Understanding Stock Market Valuations: BofA's Rationale For Investors

Table of Contents

Key Valuation Metrics Explained

Several key metrics help investors assess stock market valuations. Understanding these metrics is fundamental to evaluating individual stocks and the market as a whole. Let's examine some of the most commonly used:

-

Price-to-Earnings Ratio (P/E): This ratio compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating high growth expectations or overvaluation. It's calculated by dividing the market price per share by the earnings per share. For example, if a stock trades at $50 and has an EPS of $5, its P/E ratio is 10. However, comparing P/E ratios across different industries is crucial, as some sectors naturally have higher P/E ratios than others.

-

Price-to-Book Ratio (P/B): This ratio compares a company's market capitalization to its book value (assets minus liabilities). A high P/B ratio can signal overvaluation, while a low ratio might suggest undervaluation. It's calculated by dividing the market price per share by the book value per share. This metric is particularly useful for valuing companies with significant tangible assets.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's useful for valuing companies with negative earnings or those in early stages of growth. A lower P/S ratio might indicate a potentially undervalued company. The calculation is the market price per share divided by the revenue per share. However, relying solely on P/S can be misleading without considering profitability.

-

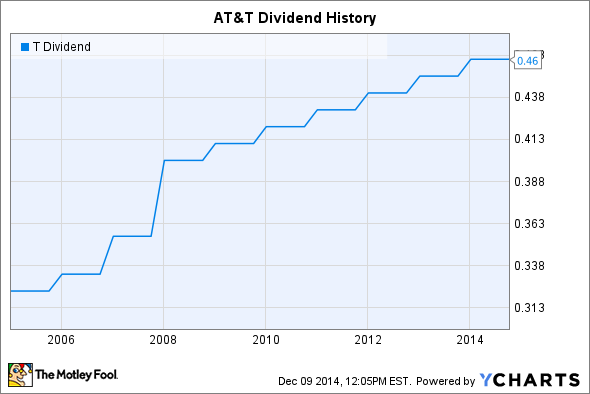

Dividend Yield: This metric represents the annual dividend payment relative to the stock price. A high dividend yield can be attractive to income-seeking investors, but it's crucial to consider the company's financial health and sustainability of dividend payouts. It's calculated by dividing the annual dividend per share by the market price per share.

BofA's Current Market Outlook and Valuation Analysis

BofA regularly publishes reports analyzing stock market valuations and offering predictions on future market performance. (Note: Replace this section with specific references to BofA's recent reports and analyses, including hyperlinks to the reports whenever possible. For instance, you might mention a specific report on sector valuations or their overall market outlook for the next quarter/year).

-

Key Predictions: [Insert BofA's key predictions for future market performance based on their reports].

-

Undervalued/Overvalued Sectors: [Insert BofA's assessment of undervalued and overvalued sectors, including their rationale. Examples could include technology, energy, or financials].

-

Risk and Reward Assessment: [Summarize BofA's stance on risk and reward in the current market based on their valuation analyses. Are they bullish or bearish? What are the main factors driving their outlook?]

-

Comparison to Other Institutions: [Compare BofA's outlook to that of other major financial institutions like Goldman Sachs or JP Morgan. Are there significant differences in their predictions and analyses?]

Interpreting BofA's Rationale and Applying it to Your Portfolio

BofA's analysis provides valuable context, but it shouldn't be the sole basis for your investment decisions. Individual investors can use this information to refine their strategies:

-

Identifying Undervalued Stocks: By comparing a company's valuation metrics (P/E, P/B, P/S) to its peers and industry averages, and considering BofA's insights on specific sectors, investors can identify potentially undervalued stocks.

-

Portfolio Diversification: BofA's outlook can help inform your portfolio diversification strategy. If BofA predicts strong performance in a specific sector, you might consider increasing your allocation to that sector (within your risk tolerance).

-

Due Diligence is Crucial: Always conduct thorough due diligence before making any investment decisions. Review company financials, competitive landscape, management team, and future growth prospects. BofA's analysis is just one piece of the puzzle.

-

Risk Tolerance: Your investment strategy should align with your risk tolerance. BofA's (or any analyst's) optimistic outlook doesn't negate the inherent risks in the stock market. A conservative investor might still prefer a less aggressive approach even if the market outlook is positive.

Understanding the Limitations of Valuation Models

It's essential to acknowledge that valuation models are not perfect predictors of future performance. Several factors can influence stock prices beyond what these models capture:

-

Macroeconomic Factors: Inflation, interest rates, and economic growth significantly impact stock market valuations. A change in these factors can quickly alter market sentiment and stock prices.

-

Market Sentiment: Investor psychology and market sentiment play a crucial role. Fear and greed can drive prices up or down regardless of fundamental valuations.

-

Predicting Future Earnings: Accurately predicting future earnings and growth is extremely challenging. Unexpected events or changes in a company's strategy can significantly alter its future performance.

-

Qualitative Factors: Valuation models primarily focus on quantitative data. However, qualitative factors, such as management quality, competitive advantages, and regulatory changes, are equally important.

Conclusion

Understanding stock market valuations is crucial for successful investing. While BofA's analysis provides valuable insights, it's essential to conduct your own thorough research and consider your individual risk tolerance. Remember that valuation metrics are just tools; they don't guarantee future returns. By combining quantitative analysis with qualitative factors and staying informed about market trends, you can make more informed investment decisions.

Call to Action: Gain a deeper understanding of stock market valuations and learn how to apply BofA's insights—and your own research—to your portfolio. Continue your research on stock market valuation techniques and explore other resources to refine your investment strategy. Stay informed about market trends and valuation changes to make sound investment decisions and achieve your financial goals.

Featured Posts

-

Challenges For Premium Automakers In China Bmw Porsche And Beyond

Apr 22, 2025

Challenges For Premium Automakers In China Bmw Porsche And Beyond

Apr 22, 2025 -

Hollywood Shut Down The Impact Of The Writers And Actors Strike

Apr 22, 2025

Hollywood Shut Down The Impact Of The Writers And Actors Strike

Apr 22, 2025 -

The China Factor How It Affects Bmw Porsche And Other Automakers

Apr 22, 2025

The China Factor How It Affects Bmw Porsche And Other Automakers

Apr 22, 2025 -

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025

Higher Stock Prices Higher Risks What Investors Need To Know

Apr 22, 2025 -

The Shifting Sands Of The Chinese Auto Market A Look At Bmw And Porsche

Apr 22, 2025

The Shifting Sands Of The Chinese Auto Market A Look At Bmw And Porsche

Apr 22, 2025