Are Chinese Stocks In Hong Kong A Good Investment Now?

Table of Contents

Understanding the Hong Kong Stock Market's Unique Position

Hong Kong serves as a crucial gateway for international investors seeking exposure to the Chinese market. Its established and relatively transparent regulatory framework, coupled with its robust infrastructure, makes it significantly easier to invest in Chinese companies than directly engaging with mainland Chinese exchanges. This accessibility is a key advantage.

Investing in Hong Kong-listed Chinese companies offers several benefits:

- Easier Access: Compared to directly investing in mainland China, Hong Kong offers significantly simpler access for international investors. Navigating the complexities of the mainland Chinese market is often challenging for foreign entities.

- Higher Liquidity: Hong Kong's stock exchange typically boasts higher liquidity than many mainland exchanges, meaning it's easier to buy and sell shares without significantly impacting the price.

- Broader Asian Market Diversification: Investing in Hong Kong provides diversification opportunities beyond just Chinese companies, offering exposure to a wider range of Asian businesses.

- Diverse Company Exposure: The Hong Kong Stock Exchange (HKEX) lists both established, blue-chip Chinese companies and fast-growing, innovative enterprises, catering to various investment strategies.

Analyzing the Current Economic and Political Climate in China

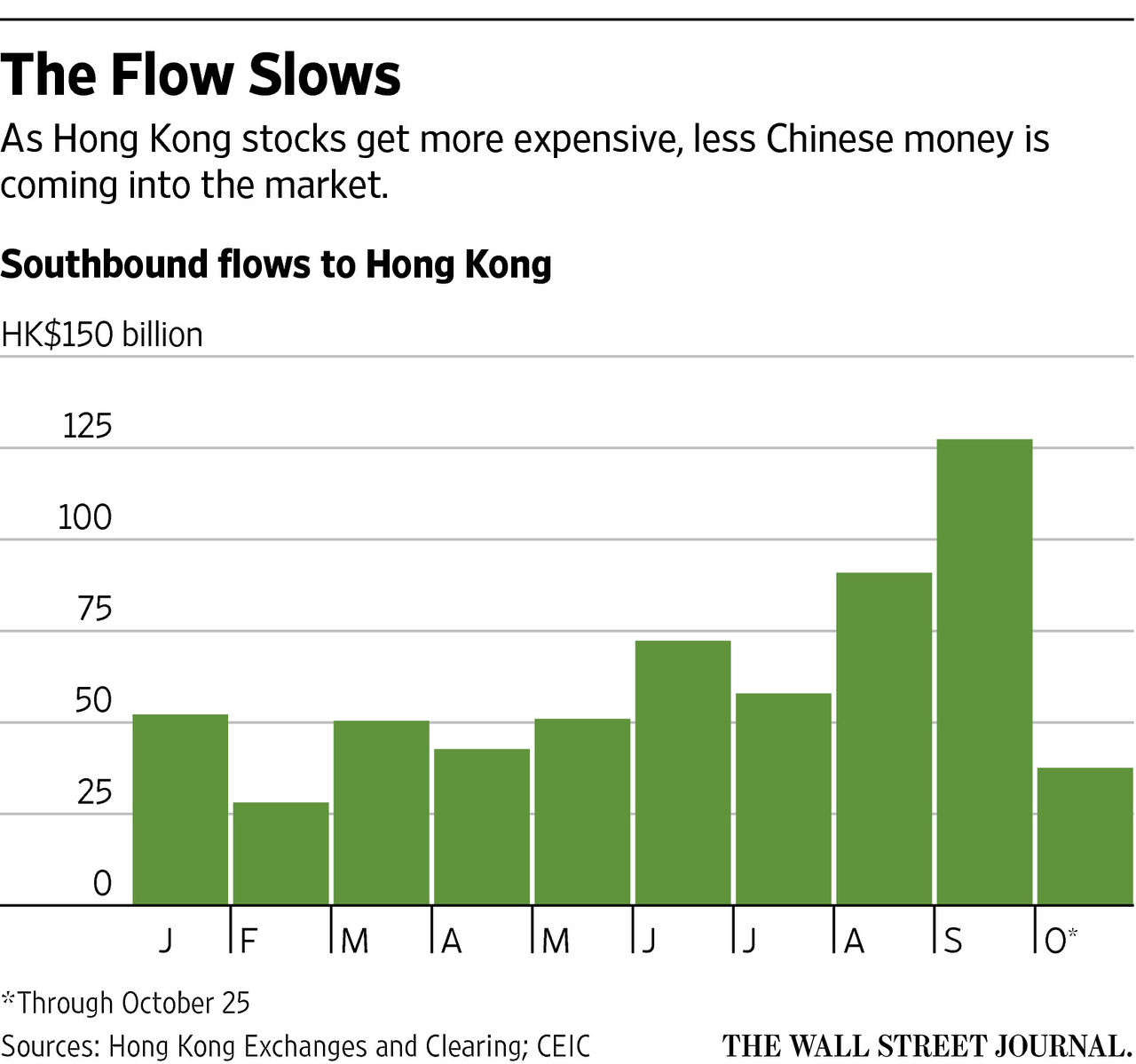

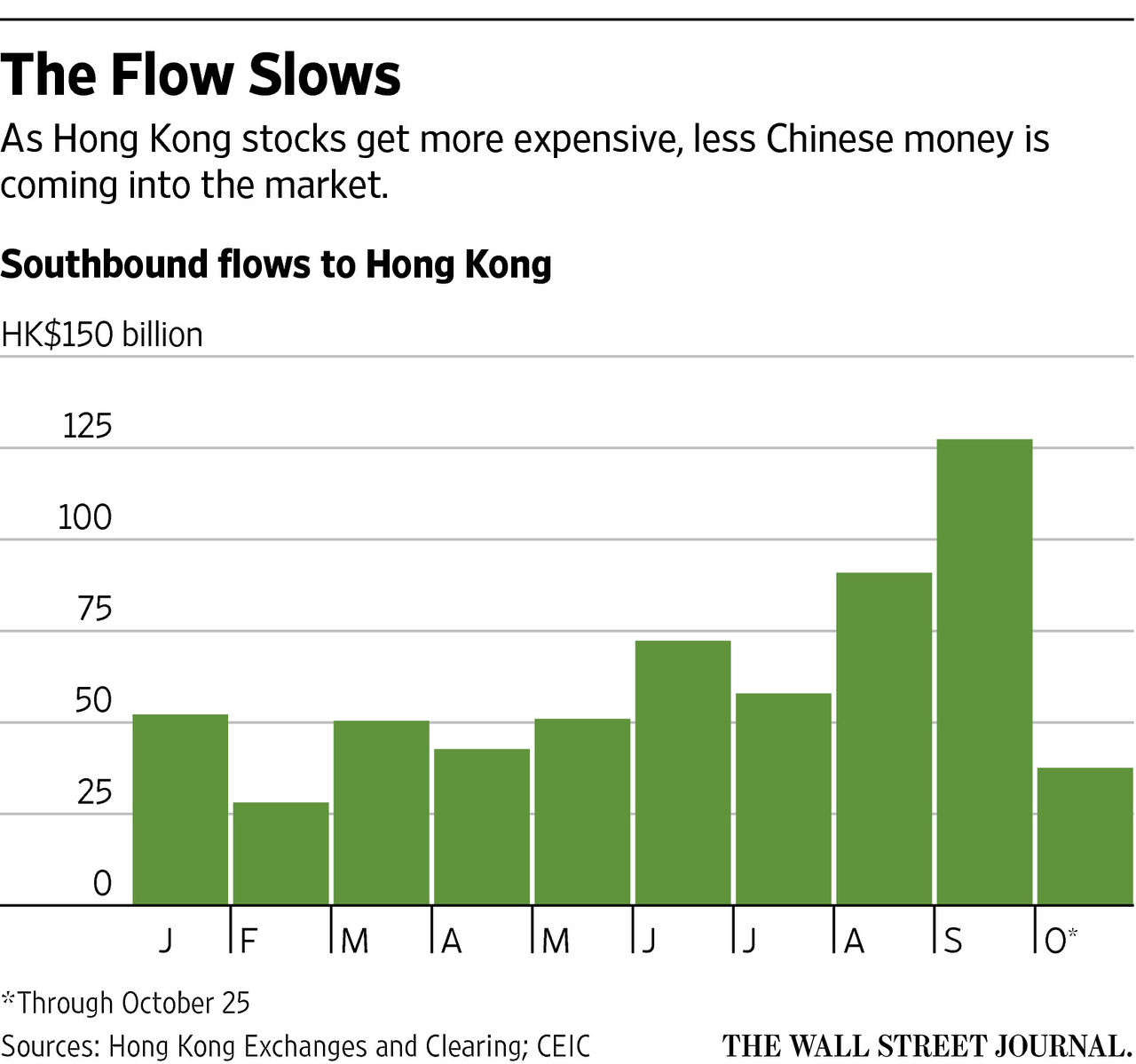

The current economic and political landscape in China significantly impacts the performance of Hong Kong-listed Chinese stocks. Geopolitical tensions and regulatory shifts are major factors to consider.

