Vodacom (VOD) Reports Strong Earnings, Boosting Investor Payout

Table of Contents

Strong Revenue Growth Fuels Increased Earnings

Vodacom's impressive financial performance is primarily driven by robust revenue growth across its diverse service portfolio. The company demonstrated significant gains in mobile data, fixed-line services, and its burgeoning fintech sector, resulting in improved operating income and enhanced profitability. This strong financial performance is a testament to Vodacom's effective operational strategies and its ability to capitalize on market opportunities.

- Revenue Increase: Vodacom reported a year-over-year revenue increase of X% (replace X with the actual percentage from the report). This substantial growth showcases the company's continued dominance in the market.

- Service Segment Breakdown: A significant portion of this revenue growth stemmed from the mobile data segment, which saw a Y% increase (replace Y with the actual percentage), followed by a Z% increase (replace Z with the actual percentage) in fixed-line services. The fintech sector also contributed significantly to overall revenue, highlighting the company's diversification strategy.

- Market Share Gains: Vodacom's strategic initiatives have also resulted in notable market share gains, further solidifying its position as a leading telecommunications provider.

Increased Investor Payout: Dividends and Share Buybacks

The strong financial performance has enabled Vodacom to significantly increase its investor payout, benefiting shareholders through both dividend increases and potential share buyback programs. This demonstrates Vodacom's commitment to returning value to its investors and enhancing shareholder value. The increased dividend payout and the prospect of share buybacks contribute to an attractive investor return and potentially boost the stock valuation.

- Dividend Increase: Vodacom announced a dividend increase of A% (replace A with the actual percentage or amount), demonstrating confidence in its future prospects and rewarding its shareholders handsomely. This represents a substantial return for investors holding VOD stock.

- Share Buyback Program: Details of the share buyback program (if applicable), its size, and its anticipated impact on the stock price and earnings per share (EPS) should be detailed here. The implementation of such a program would further enhance shareholder value.

- Potential Yield: The increased dividend, coupled with the potential impact of the share buyback program, results in an attractive yield, making Vodacom's stock potentially more appealing to income-seeking investors.

