XRP And The SEC: Navigating The Regulatory Landscape

Table of Contents

The SEC's Case Against Ripple

The SEC's case against Ripple centers on the allegation that XRP is an unregistered security. The SEC argues that Ripple conducted an unregistered securities offering, violating federal securities laws by selling billions of XRP without registering them with the SEC. Their key arguments include:

- Unregistered securities offering: The SEC claims Ripple’s sales of XRP constitute an unregistered securities offering, defrauding investors.

- Violation of federal securities laws: The SEC alleges Ripple violated multiple provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

- Allegations of misleading investors: The SEC asserts Ripple misled investors about XRP’s nature and its regulatory status.

The potential consequences for Ripple are severe, including substantial fines and potential legal repercussions for its executives. Furthermore, a ruling against Ripple could set a precedent impacting other cryptocurrency projects and significantly shaping future cryptocurrency regulation. The SEC's case largely hinges on the application of the Howey Test, a legal framework used to determine whether an investment contract constitutes a security.

Ripple's Defense and Key Arguments

Ripple vehemently denies the SEC's allegations, arguing that XRP is not a security but a decentralized digital asset with distinct utility. Their defense strategy incorporates several key arguments:

- XRP is not a security, but a digital asset: Ripple emphasizes XRP's functionality as a payment tool and its decentralized nature, differentiating it from traditional securities.

- Focus on XRP's decentralized nature and utility: Ripple highlights XRP's use in cross-border payments and its operational independence from Ripple Labs.

- Challenge to the SEC's application of the Howey Test: Ripple argues that the Howey Test doesn't apply to XRP, given its decentralized nature and lack of direct investment contract with Ripple.

- Highlighting the programmatic sales of XRP: Ripple points to the largely programmatic nature of XRP sales, arguing against the intent to defraud investors.

Several legal experts and industry analysts have offered opinions supporting Ripple's position, emphasizing the complexities of applying traditional securities laws to the novel world of cryptocurrencies. The success of Ripple's defense will largely depend on convincing the court that XRP operates outside the conventional definition of a security.

The Implications of the Case for the Crypto Market

The SEC vs. Ripple case holds significant implications for the entire cryptocurrency industry. The outcome will create ripples (pun intended!) throughout the crypto market, impacting:

- Uncertainty and volatility in the crypto market: The legal uncertainty surrounding XRP has already caused market volatility, and a definitive ruling will likely trigger further price fluctuations.

- Impact on other crypto projects facing similar regulatory scrutiny: The ruling could influence the regulatory landscape for other crypto projects, potentially leading to more enforcement actions or clarifying existing regulations.

- Potential changes to regulatory frameworks for cryptocurrencies: The case may lead to the development of more specific and comprehensive regulatory frameworks for cryptocurrencies.

- Influence on future ICOs and token sales: The outcome will likely impact how future Initial Coin Offerings (ICOs) and token sales are structured and regulated.

The potential for increased regulatory clarity is substantial, but there's also a risk of further confusion and inconsistency in how cryptocurrencies are regulated across different jurisdictions. This highlights the need for a clearer, more globally coordinated approach to crypto regulation.

Navigating the Regulatory Landscape: Best Practices for Investors

The uncertain regulatory environment surrounding XRP and other cryptocurrencies demands cautious and informed investment strategies. Investors should prioritize:

- Conducting thorough due diligence: Before investing in any cryptocurrency, research the project, its team, and its underlying technology.

- Understanding the risks associated with investing in cryptocurrencies: Cryptocurrencies are highly volatile and speculative assets, carrying significant risk of loss.

- Staying informed about regulatory developments and legal updates: Keep abreast of the latest news and legal decisions impacting the crypto space.

- Diversifying your investment portfolio: Don't put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

Responsible investing requires a comprehensive understanding of the risks involved. Thorough research and a diversified portfolio are critical for navigating the unpredictable world of cryptocurrency investments.

Conclusion: Understanding the XRP and SEC Landscape

The SEC vs. Ripple case is a landmark legal battle with far-reaching consequences for the cryptocurrency industry. The complexities of applying traditional securities laws to decentralized digital assets are highlighted by this ongoing legal fight. Its outcome will shape cryptocurrency regulation for years to come. Staying updated on the XRP and SEC situation is crucial for investors and anyone involved in the cryptocurrency market. Learn more about XRP regulation and make informed decisions about XRP investing. By conducting thorough due diligence and staying informed about regulatory developments, investors can navigate this complex landscape and make responsible choices regarding their cryptocurrency portfolio.

