US Airlines Face Direct Airbus Tariff Payments: A New Chapter In The Trade War

Table of Contents

The WTO Ruling and its Implications for US Airlines

The WTO's findings confirmed the existence of illegal subsidies provided to Airbus by European governments, authorizing the US to impose retaliatory tariffs on Airbus aircraft. These tariffs, impacting a range of Airbus models, directly affect US airlines that have purchased or plan to purchase these aircraft. The financial implications are substantial, adding millions, if not billions, to the cost of new aircraft acquisitions.

- Specific tariff percentages: The tariffs vary depending on the Airbus model, ranging from a few percentage points to upwards of 15%, significantly increasing the cost of acquisition.

- Estimated financial impact: Major US airlines like Delta, United, and American are facing substantial financial burdens. Preliminary estimates suggest hundreds of millions of dollars in added costs for each airline, though precise figures remain elusive due to the complexity of airline contracts and aircraft financing.

- Increased airfares: The increased costs associated with Airbus tariffs are likely to be passed on to consumers in the form of higher airfares, impacting travel affordability and potentially reducing demand.

How US Airlines are Responding to the Tariffs

Faced with the significant financial implications of the Airbus tariffs, US airlines are exploring various strategies to mitigate the impact. These range from negotiations with Airbus to exploring alternative aircraft manufacturers and lobbying for government intervention.

-

Negotiating with Airbus: Airlines are likely attempting to negotiate price adjustments or other concessions with Airbus to offset some of the tariff burden. The success of these negotiations remains to be seen, depending on Airbus's willingness to compromise.

-

Shifting orders to Boeing: Where feasible, airlines might be shifting orders to Boeing aircraft, although this option isn't always straightforward due to aircraft availability, fleet compatibility, and long-term contract commitments.

-

Absorbing increased costs: Some airlines might absorb the increased costs, at least in the short term, impacting their profit margins. This strategy is only viable if the financial impact is manageable and doesn't jeopardize the airline's overall financial health.

-

Lobbying for government intervention: Airlines are likely lobbying the US government for tariff reductions or other forms of support to alleviate the financial pressure. This involves advocating for policy changes and engaging in political discussions.

-

Specific examples: While specifics remain confidential for competitive reasons, anecdotal evidence suggests airlines are employing a combination of these strategies.

-

Effectiveness analysis: The long-term effectiveness of each strategy is uncertain and dependent on various factors including the duration of the tariffs, Airbus's response, and market dynamics.

-

Challenges and limitations: Negotiations with Airbus are complex, shifting to Boeing may not always be possible, and absorbing increased costs can strain profitability. Government intervention is not guaranteed.