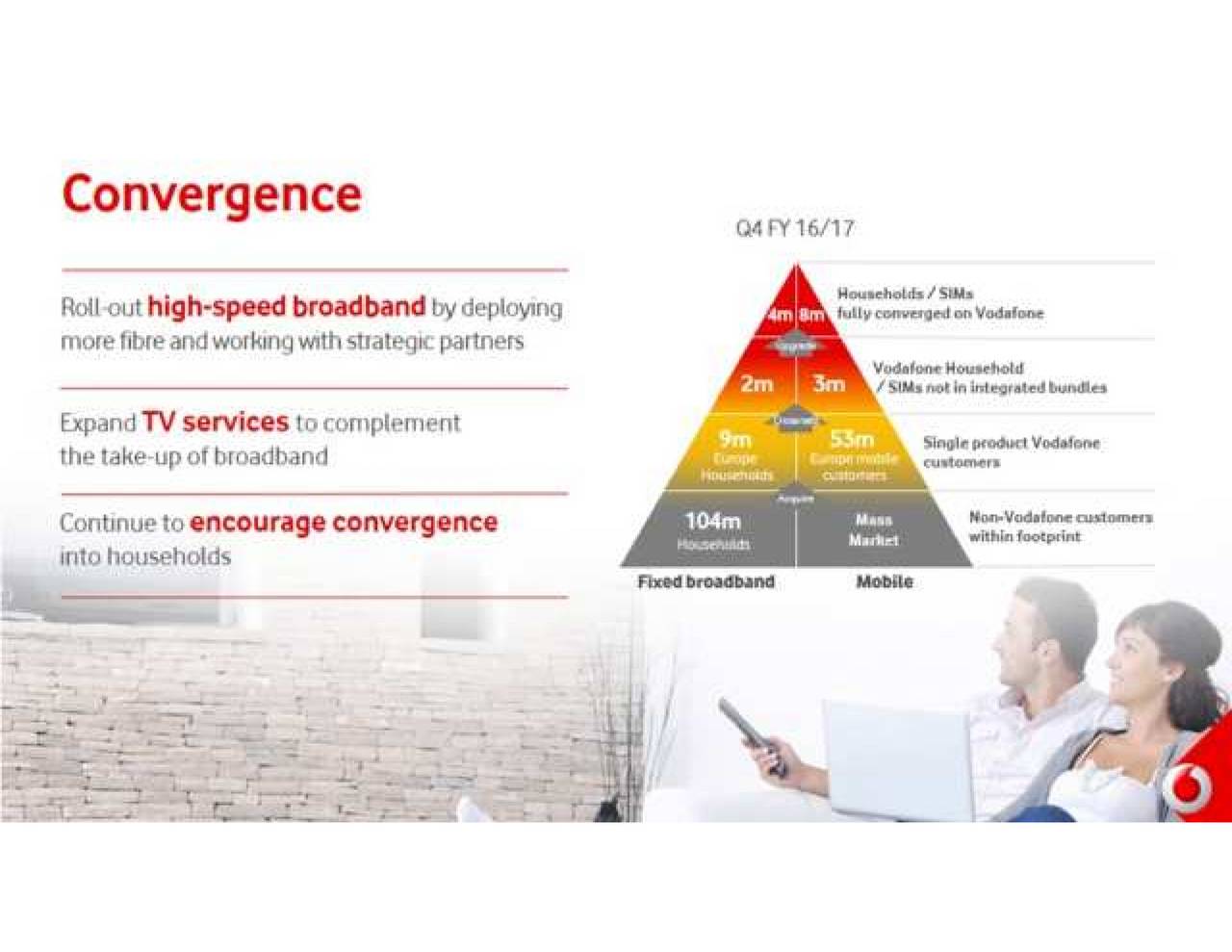

Strategic Initiatives Driving Success

Vodacom's success is not merely coincidental; it's the result of well-executed strategic initiatives. Significant network investments, continuous product innovation, and strategic market expansion have all contributed to its remarkable financial performance. This demonstrates Vodacom's proactive approach to staying ahead of the competition and adapting to the ever-evolving technological landscape.

- Network Investments: Heavy investments in upgrading and expanding its network infrastructure have improved service quality and capacity, leading to increased customer satisfaction and attracting new subscribers.

- Product Innovation: The launch of new products and services, tailored to meet evolving customer needs, has been instrumental in driving revenue growth and maintaining a competitive edge in the market.

- Market Expansion: Strategic expansion into new markets or market segments has broadened Vodacom's reach and diversified its revenue streams, reducing reliance on any single market.

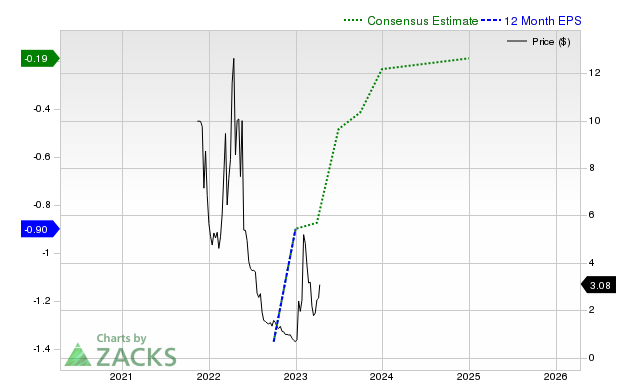

Future Outlook and Investment Implications

Considering Vodacom's strong earnings and the positive market response, the outlook for the company remains optimistic. However, potential risks and challenges should always be considered when evaluating investment opportunities. A thorough market analysis is crucial for making informed investment decisions.

- Growth Projections: Based on current trends and the company's strategic plans, Vodacom is expected to maintain a healthy growth trajectory in the coming years (provide specifics if available).

- Potential Challenges: Challenges such as increasing competition, regulatory changes, and potential economic downturns could impact Vodacom's future performance. Investors should carefully consider these potential risks.

- Investment Recommendations: Given Vodacom's strong financial results, increased investor payout, and positive future outlook, the company presents a compelling investment opportunity for investors seeking exposure to the telecommunications sector.

Conclusion: Vodacom (VOD) Earnings Signal Strong Investment Opportunity

Vodacom's (VOD) strong earnings, coupled with a substantial increase in investor payout, paint a positive picture of the company's financial health and its commitment to shareholder returns. The strategic initiatives driving this success, combined with a promising future outlook, suggest that Vodacom represents a strong investment opportunity. Learn more about Vodacom (VOD) and its promising investment opportunities by visiting their investor relations page [link to investor relations page]. Consider Vodacom (VOD) for your investment portfolio given its strong financial performance and increased investor payout.

Featured Posts

-

Big Bear Ai Holdings Bbai Reasons Behind The 2025 Stock Plunge

May 20, 2025

Big Bear Ai Holdings Bbai Reasons Behind The 2025 Stock Plunge

May 20, 2025 -

Biarritz Vs Asbh Pro D2 L Importance Du Facteur Mental

May 20, 2025

Biarritz Vs Asbh Pro D2 L Importance Du Facteur Mental

May 20, 2025 -

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025 -

Tactical Analysis Mourinhos Management Of Tadic And Dzeko

May 20, 2025

Tactical Analysis Mourinhos Management Of Tadic And Dzeko

May 20, 2025 -

Get To Know Paulina Gretzky Dustin Johnsons Wife Her Career And Kids

May 20, 2025

Get To Know Paulina Gretzky Dustin Johnsons Wife Her Career And Kids

May 20, 2025

Latest Posts

-

From Prison To Studio Vybz Kartels Exclusive Update

May 21, 2025

From Prison To Studio Vybz Kartels Exclusive Update

May 21, 2025 -

Nuffy On Touring With Vybz Kartel A Dream Come True

May 21, 2025

Nuffy On Touring With Vybz Kartel A Dream Come True

May 21, 2025 -

Is Beenie Mans New York Event The Next Big It A Stream Moment

May 21, 2025

Is Beenie Mans New York Event The Next Big It A Stream Moment

May 21, 2025 -

Vybz Kartels Exclusive Interview Life Behind Bars And New Music

May 21, 2025

Vybz Kartels Exclusive Interview Life Behind Bars And New Music

May 21, 2025 -

Vybz Kartel Tour A Dream Fulfilled For Nuphy

May 21, 2025

Vybz Kartel Tour A Dream Fulfilled For Nuphy

May 21, 2025