$67M In Ethereum Liquidations: Is Another Market Crash Coming?

Table of Contents

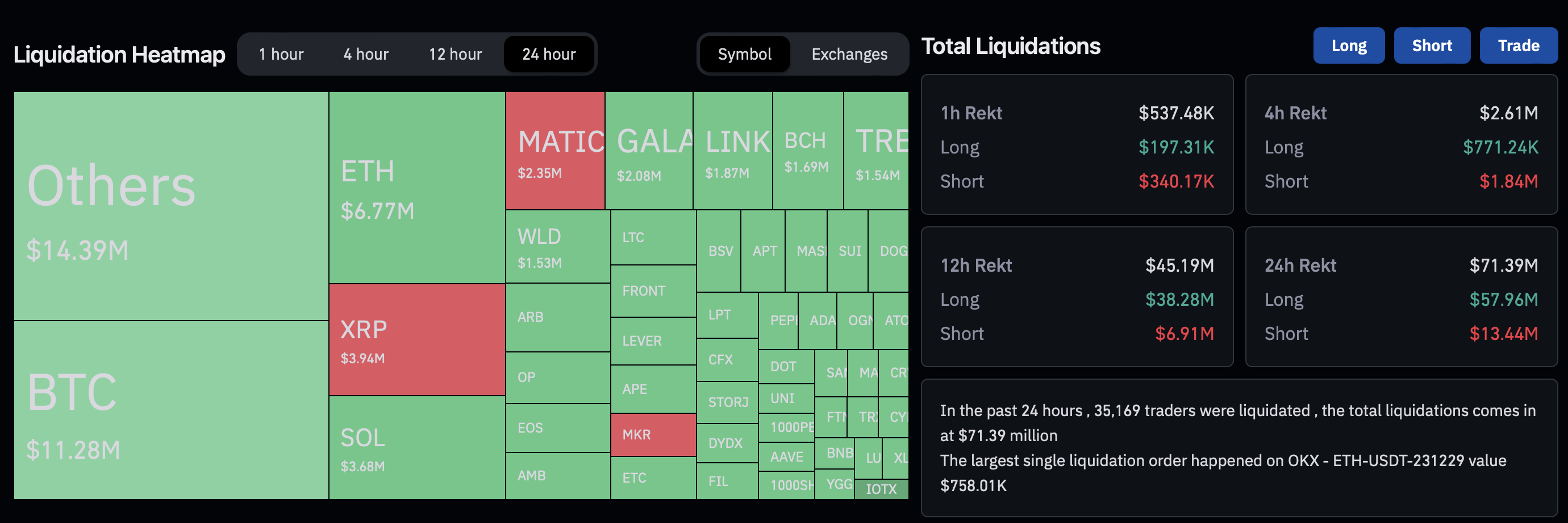

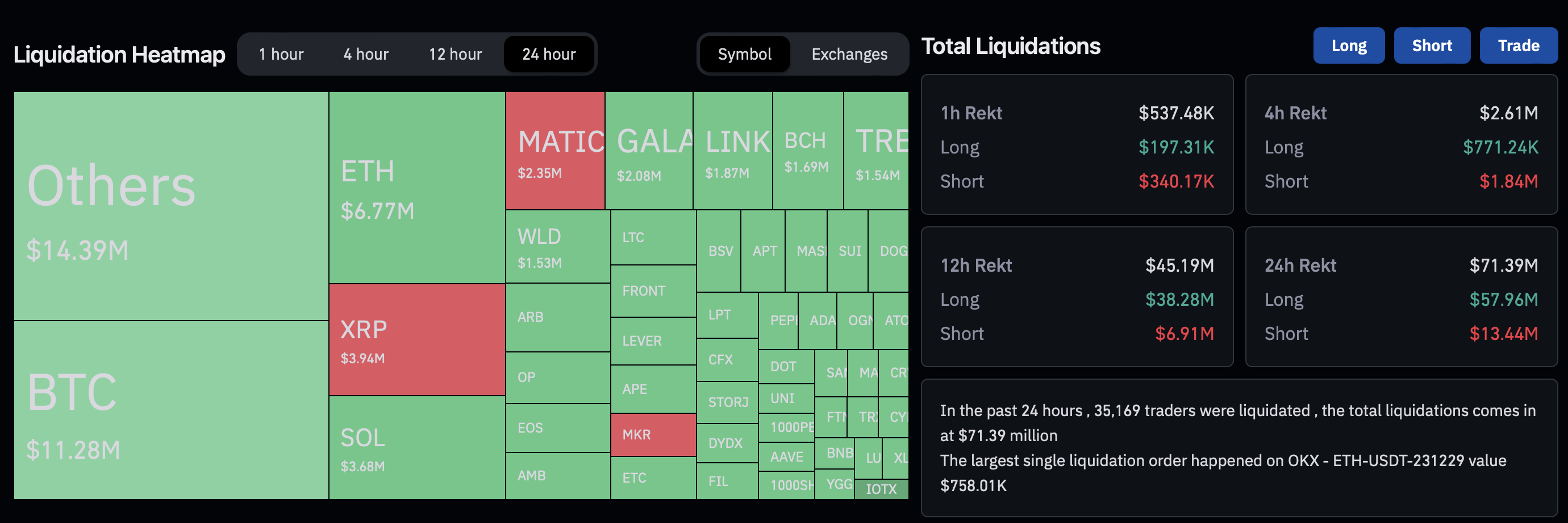

Analyzing the $67M Ethereum Liquidation Event

The $67 million Ethereum liquidation event wasn't a singular occurrence; it unfolded over a period of [Insert timeframe, e.g., 24 hours], impacting both centralized exchanges (CEXs) like [mention examples, e.g., Binance, Coinbase] and decentralized exchanges (DEXs) such as [mention examples, e.g., Uniswap, Curve]. The brunt of the impact was felt by leveraged traders holding long positions on Ethereum, who were forced to sell their assets to meet margin calls.

The Specifics of the Liquidations:

- Scale: This $67 million figure represents [quantify, e.g., a significant increase/decrease] compared to previous Ethereum liquidation events. For context, [compare to previous events, e.g., the May 2022 crash saw X million in liquidations].

- Affected Tokens: While Ethereum (ETH) bore the brunt of the impact, the ripple effect also affected other tokens, particularly those correlated with ETH's price movements, such as [mention examples, e.g., Layer-2 solutions, DeFi tokens].

- Price Impact: The liquidations directly contributed to a [quantify, e.g., X%] drop in Ethereum's price within [timeframe], exacerbating existing market anxieties.

Factors Contributing to the Liquidations

The $67 million in Ethereum liquidations weren't an isolated incident; several factors converged to create a perfect storm.

Macroeconomic Factors:

- Economic Uncertainty: The current macroeconomic climate, characterized by high inflation, rising interest rates, and recessionary fears, has significantly impacted investor risk appetite. This risk aversion is spilling over into the cryptocurrency market, leading to increased selling pressure.

- Regulatory Scrutiny: Increased regulatory scrutiny of the cryptocurrency industry, particularly in [mention regions, e.g., the US, EU], has also contributed to market instability and uncertainty, prompting some investors to reduce their exposure.

- Market Sentiment: The Fear and Greed Index, a widely used metric to gauge market sentiment, has shown a significant shift towards fear in recent weeks, indicating a negative overall outlook among investors.

Assessing the Risk of a Larger Market Crash

To understand the potential for a broader market crash, it's vital to examine historical precedents and current market indicators.

Historical Precedents:

- Past Liquidations: [Mention examples of past significant liquidation events and their aftermath. Did they trigger broader market crashes or were they contained events? Analyze the similarities and differences with the current situation].

