Will Ripple (XRP) Reach $3.40? A Technical Analysis

Table of Contents

Current Market Conditions and XRP's Performance

Understanding the broader cryptocurrency market landscape is crucial for assessing XRP's potential. Currently, the market is [insert current market sentiment: e.g., experiencing moderate volatility, showing signs of recovery, etc.]. This overall sentiment significantly impacts XRP's price, as it often moves in correlation with other major cryptocurrencies like Bitcoin. Analyzing the XRP market analysis reveals recent price movements. For example, [cite specific price movements, referencing key support and resistance levels with chart examples]. Several factors contribute to XRP’s current price action:

-

Regulatory Developments: The ongoing SEC lawsuit against Ripple significantly influences market sentiment and trading volume. Positive developments could lead to a price surge, while negative news might cause a downturn. Keywords: XRP market analysis, Ripple price chart, current XRP price, XRP trading volume, cryptocurrency market trends.

-

Adoption Rates: The increasing adoption of XRP by financial institutions and payment providers plays a crucial role. Higher adoption generally translates to increased demand and, consequently, a higher price.

-

Market Sentiment: Investor sentiment, driven by news, social media discussions, and overall market confidence, dictates short-term price fluctuations. Positive sentiment can fuel bullish rallies, while negative sentiment can trigger sell-offs.

Technical Analysis Indicators

Technical analysis offers valuable insights into potential price movements. Let's examine some key indicators for XRP:

Moving Averages (MA)

Moving averages, such as the 50-day MA and 200-day MA, smooth out price fluctuations to reveal underlying trends. Currently, [explain the current state of the 50-day and 200-day MAs for XRP, noting whether they are above or below the current price and what that suggests]. This analysis helps identify potential support and resistance levels. Keywords: XRP moving averages, 50-day MA XRP, 200-day MA XRP, technical indicators XRP.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests an overbought market, indicating potential for a price correction. Conversely, an RSI below 30 suggests an oversold market, indicating potential for a price rebound. [Analyze XRP's current RSI and interpret its implications]. Keywords: XRP RSI, relative strength index XRP, overbought XRP, oversold XRP.

MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that identifies potential buy and sell signals. [Explain the current MACD state for XRP and any potential signals it reveals]. A bullish crossover (MACD line crossing above the signal line) can signal a potential upward trend, while a bearish crossover can suggest a downward trend. Keywords: XRP MACD, moving average convergence divergence XRP, MACD signals XRP.

Support and Resistance Levels

Identifying key support and resistance levels on the XRP price chart is crucial. Support levels represent price points where buying pressure is strong enough to prevent further price declines. Resistance levels represent price points where selling pressure is strong enough to prevent further price increases. [Identify key support and resistance levels on the XRP chart and discuss their significance]. A breakout above resistance can signal a significant price increase, while a breakdown below support can signal a significant price decrease. Keywords: XRP support levels, XRP resistance levels, price breakout XRP.

Factors Affecting XRP's Future Price

Beyond technical analysis, several external factors influence XRP's future price:

-

SEC Lawsuit: The outcome of the SEC lawsuit against Ripple is a major uncertainty. A favorable ruling could significantly boost XRP's price, while an unfavorable ruling could cause a sharp decline.

-

Ripple Adoption: Increased adoption by financial institutions and payment providers is crucial for long-term growth. Wider adoption could drive demand and push the price higher.

-

Technological Advancements and Partnerships: Ripple's ongoing development and strategic partnerships influence investor confidence and the overall potential of the XRP ecosystem. Positive developments in these areas could lead to higher prices. Keywords: SEC lawsuit XRP, Ripple adoption, XRP partnerships, XRP technology.

Conclusion: Will XRP Hit $3.40? The Verdict

Based on the technical analysis and consideration of external factors, reaching $3.40 for XRP appears [likely/unlikely/uncertain – choose one based on your analysis]. The ongoing SEC lawsuit remains a significant wildcard, and the cryptocurrency market is inherently unpredictable. This analysis presents a snapshot in time, and the situation is subject to change. It's crucial to remember that this is not financial advice, and any investment decisions should be made after thorough independent research. Share your thoughts on this XRP price prediction in the comments below! Continue following for more XRP technical analysis updates. Remember to conduct your own thorough research on Ripple (XRP) before making any investment decisions.

