Understanding The Surge In The Venture Capital Secondary Market

Table of Contents

Increased Demand for Liquidity

Limited partners (LPs) in venture capital funds are increasingly seeking liquidity for their investments, particularly in later-stage funds. This demand for liquidity in the venture capital secondary market is a significant driver of its growth. This isn't simply a matter of wanting faster returns; several factors contribute:

-

Growing demand from LPs seeking faster returns: Venture capital is traditionally a long-term investment, but the need for quicker returns is increasing. LPs may need to redeploy capital elsewhere, meet unforeseen expenses, or simply adjust their portfolio allocations.

-

Need for portfolio rebalancing and diversification: LPs often aim for a diversified portfolio across different asset classes. Selling existing venture capital stakes allows them to rebalance their holdings and reduce overall portfolio risk.

-

Increased pressure to meet capital commitments in other areas: LPs may face pressure to commit capital to other promising investment opportunities, necessitating the sale of existing venture capital assets to free up funds.

-

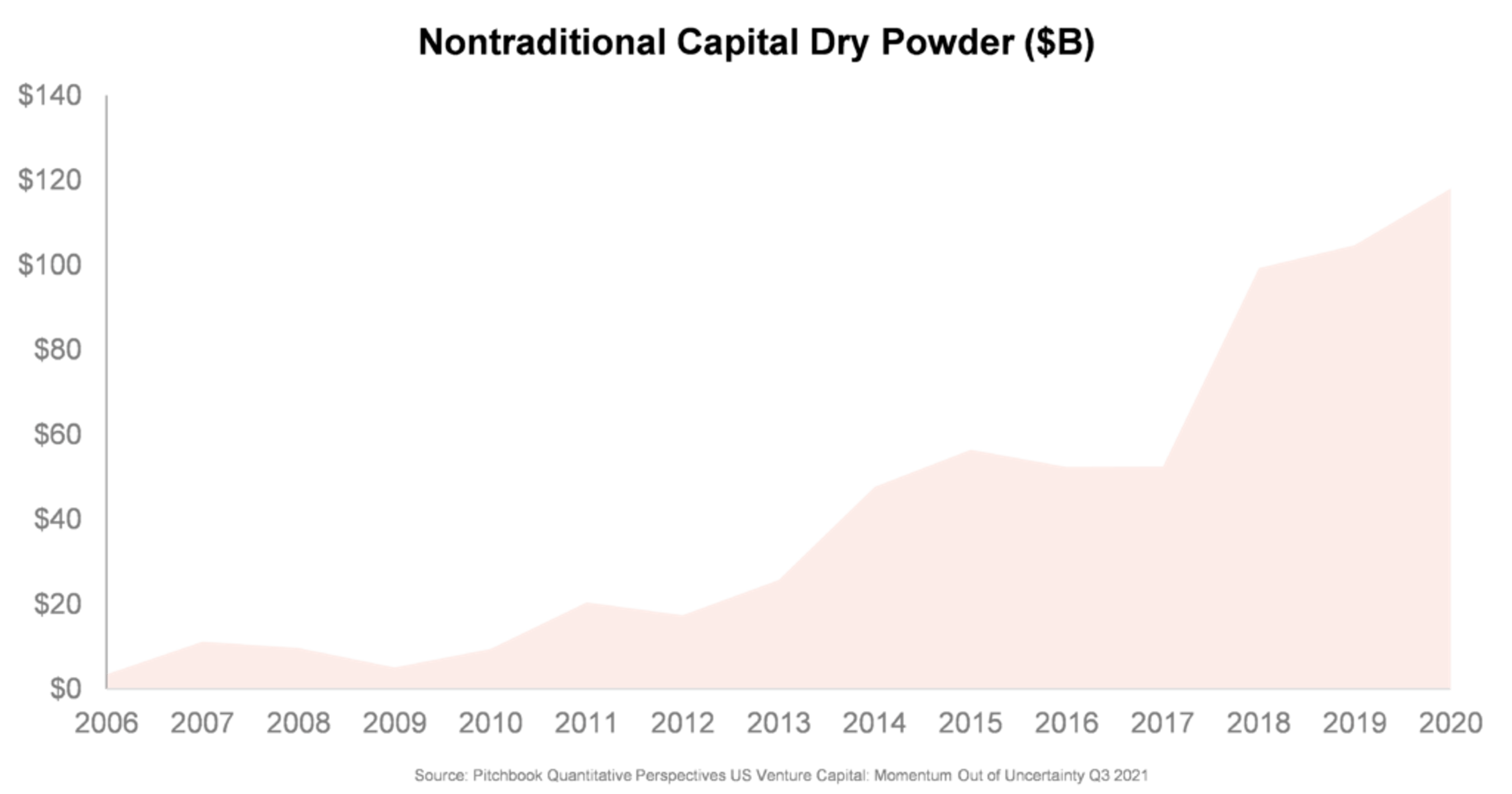

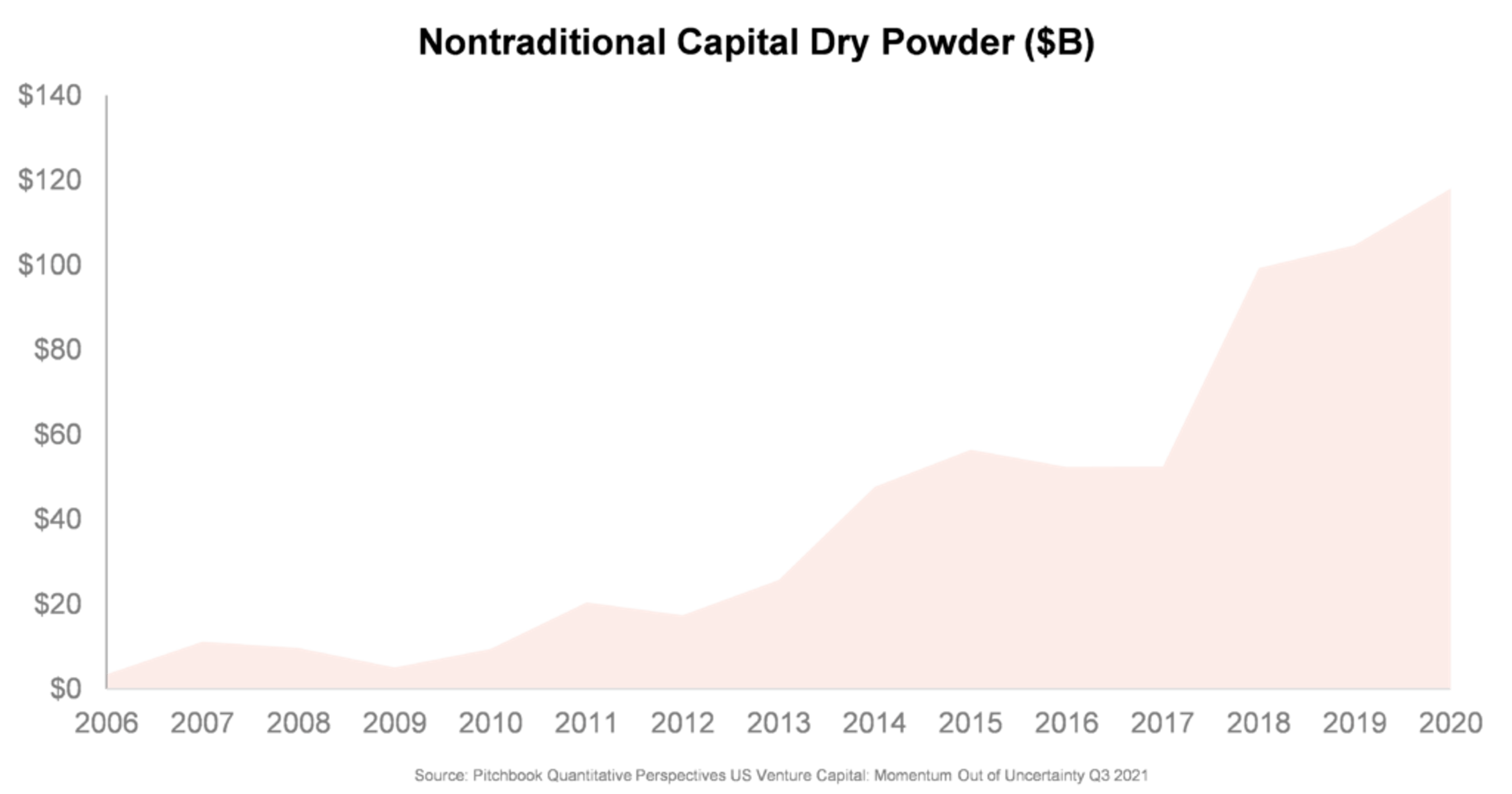

Emergence of specialized secondary market funds: The rise of dedicated secondary market funds has further fueled this trend, providing LPs with a readily available and efficient mechanism for realizing liquidity. These funds actively seek out opportunities in the VC secondary market, creating more buyers and further stimulating activity.

Attractive Returns and Opportunities for Buyers

