Stock Market Update: Dow Futures Decline, Dollar Falls On Trade Worries

Table of Contents

Dow Futures Decline: A Deeper Dive

The Dow Futures experienced a considerable drop today, reflecting a broader sentiment of apprehension within the market. This section will explore the key drivers behind this downturn.

Impact of Trade Tensions

Escalating trade disputes between major global economies are the primary culprits behind the current market volatility. The uncertainty surrounding trade negotiations directly impacts investor confidence, prompting widespread sell-offs. The threat of new tariffs and trade restrictions creates an environment of instability, discouraging investment and prompting investors to seek safer havens.

- Increased tariffs on imported goods: Higher tariffs increase the cost of goods, impacting both businesses and consumers, thus dampening economic growth.

- Threat of further trade restrictions: The unpredictable nature of trade policy creates a climate of fear, hindering long-term planning and investment decisions.

- Uncertainty over future trade agreements: The lack of clarity regarding future trade relations fuels apprehension and contributes to the overall market downturn.

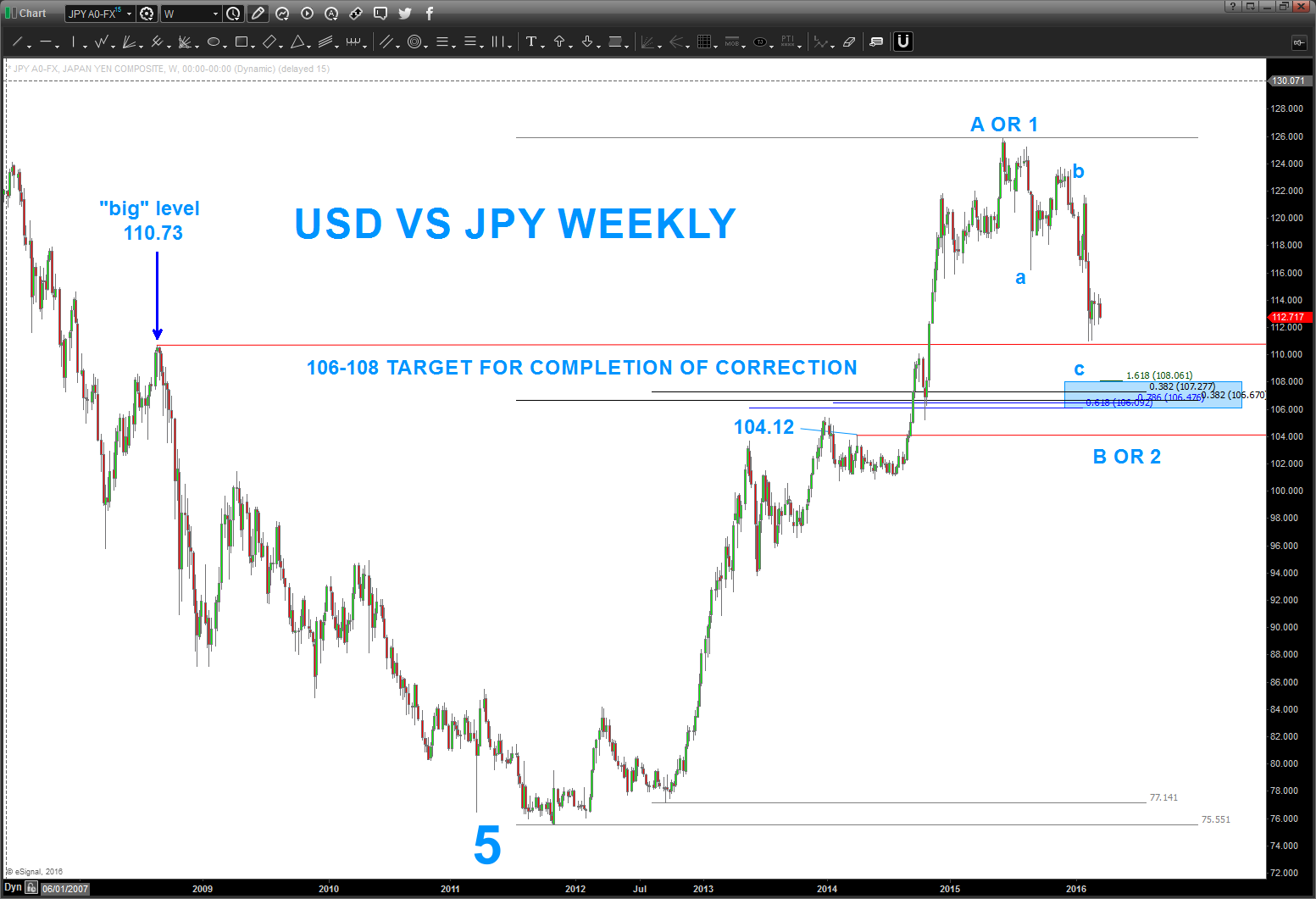

Technical Analysis of Dow Futures

A technical analysis of Dow Futures charts reveals a bearish trend, suggesting that further declines are a possibility in the near term. Key support and resistance levels are crucial indicators to watch for short-term price movements. Volume analysis provides insights into the intensity of the selling pressure.

- Analysis of key chart indicators (e.g., moving averages, RSI): Technical indicators signal a bearish momentum, confirming the downward trend.

- Identification of potential support and resistance levels: Monitoring these levels will help predict potential price reversals or further declines.

- Assessment of trading volume to confirm trends: High trading volume during the decline confirms the strength of the selling pressure.

Dollar Weakness Amidst Trade Worries

The decline in Dow Futures is intertwined with the weakening of the US dollar, a reflection of the broader anxieties surrounding global trade.

Correlation Between Dollar and Trade

The dollar's value often mirrors investor confidence in the US economy. Trade disputes can erode this confidence, making the dollar less attractive to international investors. Safe-haven assets, such as gold, tend to appreciate during times of trade uncertainty, further impacting the dollar's value.

- Explanation of the inverse relationship between the dollar and safe-haven assets: As investors seek safety, they move towards assets like gold, causing the dollar to depreciate.

