Understanding The Reasons Behind D-Wave Quantum Inc. (QBTS) Stock's Monday Drop

Table of Contents

Monday saw a significant drop in D-Wave Quantum Inc. (QBTS) stock price, leaving many investors wondering about the reasons behind this sudden decline. This article delves into the potential factors contributing to this downturn, analyzing market trends and company-specific news to provide a comprehensive understanding of the QBTS stock's performance. We'll examine both macro-economic influences and company-specific events to shed light on this notable market movement.

Market-Wide Factors Influencing QBTS Stock Performance

Several broader market forces could have contributed to the QBTS stock price decline on Monday. Understanding these external factors is crucial for a complete analysis.

Overall Market Sentiment

The overall market sentiment on Monday played a significant role. A negative sentiment across the broader market can drag down even fundamentally strong stocks. This is especially true for growth stocks like QBTS, which are often more volatile than established companies in mature sectors.

- Tech Sector Downturn: A general downturn in the technology sector, which often correlates with fluctuations in quantum computing stocks, could have negatively impacted QBTS. Investor apprehension towards riskier assets frequently results in sell-offs across the tech landscape.

- Interest Rate Hikes: The anticipation of or actual announcement of interest rate hikes by central banks can trigger a flight to safety, leading investors to move away from speculative investments, including those in the nascent quantum computing sector.

- Geopolitical Uncertainty: Global geopolitical instability can also influence market sentiment, leading to increased risk aversion and sell-offs across various sectors.

Data Points: On Monday, the Nasdaq Composite fell by [insert percentage] and the S&P 500 dropped by [insert percentage], reflecting a negative overall market sentiment that likely impacted QBTS stock.

Sector-Specific Pressures

Beyond the overall market mood, the quantum computing sector itself might have faced specific headwinds. Negative news related to competitors or the broader industry outlook can directly affect investor confidence in QBTS.

- Competitor Advancements: News of significant breakthroughs by competitors in the quantum computing field could have negatively affected QBTS's perceived market position, triggering selling pressure.

- Regulatory Uncertainty: Potential changes in government regulations related to the quantum computing industry or the technology itself can create uncertainty, making investors hesitant to hold onto QBTS stock.

- Funding Challenges: Reports of funding challenges faced by other quantum computing companies could signal a potential slowdown in the sector's growth, impacting investor confidence in the entire space, including QBTS.

Data Points: [Cite any relevant industry reports or analyst opinions regarding challenges in the quantum computing sector on that specific Monday].

D-Wave Quantum Inc. (QBTS)-Specific News and Developments

Company-specific news and developments often have a direct and significant impact on a stock's price. Let's explore any such events that might have contributed to Monday's QBTS stock decline.

Company-Specific Announcements

Any news releases or announcements by D-Wave Quantum itself could be a primary driver of the stock price drop. Negative news tends to be particularly impactful.

- Earnings Miss: A disappointing earnings report, with lower-than-expected revenue or profits, could have sparked a sell-off.

- Product Delays: Announcements of delays in product launches or development milestones can signal challenges and reduce investor confidence.

- Management Changes: Unexpected departures of key personnel can also create uncertainty and negatively influence investor sentiment.

Data Points: [Link to any relevant company announcements or news articles from Monday].

Analyst Ratings and Price Target Revisions

Changes in analyst ratings and price targets from prominent financial institutions can significantly impact a stock's price. Downgrades often trigger selling.

- Rating Downgrades: If major investment banks downgraded their ratings for QBTS stock, it could have contributed to the sell-off.

- Price Target Reductions: A reduction in the price target by analysts reflects a less optimistic outlook for the company's future performance.

Data Points: [Include links to analyst reports or news articles covering any rating changes or price target revisions on Monday.]

Investor Sentiment and Trading Activity

Analyzing investor behavior through trading volume and short-selling activity can offer further insights into the QBTS stock drop.

Trading Volume and Volatility

High trading volume coupled with significant price drops often suggests strong bearish sentiment. Unusual activity warrants attention.

- Elevated Trading Volume: Significantly higher-than-average trading volume on Monday could indicate a rush of selling by investors.

- Increased Volatility: Sharp price fluctuations throughout the day suggest intense market activity and potentially heightened uncertainty.

Data Points: Compare Monday's trading volume and price volatility to previous trading days to highlight any significant differences.

Short Selling and Options Activity

Short selling, where investors bet against a stock's price, and options trading can amplify downward pressure.

- Increased Short Interest: A significant increase in short interest before or during Monday's trading session might have exacerbated the price decline.

- Options Market Activity: Unusual activity in the options market, such as a surge in put options (bets on price declines), could suggest a bearish outlook among some investors.

Data Points: [Cite data on short interest if available. Mention any unusual options activity if reported].

Conclusion

The QBTS stock price drop on Monday was likely a confluence of factors. Broad market weakness, sector-specific concerns, company-specific news (if any), and investor sentiment all contributed to the decline. Understanding these intertwined elements is crucial for investors seeking to navigate the complexities of the quantum computing market.

Call to Action: Stay informed about QBTS stock and the quantum computing sector by conducting thorough research into the company's financials, upcoming announcements, and prevailing industry trends. Monitor QBTS stock performance and related news for future insights into the company’s performance and the broader quantum computing market. Making informed investment decisions regarding QBTS stock requires continuous monitoring and in-depth analysis of both macro and micro factors.