- US-China Trade Relations: The ongoing relationship between the US and China, including trade disputes and sanctions, can create considerable volatility in the market. Periods of heightened tension often lead to market downturns.

- Regulatory Crackdowns: China's government has implemented regulatory crackdowns on various sectors, particularly technology, impacting the valuations of affected companies. This highlights the importance of understanding potential regulatory risks.

- Economic Growth Rate: China's overall economic growth rate directly influences the performance of its companies. A slowing economy can negatively affect stock valuations.

- Political Instability: While Hong Kong enjoys a relatively stable political environment compared to mainland China, regional geopolitical events can still influence investor sentiment and market behavior.

Evaluating Key Sectors and Individual Stocks

The Hong Kong-listed Chinese market encompasses a wide range of sectors. Some promising areas include:

- Technology: Despite regulatory challenges, the Chinese technology sector remains a significant area of investment, with companies developing innovative products and services.

- Consumer Goods: A growing middle class fuels significant growth in the consumer goods sector, making it an attractive area for investment.

- Healthcare: An aging population and increasing healthcare spending create opportunities within the healthcare sector.

When selecting individual stocks, consider these crucial factors:

- Company Fundamentals: Thoroughly research a company's financial health, including its revenue, profitability, and debt levels.

- Diversification: Don't put all your eggs in one basket. Diversify your investments across various sectors and companies to mitigate risk.

- Growth Prospects: Analyze a company's growth potential and its ability to adapt to market changes.

- Valuation Metrics: Use valuation metrics like the Price-to-Earnings (P/E) ratio to assess whether a stock is appropriately priced.

Managing Risk in the Chinese Stock Market

The Chinese stock market, particularly in Hong Kong, is known for its volatility. Implementing effective risk management strategies is essential:

- Diversification: Spread your investments across different sectors, companies, and asset classes to reduce your exposure to any single risk.

- Stop-Loss Orders: Use stop-loss orders to automatically sell your shares if the price falls below a predetermined level, limiting potential losses.

- Risk Tolerance: Choose investment strategies that align with your individual risk tolerance. Don't invest more than you can afford to lose.

- Stay Informed: Keep abreast of market trends, news, and regulatory changes to make informed investment decisions.

The Role of Currency Fluctuations

Exchange rate fluctuations between the Hong Kong dollar (HKD) and other major currencies like the US dollar (USD) or the Euro (EUR) can significantly impact your returns. A weakening HKD can reduce the value of your investments when converted back to your home currency. Strategies for managing currency risk include hedging using financial instruments or diversifying your portfolio across different currencies.

Conclusion

Investing in Chinese stocks listed in Hong Kong presents both significant opportunities and considerable risks. The current political and economic climate demands careful consideration and due diligence. Success depends on understanding the unique characteristics of this market, conducting thorough research, and managing risk effectively.

Call to Action: Before making any investment decisions regarding Chinese stocks in Hong Kong, conduct thorough research, consult with a qualified financial advisor, and carefully assess your risk tolerance. Make informed decisions about your investment in Hong Kong-listed Chinese stocks.

Featured Posts

-

Save With Google Fi The 35 Unlimited Data Plan Unveiled

Apr 24, 2025

Save With Google Fi The 35 Unlimited Data Plan Unveiled

Apr 24, 2025 -

Rethinking Middle Management Their Crucial Role In Modern Organizations

Apr 24, 2025

Rethinking Middle Management Their Crucial Role In Modern Organizations

Apr 24, 2025 -

High Rollers An Exclusive Preview Of Posters And Photos From The New John Travolta Action Film

Apr 24, 2025

High Rollers An Exclusive Preview Of Posters And Photos From The New John Travolta Action Film

Apr 24, 2025 -

Turning Toilet Talk Into Podcast Gold An Ai Powered Approach

Apr 24, 2025

Turning Toilet Talk Into Podcast Gold An Ai Powered Approach

Apr 24, 2025 -

U S Border Patrol Sees Fewer Apprehensions At Canada U S Border White House Data

Apr 24, 2025

U S Border Patrol Sees Fewer Apprehensions At Canada U S Border White House Data

Apr 24, 2025