Thailand Inflation Dip: More Rate Cuts On The Horizon?

Table of Contents

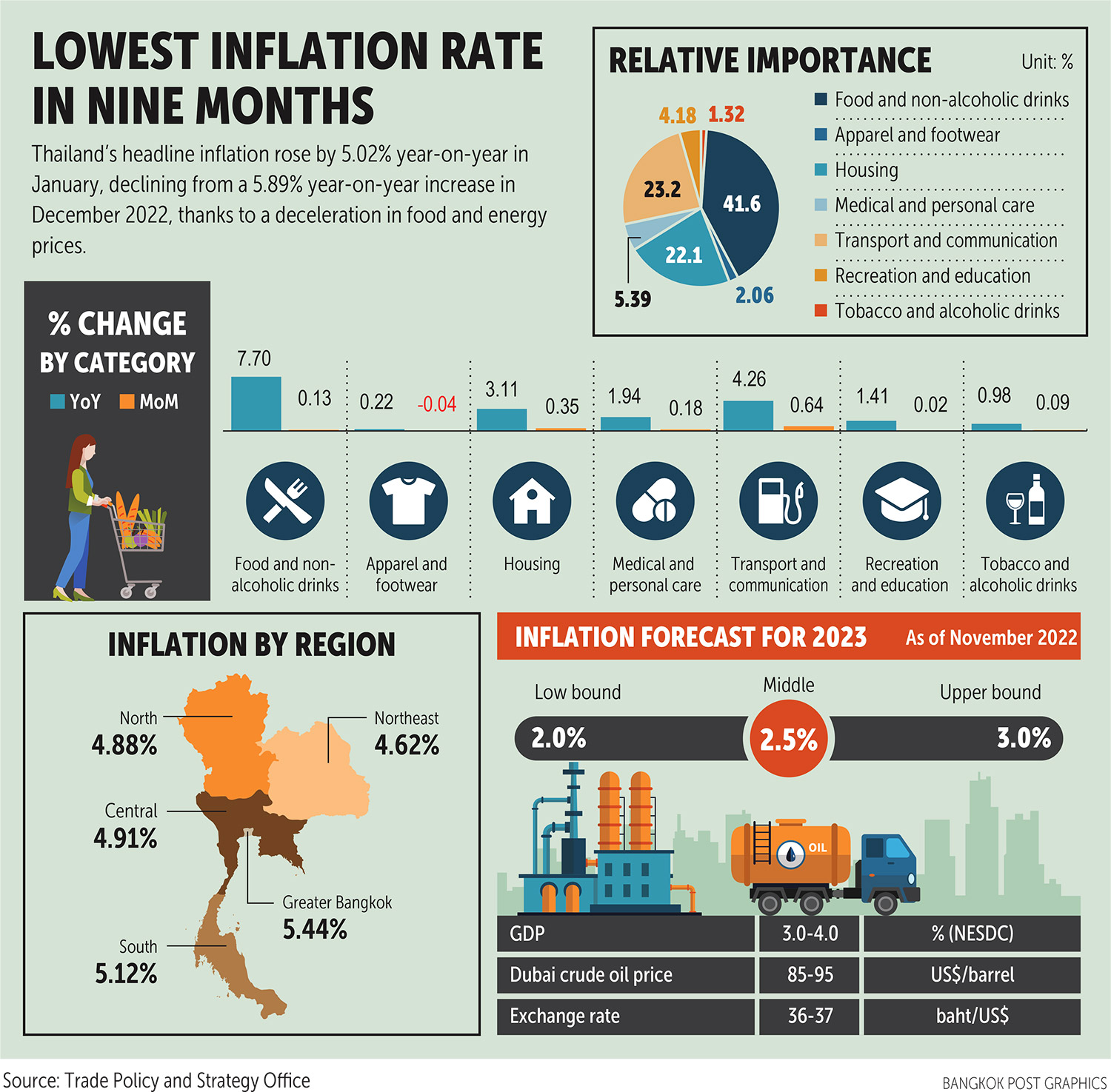

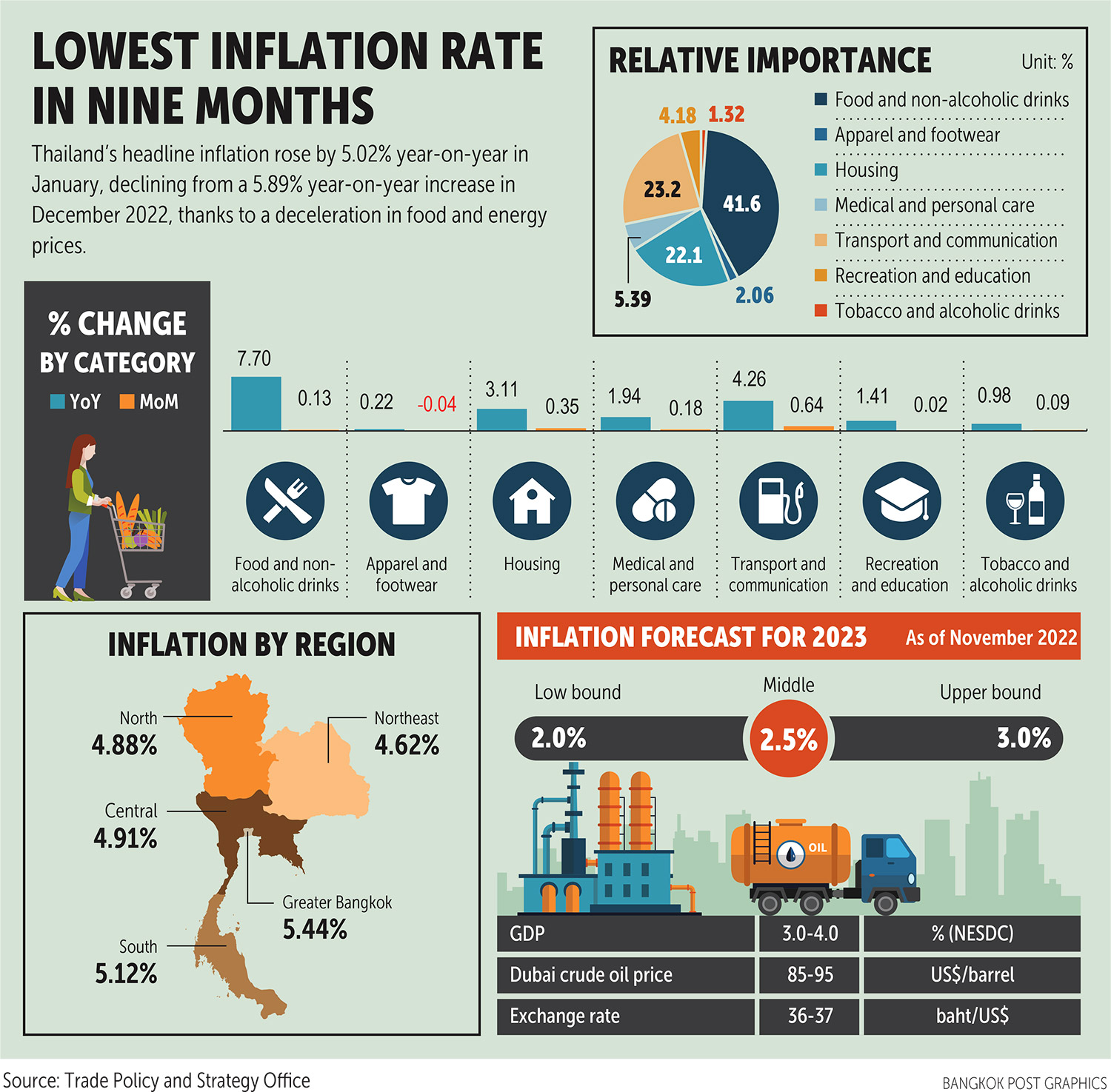

The Recent Decline in Thailand Inflation

Factors Contributing to the Dip

Several factors have contributed to the recent decline in Thailand's inflation rate. Analyzing these factors is crucial to understanding the potential for future interest rate adjustments by the Bank of Thailand.

-

Lower Energy Prices: Global energy prices have experienced a significant decline in recent months, directly impacting Thailand's Consumer Price Index (CPI). This decrease is particularly noticeable in fuel and electricity costs, which are major components of the CPI basket. For example, the average price of gasoline decreased by X% in the last quarter, contributing to a Y% reduction in overall energy inflation. Keywords: CPI, inflation rate Thailand, energy prices, supply chain.

-

Easing Global Supply Chain Pressures: The easing of global supply chain disruptions has led to lower prices for imported goods. Reduced shipping costs and improved availability of raw materials have contributed to a moderation in import inflation. This has had a positive knock-on effect on the prices of many consumer goods in Thailand.

-

Government Policies: The Thai government has implemented several policies aimed at mitigating inflationary pressures. These include measures to control food prices and subsidies for essential goods. These policies have helped to stabilize prices and prevent further inflation spikes. For instance, the government's price-control measures on rice have helped keep food inflation relatively low.

Analysis of Inflation Data

Thailand's inflation rate, as measured by the CPI, has shown a marked decrease. Year-on-year inflation, which was at Z% in [Month, Year], has fallen to W% in [Month, Year]. Monthly inflation has also shown a consistent downward trend.

[Insert chart or graph showing inflation data here]

Comparing these figures to previous periods reveals a significant slowdown in the rate of inflation. Forecasts from leading economic institutions suggest that inflation will remain relatively subdued in the coming months, although uncertainties remain.

The Bank of Thailand's Monetary Policy

Past Interest Rate Decisions

The Bank of Thailand's Monetary Policy Committee (MPC) has been actively responding to the evolving inflation landscape. In recent months, the MPC has implemented [Number] interest rate cuts, lowering the policy rate from [Previous Rate]% to the current rate of [Current Rate]%. These decisions were primarily driven by the need to stimulate economic growth while keeping inflation under control.

- [Date]: MPC meeting resulted in a [size]% cut, citing [reason].