- On-Chain Data: Analysis of on-chain data, such as whale activity (large-scale movements of crypto assets) and exchange reserves, can provide insights into potential future price movements. [Discuss any relevant findings, e.g., increased whale accumulation, significant outflows from exchanges].

- Stablecoin Impact: The role of stablecoins in maintaining market stability is crucial. [Discuss any potential vulnerabilities in the stablecoin ecosystem and their potential impact on the market in case of de-pegging].

What to Expect in the Short and Long Term

Predicting the future of the crypto market is inherently challenging, but we can analyze the current situation to offer potential short-term and long-term outlooks.

Short-Term Predictions:

- Price Ranges: Based on technical analysis, Ethereum's price could range between [mention potential price ranges, e.g., $1500-$1800] in the short term, with support levels around [mention specific support levels] and resistance at [mention resistance levels].

- Catalysts: Further price movements could be catalyzed by factors such as [mention possible catalysts, e.g., major regulatory announcements, significant on-chain events, shifts in macroeconomic indicators].

Long-Term Outlook:

- Ethereum Fundamentals: The underlying fundamentals of Ethereum, including its robust network, growing decentralized applications (dApps), and ongoing development, remain strong. The long-term prospects for Ethereum are still positive.

- Adoption Trends: The continued adoption of Ethereum in various sectors, such as DeFi and NFTs, will play a significant role in its long-term price appreciation.

- Market Recovery: Despite the current volatility, the cryptocurrency market has historically shown resilience and the potential for recovery.

Conclusion: Is Another Crypto Crash Imminent After $67M in Ethereum Liquidations?

The $67 million in Ethereum liquidations serve as a stark reminder of the inherent volatility in the cryptocurrency market. While the event itself was significant, whether it signifies an imminent major market crash remains uncertain. Several factors, including macroeconomic conditions, regulatory developments, and market sentiment, will play a critical role in shaping the market's trajectory. Based on our analysis, a major crash is not inevitable, but investors should remain vigilant and prepared for potential market fluctuations. Continue following market developments closely and conduct your own thorough research on Ethereum liquidations and their broader implications for the cryptocurrency market. Subscribe to our newsletter for the latest updates and insights into Ethereum liquidations and other key market events.