- Discussion of the impact of negative trade news on investor confidence: Negative trade news fuels uncertainty and risk aversion, leading to a sell-off in the dollar.

- Analysis of the dollar's performance against other major currencies: The dollar's weakness is apparent against other major currencies, reflecting global concerns about the US economy.

Implications for Global Markets

A weaker dollar can significantly impact international trade and investment flows. While it might make US exports more competitive, it also increases the cost of imports, potentially fueling inflation. This fluctuation contributes to market instability and heightened volatility.

- Examination of the effect on US exports and imports: A weaker dollar benefits exporters but makes imports more expensive for US consumers.

- Discussion of the potential impact on global currency markets: The dollar's weakness ripples through global currency markets, causing fluctuations in exchange rates.

- Analysis of the wider macroeconomic consequences: The uncertainty surrounding trade and currency fluctuations can have significant macroeconomic consequences globally.

Looking Ahead: Potential Scenarios and Investor Strategies

Navigating the current market requires careful consideration of potential scenarios and the adoption of appropriate investor strategies.

Scenario Planning

Several scenarios could unfold depending on how trade tensions resolve (or escalate). Different asset classes will react differently to each scenario.

- Optimistic scenario: Resolution of trade disputes leads to renewed investor confidence and a market recovery.

- Pessimistic scenario: Further escalation of trade wars results in a prolonged market downturn and increased volatility.

- Neutral scenario: A stalemate in trade negotiations leads to continued market uncertainty and volatility.

Investor Strategies

In this uncertain market environment, investors should prioritize diversification to mitigate risk and maintain a long-term investment horizon. Remember, this is general advice and not financial advice. Consult with a financial professional for personalized guidance.

- Importance of diversification across asset classes: Diversification reduces the impact of losses in any single asset class.

- Strategies for managing risk during periods of market uncertainty: Risk management techniques, such as stop-loss orders, can help limit potential losses.

- Importance of maintaining a long-term investment horizon: A long-term perspective helps weather short-term market fluctuations.

