Pakistan's IMF Bailout In Jeopardy: $1.3 Billion Package Under Review

Table of Contents

Key Conditions for IMF Bailout Release and Current Challenges

The release of the $1.3 billion is contingent upon Pakistan meeting several stringent conditions set by the IMF. Failure to meet these conditions will likely result in the suspension or cancellation of the bailout package, plunging the country into further economic turmoil. The key challenges include:

Fiscal Consolidation Measures

The IMF demands significant fiscal reforms, focusing on increased tax revenue and reduced government spending. This involves painful choices, impacting various sectors of the economy. The implementation, however, faces significant headwinds:

- Resistance from powerful vested interests: Powerful lobbies are resisting tax reforms, hindering the government's ability to increase revenue. This includes challenges in broadening the tax base and collecting taxes effectively from wealthy individuals and large corporations.

- Difficulties in reducing energy subsidies: Despite soaring fuel costs, reducing energy subsidies remains politically challenging. These subsidies place a heavy burden on the national budget, and their continuation undermines fiscal sustainability.

- Political instability impacting implementation: Political instability and frequent changes in government policies further complicate the implementation of the fiscal consolidation plan, creating uncertainty and hindering progress. The lack of a stable political environment makes it difficult to implement and maintain long-term economic reforms.

Exchange Rate Flexibility

The IMF insists on a market-determined exchange rate for the Pakistani Rupee. However, managing this transition while mitigating the negative impacts on inflation and debt servicing proves extremely challenging.

- Depreciation of the Rupee fueling inflation: The depreciation of the Rupee against the US dollar is a major driver of inflation, increasing the cost of imported goods and impacting the purchasing power of Pakistani citizens. This is creating hardship for ordinary Pakistanis.

- Concerns over the impact of devaluation on imported goods and debt servicing: The devaluation of the Rupee increases the cost of imports, making essential goods more expensive. It also significantly increases the burden of repaying external debt denominated in foreign currencies.

- Debate over the appropriate speed and method of exchange rate adjustment: There is ongoing debate about the optimal speed and method for adjusting the exchange rate, balancing the need for market-determined rates with the necessity to avoid drastic and destabilizing fluctuations. This requires careful consideration and strategic management.

Structural Reforms

The IMF's demands extend beyond immediate fiscal adjustments. They encompass broader structural reforms aimed at improving governance, tackling corruption, and enhancing the business environment – long-term challenges with immediate implications for the Pakistan IMF bailout.

- Need for improvements in state-owned enterprises' efficiency and profitability: Many state-owned enterprises are inefficient and loss-making, placing a strain on public finances. Reforms are needed to improve their performance and reduce their reliance on government support.

- Addressing concerns over transparency and accountability in government operations: Improving transparency and accountability in government operations is crucial to build trust with the IMF and international investors. This involves strengthening institutional frameworks and combating corruption.

- Attracting foreign investment through structural reforms: Structural reforms are essential for creating a more attractive investment climate, attracting foreign capital to stimulate economic growth and create jobs.

Potential Consequences of a Failed Bailout

Failure to secure the IMF bailout would have catastrophic consequences for Pakistan's economy and its standing on the global stage. The potential ramifications include:

Economic Recession

Without the IMF bailout, Pakistan faces a high risk of a severe economic recession, leading to widespread hardship.

- Sharp decline in GDP growth: A failure to secure the bailout would likely lead to a sharp contraction in GDP growth, further worsening the economic situation.

- Increased inflation and cost of living crisis: Inflation would likely accelerate, leading to a cost-of-living crisis for ordinary Pakistanis, further exacerbating existing social and political tensions.

- Potential social unrest due to economic hardship: The economic hardship resulting from a failed bailout could trigger widespread social unrest and instability.

Debt Default

The lack of IMF funding significantly increases the risk of Pakistan defaulting on its external debt obligations.

- Loss of access to international financial markets: A default would likely lead to Pakistan's exclusion from international financial markets, making it extremely difficult to secure future financing.

- Further devaluation of the Rupee: A default would likely trigger a further devaluation of the Rupee, leading to higher inflation and further economic instability.

- Potential for sanctions and economic isolation: International sanctions and economic isolation are potential consequences of a debt default, further hindering economic recovery.