- [Date]: Another [size]% cut followed, with the MPC highlighting [reason].

Potential for Future Rate Cuts

The potential for further rate cuts depends on several interconnected factors.

-

Economic Growth Forecasts: The BOT's future decisions will heavily depend on the projected growth of the Thai economy. If growth remains sluggish, further rate cuts might be implemented to stimulate economic activity. Keywords: economic growth Thailand, baht exchange rate, global economic outlook.

-

Currency Stability: The stability of the baht (THB) is a key consideration for the BOT. Aggressive rate cuts could weaken the currency, potentially impacting import costs and inflation.

-

Global Economic Conditions: Global economic uncertainty poses a significant risk. A global economic slowdown could dampen export demand, affecting Thailand's growth prospects and influencing the BOT's policy decisions.

Experts are divided on the likelihood of further rate cuts. Some analysts believe that the current inflation dip justifies continued easing of monetary policy, while others advocate for a more cautious approach, emphasizing the need to maintain currency stability and avoid fueling asset bubbles. Further rate cuts could boost consumer confidence and investment sentiment, potentially leading to increased consumer spending and business investment. However, it could also negatively impact Thailand's exports by making them less competitive.

Economic Outlook and Risks

Potential Risks and Uncertainties

Despite the positive signs, several risks and uncertainties could affect Thailand's economic outlook and the BOT's monetary policy decisions.

-

Global Recession: The threat of a global recession remains a significant concern. A global downturn could significantly reduce demand for Thai exports, impacting economic growth and potentially increasing inflationary pressures. Keywords: global recession, geopolitical risks, Thailand economy.

-

Geopolitical Instability: Geopolitical tensions and conflicts can disrupt global supply chains and energy markets, affecting Thailand's inflation and economic growth.

-

Domestic Political Factors: Domestic political developments can also influence investor confidence and economic activity, indirectly impacting inflation and interest rates. The BOT needs to consider these factors when making monetary policy decisions.

Growth Projections and Their Impact

The Thai economy is projected to grow at [Percentage]% in the coming year. This growth projection is [Positive/Negative] compared to previous years. This projected growth will play a crucial role in shaping the BOT's monetary policy decisions. Stronger-than-expected growth could lessen the urgency for further interest rate cuts, whereas slower-than-expected growth might increase the likelihood of additional easing.

Conclusion

Thailand's recent dip in inflation, driven by factors such as lower energy prices and easing supply chain pressures, has led to speculation about further interest rate cuts by the Bank of Thailand. While past rate cuts have aimed to stimulate economic growth, the BOT must carefully consider the potential impact on currency stability and global economic uncertainties. Future decisions will depend on factors like economic growth forecasts, currency stability, and global conditions. Understanding the interplay of these factors is crucial for navigating the evolving economic landscape.

Call to Action: Stay informed about the evolving economic situation in Thailand and the Bank of Thailand's monetary policy decisions to make informed financial choices. Follow reputable economic news sources for updates on Thailand inflation and interest rate announcements. Regularly monitor the Bank of Thailand's website for official statements and policy updates related to Thailand inflation and interest rates.

Featured Posts

-

Investigating The Use Of Apple Watches By Nhl Referees

May 07, 2025

Investigating The Use Of Apple Watches By Nhl Referees

May 07, 2025 -

Analyzing The Minnesota Timberwolves Unexpected Rise

May 07, 2025

Analyzing The Minnesota Timberwolves Unexpected Rise

May 07, 2025 -

Le Potentiel De Lane Hutson Devenir Un Defenseur Numero 1 Dans La Lnh

May 07, 2025

Le Potentiel De Lane Hutson Devenir Un Defenseur Numero 1 Dans La Lnh

May 07, 2025 -

Tajemnice Konklawe Rzut Oka Na Wybory Papieskie W Watykanie

May 07, 2025

Tajemnice Konklawe Rzut Oka Na Wybory Papieskie W Watykanie

May 07, 2025 -

San Francisco Giants Harrison And Whisenhunt Impress

May 07, 2025

San Francisco Giants Harrison And Whisenhunt Impress

May 07, 2025

Latest Posts

-

Watch Cavaliers Vs Heat Game 2 Your Guide To Nba Playoffs Live Streaming

May 07, 2025

Watch Cavaliers Vs Heat Game 2 Your Guide To Nba Playoffs Live Streaming

May 07, 2025 -

Nba Playoffs Game 2 Cavaliers Vs Heat Live Stream Tv Schedule And More

May 07, 2025

Nba Playoffs Game 2 Cavaliers Vs Heat Live Stream Tv Schedule And More

May 07, 2025 -

Nba Playoffs Game 1 Heat Vs Cavaliers Your Guide To Winning Bets And Predictions

May 07, 2025

Nba Playoffs Game 1 Heat Vs Cavaliers Your Guide To Winning Bets And Predictions

May 07, 2025 -

Nba Playoffs Heat Vs Cavaliers Predictions Picks And Best Bets For Game 1

May 07, 2025

Nba Playoffs Heat Vs Cavaliers Predictions Picks And Best Bets For Game 1

May 07, 2025 -

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025