Understanding The Risks: Is This New Investment Right For Retirement?

Table of Contents

Assessing Your Risk Tolerance for Retirement Investments

Before diving into any specific investment, understanding your risk tolerance is paramount for successful retirement planning. This involves a thorough self-assessment, considering your goals, timeline, and current financial situation.

Defining Your Retirement Goals and Timeline:

- Short-term vs. long-term goals: Are you aiming for a specific retirement date, or do you have more flexibility? Short-term goals require more conservative investments, while longer time horizons allow for greater risk-taking.

- Desired income level in retirement: How much income do you need to maintain your desired lifestyle? This will influence the amount of capital you need to accumulate and the level of risk you can afford to take.

- Life expectancy considerations: Your life expectancy plays a crucial role in determining how long your retirement savings need to last. Longer lifespans necessitate more cautious investment strategies.

Aligning your investment strategy with your individual retirement goals and time horizon is critical. A well-defined retirement plan acts as a roadmap, guiding your investment decisions and increasing the likelihood of achieving your desired retirement income.

Understanding Different Investment Risk Levels:

Different investment options carry varying degrees of risk:

- Conservative (bonds, CDs): These offer lower potential returns but are generally safer and less volatile. They are suitable for those with a low risk tolerance or shorter time horizons.

- Moderate (balanced funds): These blend stocks and bonds, offering a balance between risk and return. They are a good option for those seeking moderate growth with acceptable risk.

- Aggressive (stocks, high-yield bonds): These offer higher potential returns but also carry significantly higher risk. They are suitable for those with a higher risk tolerance, longer time horizons, and a greater capacity for loss.

It's important to understand the risk-reward trade-off. Higher potential returns usually come with higher risk. Diversification across different asset classes is crucial for mitigating risk and optimizing returns.

Evaluating Your Current Financial Situation:

Your current financial health significantly impacts your suitability for new, potentially risky, retirement investments. Consider:

- Existing savings and investments: What assets do you currently hold? This forms the foundation of your retirement portfolio.

- Debt levels: High levels of debt can limit your ability to take on additional investment risk. Addressing debt before making significant new investments is often advisable.

- Other income sources (pensions, Social Security): These sources provide a safety net and can influence the level of risk you can comfortably assume with your investments.

A comprehensive assessment of your financial health provides a realistic view of your capacity for risk and helps ensure that new retirement investments align with your overall financial stability.

Analyzing the Specifics of the New Retirement Investment

Before committing to any new retirement investment, thorough due diligence is essential. This involves a meticulous analysis of the investment's features, potential risks, and associated costs.

Due Diligence on the Investment Opportunity:

- Research the investment thoroughly: Investigate the company's history, financial statements, and regulatory filings. Look for red flags and signs of instability.

- Seek professional financial advice: A qualified financial advisor can provide unbiased guidance, helping you assess the investment's suitability for your retirement goals and risk profile.

Independent verification and professional consultation are crucial before investing your hard-earned retirement savings. Don't rely solely on marketing materials or promises of high returns.

Understanding the Investment's Fees and Expenses:

Fees significantly impact long-term returns. Carefully examine:

- Management fees: These are charged annually for managing the investment.

- Expense ratios: These represent the annual cost of running the investment.

- Transaction costs: These include brokerage fees and other charges associated with buying and selling the investment.

Compare fees across different investment options. Small differences in fees can compound over time, substantially reducing your overall returns.