Featured Posts

-

Augmentation De L Activite Des Cordistes Due A La Construction De Tours A Nantes

May 21, 2025

Augmentation De L Activite Des Cordistes Due A La Construction De Tours A Nantes

May 21, 2025 -

Bp Ceo Pay Cut A 31 Reduction Explained

May 21, 2025

Bp Ceo Pay Cut A 31 Reduction Explained

May 21, 2025 -

Maybank Facilitates Significant Investment In Economic Zone 545 Million

May 21, 2025

Maybank Facilitates Significant Investment In Economic Zone 545 Million

May 21, 2025 -

Clisson Quand Le Symbole Religieux Pose Question Au Sein D Un Etablissement Scolaire

May 21, 2025

Clisson Quand Le Symbole Religieux Pose Question Au Sein D Un Etablissement Scolaire

May 21, 2025 -

Peppa Pigs Mum Announces New Babys Gender Fans React

May 21, 2025

Peppa Pigs Mum Announces New Babys Gender Fans React

May 21, 2025

Latest Posts

-

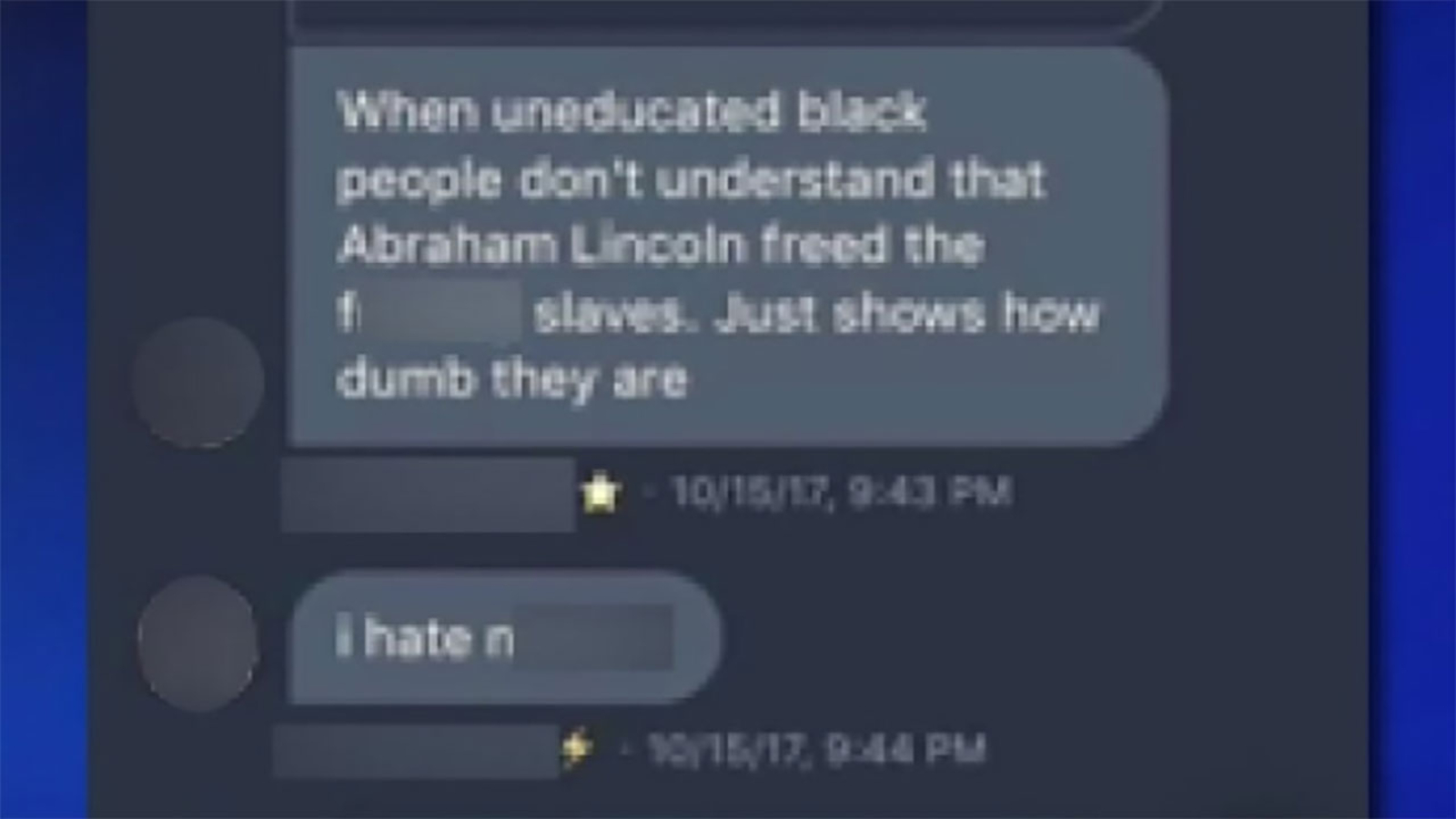

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025 -

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025

Lawsuit Update Appeal In Case Of Ex Tory Councillors Wifes Racist Tweet

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025 -

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Court Delays Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025