XRP News Today: Ripple Lawsuit Update And US ETF Prospects

Table of Contents

Ripple Lawsuit Update: A Turning Point?

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) remains a central focus for XRP investors. This protracted case centers on whether XRP is a security, a designation that would have significant ramifications for its trading and future prospects. Recent court filings and expert testimonies offer crucial insights into potential outcomes.

-

Summary of recent court filings and significant developments: Recent rulings have focused on the definition of "investment contract" as applied to XRP sales. The judge's interpretations of "programmatic sales" – those conducted through automated systems – are particularly significant, determining whether these sales qualify as securities offerings.

-

Expert opinions and analyses on the potential outcomes: Legal experts offer divergent opinions. Some believe the SEC has a strong case concerning certain XRP sales, while others contend that a clear distinction exists between Ripple’s institutional sales and the open market trading of XRP. The outcome could profoundly impact the cryptocurrency market’s overall regulatory landscape.

-

How the ruling could impact XRP's price and market position: A favorable ruling for Ripple could trigger a substantial price increase for XRP, boosting investor confidence and potentially leading to wider adoption. Conversely, an unfavorable ruling could negatively impact XRP's price and market standing, although the market's reaction remains unpredictable.

-

Discussion of "programmatic sales" and their legal implications: The definition and legal implications of "programmatic sales" are at the heart of the SEC's argument. The court's interpretation of these sales will set a precedent that could impact not only XRP but other cryptocurrencies with similar distribution methods.

-

Mention any recent statements from Ripple executives or legal team: Ripple executives have consistently maintained their confidence in their defense and their belief that XRP is not a security. Statements from their legal team often emphasize the importance of clear regulatory frameworks for the cryptocurrency industry.

US ETF Prospects for XRP: A Realistic Possibility?

The possibility of an XRP ETF (Exchange-Traded Fund) in the US market is a significant topic of discussion. However, securing SEC approval for a crypto ETF, particularly one tied to XRP, presents substantial challenges.

-

Discussion of the SEC's stance on crypto ETFs in general: The SEC has historically expressed concerns about the volatility and potential for market manipulation within the cryptocurrency market, impacting its approval of crypto ETFs. These concerns need to be addressed for any crypto asset to secure ETF approval.

-

Explanation of the hurdles facing XRP-specific ETF applications: The uncertainty surrounding the Ripple lawsuit is a major hurdle. A negative ruling could significantly reduce the likelihood of XRP ETF approval. The SEC will also likely scrutinize XRP's regulatory compliance and overall market maturity before considering any application.

-

Comparison to other cryptocurrencies that have already secured ETF approval (or are close): While Bitcoin and Ethereum futures ETFs are now available, the approval process has been lengthy and rigorous. The SEC's approach to XRP will depend on several factors, including the outcome of the Ripple lawsuit and evidence of compliance with its regulatory requirements.

-

Potential benefits and risks of an XRP ETF for investors: An XRP ETF would offer investors easier access to XRP, potentially increasing liquidity and driving price stability. However, investors should also be aware of the inherent risks associated with cryptocurrencies, including volatility and regulatory uncertainty.

-

Speculation on potential timelines for XRP ETF approval: Predicting a timeline is challenging. The outcome of the Ripple lawsuit will likely play a crucial role in determining whether and when an XRP ETF might be approved.

Impact of Ripple Lawsuit Outcome on ETF Prospects

The Ripple lawsuit's outcome will significantly impact the prospects of an XRP ETF.

-

How a positive ruling for Ripple could expedite ETF approval: A favorable ruling would substantially increase the chances of XRP ETF approval, removing the primary regulatory obstacle. This would signal to the SEC that XRP is not a security, easing concerns about market manipulation and investor protection.

-

How a negative ruling could delay or prevent ETF approval: A negative ruling could significantly delay or even prevent XRP ETF approval. The SEC might interpret an adverse ruling as evidence of XRP's classification as a security, making ETF approval highly unlikely.

-

Discussion of the uncertainty surrounding the regulatory landscape: The regulatory landscape for cryptocurrencies remains uncertain, adding to the complexity of predicting the timeline for ETF approval. Ongoing regulatory developments could further impact the SEC’s decision-making process.

-

Analysis of market sentiment and investor expectations: Market sentiment and investor expectations play a significant role. Positive news regarding the lawsuit or regulatory developments will likely influence investor sentiment and increase the demand for an XRP ETF.

The Broader XRP Market Landscape

Beyond the legal battles and ETF prospects, the overall XRP market continues to evolve.

-

Current XRP price and trading volume: Monitor real-time XRP price and trading volume data for the most up-to-date market information. Factors such as news events, regulatory developments, and overall market sentiment heavily influence XRP's price.

-

Adoption by businesses and institutions: XRP's adoption by businesses and institutions for cross-border payments continues, demonstrating its practical use cases. The extent of this adoption will be a key factor in determining future market value.

-

Key partnerships and collaborations: Ripple's partnerships and collaborations with financial institutions and payment processors are instrumental in driving XRP's adoption. These partnerships contribute to expanding its network and utility.

-

Recent developments in the XRP Ledger technology: Ongoing improvements and upgrades to the XRP Ledger, such as increased transaction speeds and scalability enhancements, strengthen the technology's foundation and attract further adoption.