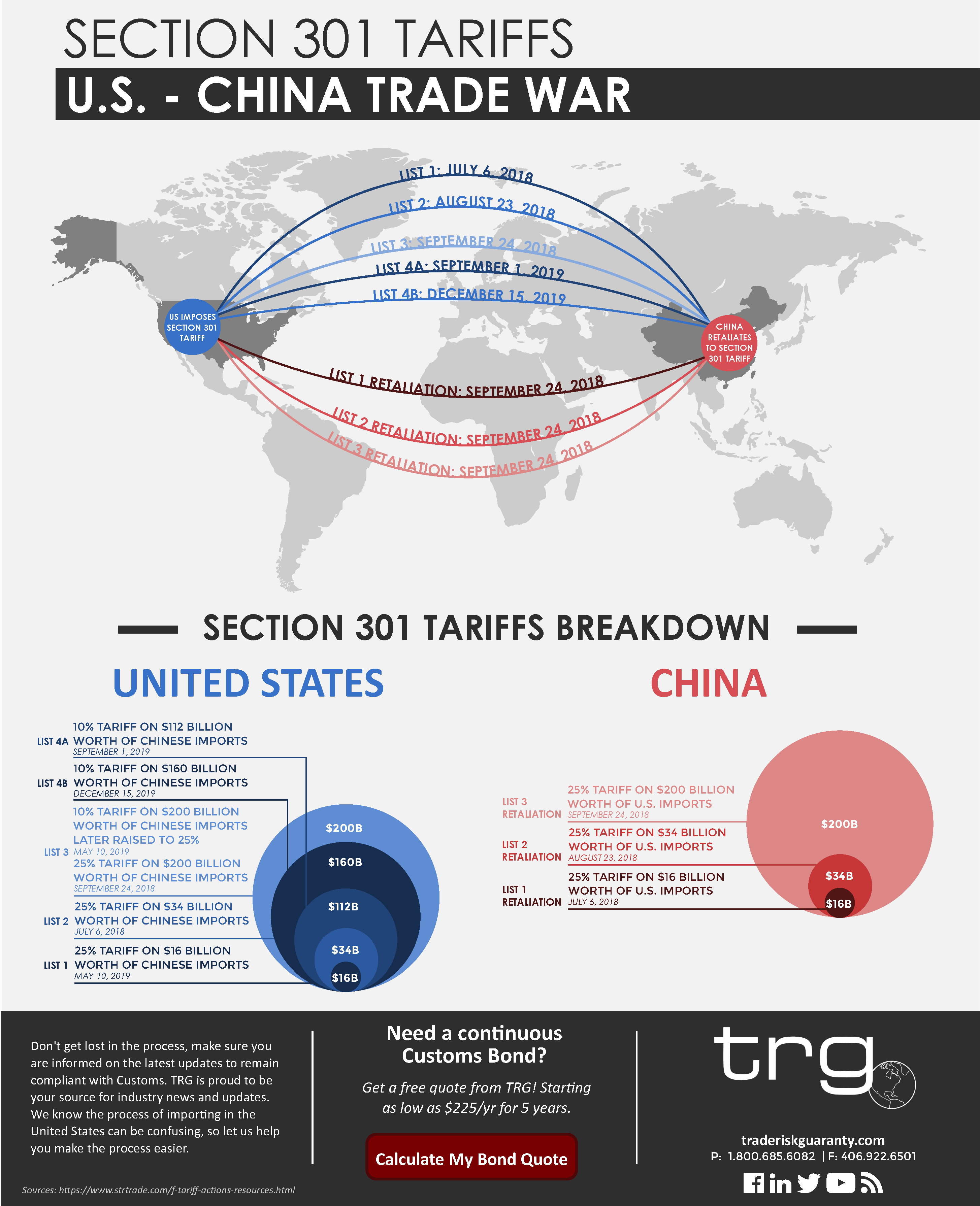

The Broader Context of the US-EU Trade Dispute

The Airbus tariff dispute is part of a long-standing and complex trade war between the US and the EU, centered around allegations of illegal subsidies provided to both Airbus and Boeing. This dispute has broader implications for international trade relations, setting a precedent for future trade disagreements and potentially impacting other industries.

- Key events: The dispute has unfolded over several years, involving investigations, rulings, and retaliatory measures from both sides. This complex history highlights the deep-rooted nature of this trade conflict.

