Will Palantir Reach A $1 Trillion Valuation By The End Of The Decade?

Table of Contents

Palantir's Current Market Position and Growth Trajectory

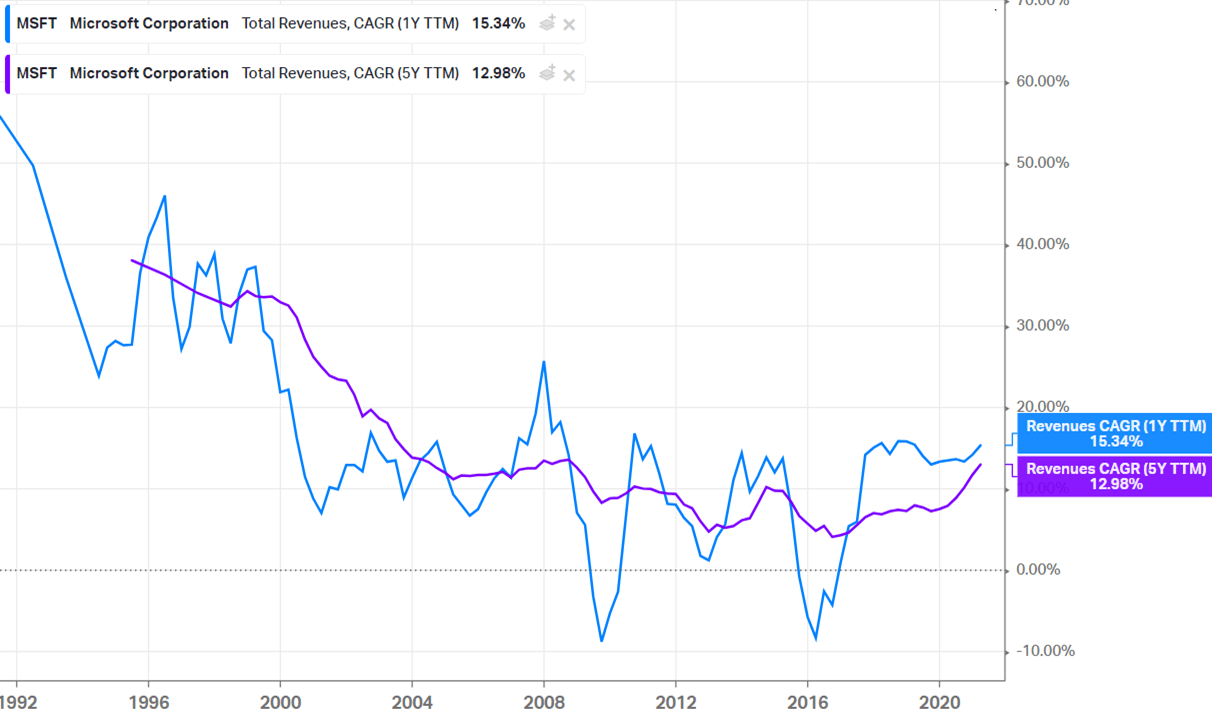

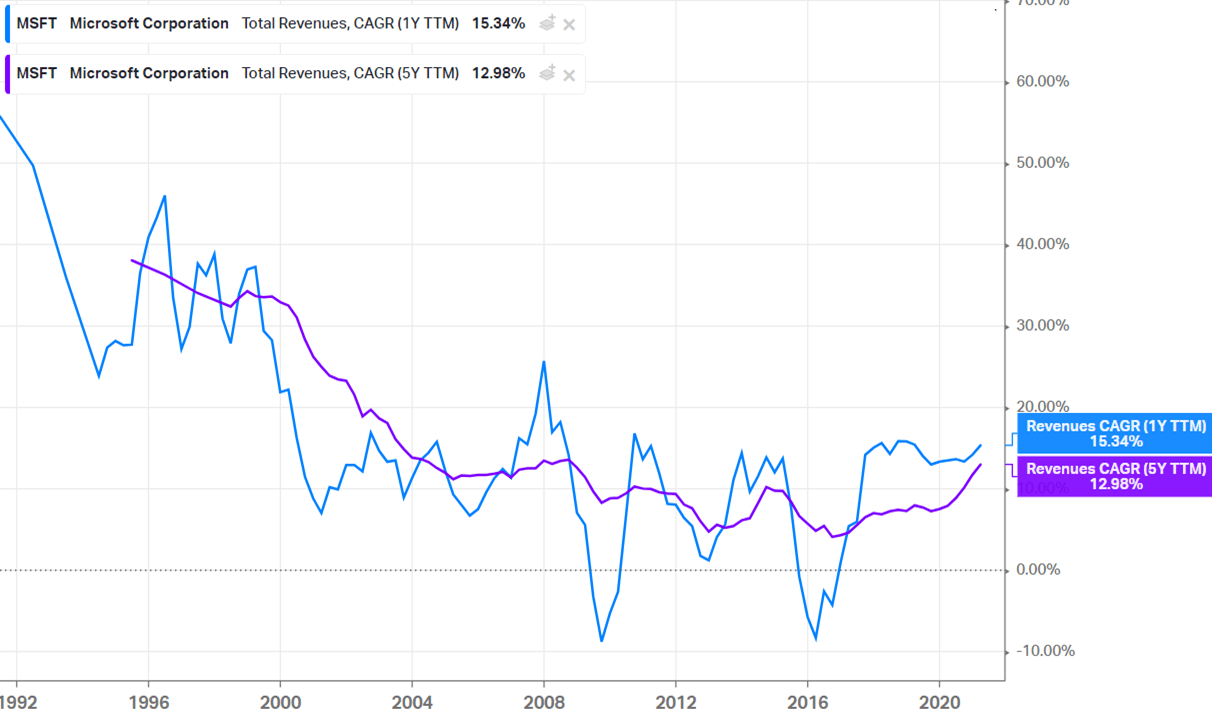

Analyzing Palantir's Revenue Growth

Palantir's revenue growth has been significant, driven by a combination of government and commercial contracts. Analyzing historical data and projecting future growth requires considering various market scenarios.