Conclusion

The XRP market landscape is shaped by several key factors: the ongoing Ripple lawsuit, the potential for US XRP ETFs, and broader market dynamics. The outcome of the Ripple case holds significant implications for XRP's future price and market position, directly influencing the likelihood of ETF approval. Sustained adoption by businesses and ongoing technological advancements within the XRP Ledger further contribute to XRP's overall development and potential.

Call to Action: Stay updated on the latest XRP news and analysis. Continue to monitor the Ripple lawsuit and the evolving regulatory landscape for crucial information affecting your XRP investments. Learn more about XRP and its potential by exploring [link to relevant resource]. Stay informed about all the important XRP News Today!

Featured Posts

-

Kshmyr Ke Msyle Pr Brtanwy Wzyr Aezm Kw Thryry Drkhwast

May 01, 2025

Kshmyr Ke Msyle Pr Brtanwy Wzyr Aezm Kw Thryry Drkhwast

May 01, 2025 -

Duurzaam Schoolgebouw Kampen Rechtszaak Tegen Enexis Over Stroomaansluiting

May 01, 2025

Duurzaam Schoolgebouw Kampen Rechtszaak Tegen Enexis Over Stroomaansluiting

May 01, 2025 -

Xrp Cryptocurrency A Beginners Guide

May 01, 2025

Xrp Cryptocurrency A Beginners Guide

May 01, 2025 -

Meer Dan Duizend Limburgse Ondernemers Wachten Op Aansluiting Enexis

May 01, 2025

Meer Dan Duizend Limburgse Ondernemers Wachten Op Aansluiting Enexis

May 01, 2025 -

Brtanwy Wzyr Aezm Kw Kshmyr Ke Msyle Pr Dstawyz Pysh Ky Gyy

May 01, 2025

Brtanwy Wzyr Aezm Kw Kshmyr Ke Msyle Pr Dstawyz Pysh Ky Gyy

May 01, 2025

Latest Posts

-

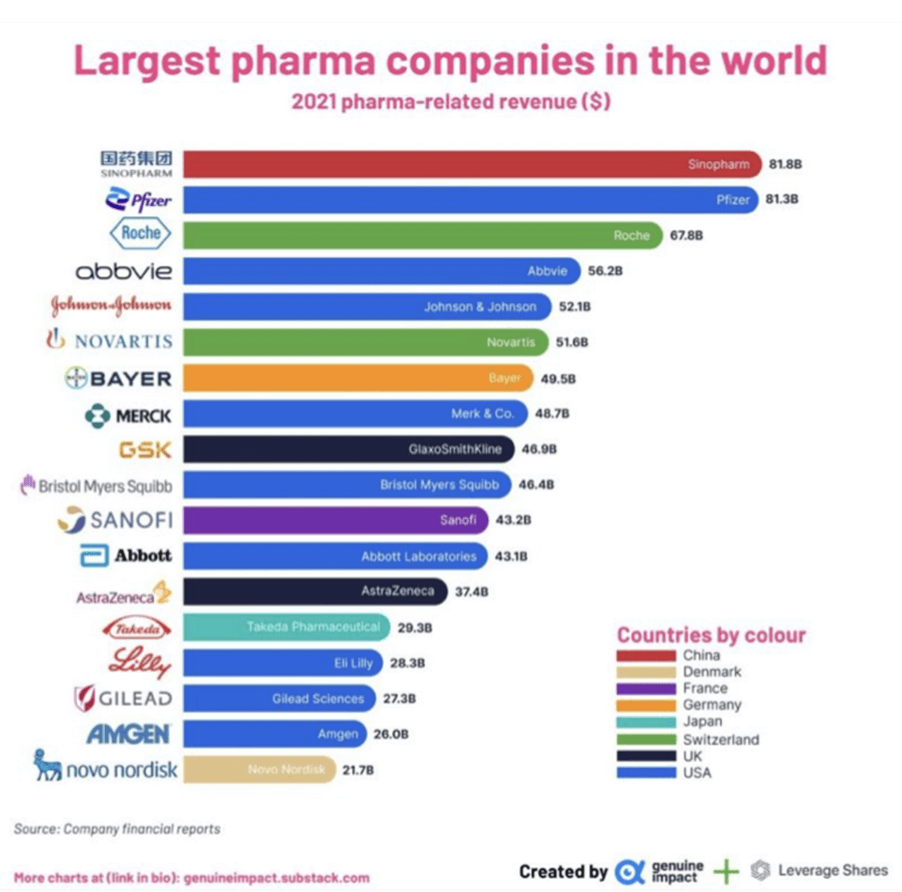

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025 -

Market Uncertainty Secure Your S And P 500 Investments With Smart Strategies

May 01, 2025

Market Uncertainty Secure Your S And P 500 Investments With Smart Strategies

May 01, 2025 -

Uncovering The Countrys Promising New Business Locations

May 01, 2025

Uncovering The Countrys Promising New Business Locations

May 01, 2025 -

Retailers Sound Alarm Tariff Price Increases Are Inevitable

May 01, 2025

Retailers Sound Alarm Tariff Price Increases Are Inevitable

May 01, 2025 -

Chinas Push For Us Drug Import Substitutes A National Strategy

May 01, 2025

Chinas Push For Us Drug Import Substitutes A National Strategy

May 01, 2025