Infineon (IFX) Misses Sales Estimates Amidst Tariff Uncertainty

Table of Contents

Infineon's (IFX) Financial Performance: A Detailed Look

Infineon's recent financial report revealed a significant miss on sales estimates. While the company did not release precise projected figures before the report, analysts' consensus estimates were considerably higher than the actual results. This shortfall translated into a lower-than-expected earnings per share (EPS), disappointing investors and raising questions about the company's short-term prospects.

- Revenue Figures: While the exact breakdown by segment may vary, the overall revenue significantly fell short of projected numbers, indicating weakness across multiple product lines.

- Operating Margin: The operating margin experienced a contraction, reflecting the pressure on profitability due to decreased sales and potentially increased costs.

- Net Income: The impact on net income was substantial, further emphasizing the severity of the sales miss and highlighting the need for strategic adjustments.

- Guidance for Future Quarters: The company's outlook for the coming quarters is likely to be cautious, reflecting the prevailing uncertainties in the global market.

This disappointing performance underscores the challenges Infineon faces in navigating the current economic climate and underscores the importance of understanding the underlying factors.

The Impact of Tariff Uncertainty on Infineon (IFX)

Global trade tensions and the resulting tariff uncertainty have significantly impacted Infineon's operations. The imposition of tariffs on various goods, particularly those involving semiconductor components and related materials, has disrupted its supply chains and increased production costs.

- Increased Production Costs: Tariffs on imported materials have directly increased the cost of producing Infineon's products, squeezing profit margins.

- Disruption of Supply Chains: Trade disputes have created delays and uncertainties in the global supply chain, making it more difficult for Infineon to obtain the necessary components in a timely and cost-effective manner.

- Reduced Demand in Affected Markets: Tariffs can lead to higher prices for consumers, which can dampen demand in certain markets, especially those heavily impacted by trade disputes.

- Potential for Price Increases: To offset increased production costs, Infineon might be forced to increase its product prices, potentially impacting sales volume further.

Other Factors Contributing to Infineon's (IFX) Underperformance

While tariff uncertainty plays a significant role, other factors contribute to Infineon's missed sales estimates. The semiconductor market is highly competitive, and weakening global demand adds to the pressure.

- Competition: Intense competition from other major semiconductor manufacturers continues to put pressure on pricing and market share.

- Weakening Global Demand: The slowdown in the global economy has reduced the demand for semiconductors across various sectors, affecting Infineon's sales.

- Supply Chain Bottlenecks: Even beyond tariff issues, broader supply chain bottlenecks and logistical challenges impact the timely delivery of products.

- Internal Company Challenges: Internal strategic decisions or operational inefficiencies may also have contributed to the underperformance, although these factors require further investigation.

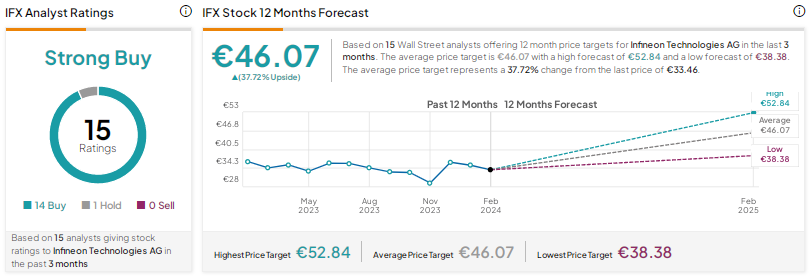

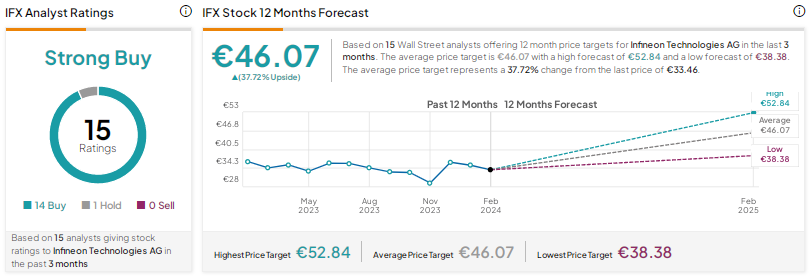

Analyst Reactions and Future Outlook for Infineon (IFX)

Following the release of the financial report, analysts have expressed mixed reactions. Some have downgraded their ratings on Infineon (IFX) stock performance, citing concerns about the company's ability to overcome the current headwinds. Others maintain a more positive outlook, believing that Infineon's long-term growth prospects remain strong.

- Downgraded Ratings: Several analysts have lowered their price targets and ratings for Infineon's stock, reflecting the negative impact of the missed estimates.

- Concerns about Long-Term Growth: Analysts express concerns about the potential impact of ongoing trade disputes and economic slowdown on Infineon's future growth.

- Positive Outlook (Cautious): Some analysts maintain a relatively positive outlook, highlighting Infineon's strong technology portfolio and market position, though with a more cautious tone.

Analyst commentary varies widely, underlining the uncertainty surrounding Infineon's immediate future.

Conclusion: Understanding the Infineon (IFX) Situation and What's Next

Infineon (IFX) Misses Sales Estimates primarily due to the combined impact of tariff uncertainty, increased production costs, disrupted supply chains, and weakening global demand for semiconductors. While the company faces significant challenges, its long-term prospects depend on navigating these headwinds effectively. To stay informed about Infineon (IFX) stock performance and the evolving impact of tariffs on its financial outlook, follow the company's investor relations website and industry news sources closely. Understanding the complexities surrounding Infineon's challenges and its strategies for overcoming them is key to evaluating its future potential. Keep abreast of Infineon's financial performance and the impact of tariffs on Infineon to make informed investment decisions.

Featured Posts

-

Is Palantir Stock A Good Investment Pros Cons And Analysis

May 10, 2025

Is Palantir Stock A Good Investment Pros Cons And Analysis

May 10, 2025 -

Us China Trade War Intensifies Market Reaction And Uk Brexit Trade Deal Analysis

May 10, 2025

Us China Trade War Intensifies Market Reaction And Uk Brexit Trade Deal Analysis

May 10, 2025 -

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025 -

Uterus Transplantation A New Pathway To Motherhood For Transgender Women

May 10, 2025

Uterus Transplantation A New Pathway To Motherhood For Transgender Women

May 10, 2025 -

Edmonton Oilers Draisaitl Expected Back Before Playoffs

May 10, 2025

Edmonton Oilers Draisaitl Expected Back Before Playoffs

May 10, 2025