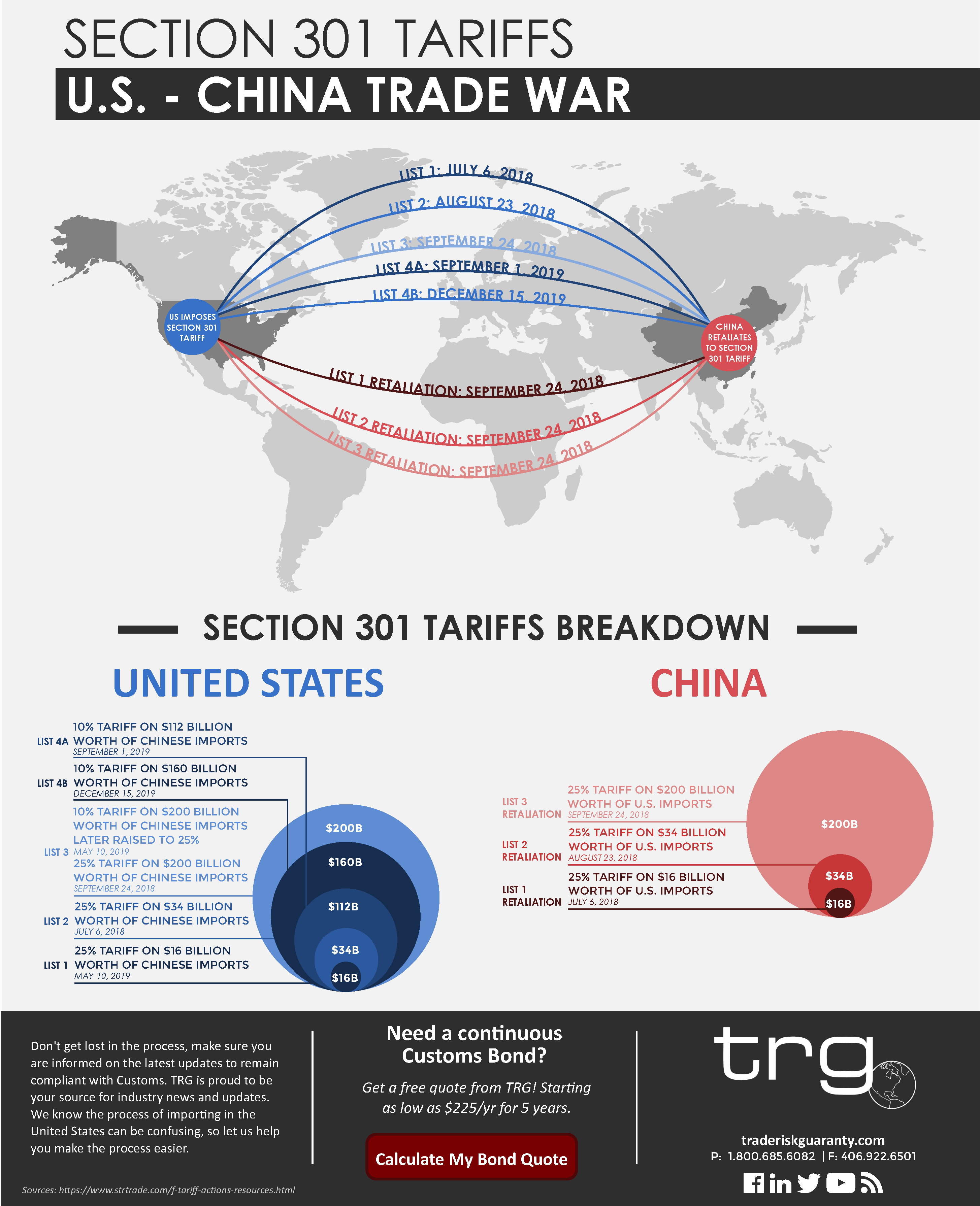

- Impact on the global aviation industry: This trade dispute impacts not just US and European airlines but also the global aviation industry, creating uncertainty and potentially affecting aircraft production, supply chains, and international partnerships.

- Political considerations: The dispute has significant political implications, influencing relations between the US and EU, and adding complexity to international trade negotiations. Diplomatic efforts to de-escalate the conflict are ongoing, but the future remains uncertain.

Potential Long-Term Effects on the Airline Industry

The Airbus tariffs could have significant long-term consequences for the US airline industry. These include financial strain, potential market shifts, and wider economic ripple effects.

- Long-term financial projections: The continued imposition of tariffs could lead to decreased profitability and potentially threaten the financial stability of some airlines, particularly smaller carriers.

- Market shifts and consolidation: The increased costs and market uncertainty could lead to industry consolidation, with larger airlines potentially acquiring smaller ones struggling under the added burden of tariffs.

- Economic ripple effects: The impact extends beyond the aviation sector, affecting related industries such as aerospace manufacturing, maintenance, and tourism.

The Impact of Airbus Tariffs on US Airlines: Looking Ahead

The imposition of Airbus tariffs represents a significant challenge for US airlines, adding substantial financial burdens and creating uncertainty. Airlines are employing various strategies to mitigate the impact, but the long-term consequences remain to be seen. The broader US-EU trade dispute has significant implications for international trade relations and the global aviation industry.

To stay informed about further developments in this evolving situation, continue to monitor news reports and government announcements regarding Airbus tariffs and their impact on US airlines. Engage in discussions surrounding trade policy and its effects on the aviation industry and the broader economy. Understanding the intricacies of the “Airbus tariffs” and their cascading effects on the “US airline” industry is crucial in navigating the complex landscape of the ongoing "trade war." For up-to-date information, consult the websites of the WTO and the US Department of Commerce.

Featured Posts

-

Sounesss Scathing Assessment Of Manchester Uniteds Transfers

May 03, 2025

Sounesss Scathing Assessment Of Manchester Uniteds Transfers

May 03, 2025 -

Auto Industry Confusion Deciphering The Impact Of Trumps Tariffs

May 03, 2025

Auto Industry Confusion Deciphering The Impact Of Trumps Tariffs

May 03, 2025 -

Expensive Offshore Wind Challenges And Shifting Investment Priorities

May 03, 2025

Expensive Offshore Wind Challenges And Shifting Investment Priorities

May 03, 2025 -

Official Lotto And Lotto Plus Results Saturday 12th April 2025

May 03, 2025

Official Lotto And Lotto Plus Results Saturday 12th April 2025

May 03, 2025 -

Tulsa Homeless Crisis The Tulsa Day Centers Observations

May 03, 2025

Tulsa Homeless Crisis The Tulsa Day Centers Observations

May 03, 2025