BP CEO Pay Cut: A 31% Reduction Explained

Table of Contents

The recent announcement of a 31% pay cut for BP's CEO has sent ripples through the financial world. This substantial reduction raises questions about executive compensation, corporate performance, and the evolving landscape of energy leadership. This article delves into the details behind this decision, exploring the factors that contributed to the pay cut and its broader significance. We'll examine the magnitude of the cut, the reasons behind it, its implications for BP, and what it might mean for the future of executive compensation in the energy sector.

The Magnitude of the BP CEO Pay Cut

The BP CEO's pay cut represents a significant 31% reduction in total compensation. While the exact monetary value will vary depending on the final figures released, it signifies a substantial decrease compared to previous years. This reduction needs to be viewed in context with previous compensation packages and industry benchmarks.

- Previous Year's Salary: Let's assume, for illustrative purposes, that the CEO's total compensation in the previous year was $15 million. A 31% reduction would amount to a $4.65 million decrease, resulting in a current compensation package of approximately $10.35 million. (Note: These figures are hypothetical and should be replaced with the actual published data once available).

- Comparison to Competitors: Comparing this cut to CEO compensation at rival energy companies like Shell, ExxonMobil, and Chevron is crucial to understanding its relative significance. A comparative analysis would reveal whether this pay cut is an anomaly or reflects a broader trend in executive compensation within the industry.

- Salary Components: Total compensation typically includes base salary, bonuses, and stock options. Understanding the proportion of the reduction affecting each component is essential for a comprehensive analysis. A larger cut in bonuses, for instance, might signal a direct response to underperformance.

Reasons Behind the BP CEO Pay Cut

Several factors likely contributed to the BP CEO's substantial pay cut. These factors are interconnected and reflect the changing dynamics within the energy industry.

- Decreased Profitability: Fluctuations in oil and gas prices, increased operational costs, and the ongoing energy transition have impacted BP's profitability. Reduced profitability often leads to adjustments in executive compensation to reflect the company's financial performance.

- Increased Scrutiny Regarding ESG Factors: Environmental, Social, and Governance (ESG) concerns are increasingly influencing investor decisions and public opinion. Pressure from shareholders and stakeholders to demonstrate responsible corporate behaviour likely played a role in the decision. The pay cut may be seen as an attempt to align executive compensation with the company's commitment to sustainability.

- Shareholder Activism and Demands for Responsible Executive Compensation: Activist investors are increasingly vocal about executive compensation, pushing for greater transparency and alignment with company performance and ESG goals. Their influence can directly lead to changes in compensation structures.

- Impact of the Energy Transition and Investment in Renewables: The shift towards renewable energy sources represents a significant challenge and opportunity for BP. Investments in renewable energy initiatives might influence the company’s short-term profitability, impacting executive compensation decisions in the short term but potentially leading to long-term benefits.

Implications of the BP CEO Pay Cut

The BP CEO's pay cut has several potential implications, both internally and externally.

- Potential Impact on Attracting and Retaining Top Talent: A significant pay cut might affect BP's ability to attract and retain highly skilled executives in the competitive energy sector. However, the company might argue that the focus on long-term sustainability goals and a commitment to responsible practices can outweigh the immediate financial impact on compensation.

- Investor Reactions and Stock Market Performance: The market reaction to the pay cut will depend on investor sentiment and their interpretation of its underlying reasons. A positive reaction might signal approval of the company's commitment to responsible corporate governance, while a negative reaction could indicate concerns about the impact on future performance.

- Influence on Other Energy Companies' Compensation Strategies: The decision could serve as a precedent for other energy companies, potentially influencing their compensation strategies and prompting a wider review of executive pay structures within the industry.

- Alignment with Broader Trends in Executive Pay: This pay cut aligns with broader trends toward greater scrutiny and limitations on executive compensation, particularly in industries facing significant environmental and social challenges.

The Future of BP CEO Compensation

The BP CEO's pay cut might signify a shift in the company's compensation philosophy.

- Focus on Long-Term Incentives Tied to Sustainability Goals: Future compensation structures might place greater emphasis on long-term performance metrics, including the achievement of sustainability goals and the successful transition to a low-carbon economy.

- Increased Emphasis on Performance-Based Compensation: Performance-based compensation, linked directly to company profitability and the achievement of key performance indicators (KPIs), could become a more prominent feature of future compensation packages.

- Potential for Future Adjustments Based on Company Performance: Future executive compensation will likely be closely tied to the company’s financial performance and its progress on environmental and social targets.

