XRP ETF Approval Could Unleash $800 Million In Week 1 Inflows

Table of Contents

H2: Institutional Investor Interest and the XRP ETF

Currently, institutional investors face significant limitations when it comes to direct XRP investment. Strict regulations, custodial challenges, and concerns about market manipulation deter many large funds from adding XRP to their portfolios. However, the approval of an XRP ETF would dramatically change this landscape. An ETF offers a regulated and accessible vehicle for institutional investors to gain exposure to XRP, overcoming many of the existing barriers.

The advantages of ETFs for institutions are substantial:

- Reduced regulatory hurdles: ETFs are subject to stringent regulatory oversight, offering a level of comfort to institutions concerned about compliance.

- Increased liquidity: ETFs provide significantly higher liquidity compared to directly trading XRP on exchanges.

- Simplified investment processes: Investing in an ETF is straightforward, requiring less specialized knowledge and infrastructure than direct cryptocurrency holdings.

- Potential for significant capital inflow: The accessibility and regulatory clarity of an ETF are expected to unlock substantial institutional investment in XRP.

H2: The $800 Million Inflow Projection: Methodology and Assumptions

The $800 million inflow projection isn't plucked from thin air. Several reputable financial analysts, based on their models considering past ETF launches and XRP's market capitalization, have predicted this figure. Their estimations are based on several key assumptions:

- Analyst predictions and their rationale: Analysts have considered factors like the size of the currently sidelined institutional capital, investor appetite for crypto exposure through regulated products, and historical performance data from similar ETF launches.

- Comparison with other ETF launches: The projections leverage data from previous successful ETF launches in other asset classes to model potential XRP ETF inflows.

- Market capitalization analysis: Analyzing XRP’s current market cap and the potential for increased valuation following ETF approval is a crucial part of the projection.

- Potential for exceeding or falling short of projections: It's crucial to understand that this figure represents a prediction, not a guarantee. Actual inflows could be higher or lower, depending on several factors including overall market sentiment, regulatory developments, and competition from other crypto assets.

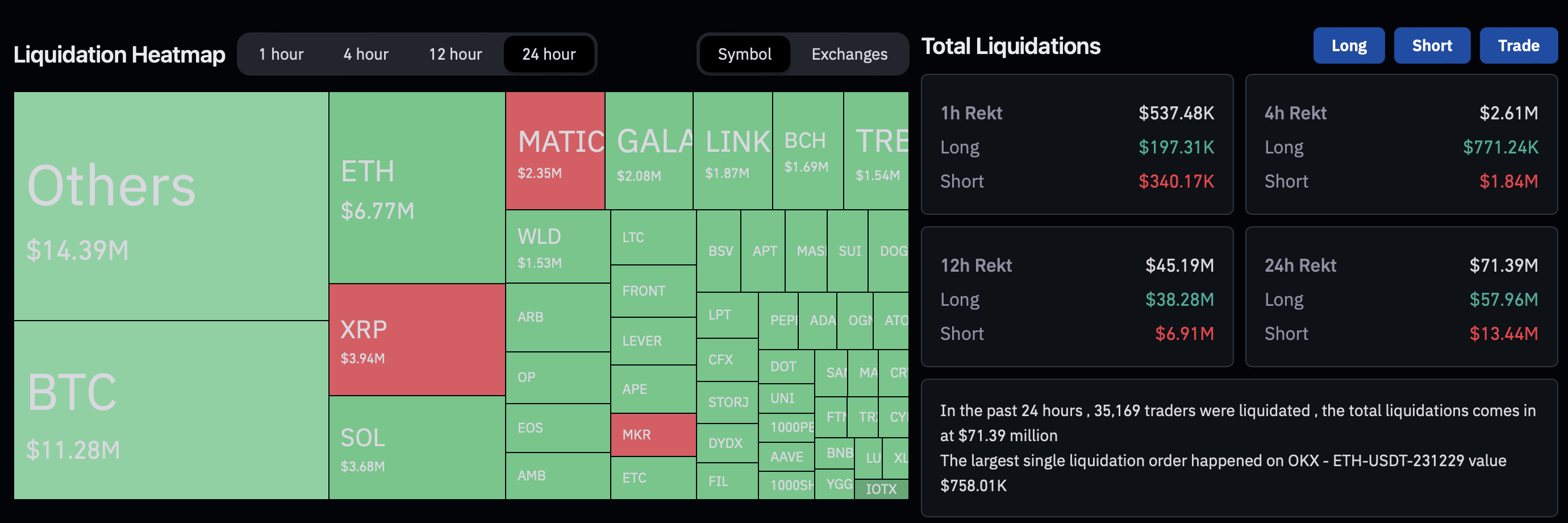

H2: Impact on XRP Price and Market Volatility

A sudden influx of $800 million, or even a larger sum, would undoubtedly have a significant impact on XRP's price. We can expect short-term volatility, with potential for both sharp increases and corrections as the market adjusts to the new influx of capital.