Featured Posts

-

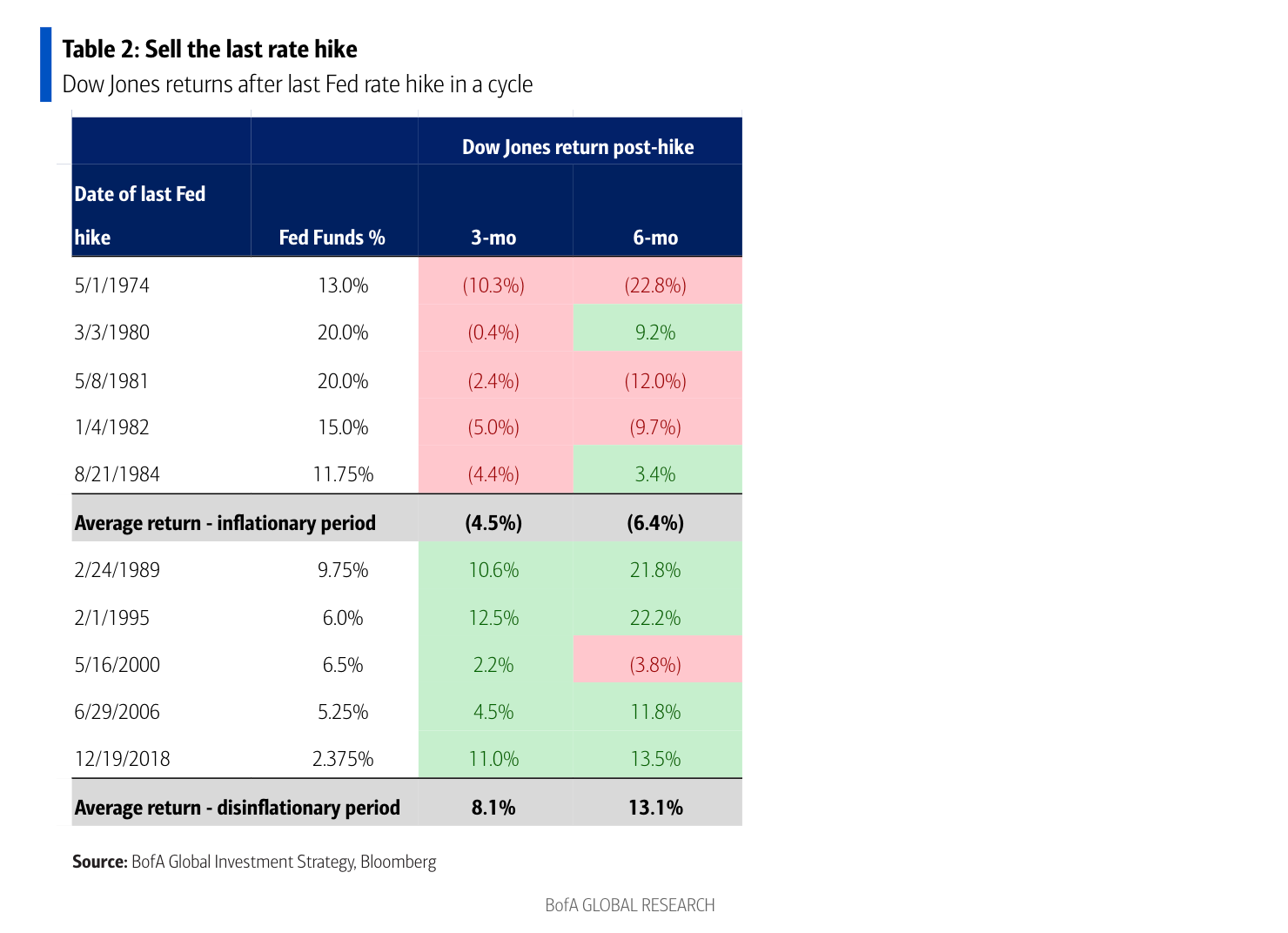

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 02, 2025

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

May 02, 2025 -

Historic Moment Kashmir Joins Indian Rail Network

May 02, 2025

Historic Moment Kashmir Joins Indian Rail Network

May 02, 2025 -

England Vs France Six Nations Dalys Late Show Decides The Match

May 02, 2025

England Vs France Six Nations Dalys Late Show Decides The Match

May 02, 2025 -

Limited Time Offer Free Captain America Items In The Fortnite Item Shop

May 02, 2025

Limited Time Offer Free Captain America Items In The Fortnite Item Shop

May 02, 2025 -

Ponants 1500 Flight Credit Program For Paul Gauguin Cruise Agents

