Unexpected Drop In PBOC's Yuan Support Measures

Table of Contents

Reasons Behind the Unexpected Drop in PBOC Intervention

The reduction in PBOC intervention in the Yuan's exchange rate can be attributed to a confluence of factors. Let's explore some key possibilities:

Shifting Economic Priorities

The PBOC might be shifting its focus from maintaining strict currency stability to other pressing economic goals. This could involve prioritizing:

- Stimulating domestic demand: Boosting internal consumption to counterbalance slowing export growth.

- Managing inflation: Focusing on price stability as a cornerstone of economic health.

- Addressing debt levels: Tackling the rising levels of corporate and local government debt.

Recent economic indicators, such as slowing industrial production growth and a decline in investment, could suggest such a shift. Government statements emphasizing the importance of domestic consumption and structural reforms further support this analysis.

Increased Confidence in the Yuan

A less interventionist approach by the PBOC could also reflect growing confidence in the Yuan's inherent stability. This confidence might stem from:

- Improving economic fundamentals: Stronger-than-expected GDP growth, improved fiscal health, and successful structural reforms.

- Successful domestic reforms: Progress in tackling overcapacity in certain industries and fostering innovation.

Data showing a stable or even appreciating Yuan against a basket of currencies, combined with increasing trading volumes, could point towards this interpretation.

Strategic Approach to Currency Management

The reduced intervention might be a strategic move towards a more market-oriented exchange rate regime. Allowing the Yuan to find its natural market value could offer several advantages:

- Improved market efficiency: A more freely floating Yuan could better reflect market forces and lead to greater efficiency in allocating capital.

- Enhanced internationalization: A more market-determined exchange rate could accelerate the Yuan's integration into the global financial system.

However, this approach also presents risks: increased volatility and potential for sharp depreciations. Any official communication from the PBOC regarding a shift towards a more flexible exchange rate policy would be crucial in interpreting this aspect.

Potential Consequences of Reduced PBOC Support

The decreased PBOC support for the Yuan carries significant implications for both the domestic and global economies.

Impact on Yuan Exchange Rate

Reduced intervention could lead to increased volatility in the Yuan's exchange rate. Potential scenarios include:

- Gradual depreciation: A slow and steady decline in the Yuan's value against the dollar.

- Sharp fluctuations: Periods of significant appreciation or depreciation, potentially causing market instability.

- Unexpected appreciation: The Yuan could strengthen unexpectedly if market forces outweigh expectations.

Analyzing historical and projected exchange rate charts is essential to understanding potential scenarios and their impact on Chinese exports and imports.

Implications for Global Markets

The shift in PBOC policy could have broader implications for global financial markets, impacting:

- Other emerging market currencies: Increased volatility in the Yuan could trigger similar movements in other emerging market currencies.

- Investor sentiment towards China: The reduced intervention might affect investor confidence and capital flows into China.

Reactions from international financial institutions and market analysts provide valuable insights into the potential global consequences.

Domestic Economic Effects

Within China, reduced PBOC intervention could impact:

- Inflation: A weaker Yuan could lead to increased import prices and potentially higher inflation.

- Interest rates: The PBOC might adjust interest rates to counter inflationary pressures or to stabilize the currency.

- Economic growth: The impact on economic growth could be complex, with potentially negative effects on export-oriented sectors but positive effects on domestic demand.

Economic forecasts and expert opinions provide insights into the likely domestic economic effects.

Conclusion: Understanding the Implications of the Drop in PBOC's Yuan Support Measures

The recent decrease in PBOC's Yuan support measures reflects a potentially significant shift in China's monetary policy. The reasons behind this shift are multifaceted, potentially including a reassessment of economic priorities, increased confidence in the Yuan's stability, and a strategic move toward a more market-oriented exchange rate regime. The consequences are far-reaching, with potential impacts on the Yuan's exchange rate, global markets, and the Chinese economy itself. Understanding these complexities requires continuous monitoring of economic indicators, government policies, and market reactions.

Stay updated on the latest developments in PBOC's Yuan support measures and their impact by subscribing to our newsletter! We will continue to provide insightful analysis on the evolving dynamics of the Chinese economy and its global implications.

Featured Posts

-

Android 14s Youthful Design Whats Changed

May 16, 2025

Android 14s Youthful Design Whats Changed

May 16, 2025 -

Dissecting Androids Updated Visual Identity

May 16, 2025

Dissecting Androids Updated Visual Identity

May 16, 2025 -

Cassie Venturas Account Of Freak Offs With Sean Diddy Combs

May 16, 2025

Cassie Venturas Account Of Freak Offs With Sean Diddy Combs

May 16, 2025 -

Bangladesh Election Controversy Hasinas Party Excluded

May 16, 2025

Bangladesh Election Controversy Hasinas Party Excluded

May 16, 2025 -

Tom Cruise Still Owes Tom Hanks A Dollar The Story Behind The Unpaid Debt

May 16, 2025

Tom Cruise Still Owes Tom Hanks A Dollar The Story Behind The Unpaid Debt

May 16, 2025

Latest Posts

-

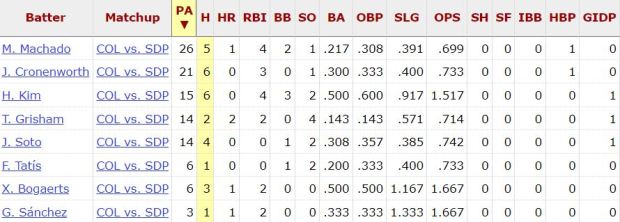

San Diego Padres Pregame Report Rain Delay And Roster Moves

May 16, 2025

San Diego Padres Pregame Report Rain Delay And Roster Moves

May 16, 2025 -

Padres On Deck A Look Ahead To The 2025 Home Opener

May 16, 2025

Padres On Deck A Look Ahead To The 2025 Home Opener

May 16, 2025 -

Cubs At Padres Spring Training Game Preview Mesa March 4th 2 05 Ct

May 16, 2025

Cubs At Padres Spring Training Game Preview Mesa March 4th 2 05 Ct

May 16, 2025 -

March 4th Spring Training Baseball Cubs Vs Padres In Mesa Game Preview

May 16, 2025

March 4th Spring Training Baseball Cubs Vs Padres In Mesa Game Preview

May 16, 2025 -

Cubs Vs Padres Mesa Spring Training Game Preview March 4th

May 16, 2025

Cubs Vs Padres Mesa Spring Training Game Preview March 4th

May 16, 2025