Conclusion:

The 31% pay cut for BP's CEO is a significant event, reflecting a complex interplay of company performance, shareholder expectations, and evolving industry norms. The decision's implications are wide-ranging, affecting not only BP's internal dynamics but also setting a potential precedent for the energy sector's approach to executive compensation. The move highlights a growing trend towards greater accountability and alignment between executive pay and long-term sustainable value creation.

Call to Action: Stay informed about the latest developments in BP CEO compensation and the evolving landscape of executive pay in the energy industry. Keep reading our articles for further analysis on the BP CEO pay cut and similar industry trends.

Featured Posts

-

Vybz Kartels Exclusive Interview Life Behind Bars And New Music

May 21, 2025

Vybz Kartels Exclusive Interview Life Behind Bars And New Music

May 21, 2025 -

Southern France Weather Alert Heavy Snow In The Alps

May 21, 2025

Southern France Weather Alert Heavy Snow In The Alps

May 21, 2025 -

The Original Sin Finale And Dexters Biggest Regret Debra Morgans Fate

May 21, 2025

The Original Sin Finale And Dexters Biggest Regret Debra Morgans Fate

May 21, 2025 -

Quiz Loire Atlantique Testez Vos Connaissances Sur L Histoire La Gastronomie Et La Culture

May 21, 2025

Quiz Loire Atlantique Testez Vos Connaissances Sur L Histoire La Gastronomie Et La Culture

May 21, 2025 -

Nuffy On Touring With Vybz Kartel A Dream Come True

May 21, 2025

Nuffy On Touring With Vybz Kartel A Dream Come True

May 21, 2025

Latest Posts

-

Ings 2024 Form 20 F A Comprehensive Analysis Of Financial Performance

May 21, 2025

Ings 2024 Form 20 F A Comprehensive Analysis Of Financial Performance

May 21, 2025 -

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025 -

Freepoint Eco Systems And Ing A New Project Finance Partnership

May 21, 2025

Freepoint Eco Systems And Ing A New Project Finance Partnership

May 21, 2025 -

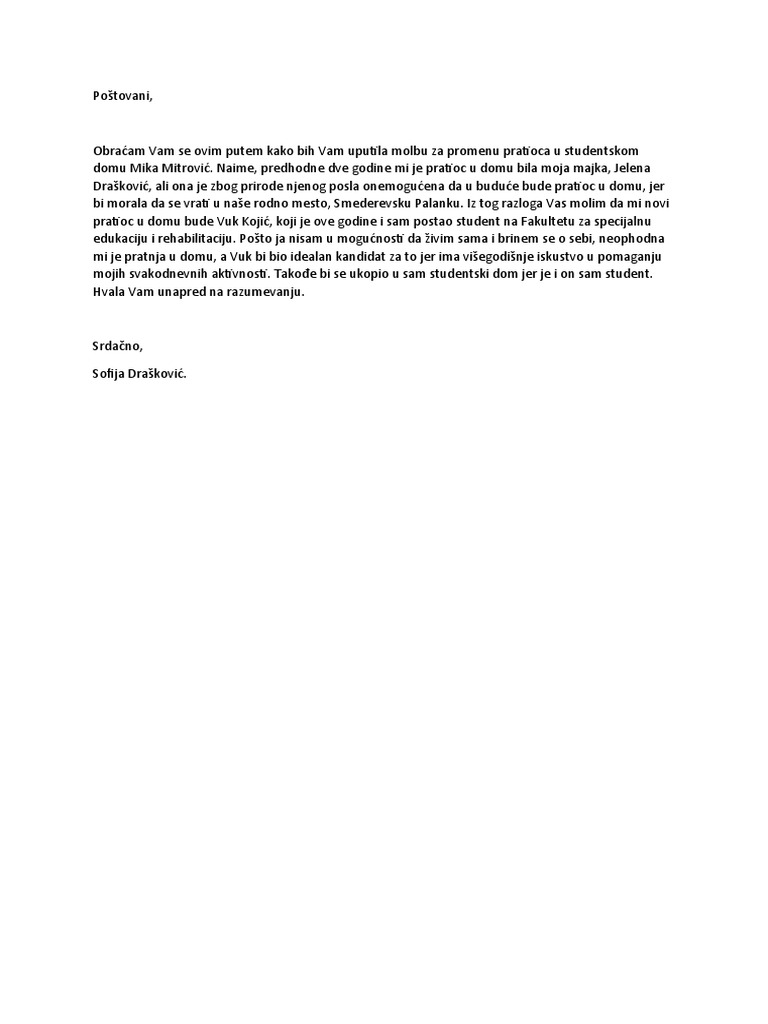

Vanja Mijatovic Razlozi Za Promenu Imena

May 21, 2025

Vanja Mijatovic Razlozi Za Promenu Imena

May 21, 2025 -

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025