion plays a pivotal role in the acceptance and success of autonomous vehicles.

Conclusion

The future of Uber's stock price is undeniably intertwined with the success of its autonomous vehicle initiatives. While the potential for significant cost reductions, revenue growth, and improved customer experience is substantial, considerable challenges related to development costs, regulatory hurdles, and public perception need to be addressed. Careful consideration of market trends and competitive pressures is crucial for an accurate Uber stock forecast. Investors should monitor the progress of Uber's AV technology and regulatory developments closely before making any investment decisions. Continue your research and stay informed on the latest developments in the autonomous vehicle sector to make informed decisions about your Uber stock investment.

Featured Posts

-

Cinema Con 2024 Stephen Kings The Long Walk Gets A Release Date

May 08, 2025

Cinema Con 2024 Stephen Kings The Long Walk Gets A Release Date

May 08, 2025 -

Several Arrested In Shreveport Following Large Scale Vehicle Theft Investigation

May 08, 2025

Several Arrested In Shreveport Following Large Scale Vehicle Theft Investigation

May 08, 2025 -

Arsenal Psg Mac Yayini Saat Bilgisi Ve Izleme Linkleri

May 08, 2025

Arsenal Psg Mac Yayini Saat Bilgisi Ve Izleme Linkleri

May 08, 2025 -

The Impact Of 67 Million In Ethereum Liquidations On The Crypto Market

May 08, 2025

The Impact Of 67 Million In Ethereum Liquidations On The Crypto Market

May 08, 2025 -

Pakstan Jely Dstawyzat Awr Gdagry Myn Mlwth Khwatyn Smyt Tyn Afrad Grftar

May 08, 2025

Pakstan Jely Dstawyzat Awr Gdagry Myn Mlwth Khwatyn Smyt Tyn Afrad Grftar

May 08, 2025