Who Will Bear The Brunt Of Trump's Economic Policies?

Table of Contents

The Impact of Trump's Tax Cuts

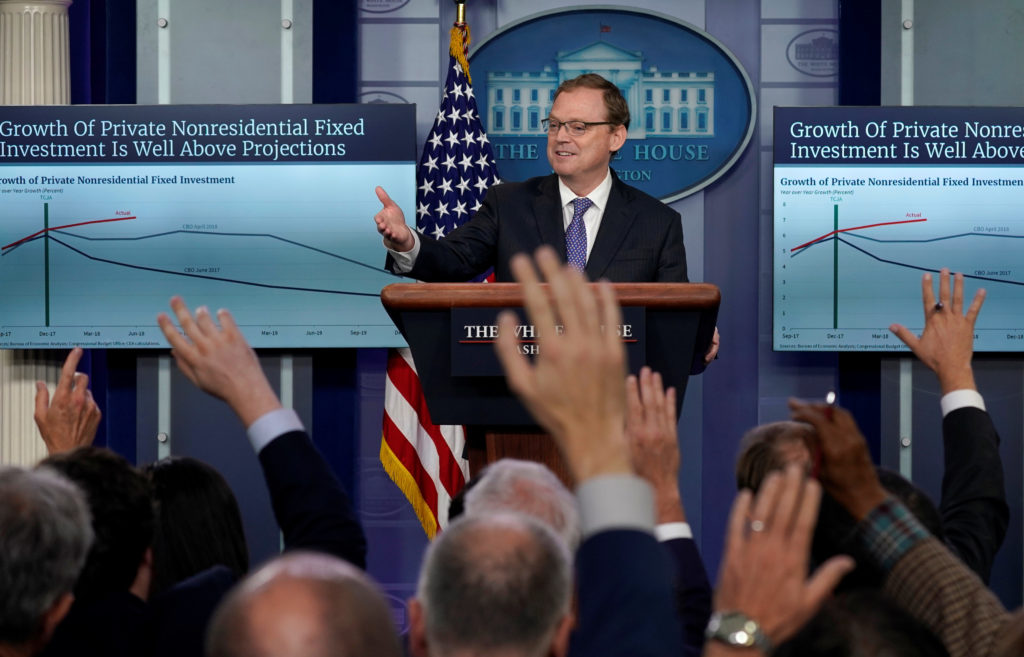

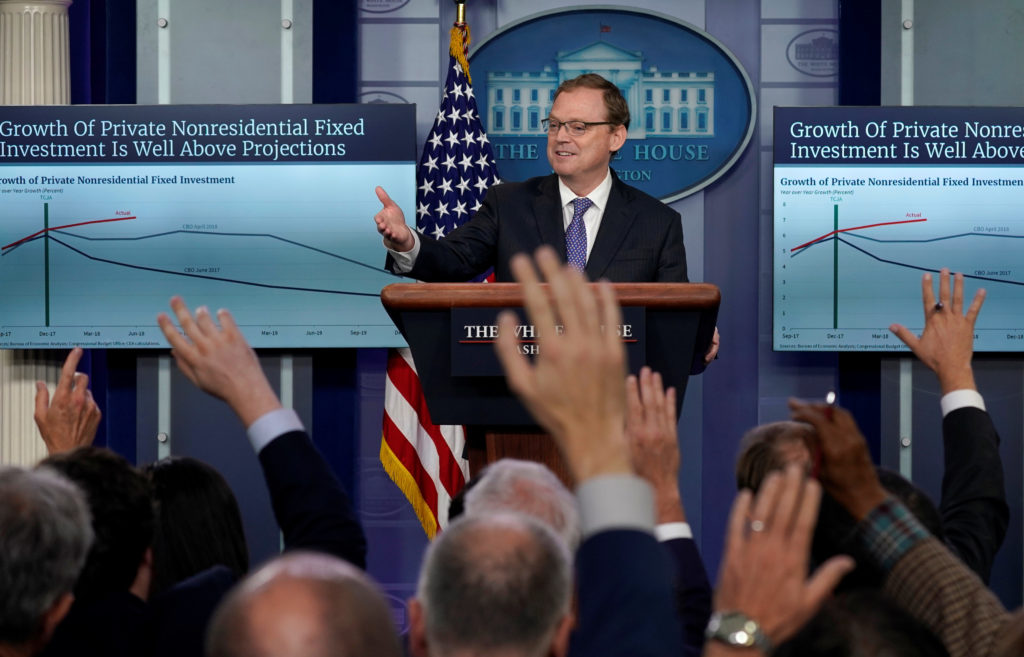

Trump's signature 2017 Tax Cuts and Jobs Act significantly lowered both corporate and individual income tax rates. The stated goal was to stimulate economic growth, but the actual impact was unevenly distributed, raising questions about who truly benefited.

Keywords: Tax cuts, corporate tax cuts, individual tax cuts, income inequality, tax burden

-

Analysis of the 2017 Tax Cuts and Jobs Act: The act drastically reduced the corporate tax rate from 35% to 21%, a move that overwhelmingly favored corporations and large businesses. While individual tax cuts were also implemented, the benefits were disproportionately skewed towards higher-income earners. Many lower- and middle-income individuals saw only modest tax reductions.

