Ethereum Price Shows Strength: Bullish Momentum And Future Outlook

Table of Contents

Analyzing Ethereum's Recent Price Surge

Several converging factors have contributed to Ethereum's recent price surge, painting a picture of robust growth and increasing adoption.

Key Factors Driving the Bullish Trend:

-

Increased Institutional Investment: Major financial institutions are increasingly allocating capital to ETH, viewing it as a valuable asset in their diversified portfolios. This institutional interest brings substantial capital influx and contributes to price stability.

-

Growing Adoption of Ethereum for DeFi and NFTs: The Ethereum network underpins a vast and thriving ecosystem of decentralized finance (DeFi) applications and non-fungible token (NFT) marketplaces. The continued growth of these sectors fuels demand for ETH.

-

Positive Regulatory Developments: While regulatory clarity remains a challenge globally, some positive developments in specific jurisdictions are gradually improving the perception and legitimacy of cryptocurrencies, indirectly benefiting Ethereum's price.

-

Network Upgrades and Improvements: The successful implementation of the Ethereum Merge, transitioning from a proof-of-work to a proof-of-stake consensus mechanism, significantly enhanced the network's efficiency and scalability, leading to reduced energy consumption and increased attractiveness for investors.

-

Decreased Selling Pressure from Miners: Post-Merge, the selling pressure from miners, previously a significant factor influencing ETH price, has diminished considerably, contributing to price stability and upward momentum.