Featured Posts

-

7 Sezon Chernogo Zerkala Podtverzhdena Li Data Vykhoda 13 Marta 2025 Goda

May 07, 2025

7 Sezon Chernogo Zerkala Podtverzhdena Li Data Vykhoda 13 Marta 2025 Goda

May 07, 2025 -

New Direct Flights Stansted To Casablanca Now Available

May 07, 2025

New Direct Flights Stansted To Casablanca Now Available

May 07, 2025 -

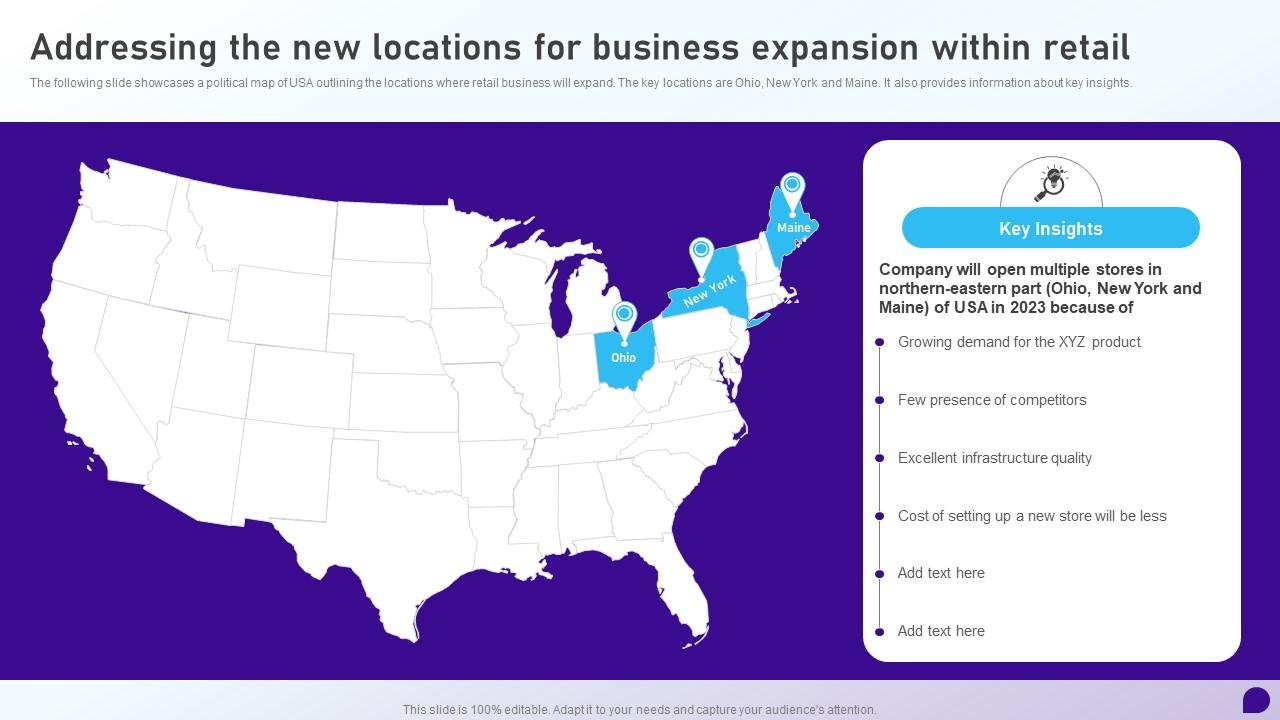

Mapping The Nations Hottest New Business Locations

May 07, 2025

Mapping The Nations Hottest New Business Locations

May 07, 2025 -

How Cobra Kai Continues The Karate Kid Legacy Examining Character Pairings

May 07, 2025

How Cobra Kai Continues The Karate Kid Legacy Examining Character Pairings

May 07, 2025 -

Young And The Restless Recap February 11 Nick And Victors Explosive Showdown

May 07, 2025

Young And The Restless Recap February 11 Nick And Victors Explosive Showdown

May 07, 2025

Latest Posts

-

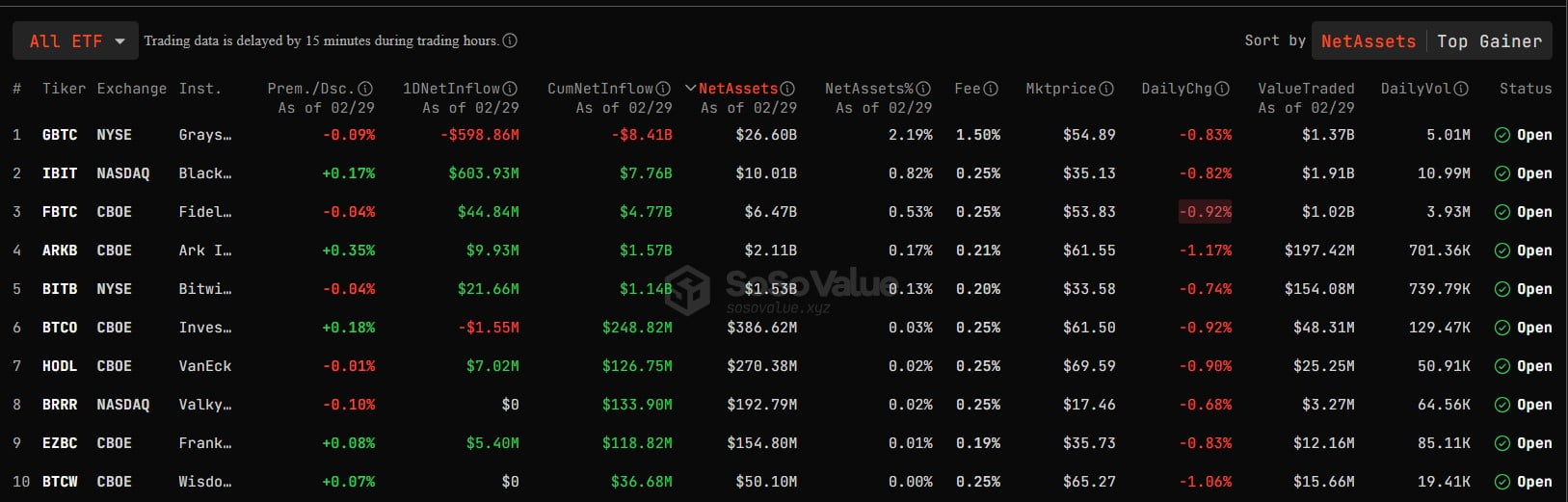

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025