US Dollar Rises As Trump's Criticism Of Fed Chair Powell Eases

Table of Contents

Trump's Past Criticism and its Impact on the Dollar

President Trump's past pronouncements regarding the Federal Reserve's monetary policy have been a significant source of volatility in the forex market. His frequent criticisms, often voiced via Twitter, focused heavily on the Federal Reserve's interest rate hikes and quantitative tightening measures. He consistently argued these policies negatively impacted economic growth and hindered his administration's economic agenda. This uncertainty created considerable market instability.

- Examples of Trump's criticism: Numerous tweets and public statements directly criticized Chairman Powell's decisions, labeling them as "crazy" or detrimental to the US economy. These outbursts often targeted interest rate increases, claiming they were stifling job creation.

- Market Reaction: The market reacted to these criticisms with increased uncertainty. The US Dollar often experienced periods of depreciation against other major currencies as investor confidence waned. This volatility made currency trading more unpredictable and risky.

- Economic Consequences: The uncertainty stemming from Trump's pronouncements contributed to increased market volatility, potentially impacting investment decisions and hindering long-term economic planning.

The Recent Shift in Trump's Stance and its Market Implications

Recently, a notable shift has occurred in President Trump's rhetoric concerning the Federal Reserve and Jerome Powell. His public statements have become noticeably less critical, suggesting a more conciliatory approach. This change in tone has had a palpable impact on market sentiment.

- Examples of Trump's shift: While not explicitly endorsing the Fed's actions, Trump's recent comments have been notably less antagonistic, suggesting a de-escalation of his previous criticisms. This change in tone has helped calm market fears.

- Data showing DXY increase: The US Dollar Index (DXY) has shown a clear upward trend since the shift in Trump's rhetoric, reflecting increased investor confidence in the US economy.

- Investor Sentiment: The reduction in political uncertainty surrounding the Fed has boosted investor confidence, leading to increased demand for the US Dollar as a safe-haven asset and a reflection of growing belief in the US economy's stability.

Economic Factors Beyond Trump's Statements

While the shift in Trump's stance has played a role in the US Dollar's recent rise, it's crucial to acknowledge other contributing economic factors. The global economic outlook, interest rate differentials, and geopolitical risks all play a significant part in determining currency exchange rates.

- Global Economic Climate: Global economic uncertainty, including trade wars and Brexit-related anxieties, often pushes investors towards the safety of the US Dollar, increasing its demand.

- Interest Rate Differentials: The US continues to offer relatively higher interest rates compared to many other major economies. This attracts foreign investment, further strengthening the US Dollar.

- Geopolitical Risks: Periods of geopolitical instability often lead to increased demand for the US Dollar as a safe-haven asset, driving up its value.

- US Economic Growth: Positive economic indicators within the US, such as strong employment figures and GDP growth, contribute to a stronger US Dollar.

Future Outlook for the US Dollar

Predicting the future trajectory of the US Dollar requires careful consideration of various intertwined political and economic factors. While the reduced uncertainty surrounding the Fed is positive, other challenges remain.

- Future Interest Rate Changes: The Federal Reserve's future decisions on interest rates will significantly influence the Dollar's value. Any shifts in monetary policy will affect investor sentiment and currency flows.

- Impact of Economic Data: Upcoming economic data releases, such as employment reports and inflation figures, will significantly influence market expectations and consequently, the Dollar's value.

- Risks and Opportunities: Currency traders and investors should carefully analyze the interplay of these factors to identify both opportunities and risks in the forex market.

Conclusion

The recent rise in the US Dollar's value is multifaceted, linked to both a reduction in President Trump's criticism of the Federal Reserve and broader economic factors. While the easing of political uncertainty surrounding the Fed has undoubtedly boosted investor confidence, the global economic climate, interest rate differentials, and geopolitical risks continue to play significant roles. The future of the US Dollar remains dependent on the interplay of these elements.

Stay updated on the latest developments impacting the US Dollar and its implications for your investments. Follow our blog for continued analysis of the US Dollar and the economic factors influencing its value.

