China's Oil Trade Diversification: Canada As A Key Player

Table of Contents

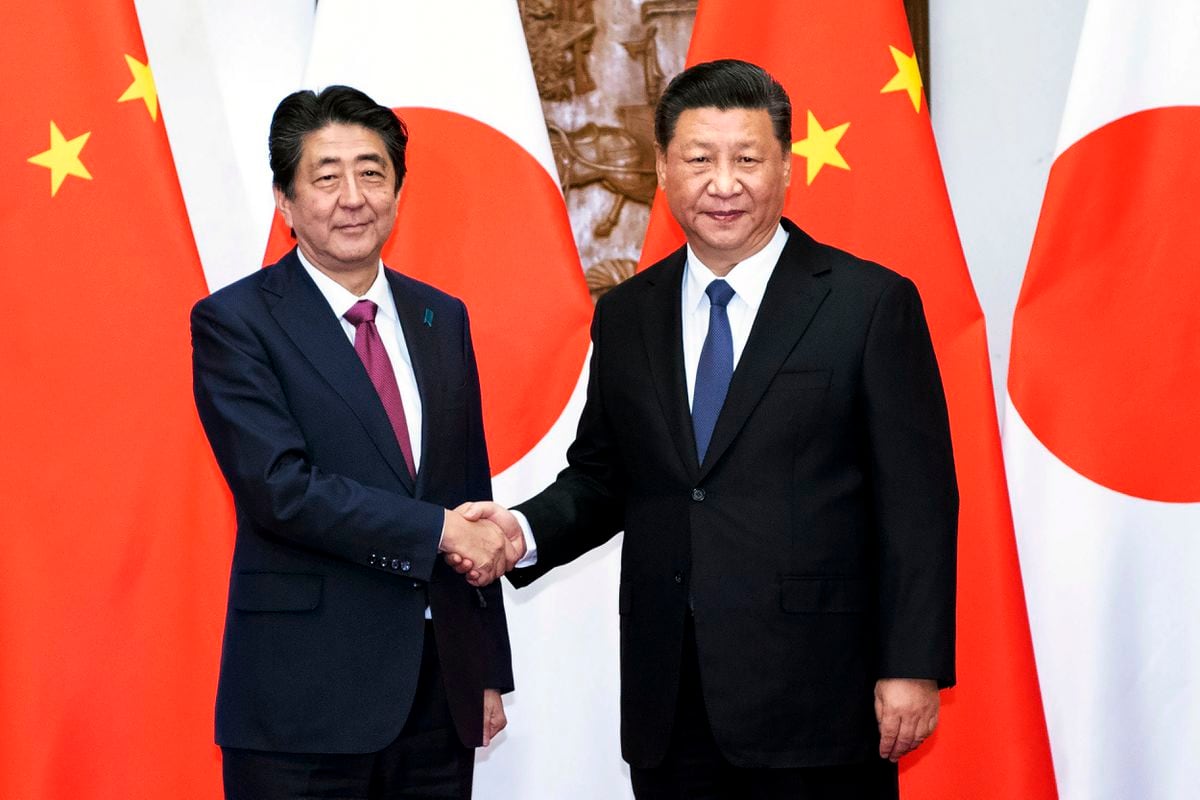

Geopolitical Factors Driving China's Oil Diversification

China's pursuit of energy independence is driven by a complex interplay of geopolitical factors. Over-reliance on a single source, particularly from politically volatile regions like the Middle East, exposes the country to significant risks. Fluctuations in global oil prices, political instability, and potential supply disruptions pose serious threats to China's economic growth. The impact of US-China trade relations further complicates the energy equation, highlighting the need for a more resilient and diversified approach.

- Reduced reliance on Middle Eastern oil supplies: Diversifying sources minimizes the impact of disruptions in the Middle East, reducing vulnerability to geopolitical tensions and conflicts.

- Mitigation of geopolitical risks and supply chain vulnerabilities: A multi-source strategy strengthens China's energy security by reducing dependence on any single supplier, improving supply chain resilience.

- Enhanced energy security for China's economic growth: A secure energy supply is crucial for sustained economic growth, ensuring reliable energy for industries and consumers.

- Diversification away from politically volatile regions: Shifting away from regions prone to instability provides greater stability and predictability in oil imports.