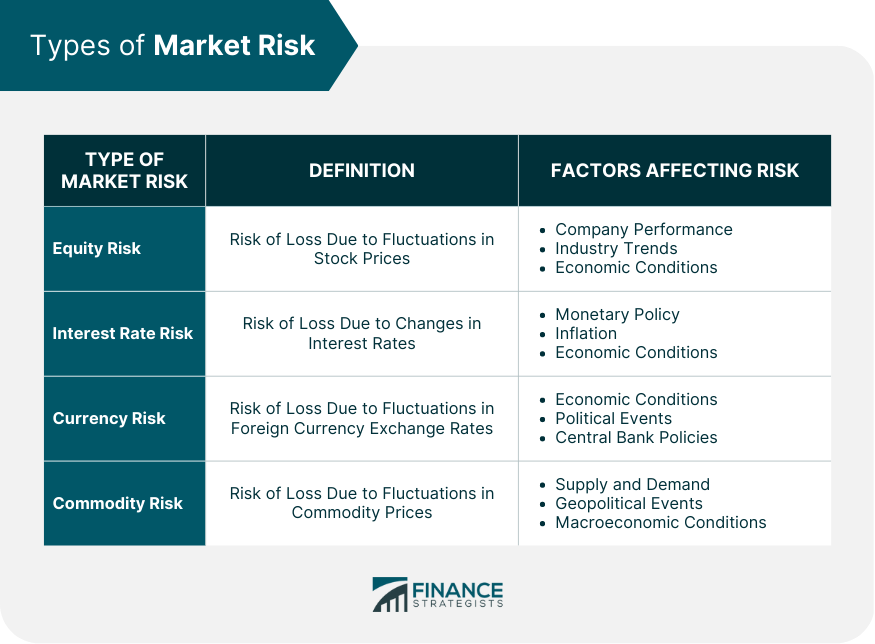

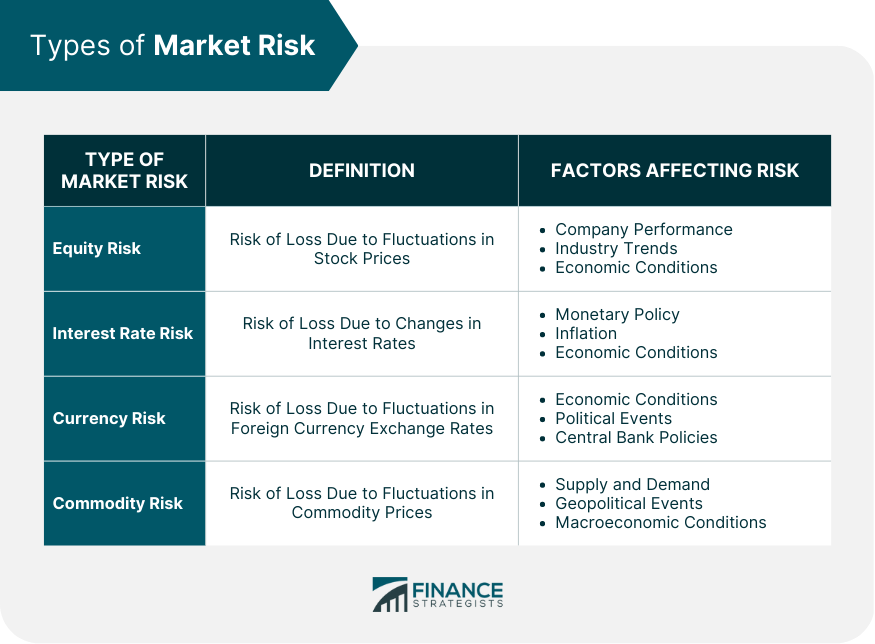

Identifying Potential Risks and Downsides:

Every investment carries inherent risks. Consider:

- Market volatility: Market fluctuations can cause significant short-term losses.

- Interest rate risk: Changes in interest rates can affect the value of fixed-income investments.

- Inflation risk: Inflation can erode the purchasing power of your retirement savings.

- Liquidity risk: The ability to easily sell an investment without incurring significant losses.

- Specific risks associated with the investment type: Research the unique risks associated with the specific type of investment you're considering (e.g., real estate, commodities, etc.).

Understanding potential downsides and considering worst-case scenarios is crucial for making informed investment decisions.

Diversification and Protecting Your Retirement Investment

Diversification is a cornerstone of sound retirement planning. It involves spreading your investments across different asset classes to reduce the impact of losses in any single investment.

The Importance of a Diversified Retirement Portfolio:

- Don't put all your eggs in one basket: Diversification reduces overall portfolio volatility and protects against significant losses due to market downturns or poor performance in a single asset class.

- Spread investments across different asset classes: This might include stocks, bonds, real estate, and other suitable asset classes, depending on your risk tolerance and retirement goals.

A well-diversified retirement portfolio is a crucial component of long-term retirement security.

Regular Portfolio Review and Rebalancing:

Ongoing portfolio management is essential for maintaining a balanced and well-performing portfolio.

- Monitor performance: Track your investments regularly to assess their performance against your goals.

- Adjust allocation as needed: Rebalance your portfolio periodically to maintain your desired asset allocation and risk level.

- Stay informed about market changes: Keep up-to-date on economic trends and market conditions to make informed adjustments to your investment strategy.

Proactive management of your retirement portfolio ensures that it remains aligned with your goals and risk tolerance over time.

Conclusion

Making informed decisions about your retirement investment is crucial for securing your financial future. Remember to assess your risk tolerance, analyze the specifics of any new investment opportunity, and prioritize diversification to protect your hard-earned savings. Take the time to thoroughly research and understand the risks involved, and consult with a qualified financial advisor to create a retirement plan that aligns with your goals and risk tolerance. Don't hesitate to seek professional guidance to ensure your retirement investment strategy is both secure and effective.

Featured Posts

-

Subystem Issue Grounds Blue Origin Rocket Launch Cancelled

May 18, 2025

Subystem Issue Grounds Blue Origin Rocket Launch Cancelled

May 18, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Detailed Analysis

May 18, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Pay Off A Detailed Analysis

May 18, 2025 -

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025 -

Dutch Politics Wilders Battles Internal Divisions In Pvv

May 18, 2025

Dutch Politics Wilders Battles Internal Divisions In Pvv

May 18, 2025 -

Kanye Wests Super Bowl Absence Taylor Swifts Alleged Role

May 18, 2025

Kanye Wests Super Bowl Absence Taylor Swifts Alleged Role

May 18, 2025

Latest Posts

-

White Lotus Fan Theories Walton Goggins Snl Monologue

May 18, 2025

White Lotus Fan Theories Walton Goggins Snl Monologue

May 18, 2025 -

Snl Walton Goggins Takes On Obsessive White Lotus Fan Theories

May 18, 2025

Snl Walton Goggins Takes On Obsessive White Lotus Fan Theories

May 18, 2025 -

Webby Awards 2024 Taylor Swift Kendrick Lamar And Simone Biles Among The Winners

May 18, 2025

Webby Awards 2024 Taylor Swift Kendrick Lamar And Simone Biles Among The Winners

May 18, 2025 -

Bad Bunny Dance Cover Tate Mc Rae And Marcello Hernandez Surprise Fans

May 18, 2025

Bad Bunny Dance Cover Tate Mc Rae And Marcello Hernandez Surprise Fans

May 18, 2025 -

Analyzing Marcello Hernandezs Snl Sketch The Suitcase Dog

May 18, 2025

Analyzing Marcello Hernandezs Snl Sketch The Suitcase Dog

May 18, 2025