-

The effect on the national debt and deficit: The tax cuts led to a substantial increase in the national debt and deficit. Reduced government revenue, coupled with increased spending, raised concerns about long-term fiscal sustainability.

-

Long-term economic consequences of the tax cuts: The long-term effects are still being debated. While proponents argued that the tax cuts would stimulate investment and economic growth, critics pointed to the widening income inequality and the unsustainable increase in the national debt.

-

Specific examples of the impact on different income brackets:

- High-income earners: Experienced significant tax savings, leading to increased disposable income.

- Middle-income earners: Saw modest tax reductions, often insufficient to offset rising costs of living.

- Low-income earners: Received minimal tax benefits, often experiencing no change or a slight increase in their tax burden due to the phasing out of certain deductions.

The Consequences of Trump's Trade Wars

Trump's administration initiated a series of trade wars, imposing tariffs on goods from various countries, particularly China. While the stated aim was to protect American industries and jobs, the consequences were far-reaching and complex.

Keywords: Trade wars, tariffs, trade protectionism, import tariffs, export markets, agricultural sector, manufacturing sector

-

Impact on specific industries: The agricultural sector, particularly soybean farmers, suffered significantly due to retaliatory tariffs imposed by China. The manufacturing sector experienced mixed results, with some industries benefiting from increased domestic demand while others faced higher input costs due to tariffs on imported materials.

-

The effect on consumer prices: Tariffs increased the prices of imported goods, leading to higher consumer costs and reduced purchasing power. This disproportionately affected low- and middle-income households.

-

Analysis of the winners and losers: Large corporations with significant lobbying power often benefited from the trade wars, while small businesses and consumers bore the brunt of increased costs and reduced market access.

-

Specific examples of tariffs and their impacts on trade: The tariffs on steel and aluminum, for instance, increased costs for domestic manufacturers reliant on these materials. Retaliatory tariffs from China significantly impacted American agricultural exports.

The Effects of Deregulation Under Trump

The Trump administration pursued a significant deregulation agenda, rolling back environmental, financial, and labor regulations. The impact of these actions remains a subject of intense debate.

Keywords: Deregulation, environmental regulations, financial regulations, labor regulations, consumer protection

-

Impact on environmental protection and public health: Weakening of environmental regulations led to increased pollution and concerns about long-term environmental damage and public health consequences.

-

The influence on financial stability and consumer protection: Rollbacks in financial regulations raised concerns about increased risk in the financial system and reduced consumer protection.

-

Effects on worker safety and labor rights: Easing of labor regulations potentially undermined worker safety and reduced protections for workers' rights.

-

Specific examples of deregulation and its consequences: The rollback of clean water regulations, for instance, increased pollution in waterways. Easing of financial regulations increased the risk of financial crises.

The Widening Gap: Income Inequality and Trump's Policies

A crucial consideration is how Trump's policies affected income inequality. The combination of tax cuts favoring the wealthy, trade wars impacting specific industries, and deregulation potentially harming worker protections all contributed to this issue.

Keywords: Income inequality, wealth gap, economic disparity, social mobility

-

How did Trump's policies affect income inequality?: The evidence suggests that Trump's policies exacerbated existing income inequality, with the wealthiest segments of the population benefiting disproportionately.

-

Data and statistics illustrating changes in wealth distribution: Studies showing increased concentration of wealth at the top of the income distribution can be cited here.

-

The long-term social and economic implications of increased inequality: Increased inequality can lead to social unrest, reduced economic mobility, and slower overall economic growth.

Conclusion

This analysis reveals that the economic policies enacted during the Trump administration had a significantly uneven impact across different segments of society. While some groups, particularly large corporations and high-income earners, benefited from tax cuts and deregulation, others, including low-income families, farmers impacted by trade wars, and workers in certain industries, experienced negative consequences. The long-term effects of these policies, including increased national debt and a widening income gap, remain a subject of ongoing debate and concern. Understanding who bore the brunt of Trump's economic policies is crucial for informed political discourse and future economic planning. Continue researching the complex interplay between economic policy and societal impact to develop a more comprehensive understanding of its effects. Further investigation into the long-term consequences of these policies is essential.

Featured Posts

-

The Future Of Robotics In Nike Sneaker Manufacturing

Apr 22, 2025

The Future Of Robotics In Nike Sneaker Manufacturing

Apr 22, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Development

Apr 22, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Development

Apr 22, 2025 -

Understanding Stock Market Valuations Bof As Rationale For Investors

Apr 22, 2025

Understanding Stock Market Valuations Bof As Rationale For Investors

Apr 22, 2025 -

Jan 6 Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 22, 2025

Jan 6 Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 22, 2025 -

Ukraine Under Fire Russia Launches Deadly Air Strikes As Us Seeks Peace

Apr 22, 2025

Ukraine Under Fire Russia Launches Deadly Air Strikes As Us Seeks Peace

Apr 22, 2025