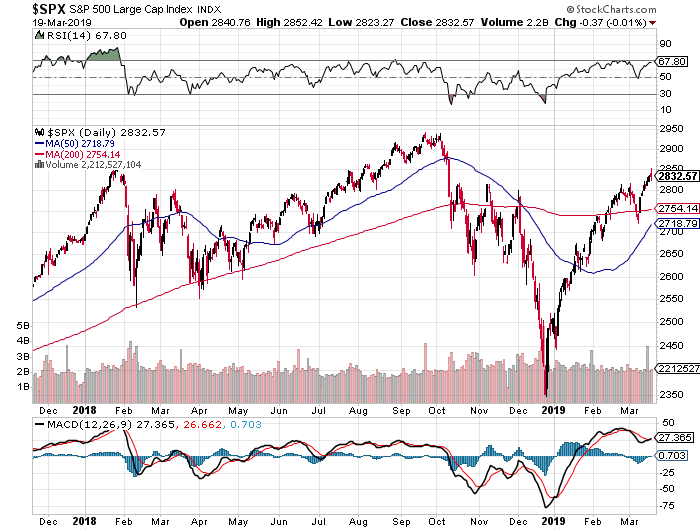

Volatility Ahead? Secure Your S&P 500 Investments With Downside Protection

Table of Contents

Understanding S&P 500 Volatility and its Impact

Factors Contributing to S&P 500 Volatility:

Market volatility is influenced by a complex interplay of factors. Understanding these contributing elements is crucial for implementing effective downside protection strategies. Key factors include:

- Economic Indicators: Inflation, interest rate hikes, and the looming threat of recession significantly impact investor sentiment and market performance. High inflation erodes purchasing power, while rising interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth. Recessionary fears often trigger sell-offs.

- Geopolitical Events: Global events, such as wars, political instability, and trade disputes, can introduce significant uncertainty and volatility into the market. These unpredictable events can trigger sudden shifts in investor confidence and market valuations.

- Company Performance: Unexpected earnings reports, disappointing sales figures, or negative news about individual companies within the S&P 500 can cause ripples throughout the index, impacting its overall performance and increasing volatility.

- Market Sentiment and Investor Psychology: Investor psychology plays a crucial role in market fluctuations. Fear, greed, and herd mentality can amplify market swings, leading to periods of both rapid gains and steep losses. Understanding these psychological factors is essential for making rational investment decisions.

The Importance of Downside Protection:

Downside protection isn't about avoiding all risk; it's about strategically managing it. Here's why it's crucial:

- Capital Preservation: Downside protection strategies aim to limit potential losses during market downturns, safeguarding your capital and preventing significant erosion of your investment.

- Emotional Discipline: Market volatility can trigger emotional reactions, leading to impulsive buy or sell decisions. Downside protection allows for a more rational approach, preventing panic selling.

- Long-Term Goals: Short-term market fluctuations shouldn't derail your long-term financial goals. Downside protection helps you stay focused on the bigger picture and ride out market volatility.

- Risk Mitigation: Effective downside protection strategies help you reduce overall portfolio risk without completely sacrificing the potential for growth.

Strategies for Securing Your S&P 500 Investments

Diversification Strategies:

Diversification is a cornerstone of risk management. Don't put all your eggs in one basket!

- Asset Allocation: Diversify across different asset classes, including bonds, real estate, and commodities. These asset classes often have a low correlation with stocks, offering a buffer during market downturns.

- Sector Diversification: Within the S&P 500, avoid over-concentration in specific sectors. A diversified portfolio reduces the impact of underperformance in any single sector.

- International Diversification: Reduce dependence on the US market by including international stocks in your portfolio. This broadens your investment base and reduces overall risk.

Hedging Techniques:

For more active risk management, consider these hedging techniques:

- Protective Puts: Purchasing put options on your S&P 500 holdings provides insurance against potential losses. A put option grants you the right to sell your shares at a predetermined price, limiting your downside risk.

