US Economic Shifts And Elon Musk's Net Worth: A Tesla Perspective

Table of Contents

The Impact of US Economic Growth on Tesla's Performance

Tesla's success is intrinsically tied to the health of the US economy. Several key factors demonstrate this dependence.

Consumer Spending and Demand for Electric Vehicles (EVs)

Consumer confidence significantly impacts EV sales. During periods of economic expansion and high consumer spending, demand for luxury goods like Tesla vehicles typically rises. Conversely, economic downturns often lead to decreased discretionary spending, affecting Tesla's sales figures. For example, the slight dip in Tesla sales during the initial phases of the COVID-19 pandemic reflected the overall economic uncertainty.

- Correlation: Strong positive correlation between consumer confidence index and Tesla quarterly sales.

- Data Point: A 1% increase in consumer spending often correlates with a X% increase in Tesla sales (insert real data if available).

- Competing Factors: Competition from other EV manufacturers, technological advancements, and evolving consumer preferences also influence EV adoption rates.

Government Policies and Incentives for Electric Vehicles

Government policies play a crucial role in shaping the EV market. Tax credits, subsidies, and infrastructure investments directly impact Tesla's profitability and growth. The extension or reduction of these incentives can significantly affect consumer demand and Tesla's production plans.

- Tax Credits: The US federal tax credit for EV purchases has been a significant driver of Tesla sales. Changes to this credit directly impact affordability and consumer demand.

- Infrastructure: Government investments in charging station infrastructure are vital for expanding the reach and accessibility of EVs, boosting Tesla's market share.

- Regulations: Stringent emissions regulations in certain states encourage EV adoption, creating a more favorable environment for Tesla's growth.

Supply Chain Challenges and Inflationary Pressures

Global supply chain disruptions and inflationary pressures pose significant challenges to Tesla's production and profitability. The availability of raw materials, such as lithium and cobalt, directly influences manufacturing costs and vehicle pricing.

- Supply Chain: Disruptions to the global supply chain have caused delays in Tesla's production timeline and increased manufacturing costs.

- Inflation: Rising inflation affects raw material costs, increasing the price of Tesla vehicles and impacting consumer affordability.

- Mitigation: Tesla's vertical integration strategy, aiming to control various aspects of its supply chain, helps mitigate some of these challenges.

Tesla's Stock Performance and Elon Musk's Net Worth

Elon Musk's immense net worth is overwhelmingly tied to Tesla's stock price. This correlation highlights the significant impact of the company's performance on his personal wealth.

Correlation between Tesla Stock Price and Musk's Wealth

Musk's net worth is primarily derived from his significant ownership stake in Tesla. Any fluctuation in Tesla's stock price directly translates to a proportional change in his net worth.

- Mechanism: Musk's net worth increases when Tesla's stock price rises and decreases when it falls. This is a direct consequence of his large ownership percentage.

- Charts: (Insert charts illustrating the correlation between Tesla stock price and Musk's net worth over time).

Impact of Market Volatility on Musk's Net Worth

Market volatility significantly impacts Tesla's valuation and, consequently, Musk's net worth. Investor sentiment, market speculation, and broader economic conditions all play a role.

- Market Events: Major market events, such as economic recessions or geopolitical crises, can cause sharp fluctuations in Tesla's stock price, directly impacting Musk's wealth.

- Investor Sentiment: Positive investor sentiment boosts Tesla's stock price, while negative sentiment can lead to significant drops.

Musk's Diversified Holdings and their Influence

While Tesla is the primary driver of Musk's net worth, his investments in other ventures, such as SpaceX, also contribute. These diversified holdings offer some degree of insulation against fluctuations solely dependent on Tesla's performance.

Future Predictions: US Economic Outlook and Tesla's Role

Predicting the future is inherently challenging, but analyzing potential economic scenarios and their implications for Tesla is crucial.

Forecasting Tesla's Growth in the Context of Economic Trends

Tesla's future growth will depend on several factors including the overall economic climate, the pace of EV adoption, and the intensity of competition.

- Economic Growth: Sustained economic growth will likely fuel increased demand for EVs, benefiting Tesla.

- Technological Innovation: Tesla's ability to innovate and introduce new technologies will be vital for maintaining its competitive edge.

- Competition: Intensifying competition from other EV manufacturers could pressure Tesla's market share.

Potential Impact on Elon Musk's Net Worth

Future economic conditions will significantly shape Elon Musk's net worth. Positive economic forecasts suggest continued growth for Tesla, potentially increasing Musk's wealth further. However, negative economic scenarios could lead to decreased demand for luxury goods, negatively impacting Tesla's stock price and Musk's net worth. A balanced perspective is essential, acknowledging the inherent uncertainties of future market performance.