The venture capital secondary market offers compelling opportunities for buyers, including strategic investors and other private equity firms. These buyers are attracted by the potential for significant returns, often exceeding those available in the primary market.

-

Potential for acquiring assets at discounted prices: Secondary market transactions frequently offer assets at valuations lower than what would be expected in a primary market transaction. This discount can stem from various factors, including the seller's need for liquidity or market timing.

-

Access to high-growth companies and promising sectors: The secondary market provides access to established, high-growth companies that might not be readily available through primary investments. This allows buyers to gain exposure to promising sectors and technologies.

-

Opportunity to build strategic partnerships and expand market reach: Acquiring a stake in a company through the secondary market can facilitate strategic partnerships and integration, leading to enhanced market penetration and synergies.

-

Diversification of investment portfolios with less risk: Buying stakes in later-stage companies via the secondary market presents a diversification opportunity with arguably lower risk compared to early-stage primary investments.

The Role of Technology and Data

Technological advancements are revolutionizing the venture capital secondary market, making transactions more efficient and transparent. The impact of technology can be seen in several key areas:

-

Online platforms facilitating faster and more transparent transactions: Dedicated online platforms are streamlining the process, connecting buyers and sellers, and providing a transparent marketplace for secondary transactions.

-

Improved due diligence capabilities through enhanced data analytics: Sophisticated data analytics tools are enabling more robust due diligence, reducing information asymmetry and improving the accuracy of valuations.

-

Use of artificial intelligence and machine learning for valuation and risk assessment: AI and machine learning are being employed to refine valuation models and assess risk more effectively, enhancing the decision-making process for both buyers and sellers. This reduces reliance on subjective estimations and improves overall market efficiency.

Impact on Venture Capital Firms

The secondary market offers significant advantages to venture capital firms, impacting their fundraising, portfolio management, and overall performance.

-

Ability to recycle capital into new investments: GP-led secondaries allow firms to sell off some of their portfolio companies, freeing up capital to reinvest in new promising ventures. This enhances their ability to continually fuel innovation and generate returns.

-

Improved fund performance by realizing returns earlier: Selling mature portfolio companies earlier than a traditional exit strategy allows firms to demonstrate quicker returns to LPs and potentially boost overall fund performance.

-

Enhanced portfolio management through selective divestments: The secondary market gives GPs flexibility to manage their portfolios effectively by strategically divesting underperforming assets or those that no longer align with their investment thesis.

-

Increased flexibility in managing fund lifecycles: Access to the secondary market increases the flexibility of fund managers in timing exits and aligning with their LPs' expectations.

