Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Argument: Why Current Valuations Aren't Necessarily Overvalued

BofA's rationale for a less pessimistic outlook on high stock market valuations rests on several key pillars. They contend that several macroeconomic factors justify the current price levels, and a simple focus on P/E ratios alone provides an incomplete picture.

-

Low interest rates justify higher P/E ratios. Low interest rates reduce the cost of borrowing for companies, boosting profitability and supporting higher valuations. When borrowing is cheap, future earnings are discounted less heavily, leading to higher present values.

-

Strong corporate earnings growth supports current valuations. Many sectors are experiencing robust earnings growth, providing a solid foundation for current market capitalization. This strong performance, when considered alongside projected future growth, helps validate higher P/E ratios.

-

Potential for further economic growth. BofA anticipates continued economic expansion in many key sectors, suggesting further room for corporate earnings growth and justifying higher valuations. This optimism is particularly notable in certain technology and consumer-driven markets.

-

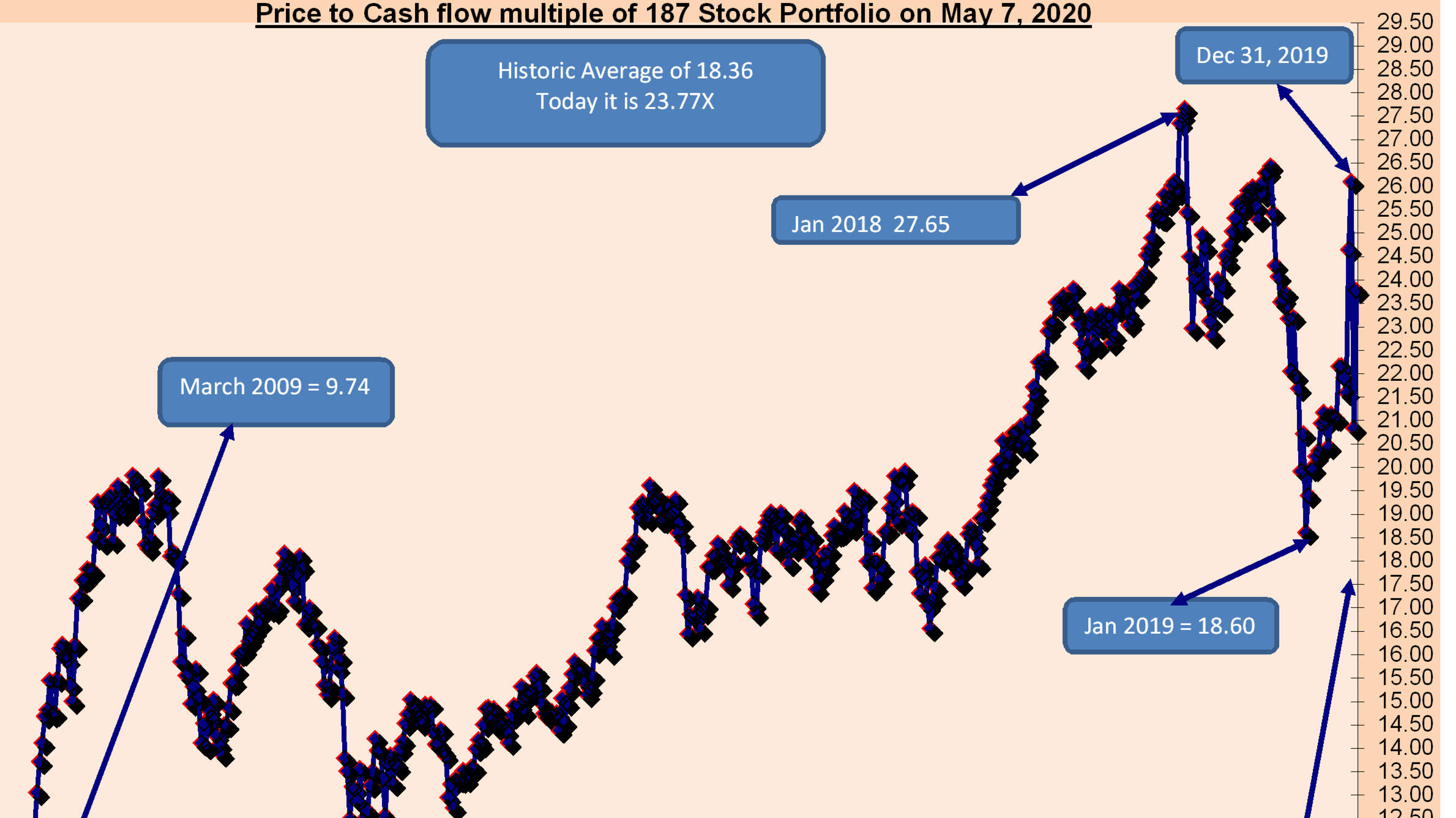

Comparison to historical valuations in similar economic environments. BofA's analysis considers historical data, comparing current valuations to periods with similar economic conditions. This historical context helps determine whether current levels are truly excessive or fall within a reasonable range considering prevailing circumstances. For example, comparing current valuations to the dot-com boom era would be insightful.

-

Specific examples of sectors or companies that justify higher valuations. BofA points to specific companies and sectors demonstrating exceptional growth and innovation, justifying their higher valuations. These examples offer concrete evidence to support their broader argument.

Addressing Investor Concerns: Debunking Common Myths

Despite BofA's positive outlook, several myths surrounding high stock market valuations persist. Addressing these concerns is crucial for building a confident investment strategy.

-

Myth 1: High valuations always precede market crashes. While high valuations can be a risk factor, they don't automatically predict a market crash. History shows instances of high valuations followed by sustained periods of growth. A nuanced understanding of market cycles and underlying economic conditions is essential.

-

Myth 2: Current valuations are detached from reality. BofA argues against this, pointing to strong economic fundamentals and corporate earnings growth as evidence of a realistic valuation. Current valuations are not solely speculative but reflect underlying economic strength, at least in the view of BofA's analysts.

-

Myth 3: There's nowhere to go but down. This pessimistic viewpoint ignores the potential for continued economic growth and further corporate earnings expansion. BofA's perspective emphasizes the possibility of continued market expansion, albeit potentially with increased volatility.