- Short-term price surges and corrections: An immediate price surge is highly probable, followed by potential consolidation and adjustments.

- Long-term price stability: Over the long term, the increased institutional investment could lead to greater price stability.

- Increased trading volume: ETF approval would likely lead to a dramatic increase in XRP trading volume.

- Potential for market manipulation: While less likely with a regulated ETF, it's important to remain aware of the potential for market manipulation, especially in the short term.

H2: Regulatory Considerations and Potential Hurdles

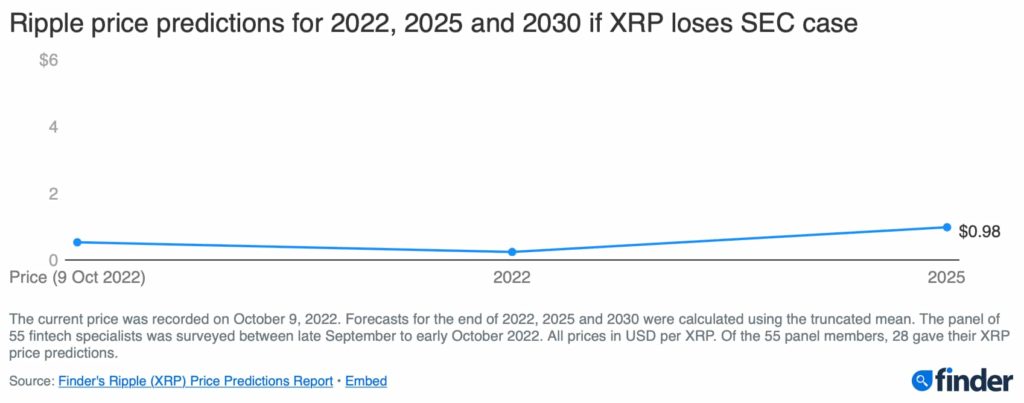

The path to XRP ETF approval is not without its obstacles. Regulatory hurdles, particularly from the US Securities and Exchange Commission (SEC), pose significant challenges. The SEC’s stance on XRP, and cryptocurrencies in general, will play a pivotal role in determining the timeline and feasibility of an XRP ETF.

- SEC approval process: Navigating the SEC's rigorous approval process is a critical step.

- International regulatory compliance: Compliance with regulatory frameworks in different jurisdictions will be necessary for a globally accessible XRP ETF.

- Potential delays and setbacks: The approval process can be lengthy and subject to delays or even outright rejection.

- Legal challenges: Legal challenges from various parties could further complicate and prolong the process.

3. Conclusion: The Future of XRP and the Potential of ETF Approval

The potential approval of an XRP ETF represents a significant turning point for the cryptocurrency. The projected $800 million inflow in the first week is a compelling indicator of the transformative impact this could have. While this figure is a prediction with inherent uncertainties, the possibility of substantial institutional investment remains a strong driver for positive growth. The long-term implications for XRP and the broader crypto market are considerable, potentially ushering in an era of greater mainstream adoption and price stability. To stay abreast of developments concerning "XRP ETF Approval," and its potential investment opportunities, stay informed about regulatory updates and continue your own research. The future of XRP may hinge on this crucial development.

Featured Posts

-

67 M In Ethereum Liquidations Is Another Market Crash Coming

May 08, 2025

67 M In Ethereum Liquidations Is Another Market Crash Coming

May 08, 2025 -

Ella Mai And Jayson Tatums Baby Confirmation In Latest Commercial

May 08, 2025

Ella Mai And Jayson Tatums Baby Confirmation In Latest Commercial

May 08, 2025 -

Build Voice Assistants With Ease Open Ais 2024 Developer Announcements

May 08, 2025

Build Voice Assistants With Ease Open Ais 2024 Developer Announcements

May 08, 2025 -

Racha Imparable Dodgers Mejor Inicio De Temporada En La Historia

May 08, 2025

Racha Imparable Dodgers Mejor Inicio De Temporada En La Historia

May 08, 2025 -

Could Xrp Reach 5 By 2025 A Realistic Assessment

May 08, 2025

Could Xrp Reach 5 By 2025 A Realistic Assessment

May 08, 2025