Conclusion

The surge in the venture capital secondary market is a complex phenomenon driven by a confluence of factors, including increased demand for liquidity, attractive returns for buyers, and the transformative power of technology. Understanding these dynamics is crucial for navigating the evolving venture capital landscape. Both limited partners seeking efficient exit strategies and general partners seeking capital recycling opportunities should consider the venture capital secondary market as a significant component of their overall strategy. Further exploration of secondary market transactions and their implications will be invaluable for all stakeholders. To stay ahead of the curve in the world of venture capital, actively explore the opportunities within this rapidly expanding market.

Featured Posts

-

Global Race To Attract Us Researchers Heats Up Post Trump Funding Cuts

Apr 29, 2025

Global Race To Attract Us Researchers Heats Up Post Trump Funding Cuts

Apr 29, 2025 -

Nyt Report Black Hawk Pilot Disregarded Orders Before Fatal Dc Crash

Apr 29, 2025

Nyt Report Black Hawk Pilot Disregarded Orders Before Fatal Dc Crash

Apr 29, 2025 -

Are High Stock Valuations A Worry Bof As Analysis For Investors

Apr 29, 2025

Are High Stock Valuations A Worry Bof As Analysis For Investors

Apr 29, 2025 -

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025 -

China Market Headwinds Challenges Faced By Bmw Porsche And Other Auto Brands

Apr 29, 2025

China Market Headwinds Challenges Faced By Bmw Porsche And Other Auto Brands

Apr 29, 2025

Latest Posts

-

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025

Is A Tremors Series Coming To Netflix Everything We Know

Apr 29, 2025 -

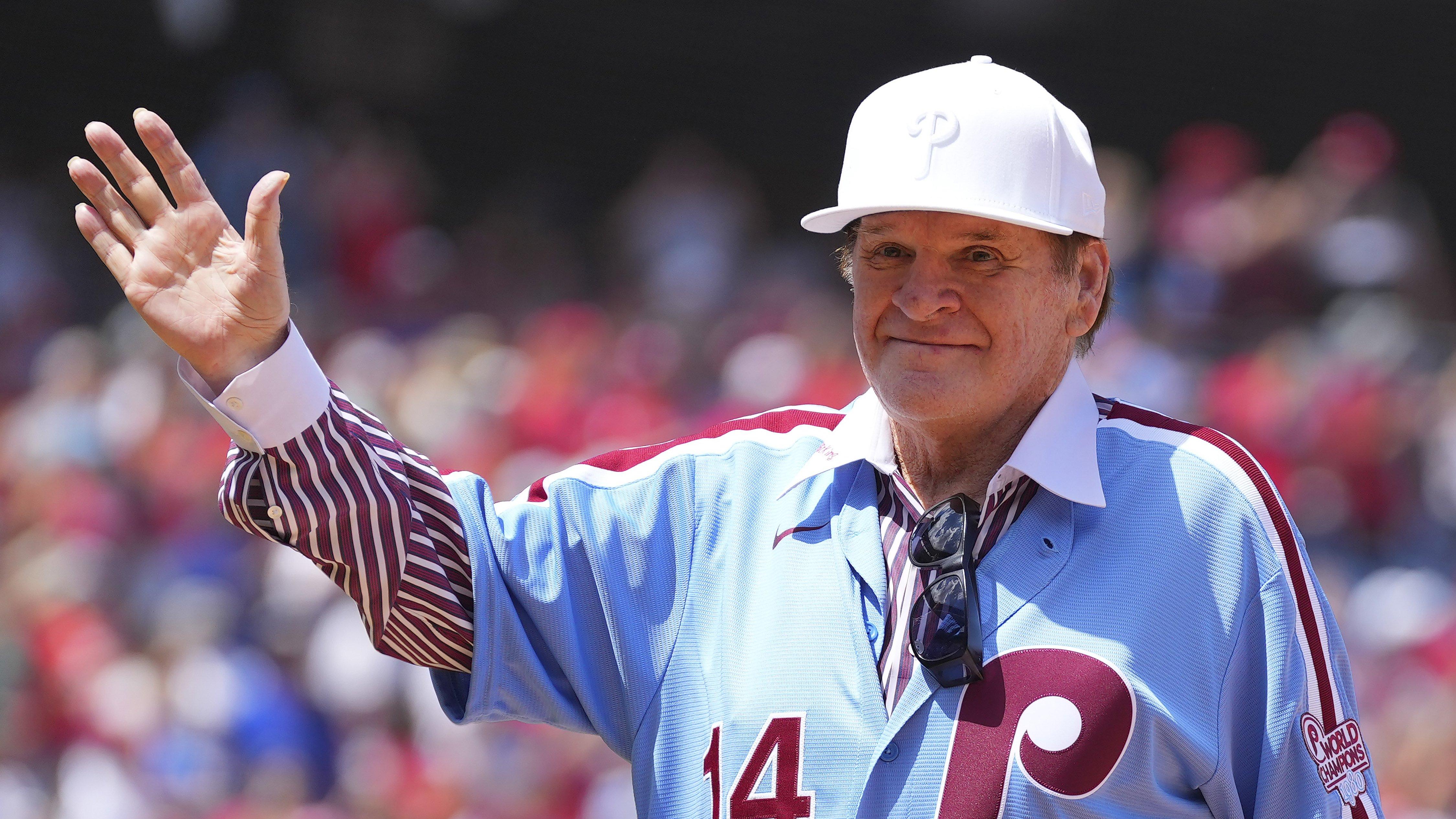

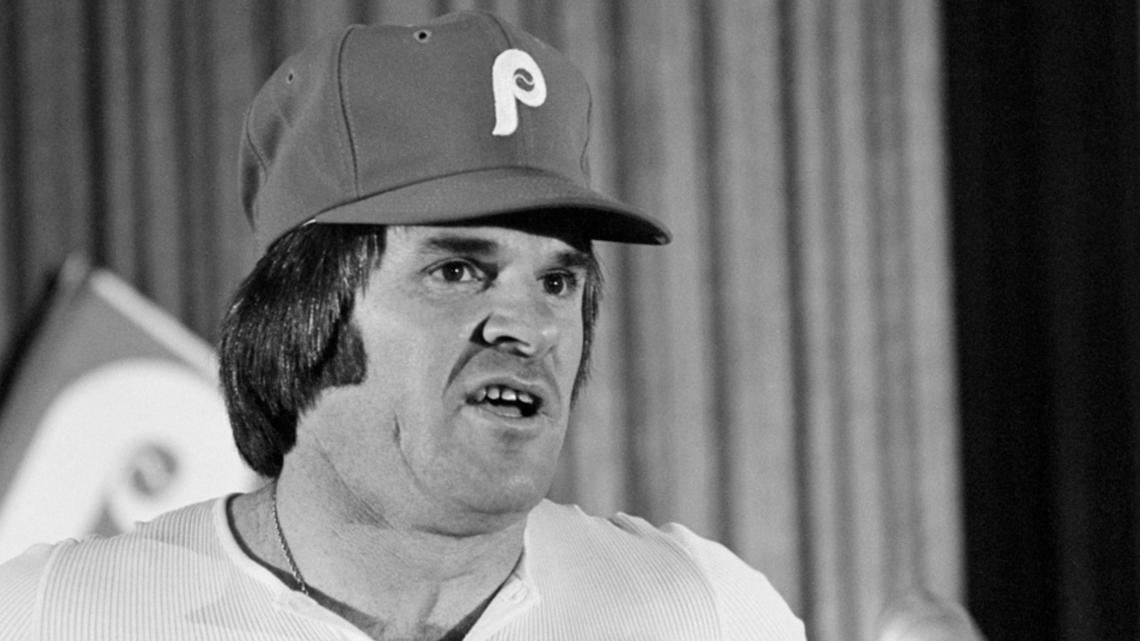

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Reported Plan

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025 -

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025

Pete Rose Pardon Trumps Plan And Its Implications For Baseball

Apr 29, 2025 -

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025