Will Canadian Tire's Acquisition Of Hudson's Bay Pay Off? A Detailed Analysis

Table of Contents

Synergies and Potential Benefits of the Merger

The Canadian Tire Hudson's Bay merger presents several potential synergies that could significantly benefit both brands. Strategic integration could unlock substantial growth opportunities.

Expanding Retail Reach and Customer Base

Hudson's Bay's strong presence in major urban centers, a key area where Canadian Tire has historically had a less dominant presence, offers immediate expansion opportunities. This strategic move allows Canadian Tire to:

-

Leverage Hudson's Bay's established presence: Gain access to prime real estate and established customer bases in key metropolitan areas across Canada.

-

Access a new demographic: Attract a higher-income demographic currently underserved by Canadian Tire's typical offerings, tapping into the customer base attracted to Hudson's Bay's upscale brands and department store experience.

-

Boost cross-promotion and loyalty program integration: Create opportunities for joint marketing campaigns and a combined loyalty program, maximizing customer engagement and driving sales across both brands. Imagine a Canadian Tire Triangle Rewards member earning points on a Hudson's Bay purchase, or vice versa. This could drastically increase customer engagement and brand loyalty.

-

Increase market share: The combined entity will command a significantly larger share of the Canadian retail market, strengthening its position against major competitors.

-

Shared Marketing Campaigns: Joint advertising campaigns focusing on complementary product offerings (e.g., outdoor gear from Canadian Tire paired with stylish apparel from Hudson's Bay for a weekend getaway).

Diversification of Product Offerings

The merger allows Canadian Tire to diversify beyond its traditional automotive, hardware, and sporting goods offerings.

-

Reduce reliance on core product lines: Mitigate the risk associated with fluctuating demand in specific product categories.

-

Introduce higher-margin products: Leverage Hudson's Bay's expertise in apparel, home goods, and luxury items to increase overall profit margins.

-

Expand into new market segments: Gain access to the luxury goods and designer brands market, attracting a new segment of high-spending consumers.

-

Opportunities for private label development: Develop and market private-label products under both the Canadian Tire and Hudson's Bay brands, further enhancing profitability.

-

Specific Product Synergies: Offering home improvement tools from Canadian Tire alongside home décor from Hudson's Bay, creating a one-stop shop for home renovation projects.

Enhanced Supply Chain and Operational Efficiencies

Consolidation of operations promises significant cost savings and operational improvements.

-

Cost savings through shared logistics: Optimize distribution networks, reducing transportation costs and improving delivery times.

-

Streamlined back-end processes: Consolidate administrative and operational functions, reducing redundancy and improving efficiency.

-

Increased purchasing power: Negotiate better deals with suppliers due to increased purchasing volume.

-

Improved inventory management: Utilize data-driven insights to optimize inventory levels and reduce waste.

-

Specific Operational Improvements: Centralizing warehousing and distribution to minimize operational costs and increase efficiency.

Challenges and Risks Associated with the Acquisition

Despite the potential benefits, the Canadian Tire Hudson's Bay acquisition presents significant challenges.

Integrating Two Distinct Brand Identities

Merging two such different brands requires careful navigation.

-

Maintaining unique brand identities: Avoid diluting the individual brand identities of Canadian Tire and Hudson's Bay to retain customer loyalty.

-

Avoiding alienating existing customer bases: Ensure that changes made do not alienate customers loyal to either brand.

-

Challenges in merging corporate cultures: Successfully integrating two distinct corporate cultures and management styles is crucial for a smooth transition.

-

Potential for brand dilution: Carefully manage brand messaging to avoid confusing or disappointing customers.

-

Target Audience Differences: Hudson's Bay caters to a more upscale demographic than Canadian Tire, requiring distinct marketing strategies for each brand.

Financial Risks and Return on Investment (ROI)

The acquisition carries substantial financial risks.

-

High acquisition cost and potential debt burden: The high cost of the acquisition could significantly increase Canadian Tire's debt levels.

-

Economic uncertainty and consumer spending: Uncertain economic conditions and consumer spending habits could negatively impact profitability.

-

Significant investment in integration: The integration process will require substantial investment in technology, personnel, and other resources.

-

Market competition and changing consumer preferences: Increased competition from other retailers and evolving consumer preferences could pose challenges.

-

Financial Analysis: A thorough due diligence process assessing market conditions, potential synergies, and realistic projections for ROI is essential.

Competition from Other Major Retailers

The Canadian retail landscape is highly competitive.

-

Competition from Walmart, Amazon, and other retailers: Facing intense competition from established players requires a strong competitive strategy.

-

Maintaining market share and customer loyalty: Requires innovative marketing and customer engagement strategies.

-

Potential for price wars: The risk of price wars with competitors, potentially reducing profit margins.

-

Competitive Analysis: A detailed analysis of competitors' strategies, strengths, and weaknesses is crucial for formulating an effective competitive strategy.

Conclusion

The success of the Canadian Tire Hudson's Bay acquisition depends heavily on effective integration, strategic brand management, and a sharp understanding of the dynamic Canadian retail market. While substantial synergies and growth potential exist, significant challenges remain. Meticulous execution and a clearly defined strategy are vital for achieving a positive return on investment. Only time will reveal whether this daring move will ultimately benefit Canadian Tire. Further research and ongoing monitoring of the Canadian Tire Hudson's Bay acquisition are necessary for a thorough understanding of its long-term implications. Continue to follow our updates on this landmark transaction and its impact on the Canadian retail landscape. Learn more about the intricacies of the Canadian Tire Hudson's Bay acquisition and its potential implications by following our future articles.