- Inverse ETFs & Short Positions (Advanced): Experienced investors might consider inverse exchange-traded funds (ETFs) or short positions to profit from market declines. However, these strategies involve significant risk and are not suitable for all investors.

- Volatility ETFs: These ETFs track volatility indices, allowing you to profit from market uncertainty. They can serve as a hedge against market declines, but their performance can be highly volatile.

Utilizing Stop-Loss Orders:

Stop-loss orders automatically sell your investments when they reach a predetermined price, limiting potential losses.

- Setting Sell Points: Carefully determine appropriate stop-loss levels based on your risk tolerance and market conditions.

- Understanding Limitations: Stop-loss orders don't guarantee protection from losses; they can be triggered by market gaps or significant price swings.

- Dynamic Adjustments: Adjust your stop-loss levels as market conditions change to optimize your risk management strategy.

Dollar-Cost Averaging (DCA):

Dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of the market price.

- Market Timing Mitigation: DCA reduces the impact of trying to time the market, smoothing out your investment cost over time.

- Long-Term Strategy: This is a suitable strategy for long-term investors with a higher risk tolerance.

- Consistent Investment: Requires discipline and a commitment to investing regularly.

Choosing the Right Downside Protection Strategy for Your Portfolio

Assessing Your Risk Tolerance:

Selecting the right strategy depends on your individual circumstances:

- Investment Goals & Time Horizon: Your time horizon significantly impacts your risk tolerance. Long-term investors can generally withstand more volatility than short-term investors.

- Financial Situation: Your overall financial health and ability to absorb potential losses determine your risk appetite.

Consulting a Financial Advisor:

Seeking professional guidance is highly recommended:

- Personalized Plan: A financial advisor can help you develop a personalized investment plan that aligns with your risk tolerance, investment goals, and financial situation.

- Tailored Strategies: They can recommend specific downside protection strategies tailored to your unique needs and circumstances.

Conclusion: Secure Your S&P 500 Future with Effective Downside Protection

Market volatility is an inherent aspect of investing in the S&P 500. By understanding the factors driving this volatility and implementing effective downside protection strategies like diversification, hedging, stop-loss orders, and dollar-cost averaging, you can significantly mitigate risk and safeguard your investments. Remember to assess your risk tolerance and consider consulting a financial advisor to develop a personalized plan. Begin securing your S&P 500 investments with effective downside protection strategies today. Learn more about downside protection for your S&P 500 portfolio and build a more resilient investment strategy.