BofA's Recommended Investment Strategy in a High-Valuation Market

Even with a positive outlook, BofA advocates a cautious yet opportunistic investment strategy. Their recommendations emphasize a balanced approach:

-

Diversification across asset classes. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) mitigates risk and reduces dependence on any single sector's performance.

-

Focus on quality companies with strong fundamentals. Investing in companies with solid earnings, strong balance sheets, and sustainable business models reduces vulnerability to market corrections.

-

Long-term investment horizon. A long-term perspective allows investors to weather short-term market volatility and benefit from long-term growth.

-

Consideration of value stocks alongside growth stocks. A balanced portfolio including both value and growth stocks provides diversification and resilience against various market conditions.

-

Potential for sector-specific opportunities. While overall valuations may be high, some sectors offer more attractive entry points than others. Careful research and sector-specific analysis can identify opportunities within a high-valuation market.

Understanding the Risks: A Balanced Perspective

While BofA's perspective is optimistic, acknowledging the inherent risks of a high-valuation market is crucial.

-

Increased market volatility. High valuations often coincide with increased market volatility, making it crucial to manage risk effectively.

-

Potential for corrections. Market corrections are a normal part of the cycle, and even with strong fundamentals, corrections can occur in a high-valuation environment.

-

Impact of interest rate hikes. Interest rate increases can impact corporate profitability and valuation multiples, making it important to monitor monetary policy.

-

Geopolitical risks. Global events and geopolitical instability can influence market sentiment and valuations.

-

Importance of risk management strategies. Implementing robust risk management strategies, including diversification and stop-loss orders, is vital in a high-valuation market.

Don't Let High Stock Market Valuations Deter You: A Call to Action

BofA's perspective offers a crucial counterpoint to prevailing anxieties surrounding high stock market valuations. While acknowledging the risks, they emphasize that strong economic fundamentals and corporate earnings support current valuations to a significant extent. A balanced approach, combining caution with opportunity recognition, is key. Don't let high stock market valuation concerns paralyze you. Instead, develop a well-informed investment strategy that considers BofA's insights and your own risk tolerance. Consult with a financial advisor to create a personalized plan that addresses your specific circumstances and goals in managing high stock market valuations effectively. Remember, navigating high stock market valuations requires careful consideration, but it doesn't necessarily signal an impending market collapse.