Canada's Oil Resources and Export Potential

Canada possesses vast oil reserves, particularly within its oil sands in Alberta. These oil sands represent one of the world's largest crude oil deposits, presenting a significant opportunity for export to the Asian market, including China. Canada's oil production capacity is substantial and continues to grow, offering a potentially reliable and large-scale supply. While pipeline infrastructure is a key consideration, ongoing projects aim to enhance export capacity, making Canadian crude oil more accessible to international markets. The characteristics of Canadian crude oil, such as Western Canadian Select (WCS), are also being refined to better suit Chinese refineries.

- Abundant oil sands reserves in Alberta: The oil sands provide a substantial and long-term resource base for oil production and export.

- Increasing oil production capacity: Canada's capacity to produce and export crude oil is growing steadily.

- Potential for expanding pipeline infrastructure to facilitate exports: Investments in pipeline infrastructure are key to increasing export capacity to meet global demand.

- Growing demand for Canadian crude oil in Asian markets: The demand for reliable and diverse oil sources in Asia presents significant opportunities for Canadian producers.

The Growing Economic Relationship Between Canada and China in the Energy Sector

The economic relationship between Canada and China in the energy sector is expanding rapidly. Increased Chinese investment in Canadian oil and gas projects signifies a growing commitment to securing Canadian oil supplies. The potential for bilateral trade agreements to further facilitate oil exports could significantly boost this economic partnership. This mutually beneficial exchange creates jobs, fosters economic growth, and strengthens ties between the two countries.

- Increased Chinese investment in Canadian oil and gas projects: Chinese companies are actively investing in Canadian energy infrastructure and production.

- Potential for bilateral trade agreements to boost oil exports: Formal agreements can streamline the trade process and reduce barriers to entry.

- Mutual economic benefits through enhanced energy cooperation: Both nations stand to gain significant economic advantages through strengthened trade in energy.

- Creation of jobs and economic growth in both countries: The expansion of this energy relationship stimulates economic activity in both Canada and China.

Challenges and Opportunities for Enhanced Cooperation

Despite the potential benefits, several challenges remain. Environmental concerns surrounding oil sands production, pipeline development controversies, and potential trade disputes or tariff implications could hinder the growth of Canada-China oil trade. Addressing these challenges requires a concerted effort to promote sustainable development, strengthen regulatory frameworks, and foster open communication and diplomacy. Opportunities exist through environmentally conscious extraction methods and proactive approaches to mitigate potential trade friction.

- Environmental regulations and sustainability concerns: Balancing energy production with environmental protection is crucial for long-term success.

- Pipeline construction and related infrastructure development: Investing in and maintaining reliable infrastructure is essential for efficient oil transportation.

- Potential trade disputes and tariff implications: Navigating trade policies and mitigating potential conflicts is vital for stable trade relations.

- Overcoming regulatory hurdles and promoting transparency: Streamlining regulations and enhancing transparency can facilitate smoother trade operations.

Conclusion

China's oil trade diversification strategy is crucial for its energy security and economic stability. Canada's substantial oil reserves and growing production capacity position it as a significant emerging supplier. The economic benefits for both nations are substantial, driving increased investment and trade. While challenges related to environmental concerns, infrastructure, and trade relations exist, opportunities for enhanced cooperation and sustainable growth abound. By addressing these challenges proactively, both countries can forge a strong and mutually beneficial energy partnership. Stay informed about the future of China's oil trade diversification and Canada's expanding role in this crucial sector. Learn more about the complexities and opportunities of this increasingly important bilateral relationship.

Featured Posts

-

Seuils Techniques Boursiers Le Guide Complet De L Alerte Trader

Apr 23, 2025

Seuils Techniques Boursiers Le Guide Complet De L Alerte Trader

Apr 23, 2025 -

Dissecting The Numbers Trumps Economic Record Revealed

Apr 23, 2025

Dissecting The Numbers Trumps Economic Record Revealed

Apr 23, 2025 -

La Carte Blanche L Uvre De Marc Fiorentino

Apr 23, 2025

La Carte Blanche L Uvre De Marc Fiorentino

Apr 23, 2025 -

Josh Naylors Rbi Diamondbacks Rally Past Brewers

Apr 23, 2025

Josh Naylors Rbi Diamondbacks Rally Past Brewers

Apr 23, 2025 -

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025

Pavel Pivovarov I Aleksandr Ovechkin Novaya Kollektsiya Mercha

Apr 23, 2025