Conclusion

Today's Stock Market Update reveals significant declines in Dow Futures and a weakening dollar, primarily fueled by anxieties surrounding escalating trade tensions. Understanding the complex interplay between trade disputes, investor sentiment, and currency fluctuations is crucial for navigating the current market conditions. While the future remains uncertain, effective risk management strategies and a long-term investment approach are paramount for success during periods of Stock Market Update volatility. Stay informed about the latest developments and continue monitoring this important Stock Market Update for further insights. Regularly check for updates on this important Stock Market Update to make informed investment decisions.

Featured Posts

-

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025

Russias Aerial Assault On Ukraine Us Peace Plan Amidst Deadly Barrage

Apr 22, 2025 -

Aramco And Byd Join Forces To Explore Electric Vehicle Innovations

Apr 22, 2025

Aramco And Byd Join Forces To Explore Electric Vehicle Innovations

Apr 22, 2025 -

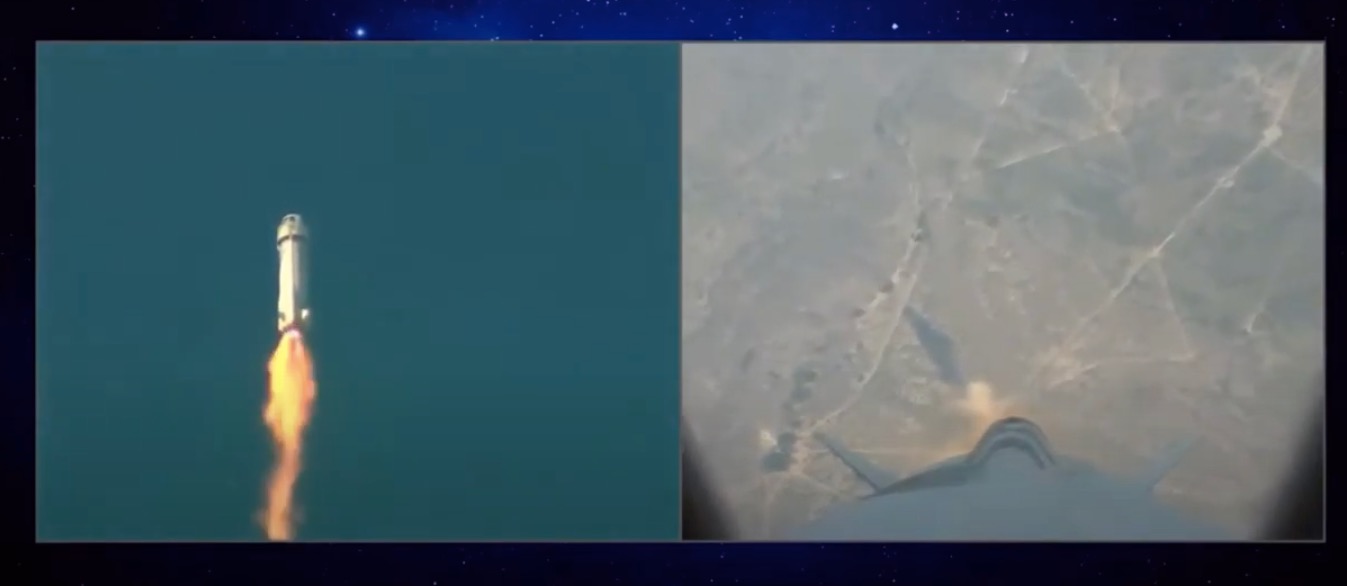

Is Blue Origins Failure Larger Than Katy Perrys Career Setback A Comparative Analysis

Apr 22, 2025

Is Blue Origins Failure Larger Than Katy Perrys Career Setback A Comparative Analysis

Apr 22, 2025 -

The Bezos Blue Origin Debacle A Case Study In Business Failure Compared To Katy Perry

Apr 22, 2025

The Bezos Blue Origin Debacle A Case Study In Business Failure Compared To Katy Perry

Apr 22, 2025 -

The Conclave And The Future Evaluating Pope Franciss Papacy

Apr 22, 2025

The Conclave And The Future Evaluating Pope Franciss Papacy

Apr 22, 2025