-

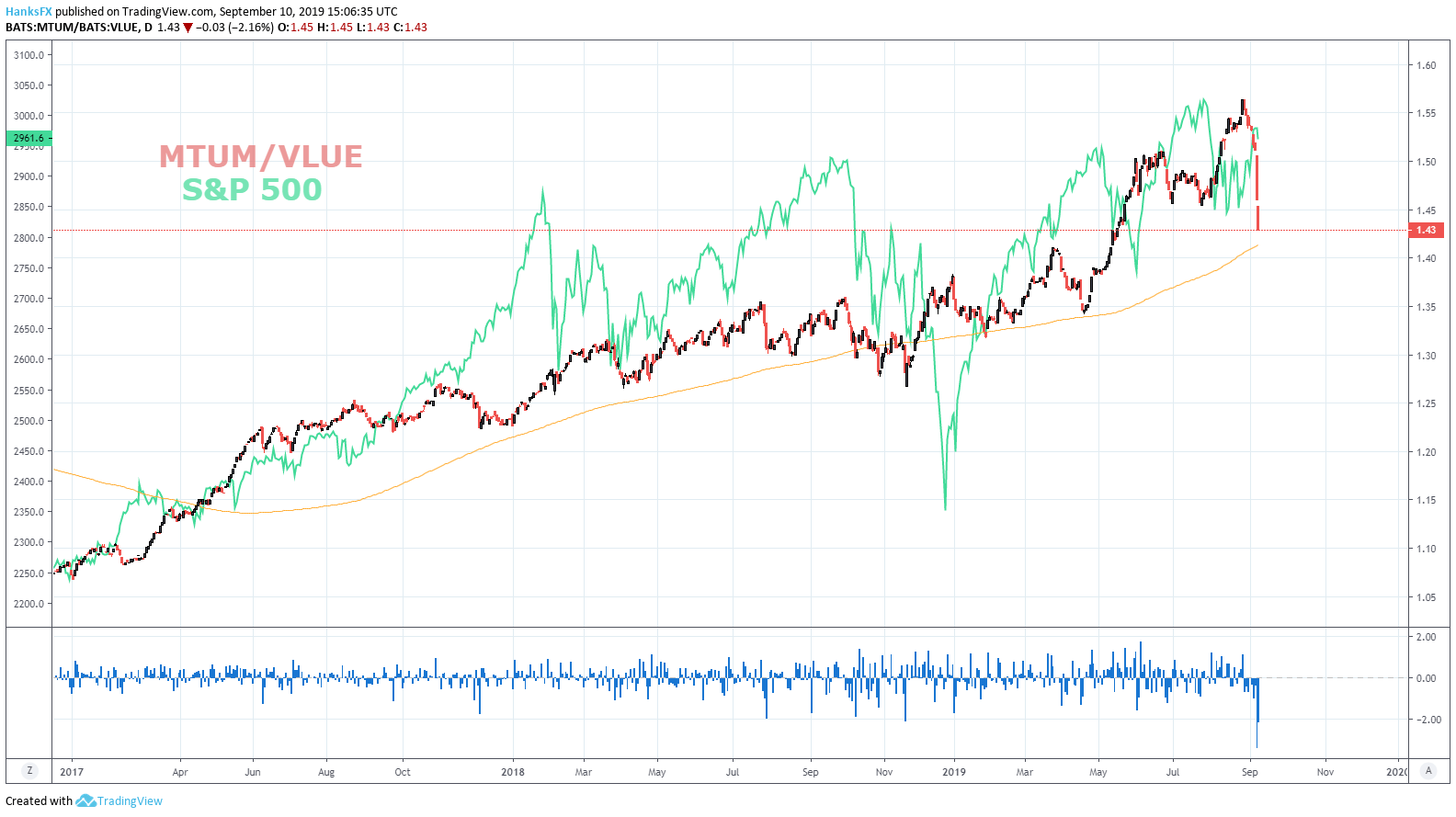

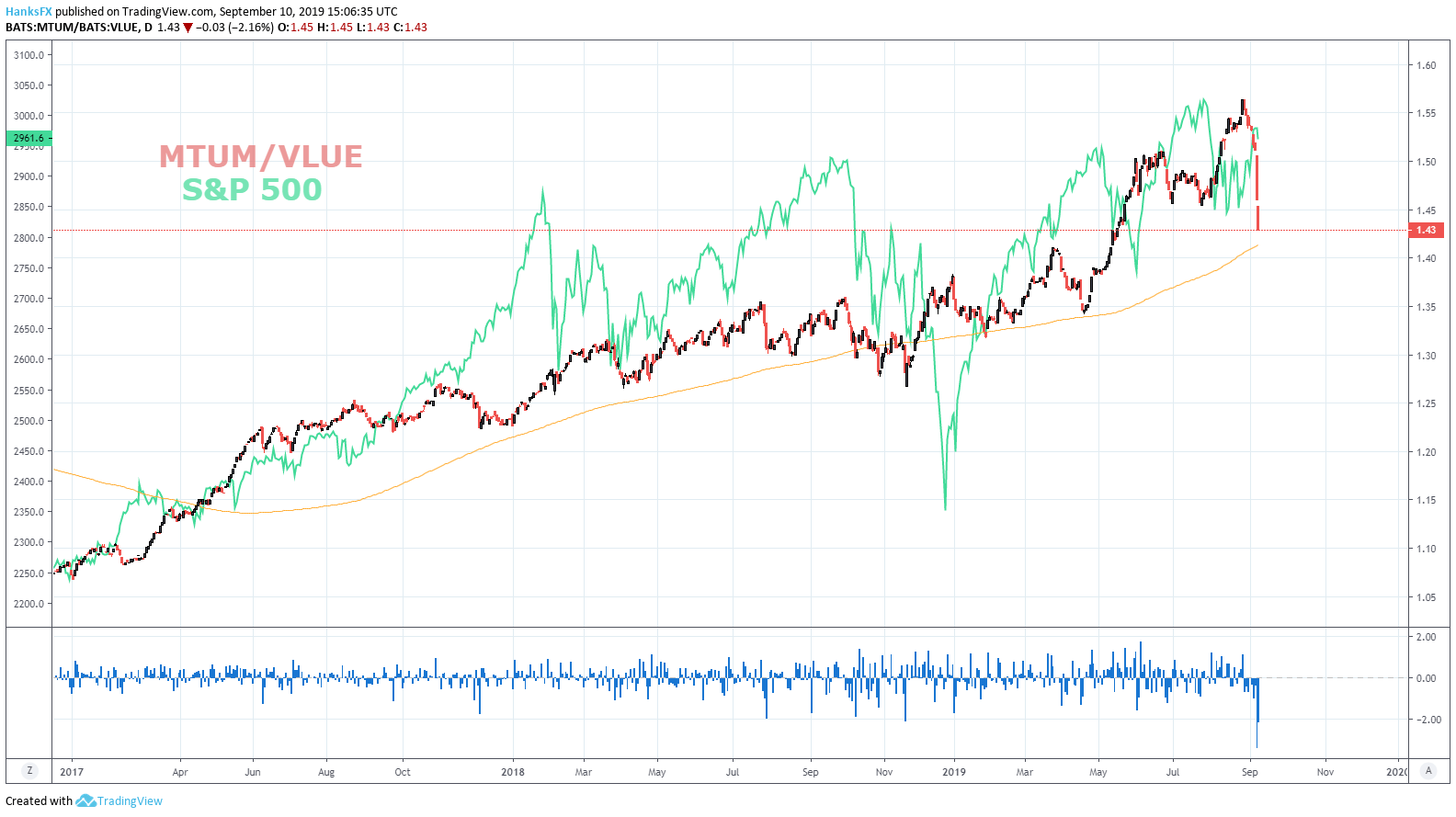

[Insert Chart/Graph showcasing ETH price movements over the relevant period.] This visual representation clearly demonstrates the recent bullish trend.