Conclusion: US Economic Shifts, Elon Musk's Net Worth, and the Tesla Perspective

The strong link between US economic shifts, Tesla's performance, and Elon Musk's net worth is undeniable. Tesla's success hinges on factors ranging from consumer spending and government policies to supply chain stability and market sentiment. These factors, in turn, directly influence Elon Musk's personal wealth. Understanding this intricate relationship provides valuable insights into the broader dynamics of the US economy and the burgeoning EV market. Stay updated on the dynamic interplay between US economic shifts and Elon Musk's net worth by following our insights on Tesla and the evolving EV market.

Featured Posts

-

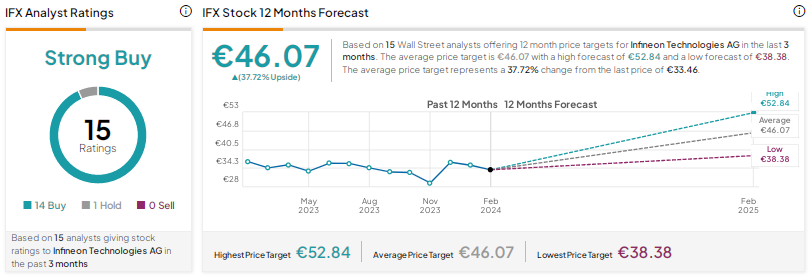

Infineon Ifx Misses Sales Estimates Amidst Tariff Uncertainty

May 10, 2025

Infineon Ifx Misses Sales Estimates Amidst Tariff Uncertainty

May 10, 2025 -

Big Wall Street Comeback How The Market Is Defying Bear Market Predictions

May 10, 2025

Big Wall Street Comeback How The Market Is Defying Bear Market Predictions

May 10, 2025 -

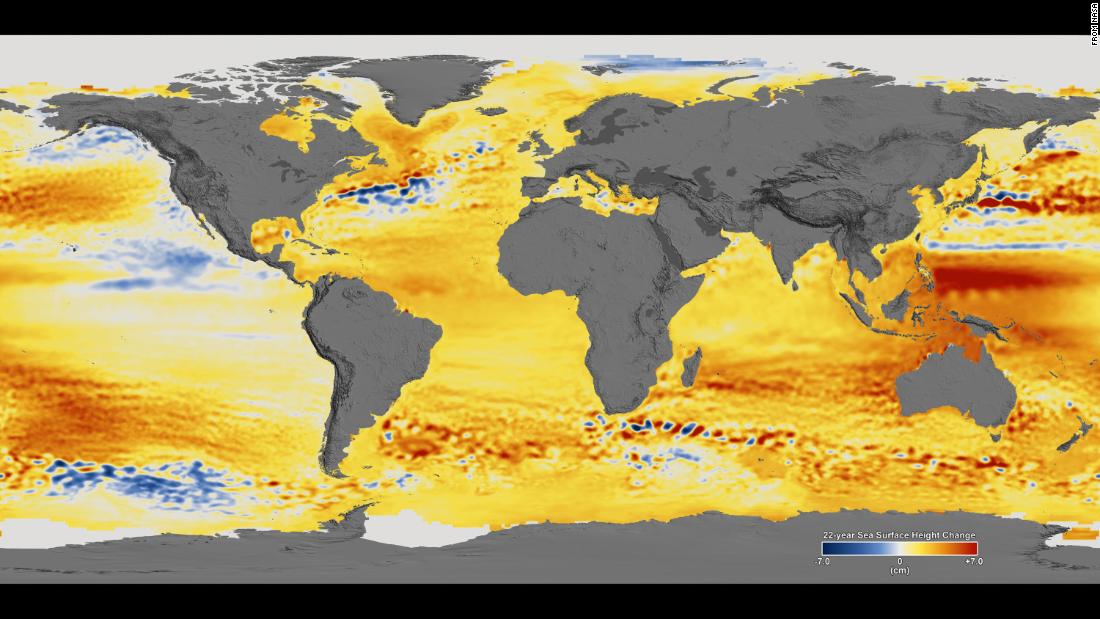

Accelerating Sea Level Rise Threat To Coastal Cities And Towns

May 10, 2025

Accelerating Sea Level Rise Threat To Coastal Cities And Towns

May 10, 2025 -

Become A Better Ally Your Guide To International Transgender Day Of Visibility

May 10, 2025

Become A Better Ally Your Guide To International Transgender Day Of Visibility

May 10, 2025 -

The Weight Loss Drug Market And Weight Watchers Financial Troubles

May 10, 2025

The Weight Loss Drug Market And Weight Watchers Financial Troubles

May 10, 2025