Featured Posts

-

Gemeente Kampen Vs Enexis Spoedprocedure Stroomnetaansluiting

May 01, 2025

Gemeente Kampen Vs Enexis Spoedprocedure Stroomnetaansluiting

May 01, 2025 -

L Accompagnement Numerique Un Atout Pour Vos Thes Dansants

May 01, 2025

L Accompagnement Numerique Un Atout Pour Vos Thes Dansants

May 01, 2025 -

Land Your Dream Private Credit Job 5 Key Strategies

May 01, 2025

Land Your Dream Private Credit Job 5 Key Strategies

May 01, 2025 -

A Reflective Prince William Kensington Palaces New Image

May 01, 2025

A Reflective Prince William Kensington Palaces New Image

May 01, 2025 -

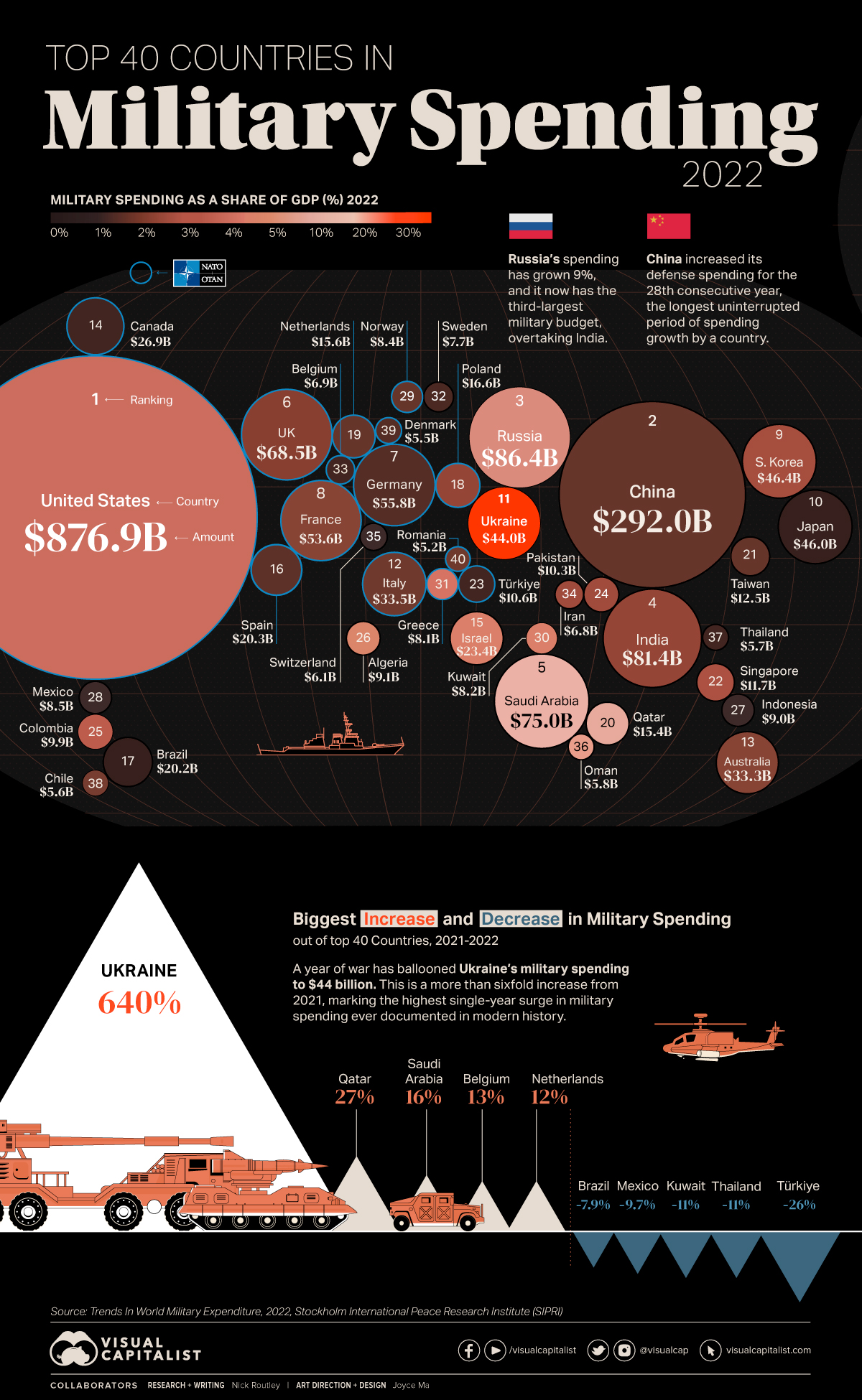

Soaring Global Military Expenditure The Impact Of The Ukraine Conflict

May 01, 2025

Soaring Global Military Expenditure The Impact Of The Ukraine Conflict

May 01, 2025

Latest Posts

-

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025 -

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025 -

Choosing The Right Cruise Line A Comparison Of Top Us Operators

May 01, 2025

Choosing The Right Cruise Line A Comparison Of Top Us Operators

May 01, 2025 -

Phap Ly Va Rui Ro Khi Dau Tu Vao Doanh Nghiep Bi Nghi Van Lua Dao

May 01, 2025

Phap Ly Va Rui Ro Khi Dau Tu Vao Doanh Nghiep Bi Nghi Van Lua Dao

May 01, 2025 -

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025