Understanding The SEC's Stance On XRP: A Comprehensive Overview

Table of Contents

The SEC's Case Against Ripple Labs

The SEC's primary argument centers on the allegation that Ripple Labs conducted an unregistered securities offering, violating federal securities laws. This claim rests heavily on the concept of XRP being considered an "investment contract" under the Howey Test.

Allegations of Unregistered Securities Offering:

- The Howey Test: The SEC argues that XRP sales meet the criteria of the Howey Test, which defines an investment contract as an investment of money in a common enterprise with a reasonable expectation of profits derived primarily from the efforts of others. They contend that investors purchased XRP anticipating its value would increase due to Ripple's efforts in promoting and developing the cryptocurrency.

- Investment Contracts and XRP: The SEC points to various aspects of Ripple's activities, including its sales of XRP to institutional investors and its marketing strategies, to support their claim that investors had a reasonable expectation of profit derived from Ripple's efforts. They cite specific examples of Ripple's involvement in institutional partnerships and their active management of XRP's distribution.

Ripple's Defense:

Ripple vehemently denies the SEC's claims, arguing that XRP is a decentralized digital asset, functioning as a currency rather than a security.

- Decentralization: Ripple highlights XRP's decentralized nature, emphasizing that they do not control its price or distribution. They argue that its usage in various payment systems demonstrates its operational independence from Ripple's activities.

- Lack of Centralized Control: Ripple counters the SEC's arguments by pointing to the numerous exchanges and independent entities facilitating XRP trading, thus minimizing Ripple's direct control over its market performance.

Key Players Involved: The lawsuit involves key figures like SEC Chair Gary Gensler, Ripple's CEO Brad Garlinghouse, and its co-founder Chris Larsen, whose actions and statements are central to the arguments presented by both sides.

The Ripple Case's Implications for the Crypto Market

The Ripple case has far-reaching consequences for the entire cryptocurrency industry.

Regulatory Uncertainty:

- Impact on Investor Confidence: The ongoing uncertainty significantly impacts investor confidence, creating hesitation in the market and affecting investment decisions across various cryptocurrencies.

- Future Regulatory Actions: The outcome of this case will serve as a crucial precedent, potentially shaping future regulatory actions against other cryptocurrency projects and influencing how digital assets are categorized and regulated. The need for clearer and more comprehensive regulatory frameworks is becoming increasingly apparent.

Impact on XRP Price and Trading:

- Price Volatility: The lawsuit has caused significant price volatility for XRP, impacting the value of holdings for many investors.

- Exchange Delistings: Several cryptocurrency exchanges delisted XRP during the height of the legal battle, limiting trading accessibility and causing further disruption.

Legal Precedents and Future Outcomes:

- Similar Cases: The SEC has initiated similar actions against other crypto projects, highlighting the potential for widespread impact depending on the outcome of the Ripple case.

- Potential Scenarios: Possible outcomes range from a complete SEC victory, solidifying its position on XRP classification and potentially triggering further regulatory scrutiny, to a Ripple victory that might redefine how certain digital assets are legally defined. A settlement between both parties is also a possibility.

Understanding the SEC's Approach to Crypto Regulation

The SEC's actions reflect a broader approach to regulating the cryptocurrency market.

Gensler's Stance on Crypto:

- Regulatory Framework: Gary Gensler, the current SEC Chair, has repeatedly expressed his belief that many cryptocurrencies, based on the Howey Test, fall under the purview of securities laws. He has advocated for stricter regulatory oversight of the industry.

- Enforcement Focus: Gensler's policy reflects a focus on enforcement and establishing clearer regulatory frameworks for digital assets within the existing securities regulations.

The SEC's Enforcement Actions: Beyond the Ripple case, the SEC has pursued numerous enforcement actions against cryptocurrency companies for various alleged violations, demonstrating its proactive stance on regulating this burgeoning industry.

Conclusion

The SEC's stance on XRP, as demonstrated in the Ripple case, highlights the significant regulatory challenges faced by the cryptocurrency industry. The outcome of this lawsuit will likely establish legal precedents that will influence how other crypto assets are classified and regulated. The implications for XRP's price, trading volume, and the overall investor confidence in the cryptocurrency market are substantial. The ongoing regulatory uncertainty underscores the need for clearer, more comprehensive regulations in the crypto space. Stay updated on the SEC's stance on XRP and follow the latest developments in the XRP case to navigate the complexities of this evolving landscape. Learn more about the complexities of XRP regulation and the ongoing debate surrounding its classification as a security or a currency.