Technical Analysis of ETH Price Charts:

Analyzing ETH price charts using technical indicators provides further insights. Support and resistance levels are key areas to watch. The moving averages (e.g., 50-day and 200-day) can indicate the overall trend. Other indicators, such as the Relative Strength Index (RSI), can help assess overbought or oversold conditions.

Disclaimer: Technical analysis is not an exact science and should not be considered definitive financial advice. Price targets derived from technical analysis are purely speculative.

Ethereum's Growing Ecosystem and Utility

Ethereum's success is significantly driven by the robustness and growth of its ecosystem.

DeFi's Continued Growth on Ethereum:

Ethereum remains the dominant platform for DeFi applications. Total Value Locked (TVL) in Ethereum-based DeFi protocols serves as a key indicator of the sector's health and contributes to ETH demand. Major DeFi protocols such as Aave, Compound, and Uniswap continue to thrive, attracting users and capital.

The NFT Market and Ethereum:

Ethereum is intrinsically linked to the NFT market, hosting many popular NFT marketplaces like OpenSea and Rarible. The trading volume in the NFT market directly influences the demand for ETH, impacting its price.

Ethereum's Role in the Metaverse:

Ethereum's decentralized and secure nature makes it a suitable platform for building and interacting within metaverse applications. The growing metaverse sector presents significant potential for future growth and ETH adoption.

Potential Risks and Challenges Facing Ethereum

Despite its bullish momentum, Ethereum faces several challenges.

Competition from other Layer-1 Blockchains:

Several competing Layer-1 blockchains, such as Solana and Cardano, offer alternative platforms for DeFi and NFT applications. This competition could potentially lead to market share erosion for Ethereum.

Regulatory Uncertainty and its Impact:

Regulatory uncertainty surrounding cryptocurrencies remains a major risk. Government regulations in various jurisdictions could significantly impact ETH price and adoption.

Scalability Issues and Solutions:

While the Merge addressed some scalability challenges, Ethereum still faces limitations. Layer-2 scaling solutions, such as Optimism and Arbitrum, aim to improve transaction throughput and reduce fees.

Ethereum Price Prediction and Future Outlook

Predicting the future price of any cryptocurrency is highly speculative.

Short-Term Price Projections: [Use cautiously, include disclaimer. Example: Based on current trends and technical analysis, a short-term price increase is possible, but significant volatility is expected.]

Long-Term Price Potential: [Use cautiously, include disclaimer. Example: The long-term potential of Ethereum is dependent on several factors, including technological advancements, regulatory developments and market adoption.]

Factors influencing future price movements:

- Technological Advancements: Continued innovation and development within the Ethereum ecosystem will be crucial for long-term growth.

- Market Sentiment and Adoption: Broader market sentiment towards cryptocurrencies and the increasing adoption of ETH will significantly influence its price.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies will play a major role in shaping the future of Ethereum.

Conclusion: Ethereum's Bullish Momentum – A Promising Future?

Ethereum's recent price strength reflects a confluence of positive factors, including increased institutional investment, the thriving DeFi and NFT ecosystems, and successful network upgrades. While challenges like competition and regulatory uncertainty remain, the long-term potential of Ethereum appears promising. Stay informed about the latest Ethereum price developments and consider how to incorporate ETH into your investment strategy. Further research into the Ethereum price and its potential for long-term growth is strongly encouraged.

Featured Posts

-

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation Of The Year

May 08, 2025

2025 Will The Monkey Be Stephen Kings Worst Film Adaptation Of The Year

May 08, 2025 -

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025

Path Of Exile 2 A Guide To Rogue Exiles

May 08, 2025 -

Celtics Vs Nets Jayson Tatum Injury Update And Game Prediction

May 08, 2025

Celtics Vs Nets Jayson Tatum Injury Update And Game Prediction

May 08, 2025 -

Improved Trade Talks Canada Seeks Stronger Ties With Washington

May 08, 2025

Improved Trade Talks Canada Seeks Stronger Ties With Washington

May 08, 2025 -

Bone Bruise Sidelines Jayson Tatum Game 2 Outlook Uncertain

May 08, 2025

Bone Bruise Sidelines Jayson Tatum Game 2 Outlook Uncertain

May 08, 2025