May 02, 2025

Ponants 1500 Flight Credit Program For Paul Gauguin Cruise Agents

May 02, 2025

Latest Posts

-

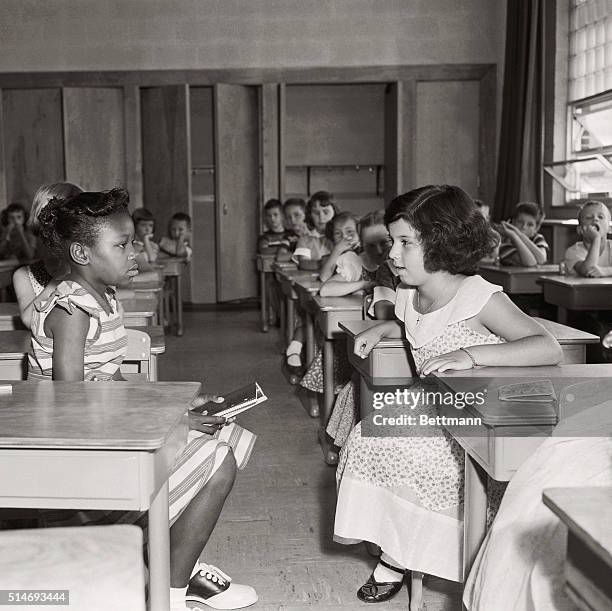

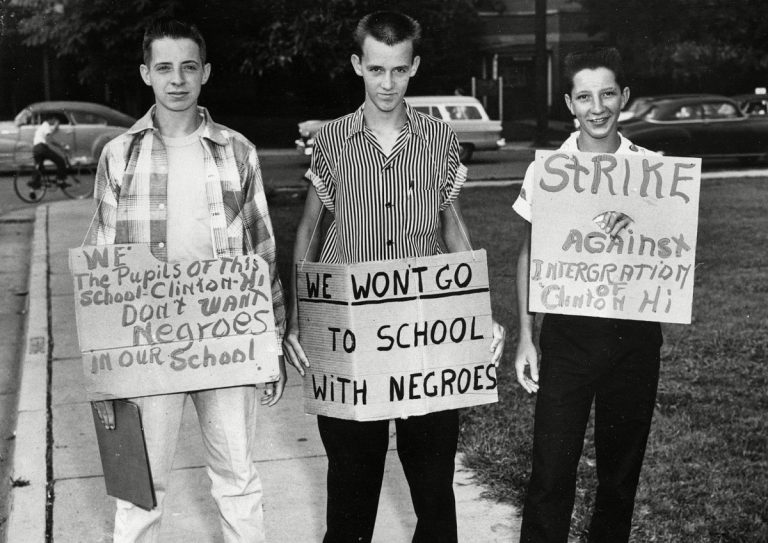

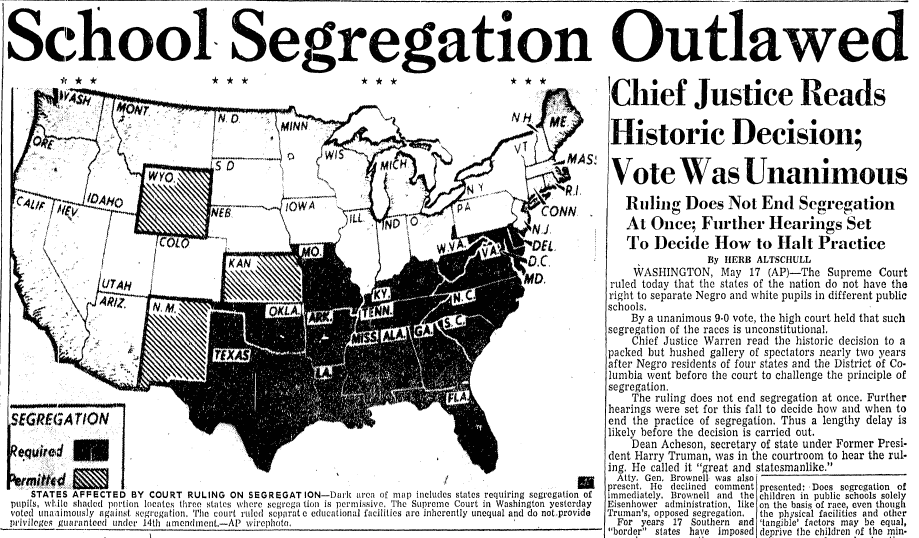

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025 -

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025 -

End Of School Desegregation Order Implications For Other Districts

May 02, 2025

End Of School Desegregation Order Implications For Other Districts

May 02, 2025 -

School Desegregation Order Terminated A Turning Point In Education

May 02, 2025

School Desegregation Order Terminated A Turning Point In Education

May 02, 2025