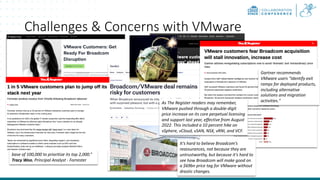

VMware Pricing Concerns: AT&T Reports A Potential 1,050% Increase From Broadcom

Table of Contents

Understanding the VMware Pricing Structure and Broadcom's Influence

Pre-Acquisition VMware Pricing Models:

Before Broadcom's acquisition, VMware offered a variety of licensing models, each with its own cost structure. Understanding these models is crucial to grasping the potential impact of the recent price increases. Common models included:

- Per-Processor (Per-CPU): Licensing was based on the number of physical processors in a server. This model often resulted in higher costs for servers with multiple processors.

- Per-Socket: Licensing was based on the number of processor sockets, regardless of the number of cores per socket. This model could be more cost-effective for servers with many cores per socket.

- vSphere with Operations Management: Bundled licensing which included management tools, often leading to a higher upfront cost but potentially offering long-term savings.

- vSAN (VMware Storage Area Network): Licensing for the software-defined storage solution, usually sold separately and added to the overall VMware licensing costs.

These various VMware licensing options offered flexibility, but the complexity could make comparing costs difficult. Accurate cost projections required a deep understanding of the specific needs and infrastructure of each organization. Now, with Broadcom's influence, these established VMware licensing costs are undergoing a significant shift.

Broadcom's Acquisition and its Impact on VMware Pricing:

Broadcom's acquisition of VMware represents a major consolidation in the technology sector. Several factors could contribute to the observed price increases:

- Increased Profitability: Broadcom may be aiming to increase profit margins on VMware products following the acquisition, leading to higher licensing fees.

- Consolidation of Resources: The merger could lead to streamlining and cost reductions for Broadcom, but these savings may not be passed on to customers, resulting in price hikes.

- Market Dominance: With increased market power, Broadcom may have less incentive to compete aggressively on price.

The AT&T case highlights the potential for significant price increases even for large enterprise clients. This raises concerns about the long-term viability and affordability of VMware solutions for businesses of all sizes.

AT&T's Experience: A Case Study of VMware Price Hikes:

AT&T's reported 1050% increase in VMware licensing costs serves as a stark warning. This dramatic jump demonstrates the potential for unpredictable and substantial cost increases post-acquisition. The implications for AT&T include:

- Significant Budgetary Strain: A 1050% increase represents a massive financial burden, requiring significant budget reallocation.

- Potential Project Delays: The unexpected cost increase could force AT&T to delay or cancel projects dependent on VMware infrastructure.

- Strategic Re-evaluation: AT&T may be forced to re-evaluate its long-term reliance on VMware and explore alternative solutions.

This case study clearly illustrates the risk businesses face as VMware pricing continues to evolve under Broadcom’s ownership.

The Wider Implications of Rising VMware Costs for Businesses

Budgetary Impacts:

The rising costs of VMware licenses pose a significant challenge for businesses, particularly smaller organizations with tighter budgets. The impact can manifest in several ways:

- Reduced IT Spending: Businesses may be forced to cut spending in other crucial areas to accommodate the increased VMware costs.

- Project Delays or Cancellations: Essential projects reliant on VMware infrastructure may be delayed or canceled due to budgetary constraints.

- Staffing Reductions: In extreme cases, companies may resort to workforce reductions to manage increased VMware expenses.

These financial pressures threaten the overall stability and growth of many businesses.

Migration Challenges:

Migrating away from VMware to alternative solutions is not a simple undertaking. It presents several hurdles:

- Significant Downtime: The migration process can involve significant downtime, disrupting business operations and potentially leading to lost revenue.

- High Migration Costs: The costs associated with migrating to a new platform can be substantial, including professional services, hardware upgrades, and software licensing.

- Compatibility Issues: Ensuring compatibility between existing applications and the new platform can be complex and time-consuming.

The complexity of migration makes it a daunting prospect for many organizations.

The Impact on Innovation:

The increasing cost of VMware can hinder innovation and technological advancements:

- Reduced Investment in New Technologies: Businesses may be forced to reduce investments in new technologies and innovations due to increased VMware licensing costs.

- Delayed Upgrades and Modernization: The high cost of upgrades can lead to delays in modernizing infrastructure, potentially impacting efficiency and security.

- Stifled Research and Development: Budget constraints stemming from VMware pricing increases could restrict R&D activities.

This impact on innovation is a critical concern for businesses seeking to remain competitive in the rapidly evolving technology landscape.

Strategies for Managing VMware Pricing Concerns

Negotiating with VMware:

Businesses should explore all avenues to negotiate favorable licensing terms with VMware:

- Leveraging Volume Discounts: Larger organizations can negotiate substantial discounts based on the volume of licenses they purchase.

- Exploring Different Licensing Options: Carefully evaluate the various licensing models offered by VMware to determine the most cost-effective option.

- Proactive Communication: Maintain open communication with VMware representatives to advocate for fair pricing and explore potential solutions.

Effective negotiation can mitigate the impact of price increases.

Exploring VMware Alternatives:

Several alternative virtualization platforms and cloud solutions offer viable options:

- Microsoft Hyper-V: A robust and cost-effective alternative, particularly for organizations already invested in the Microsoft ecosystem.

- Oracle VirtualBox: A popular open-source virtualization platform offering flexibility and cost-effectiveness.

- Public Cloud Providers (AWS, Azure, GCP): Cloud solutions offer scalability and potentially lower operational costs.

A careful comparison of features, costs, and migration complexity is crucial before making a switch.

Optimizing VMware Usage:

Efficient resource management can significantly reduce VMware costs:

- Resource Consolidation: Consolidate virtual machines onto fewer physical servers to optimize resource utilization.

- Right-Sizing VMs: Ensure that virtual machines are appropriately sized to avoid over-provisioning and wasted resources.

- Regular Monitoring and Optimization: Regularly monitor resource usage and implement optimization strategies to improve efficiency.

Optimizing VMware utilization can lead to significant cost savings without sacrificing performance.

Conclusion: Navigating the Future of VMware Pricing

The Broadcom acquisition has undeniably shifted the landscape of VMware pricing, presenting significant challenges for businesses. The potential for dramatic price increases, as evidenced by AT&T's experience, necessitates proactive strategies to manage VMware costs effectively. This involves a multi-faceted approach encompassing negotiation, exploring alternative solutions, and optimizing resource utilization. Don't let escalating VMware pricing cripple your business. Take control by exploring the options discussed in this article and develop a robust strategy to manage your VMware costs effectively.

Featured Posts

-

Diamondbacks Defeat Brewers 5 2 Game Recap And Highlights

Apr 23, 2025

Diamondbacks Defeat Brewers 5 2 Game Recap And Highlights

Apr 23, 2025 -

Understanding The Urgent Need To Sell Florida Condo Market Trends

Apr 23, 2025

Understanding The Urgent Need To Sell Florida Condo Market Trends

Apr 23, 2025 -

Chinas Oil Trade Diversification Canada As A Key Player

Apr 23, 2025

Chinas Oil Trade Diversification Canada As A Key Player

Apr 23, 2025 -

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 23, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 23, 2025 -

Underperforming Brewer Excels In Clutch Situations 2025 Season

Apr 23, 2025

Underperforming Brewer Excels In Clutch Situations 2025 Season

Apr 23, 2025