XRP Investment Surge: Trump's Endorsement Fuels Institutional Interest

Table of Contents

Trump's Endorsement and its Ripple Effect on XRP

The Nature of Trump's Comments

Determining the precise nature of Trump's comments regarding XRP is crucial. While there haven't been any direct, explicit endorsements, rumors and interpretations of his broader statements on cryptocurrencies have circulated widely within the crypto community. The ambiguity surrounding these comments is itself a significant factor in the price movement.

- Direct quotes (if available) and their context: [Insert any verifiable quotes here, carefully citing the source. If no direct quotes exist, state this clearly and explain the nature of the indirect references]. The absence of direct endorsement might even contribute to the narrative, fueling speculation and driving prices.

- Analysis of media coverage and its influence on investor sentiment: The media's interpretation and reporting of Trump's alleged comments played a major role in amplifying the perceived endorsement. News outlets often framed the ambiguity as a positive signal, further contributing to the surge in XRP investment.

- The role of social media in amplifying the impact of Trump's perceived endorsement: Social media platforms like Twitter and Telegram became echo chambers for the speculation, with numerous posts and discussions interpreting Trump's actions or words as tacit support for XRP. This created a self-fulfilling prophecy, driving up demand and pushing the price higher.

The influence of even indirect or ambiguous statements from influential figures like Trump underscores the speculative nature of the cryptocurrency market. A tweet, a fleeting remark, or even a perceived nod can significantly impact prices due to the market's inherent volatility and the psychology of investors who often react emotionally to news and speculation.

Increased Institutional Interest in XRP

Shifting Investment Strategies

The perceived endorsement, coupled with other factors, has seemingly attracted increased institutional interest in XRP. Several reasons explain this shift:

- Mention of any specific institutional investors showing increased interest in XRP (with sources): [Insert information about any institutional investors showing increased activity in XRP, with verifiable sources]. The lack of readily available information here highlights the opacity of institutional investment in crypto.

- Analysis of the potential benefits of XRP for institutional portfolios (e.g., diversification, access to cross-border payments): XRP's potential use cases in cross-border payments offer a compelling reason for institutional investors to diversify their portfolios. The speed and low cost associated with XRP transactions make it an attractive alternative to traditional banking systems.

- Comparison to other cryptocurrencies and their institutional adoption rates: Compared to Bitcoin and Ethereum, XRP's institutional adoption remains comparatively lower. However, the recent surge suggests a possible turning point, potentially driven by the perceived Trump endorsement and its implications for regulatory clarity.

The perceived legitimacy boost from Trump's (alleged) support could significantly impact institutional risk assessments. Institutional investors often prioritize regulatory certainty, and any event suggesting increased acceptance of XRP within the political landscape might lead them to reconsider its inclusion in their portfolios. However, regulatory uncertainty remains a significant barrier to wider institutional adoption.