Featured Posts

-

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025 -

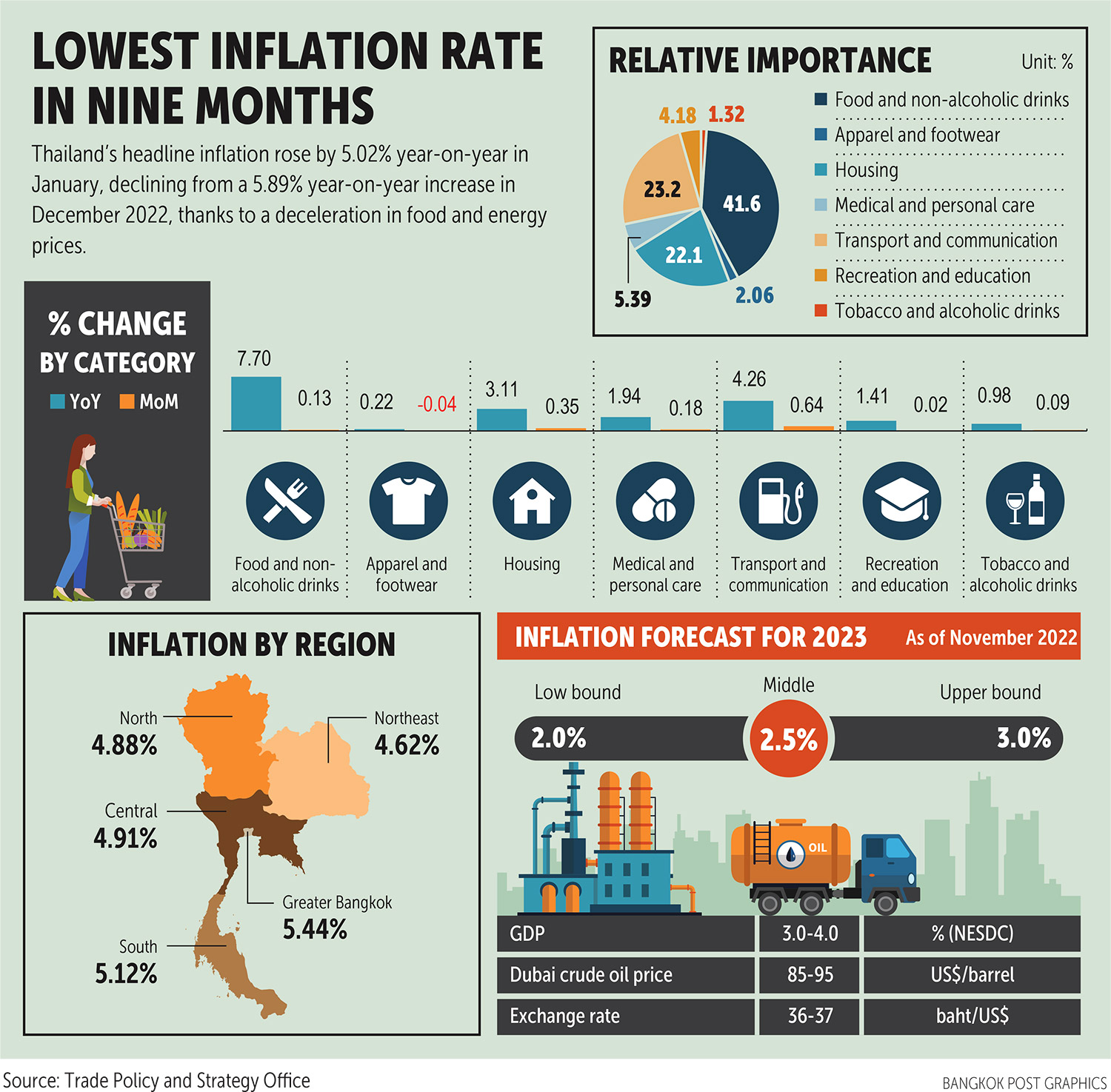

Thailand Inflation Dip More Rate Cuts On The Horizon

May 07, 2025

Thailand Inflation Dip More Rate Cuts On The Horizon

May 07, 2025 -

Nba Playoffs Mitchell And Brunsons Rise To Prominence

May 07, 2025

Nba Playoffs Mitchell And Brunsons Rise To Prominence

May 07, 2025 -

Lexington Bikers Organize Charity Rides For Family After House Explosion

May 07, 2025

Lexington Bikers Organize Charity Rides For Family After House Explosion