Geopolitical Implications

Pakistan's economic instability could destabilize the region and have broader geopolitical implications.

- Increased regional tensions due to economic uncertainty: Pakistan's economic instability could increase regional tensions, impacting relations with neighboring countries.

- Potential for cross-border migrations and security concerns: Economic hardship could lead to increased cross-border migration and exacerbate existing security concerns.

- Impact on international relations and foreign policy: Pakistan's economic difficulties would significantly impact its international relations and foreign policy options.

Conclusion

The future of the Pakistan IMF bailout remains uncertain. The successful implementation of the crucial reforms stipulated by the IMF is paramount to securing the $1.3 billion package and averting a potential economic catastrophe. Failure to meet these conditions could have devastating consequences for Pakistan's economy, social stability, and geopolitical standing. Close monitoring of the ongoing review and the government's response to IMF demands is crucial. The future of Pakistan’s economy hinges on the outcome of this critical IMF bailout process. Stay informed about developments concerning the Pakistan IMF bailout to understand the implications for the nation's economic future.

Featured Posts

-

Assessing Nigel Farages Reform Party Can It Deliver Real Change

May 09, 2025

Assessing Nigel Farages Reform Party Can It Deliver Real Change

May 09, 2025 -

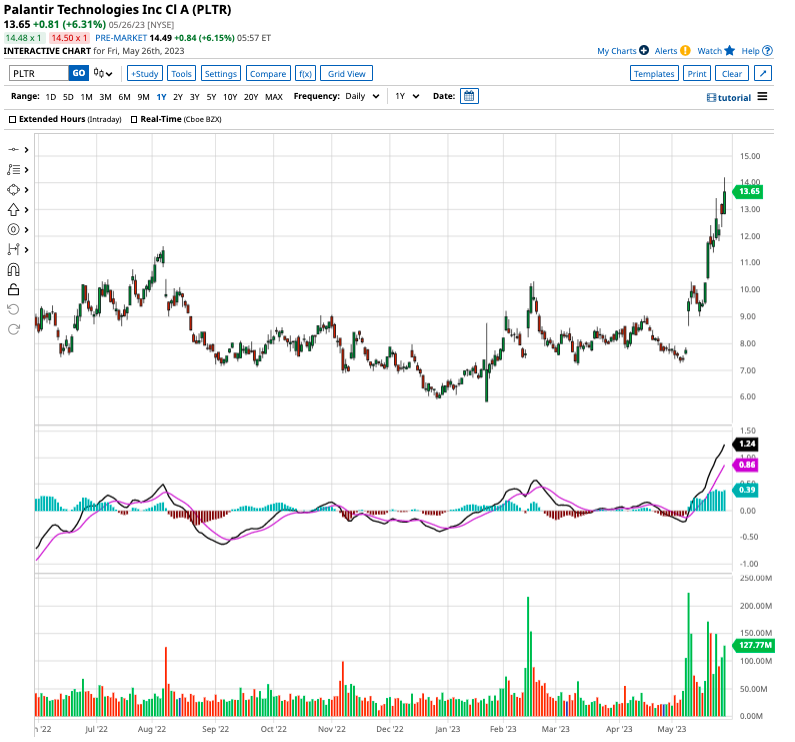

Should I Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 09, 2025

Should I Buy Palantir Stock Before Its Predicted 40 Rise In 2025

May 09, 2025 -

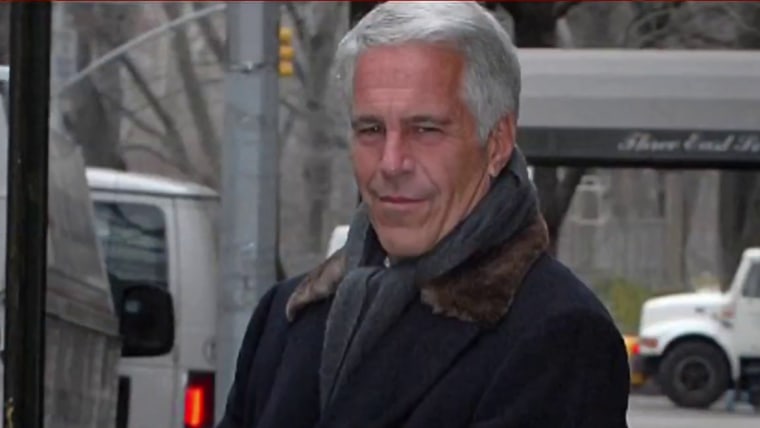

Ag Pam Bondis Decision Should The Jeffrey Epstein Files Be Released A Voters Guide

