XRP On The Brink: Analyzing The Potential Of ETFs, SEC Decisions, And Ripple's Future

Table of Contents

The SEC's Ongoing Legal Battle and its Impact on XRP's Price

The SEC's lawsuit against Ripple Labs, alleging that XRP is an unregistered security, casts a long shadow over XRP's price and future. The outcome of this case will significantly impact the cryptocurrency's trajectory.

Ripple's Legal Strategy and Potential Outcomes

Ripple's defense strategy centers on arguing that XRP is not a security and that its sales were not investment contracts. Several potential outcomes exist:

-

A Ripple Win: A victory for Ripple could lead to a significant surge in XRP's price. Investor confidence would likely rebound, and regulatory uncertainty would decrease, potentially paving the way for broader adoption. This scenario could also positively affect other crypto projects facing similar regulatory challenges.

-

An SEC Win: An SEC win could severely damage XRP's price. It could establish a precedent for increased regulation of cryptocurrencies and lead to delisting from major exchanges. Investor confidence could plummet, and the future of XRP would become significantly more uncertain.

-

A Settlement: A settlement could result in a range of outcomes, from minor concessions to more substantial limitations on XRP's usage or distribution. The impact on XRP's price would depend heavily on the specifics of the settlement.

The arguments presented by both sides are complex and involve intricate legal interpretations of securities laws. Expert opinions on the likely outcome remain divided, highlighting the uncertainty surrounding this crucial case. Keywords: Ripple lawsuit, SEC vs Ripple, XRP price prediction, regulatory uncertainty.

The Ripple Effect on Other Cryptocurrencies

The SEC's decision on Ripple will have a far-reaching impact beyond XRP itself.

-

Increased Regulation: A win for the SEC could lead to increased regulatory scrutiny of other cryptocurrencies, potentially triggering a wave of lawsuits and creating a more challenging environment for the entire crypto industry.

-

Decreased Investor Confidence: A negative outcome for Ripple could erode investor confidence in the entire cryptocurrency market, leading to a broader downturn.

-

More Defined Regulatory Framework: Conversely, a clear ruling, regardless of the outcome, could lead to a more defined regulatory framework, ultimately creating more stability and potentially attracting institutional investment. Keywords: Crypto regulation, SEC cryptocurrency regulation, altcoin regulation.

The Potential for XRP ETFs and Their Influence on Market Adoption

The approval of XRP ETFs (Exchange-Traded Funds) could dramatically alter XRP's market landscape.

Understanding Exchange-Traded Funds (ETFs)

ETFs are investment funds that trade on stock exchanges, offering investors easy access to diversified portfolios.

- Ease of Access: ETFs simplify investment in cryptocurrencies for retail and institutional investors alike.

- Diversification: Investing in XRP through an ETF allows diversification within a larger portfolio.

- Regulatory Compliance: ETFs are subject to stricter regulatory oversight than many other crypto investments. Keywords: XRP ETF, ETF, exchange-traded fund, cryptocurrency ETF, investment.

The Impact of XRP ETF Approval on Liquidity and Price

The approval of an XRP ETF could significantly boost XRP's liquidity and price.

- Increased Liquidity: ETFs attract institutional investors, leading to significantly increased trading volume and improved liquidity for XRP.

- Price Appreciation: Increased demand from institutional investors could drive up XRP's price, boosting its market capitalization.

- Institutional Investment: The ease of access provided by ETFs makes it easier for institutional investors (hedge funds, pension funds, etc.) to allocate capital to XRP. Keywords: XRP price, XRP market cap, institutional investment, liquidity.

Ripple's Technological Advancements and Future Roadmap

Ripple's technological advancements and strategic initiatives are crucial to its long-term success and the value of XRP.

RippleNet and its Role in Global Payments

RippleNet, Ripple's real-time gross settlement system (RTGS), is designed to facilitate faster and cheaper cross-border payments.

- Partnerships: RippleNet boasts partnerships with several major financial institutions, showcasing its growing adoption.