Featured Posts

-

Stock Market Update Dow Futures Decline Dollar Falls On Trade Worries

Apr 22, 2025

Stock Market Update Dow Futures Decline Dollar Falls On Trade Worries

Apr 22, 2025 -

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025 -

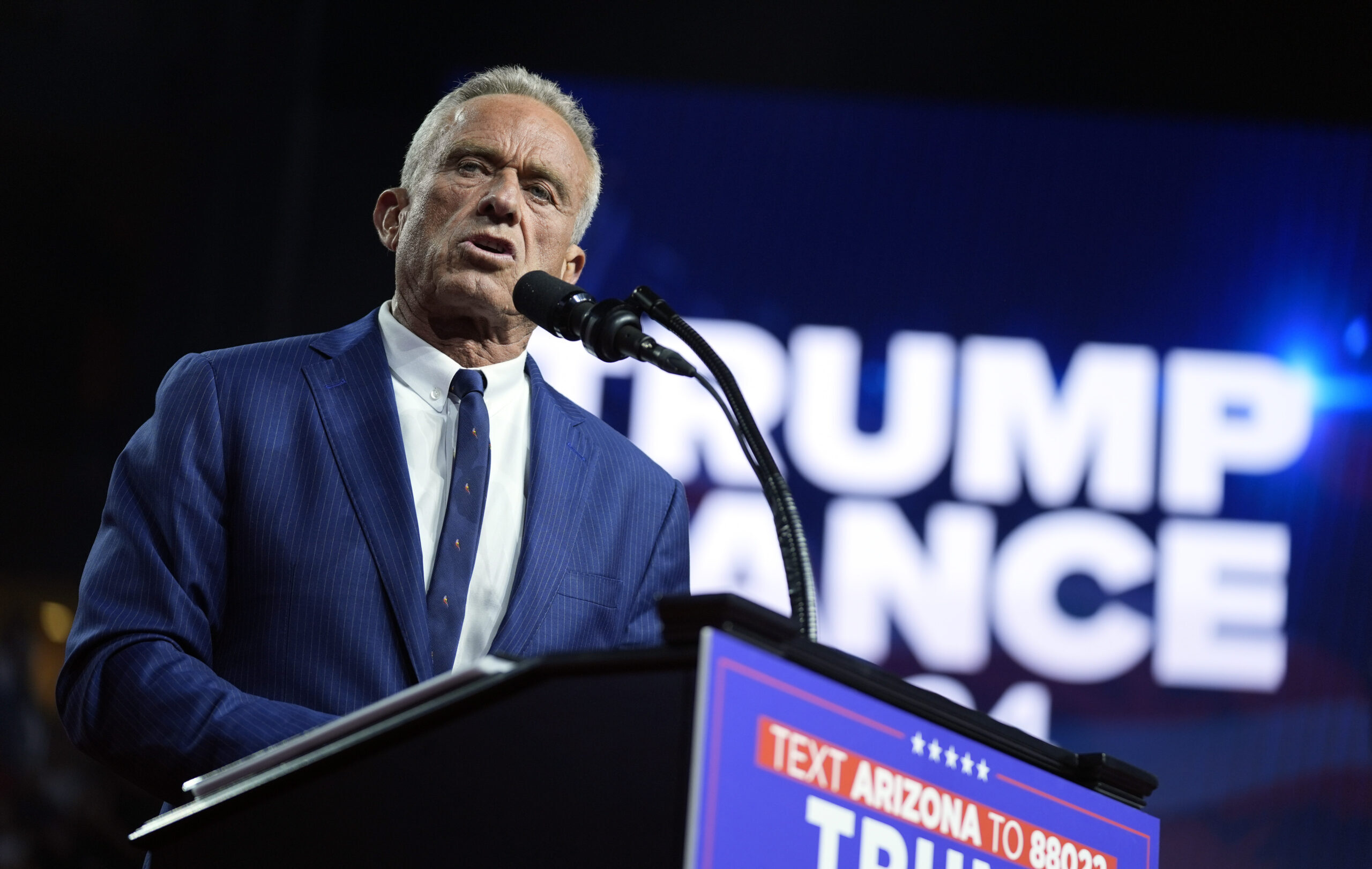

Trump Defends Obamacare At Supreme Court Rfk Jr S Political Power At Stake

Apr 22, 2025