May 09, 2025

Ag Pam Bondis Decision Should The Jeffrey Epstein Files Be Released A Voters Guide

May 09, 2025 -

1509

May 09, 2025

1509

May 09, 2025 -

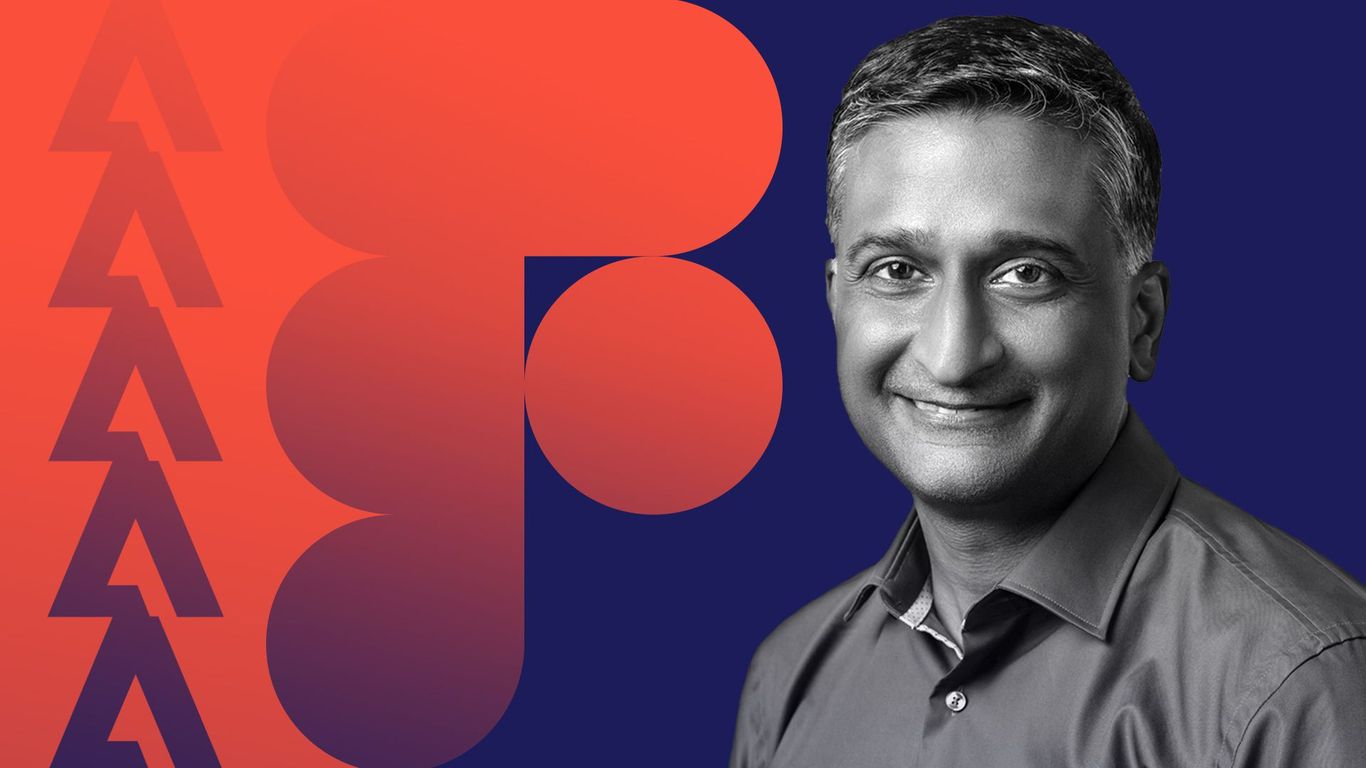

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025

How Figmas Ai Is Disrupting Adobe Word Press And Canva

May 09, 2025