- Use Cases: RippleNet addresses a real-world need for efficient global payments, driving its continued development.

- Competitive Advantage: RippleNet's speed and cost-effectiveness give it a competitive edge in the global payments market. Keywords: RippleNet, cross-border payments, blockchain technology, fintech.

Ripple's Long-Term Vision and Development Plans

Ripple's future roadmap includes continued innovation, strategic partnerships, and expansion into new markets.

- New Technologies: Ripple continues to invest in research and development, potentially incorporating new technologies to enhance RippleNet's functionality.

- Strategic Partnerships: Further partnerships with financial institutions and technology companies could enhance RippleNet's reach and functionality.

- Expansion: Ripple's expansion into new markets and sectors will be crucial for future growth. Keywords: XRP future, Ripple innovation, technology roadmap.

Conclusion

The future of XRP remains uncertain, heavily influenced by the ongoing SEC case, the potential approval of XRP ETFs, and Ripple's own strategic initiatives. While the legal battle presents significant risks, the potential for widespread ETF adoption and Ripple's continued technological advancements offer a compelling counterpoint. Staying informed about these developments is crucial for anyone interested in XRP. Continue researching the latest news and analyses regarding the SEC's decisions and the progress of RippleNet to make informed decisions about investing in XRP.

Featured Posts

-

Italy Vs France Rugby Duponts Impact On The Game

May 01, 2025

Italy Vs France Rugby Duponts Impact On The Game

May 01, 2025 -

Pm Modi To Flag Off First Train In Kashmir Ending Long Wait For Rail Connectivity

May 01, 2025

Pm Modi To Flag Off First Train In Kashmir Ending Long Wait For Rail Connectivity