Technical Analysis of the XRP Price Surge

Charting the Rise

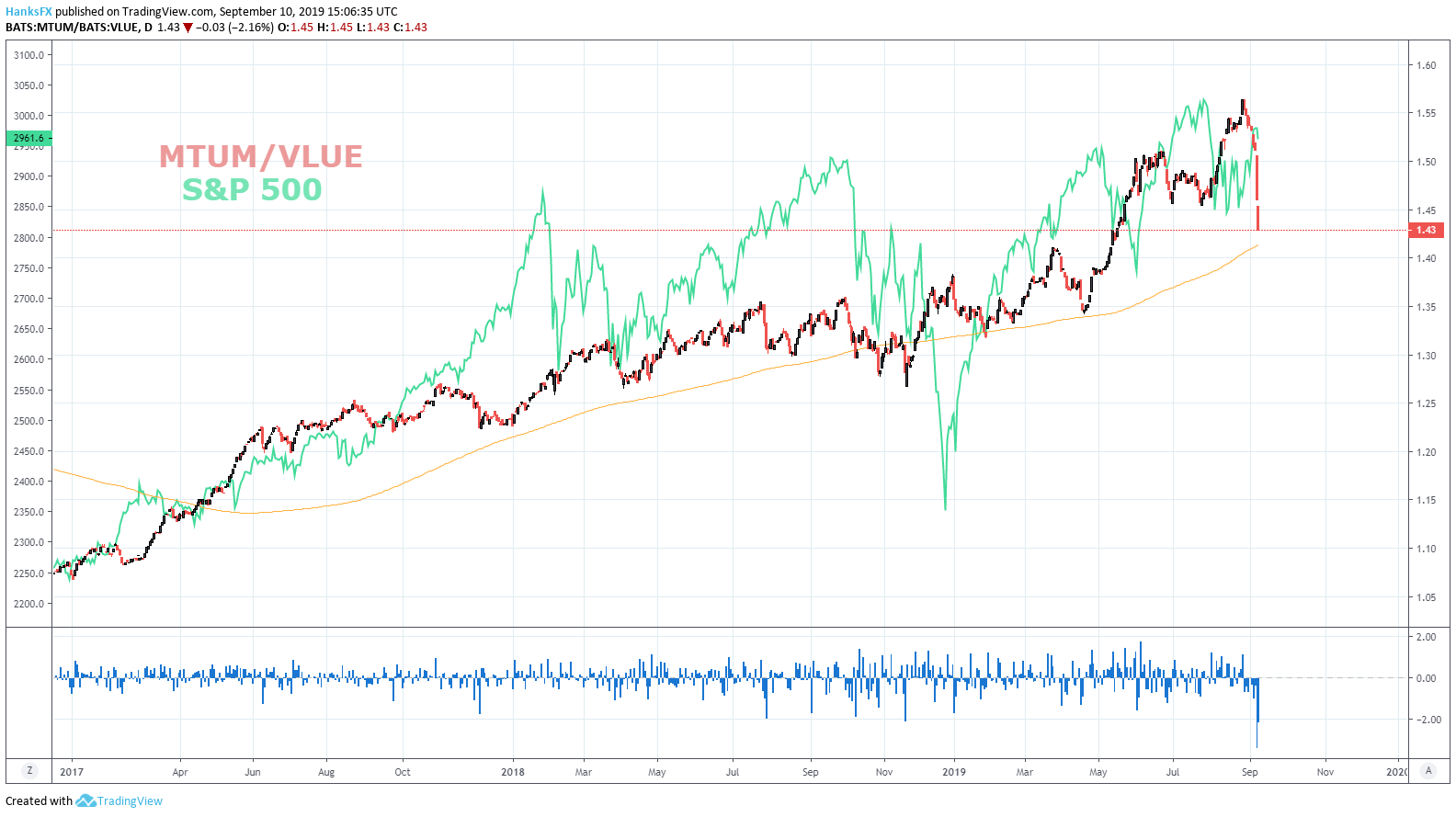

Following the perceived Trump endorsement, XRP experienced a notable price surge.

- Key price levels and trading volume data: [Insert specific data points, illustrating the price movement and trading volume. Include charts and graphs here for visual representation. Note: Data should be accurate and cited from reputable sources].

- Mention of any significant technical indicators supporting the price increase: [Analyze relevant technical indicators such as RSI, MACD, or moving averages to support the observed price increase. Explain their significance in relation to the XRP price action].

- Include charts and graphs to visually represent the price action: [Insert relevant charts and graphs clearly labeled and sourced].

Separating speculation driven by Trump's comments from other market factors influencing XRP's price is challenging. Multiple factors, including broader market trends and news related to Ripple's ongoing legal battle, likely contributed to the price movement.

Potential Risks and Future Outlook for XRP Investment

Navigating Volatility

Investing in XRP, or any cryptocurrency, involves significant risk.

- Mention ongoing legal battles facing Ripple: The ongoing legal battle between Ripple and the SEC presents a major risk for XRP investors. An unfavorable outcome could drastically impact the price and the future of the token.

- Discuss the importance of conducting thorough due diligence before investing in XRP: Before investing in XRP, investors should conduct comprehensive due diligence, understanding the project's technology, the legal challenges it faces, and the inherent volatility of the cryptocurrency market.

- Outline potential downside risks and the importance of risk management strategies: Besides the legal risks, investors must consider the general volatility of the crypto market and the possibility of significant price corrections. Diversification and appropriate risk management strategies are crucial.

The excitement surrounding the XRP investment surge shouldn't overshadow the need for informed decision-making and responsible investing.

Conclusion

The recent XRP investment surge, fueled by the perceived endorsement from Donald Trump, highlights the significant impact influential figures can have on the volatile cryptocurrency market. While the price increase presents an opportunity, investors must carefully analyze the risks involved. Conduct thorough research, understand the complexities of XRP, and carefully consider the ongoing legal challenges facing Ripple before making any investment decisions. Don't let the hype surrounding the current XRP investment surge cloud your judgment; make informed decisions based on sound financial strategies. Remember to carefully assess the risk before considering an XRP investment.

Featured Posts

-

Understanding The Volatility Why Dogecoin Shiba Inu And Sui Prices Are Fluctuating

May 08, 2025

Understanding The Volatility Why Dogecoin Shiba Inu And Sui Prices Are Fluctuating

May 08, 2025 -

Andors Showrunner Hints At A Rogue One Recut What We Know

May 08, 2025

Andors Showrunner Hints At A Rogue One Recut What We Know

May 08, 2025 -

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter

May 08, 2025

Anons Matchey Ligi Chempionov Arsenal Protiv Ps Zh Barselona Protiv Inter

May 08, 2025 -

Neymar Convocado Brasil Vs Argentina En El Monumental Por Eliminatorias

May 08, 2025

Neymar Convocado Brasil Vs Argentina En El Monumental Por Eliminatorias

May 08, 2025 -

Ethereum Price Shows Strength Bullish Momentum And Future Outlook

May 08, 2025

Ethereum Price Shows Strength Bullish Momentum And Future Outlook

May 08, 2025