Trump Defends Obamacare At Supreme Court Rfk Jr S Political Power At Stake

Apr 22, 2025 -

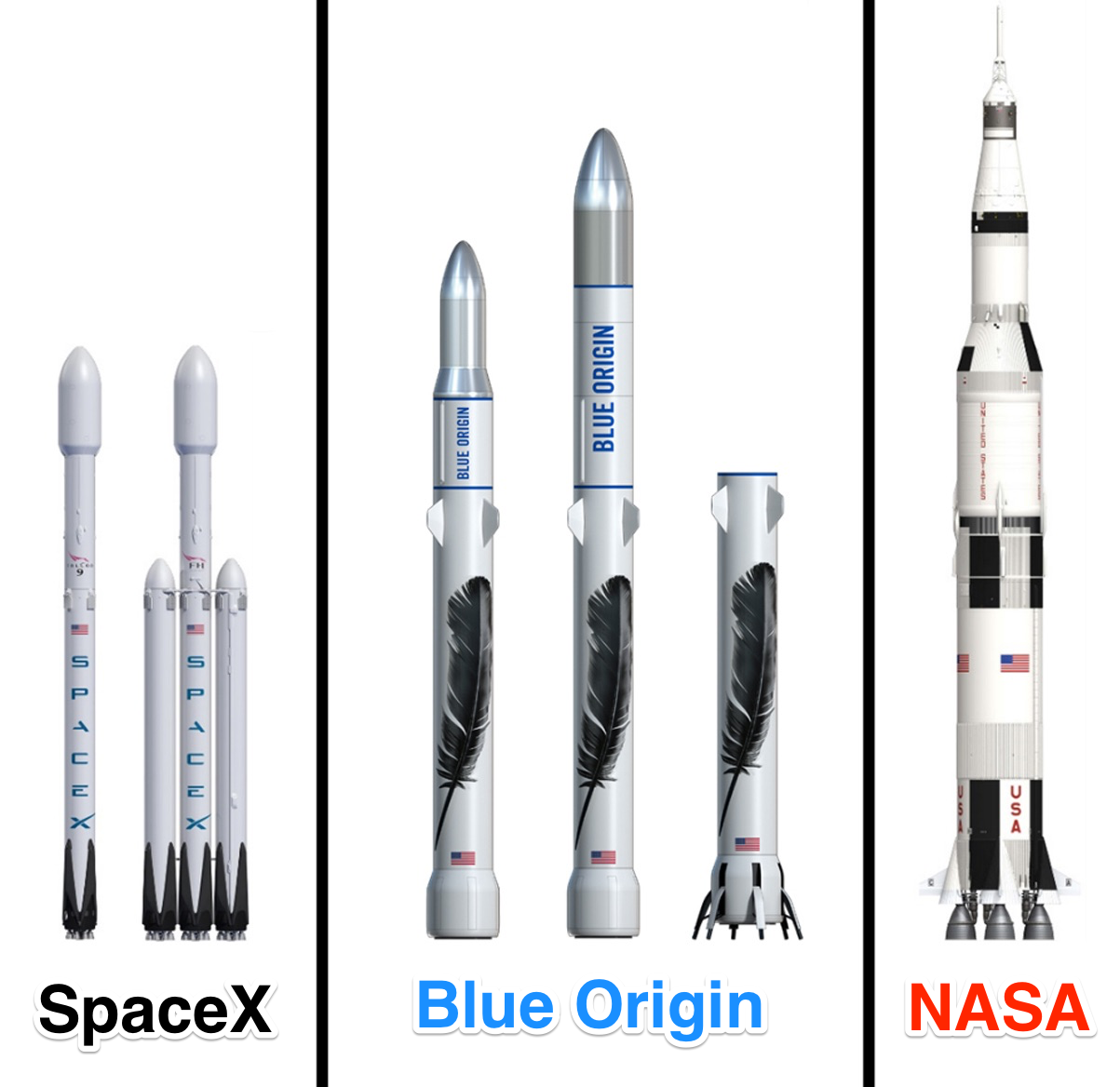

Analyzing The Impact Blue Origins Failure Compared To Katy Perrys Public Image

Apr 22, 2025

Analyzing The Impact Blue Origins Failure Compared To Katy Perrys Public Image

Apr 22, 2025 -

Strengthening Bilateral Security China And Indonesia

Apr 22, 2025

Strengthening Bilateral Security China And Indonesia

Apr 22, 2025