Featured Posts

-

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025 -

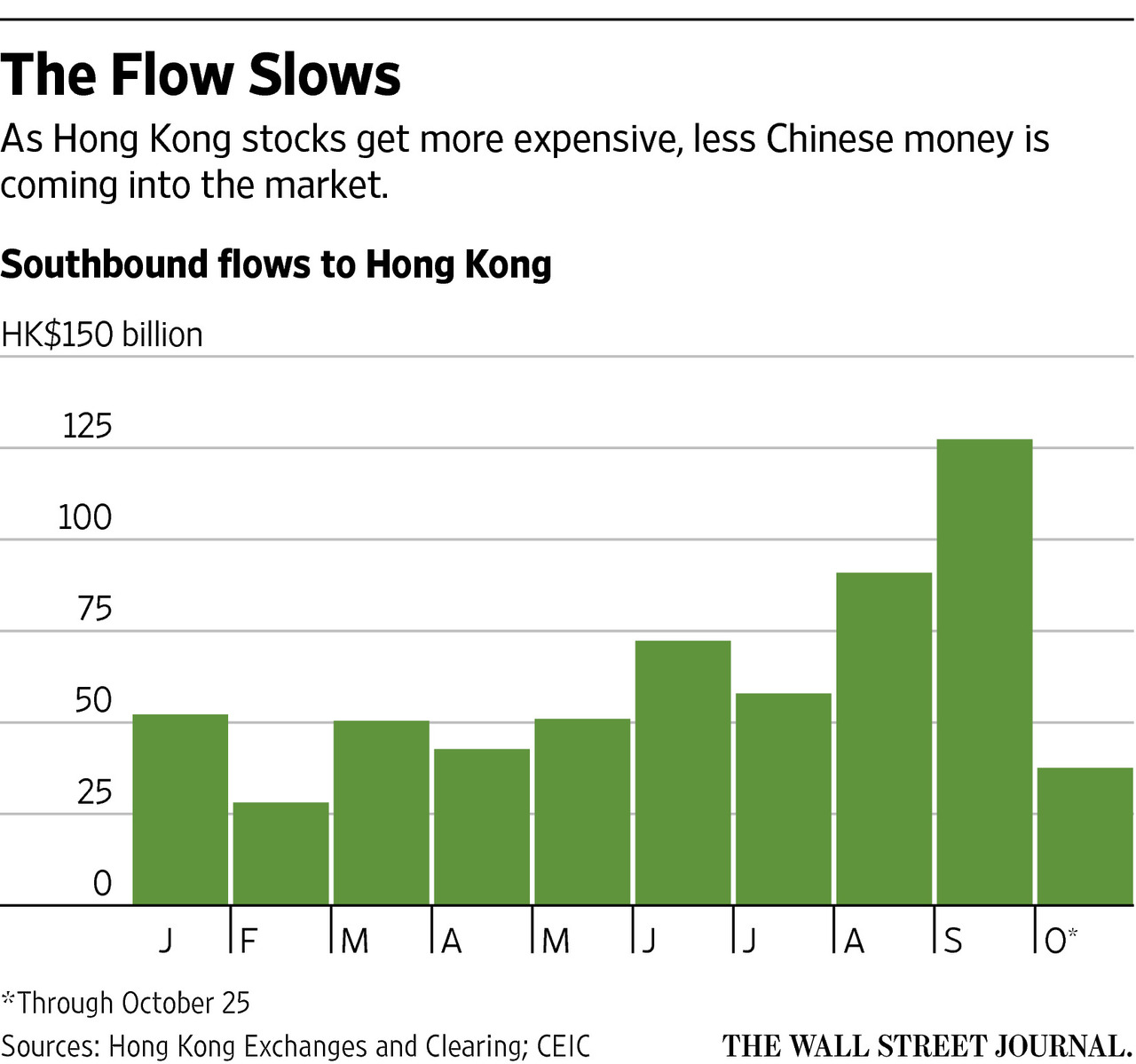

Are Chinese Stocks In Hong Kong A Good Investment Now

Apr 24, 2025

Are Chinese Stocks In Hong Kong A Good Investment Now

Apr 24, 2025 -

Tina Knowles Missed Mammogram Led To Breast Cancer A Wake Up Call

Apr 24, 2025

Tina Knowles Missed Mammogram Led To Breast Cancer A Wake Up Call

Apr 24, 2025 -

I Sygklonistiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Sygklonistiki Anartisi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025

60 Minutes Producers Resignation Loss Of Independence Cited After Trump Lawsuit

Apr 24, 2025