May 01, 2025 -

Windstar Cruises A Foodies Voyage

May 01, 2025

Windstar Cruises A Foodies Voyage

May 01, 2025 -

Colorado Buffaloes Visit Texas Tech Toppins 21 Point Performance Sets The Stage

May 01, 2025

Colorado Buffaloes Visit Texas Tech Toppins 21 Point Performance Sets The Stage

May 01, 2025 -

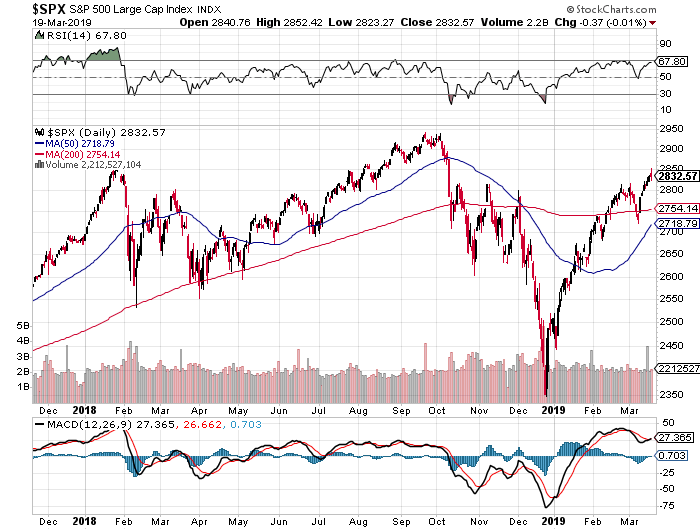

Volatility Ahead Secure Your S And P 500 Investments With Downside Protection

May 01, 2025

Volatility Ahead Secure Your S And P 500 Investments With Downside Protection