Featured Posts

-

Major New City Pickle Pickleball Facility Coming To Brooklyn

May 18, 2025

Major New City Pickle Pickleball Facility Coming To Brooklyn

May 18, 2025 -

Cnn Releases Video Of New Orleans Jail Escape

May 18, 2025

Cnn Releases Video Of New Orleans Jail Escape

May 18, 2025 -

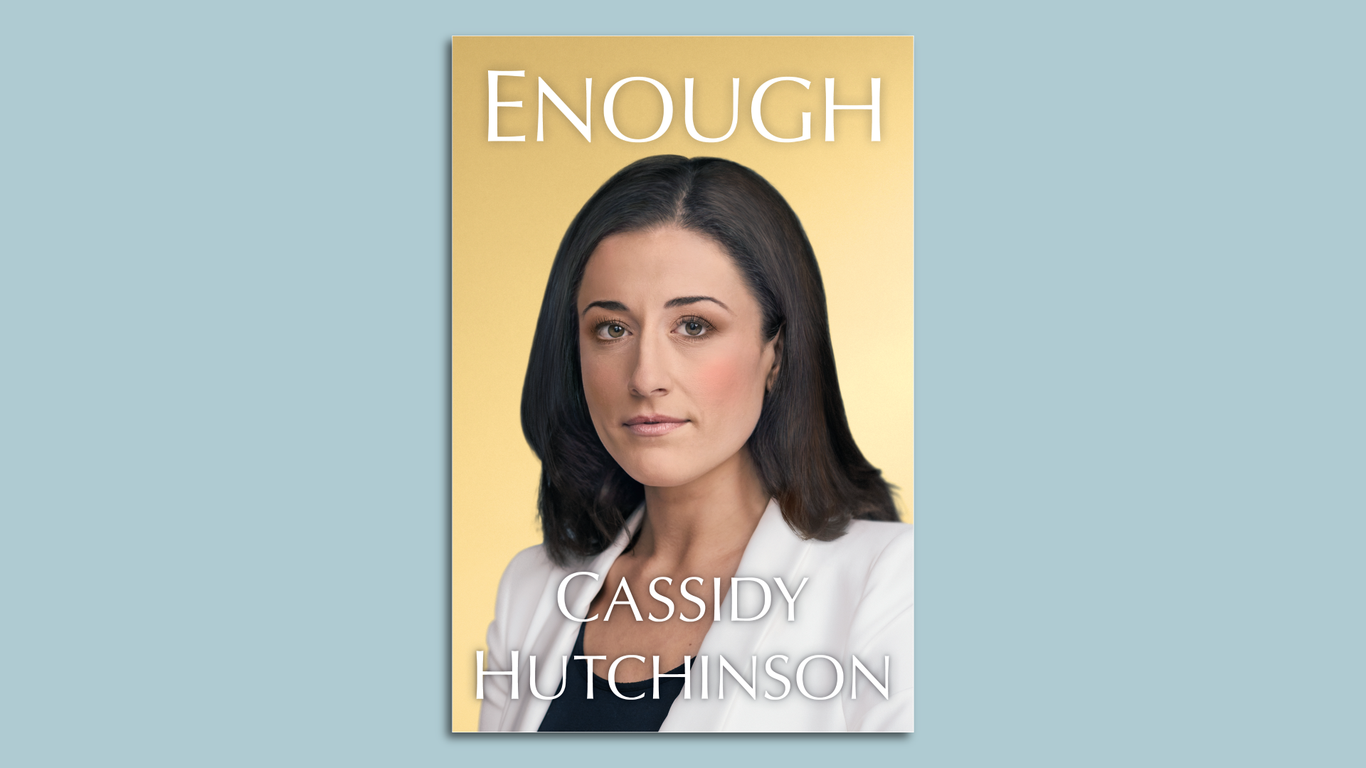

Jan 6 Hearings Witness Cassidy Hutchinson Announces Memoir

May 18, 2025

Jan 6 Hearings Witness Cassidy Hutchinson Announces Memoir

May 18, 2025 -

Early Release Program Government Addresses Prison Overcrowding Despite Criticism

May 18, 2025

Early Release Program Government Addresses Prison Overcrowding Despite Criticism

May 18, 2025 -

Walton Goggins Snl Promo Predicting The Victim

May 18, 2025

Walton Goggins Snl Promo Predicting The Victim

May 18, 2025

Latest Posts

-

Onet Le Chateau Le Charme Du Lioran Pour Vos Vacances

May 18, 2025

Onet Le Chateau Le Charme Du Lioran Pour Vos Vacances

May 18, 2025 -

Promocyjna Cena Na Fakt W Ramach Onet Premium

May 18, 2025

Promocyjna Cena Na Fakt W Ramach Onet Premium

May 18, 2025 -

Czy Polacy Ufaja Trumpowi W Kwestii Ukrainy Wyniki Nowego Sondazu

May 18, 2025

Czy Polacy Ufaja Trumpowi W Kwestii Ukrainy Wyniki Nowego Sondazu

May 18, 2025 -

Dziennikarze Onetu Oskarzeni Przez Panstwowa Spolke 100 Tys Zl Odszkodowania

May 18, 2025

Dziennikarze Onetu Oskarzeni Przez Panstwowa Spolke 100 Tys Zl Odszkodowania

May 18, 2025 -

Sejour Au Lioran Votre Guide Complet Pour Onet Le Chateau

May 18, 2025

Sejour Au Lioran Votre Guide Complet Pour Onet Le Chateau

May 18, 2025