Featured Posts

-

Cowherds Sharp Criticism Of Tatum After Celtics Game 1 Loss

May 08, 2025

Cowherds Sharp Criticism Of Tatum After Celtics Game 1 Loss

May 08, 2025 -

Nuggets Players Response To Russell Westbrook Trade Rumors

May 08, 2025

Nuggets Players Response To Russell Westbrook Trade Rumors

May 08, 2025 -

Shkelje Te Rregullave Te Uefa S Arsenali Nen Hetim Pas Ndeshjes Me Psg

May 08, 2025

Shkelje Te Rregullave Te Uefa S Arsenali Nen Hetim Pas Ndeshjes Me Psg

May 08, 2025 -

Dwp Alert Verify Your Bank Details For 12 Benefit Payments

May 08, 2025

Dwp Alert Verify Your Bank Details For 12 Benefit Payments

May 08, 2025 -

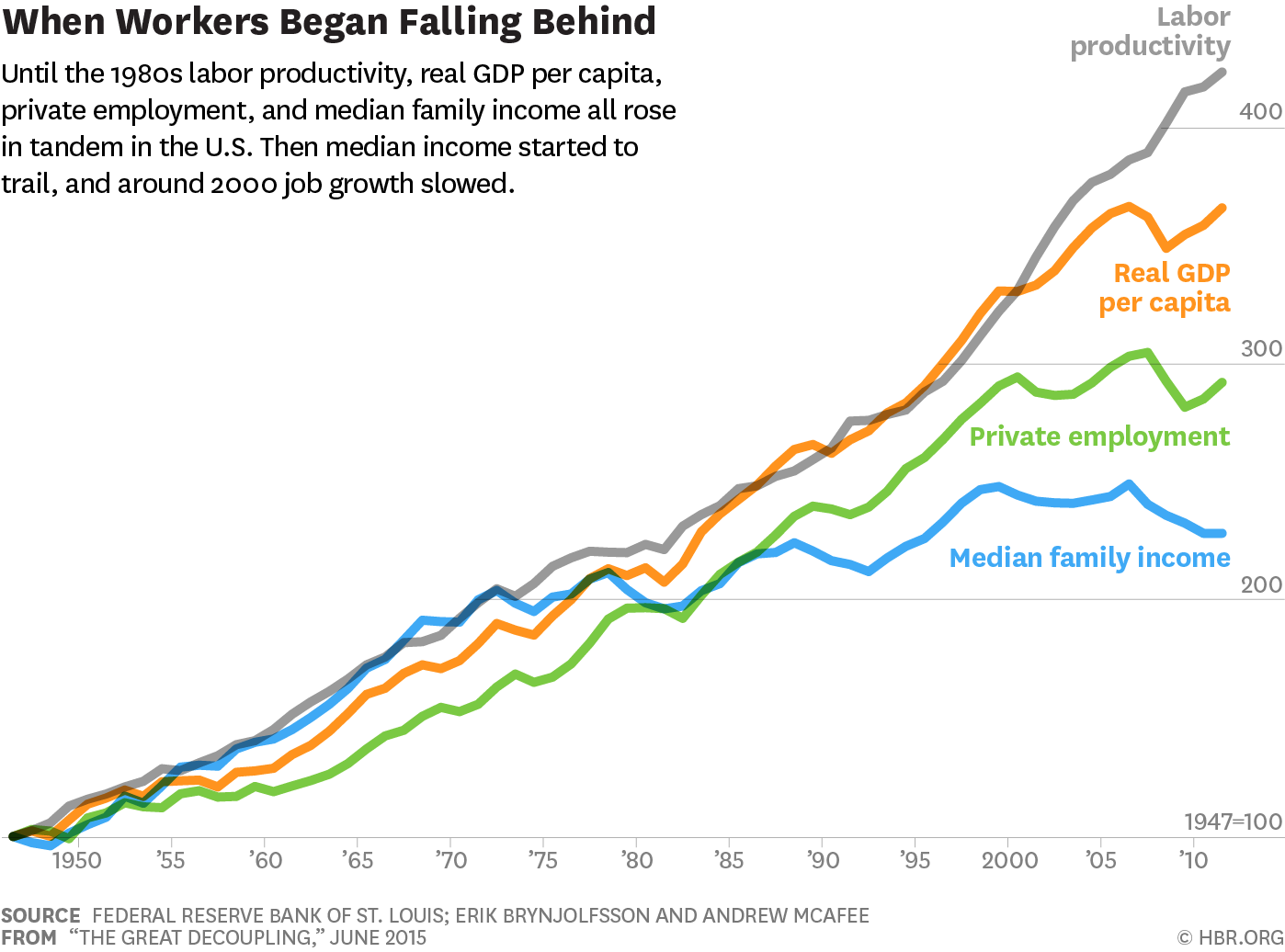

What Is The Great Decoupling And Why Does It Matter

May 08, 2025

What Is The Great Decoupling And Why Does It Matter

May 08, 2025