May 01, 2025

Latest Posts

-

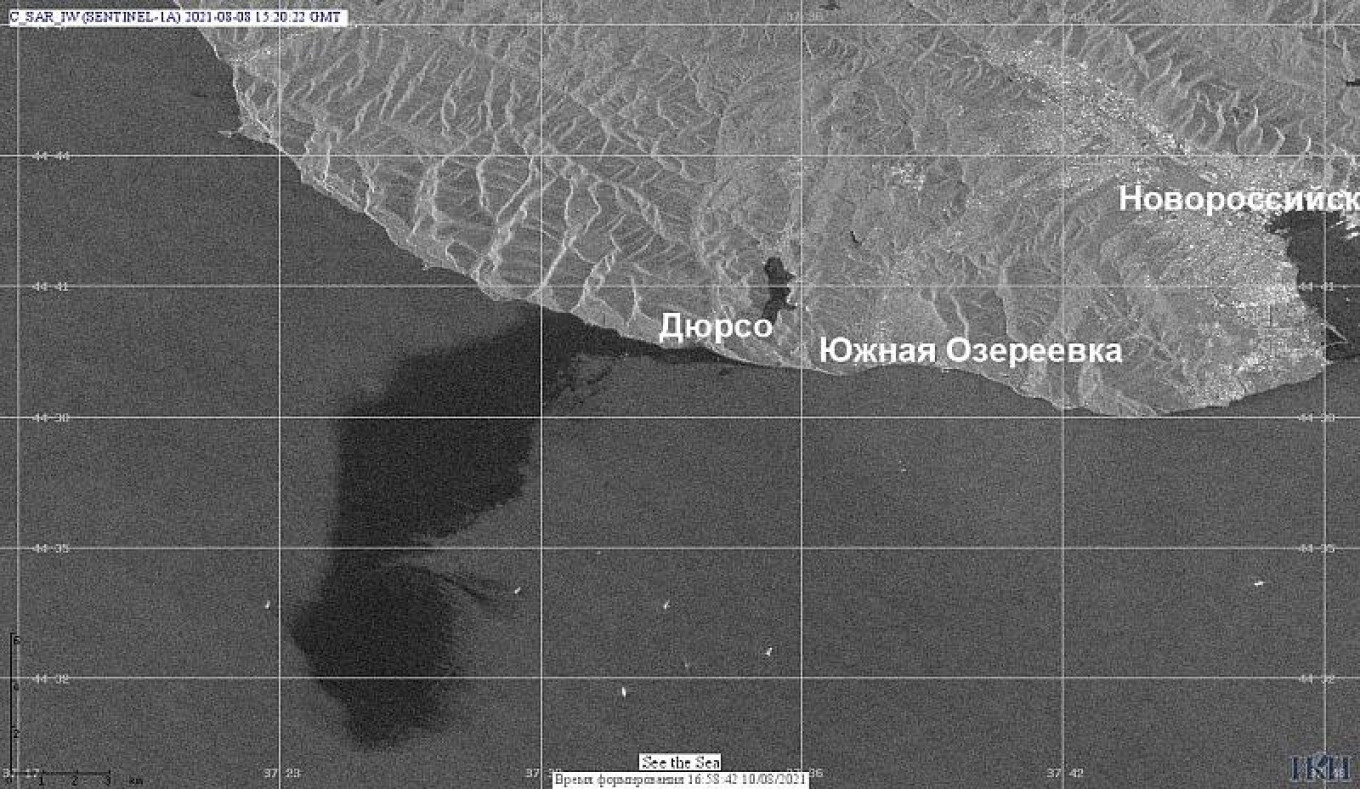

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

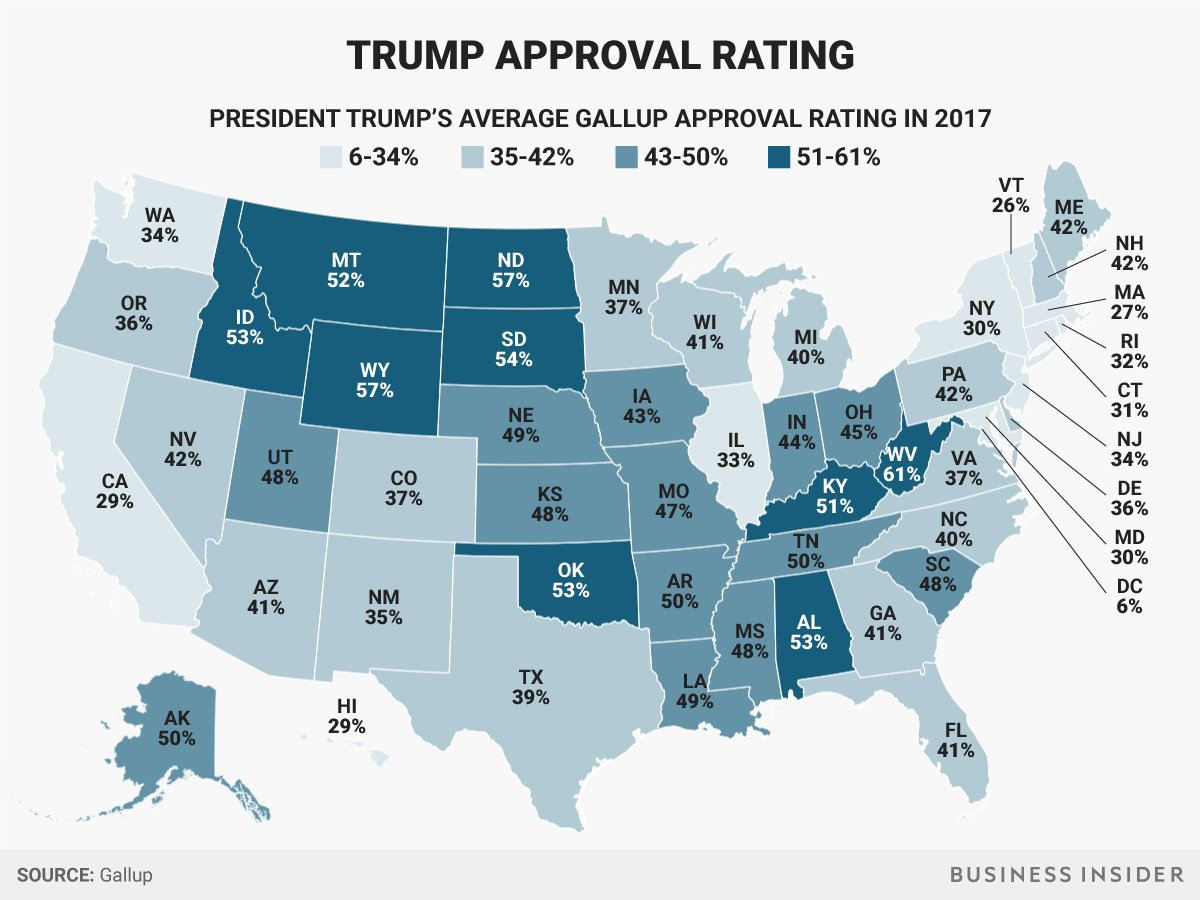

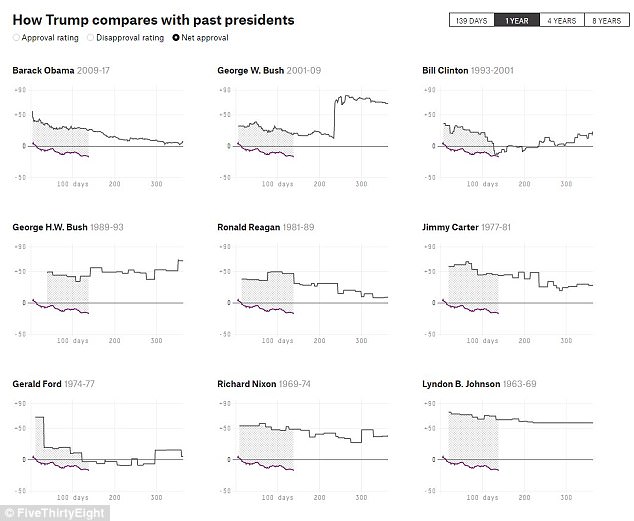

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025 -

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025

Slow Start Trumps 39 Approval Rating At The 100 Day Mark

May 01, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

May 01, 2025