-

Factors influencing revenue growth:

- Strong demand for Palantir's data analytics platforms from government agencies (intelligence, defense, etc.).

- Increasing adoption by commercial enterprises across various sectors (finance, healthcare, etc.).

- Successful launches of new products and platform enhancements, improving functionality and appeal.

- Strategic partnerships expanding market reach and access to new customer segments.

-

Compound Annual Growth Rate (CAGR) and its implications: While Palantir has demonstrated impressive CAGR in recent years, sustaining this rate to reach a $1 trillion valuation by 2030 presents a significant challenge. Achieving such a valuation requires consistent, high growth exceeding current market expectations.

Assessing Palantir's Market Share in the Data Analytics Sector

Palantir occupies a unique niche in the data analytics sector. While giants like AWS, Microsoft Azure, and Google Cloud dominate the broader cloud computing market, Palantir focuses on specialized data integration and analysis for complex problems.

-

Competitive Advantages:

- Strong expertise in handling highly sensitive government data, leading to substantial government contracts.

- Robust data security features and compliance certifications, crucial for sensitive data handling.

- Unique data integration capabilities enabling analysis across diverse and disparate datasets.

-

Potential Threats and Challenges:

- Intensifying competition from established cloud providers expanding their data analytics offerings.

- The need to continually innovate and adapt to evolving technological landscapes and customer demands.

- Potential pricing pressures and the need to demonstrate a clear return on investment for clients.

Key Factors Influencing Palantir's Future Valuation

The Role of Government Contracts

Government contracts form a cornerstone of Palantir's revenue stream. Their significance for future projections cannot be overstated.

-

Risks and Opportunities:

- Government budget fluctuations can significantly impact contract awards and revenue predictability.

- Regulatory changes and compliance requirements can increase operational costs and complexity.

- Geopolitical instability can disrupt projects and affect contract renewals.

-

Long-term Sustainability: Over-reliance on government contracts poses a risk. Diversification into the commercial sector is crucial for long-term sustainability and reducing dependence on government spending.

Expansion into the Commercial Sector

Palantir's success in the commercial sector is pivotal for achieving a $1 trillion valuation.

- Successful Partnerships and Case Studies: Highlighting successful commercial deployments showcasing Palantir's capabilities and ROI is essential for attracting new clients.

- Challenges in the Commercial Market: Competition from established players with broader product portfolios and extensive market reach presents a challenge. Palantir needs to clearly articulate its value proposition and demonstrate superior capabilities to win over commercial clients.

Technological Innovation and Product Development

Palantir's ongoing R&D efforts in AI, machine learning, and other emerging technologies are critical for driving future growth.

- Importance of Emerging Technologies: Integrating AI and machine learning into its platforms will enhance data analysis capabilities and attract new clients seeking advanced solutions.

- Impact of New Product Launches: Introducing innovative products and platform enhancements will maintain Palantir's competitive edge and fuel revenue growth.

Potential Challenges and Risks

Competition and Market Saturation

The data analytics market is increasingly competitive. Palantir faces pressure from both established players and new entrants.

- Key Competitors and Competitive Advantages: Analyzing the strengths and weaknesses of key competitors is crucial to understanding Palantir's competitive landscape.

- Risk of Market Saturation: Market saturation could limit growth opportunities and increase pricing pressure.

Economic Downturns and Geopolitical Uncertainty

Macroeconomic factors significantly impact Palantir's valuation.

- Impact of Recessionary Pressures: Economic downturns can reduce government spending and commercial investment in data analytics solutions, affecting Palantir's revenue.

- Influence of Geopolitical Instability: Geopolitical uncertainties can disrupt business operations, affect contract negotiations, and create uncertainty for investors.

Conclusion

Whether Palantir reaches a $1 trillion valuation by 2030 is a complex question. While the company exhibits strong growth potential, fueled by government contracts and expanding commercial operations, significant challenges remain. Sustaining high growth rates, navigating intense competition, and mitigating risks associated with economic downturns and geopolitical uncertainty are crucial for achieving this ambitious goal. The successful integration of AI and machine learning, along with strategic partnerships, will play a vital role in determining Palantir's future trajectory.

Call to Action: While the $1 trillion valuation target is ambitious, continued monitoring of Palantir's financial performance, strategic initiatives, and technological advancements is essential. Stay informed about Palantir's progress to better understand its potential and the likelihood of this significant valuation milestone. Keep reading for further analysis of Palantir's stock and future valuation prospects.

Featured Posts

-

Julia Wandelts Madeleine Mc Cann Claim Leads To Uk Arrest

May 09, 2025

Julia Wandelts Madeleine Mc Cann Claim Leads To Uk Arrest

May 09, 2025 -

Pakistans Imf Bailout In Jeopardy 1 3 Billion Package Under Review

May 09, 2025

Pakistans Imf Bailout In Jeopardy 1 3 Billion Package Under Review

May 09, 2025 -

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 09, 2025

Elizabeth City Police Investigate String Of Car Break Ins At Apartment Complexes

May 09, 2025 -

1078 2025

May 09, 2025

1078 2025

May 09, 2025 -

Indian Insurers Advocate For Simplified Bond Forward Regulations

May 09, 2025

Indian Insurers Advocate For Simplified Bond Forward Regulations

May 09, 2025