May 07, 2025 -

Jenna Ortegas Scream 7 Afzegging Solidariteit Met Melissa Barrera

May 07, 2025

Jenna Ortegas Scream 7 Afzegging Solidariteit Met Melissa Barrera

May 07, 2025

Latest Posts

-

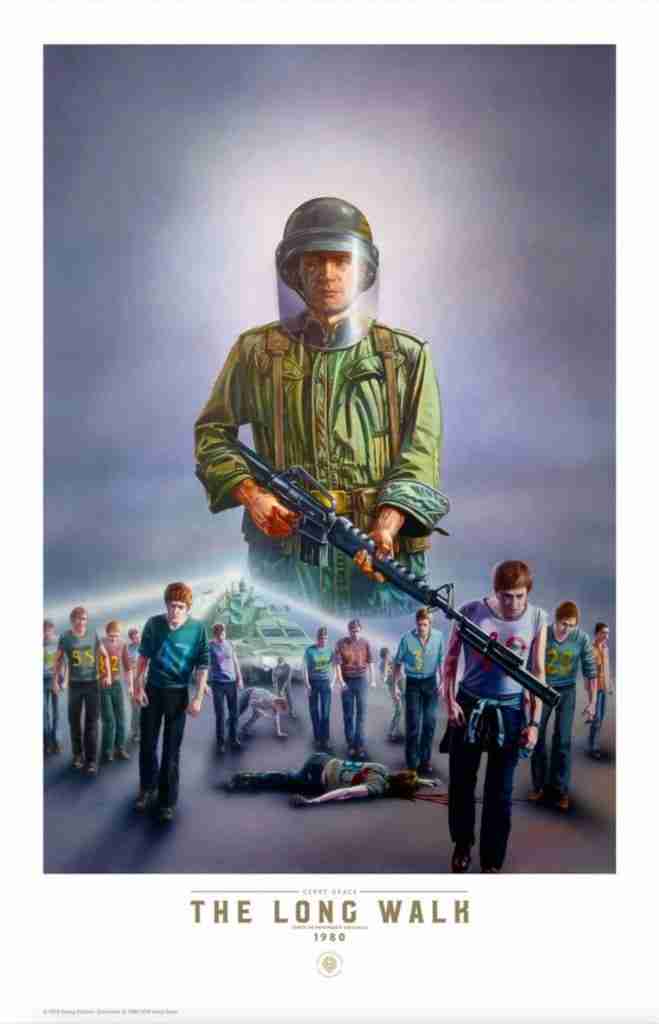

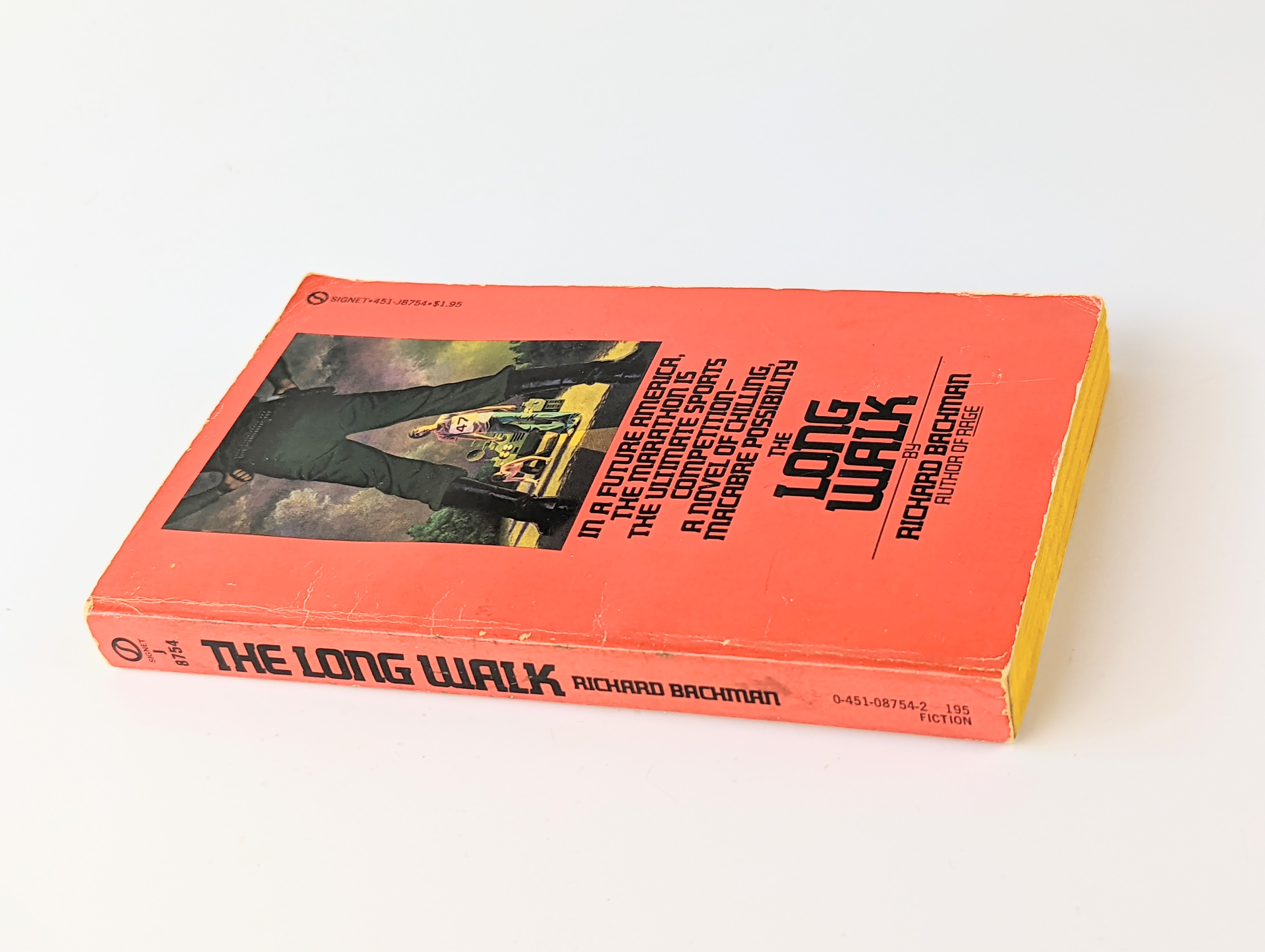

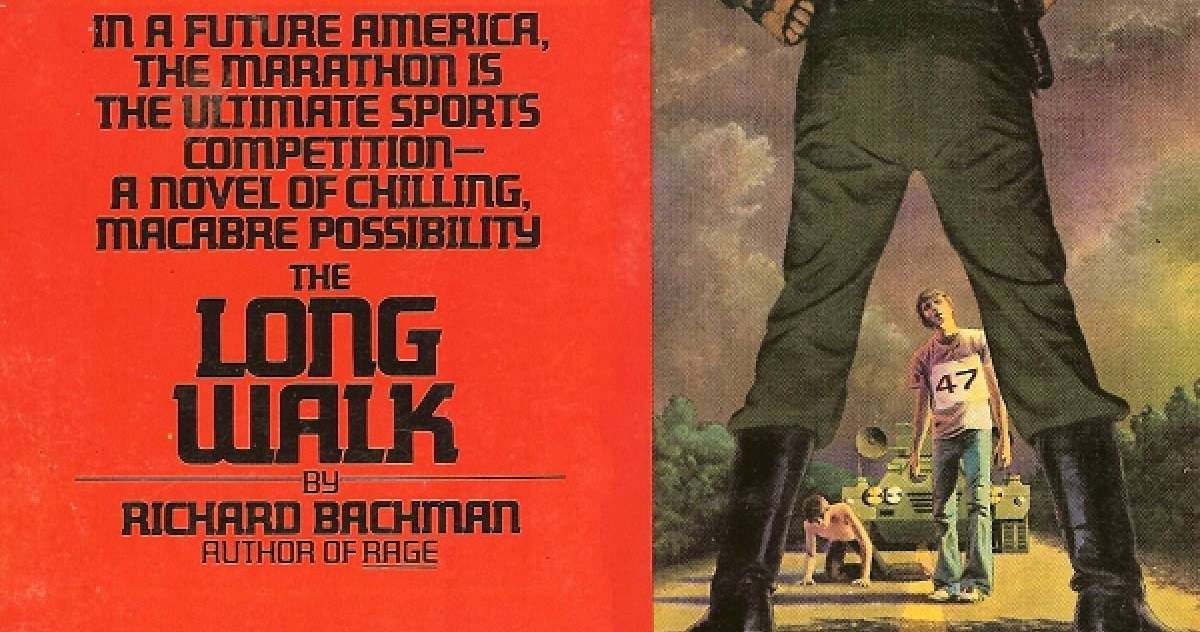

The Long Walk Stephen King Adaptation Official Trailer Debuts

May 08, 2025

The Long Walk Stephen King Adaptation Official Trailer Debuts

May 08, 2025 -

Stephen Kings The Long Walk First Trailer Released

May 08, 2025

Stephen Kings The Long Walk First Trailer Released

May 08, 2025 -

The Long Walk Trailer Mark Hamills Departure From Luke Skywalker

May 08, 2025

The Long Walk Trailer Mark Hamills Departure From Luke Skywalker

May 08, 2025 -

Mark Hamills The Long Walk A Stephen King Adaptation Trailer Breakdown

May 08, 2025

Mark Hamills The Long Walk A Stephen King Adaptation Trailer Breakdown

May 08, 2025 -

The Long Walk Movie Trailer A Chilling Adaptation Of Stephen Kings Novel

May 08, 2025

The Long Walk Movie Trailer A Chilling Adaptation Of Stephen Kings Novel

May 08, 2025