Understanding The Oil Market: News And Analysis For May 16

Table of Contents

Global Crude Oil Price Movements

Price Fluctuations and their Causes

On May 16th, the oil market experienced significant price fluctuations. Brent crude, the global benchmark, saw a [Insert Specific Price Change Percentage]% change, closing at [Insert Closing Price]. Similarly, West Texas Intermediate (WTI) crude, the US benchmark, experienced a [Insert Specific Price Change Percentage]% shift, settling at [Insert Closing Price]. These movements were primarily driven by several interconnected factors:

- OPEC+ Decision: The OPEC+ alliance's decision to [Insert Specific OPEC+ Decision, e.g., maintain current production levels] significantly impacted market sentiment. This decision, coupled with [Mention specific reasoning behind decision], influenced supply expectations and subsequently, prices.

- Geopolitical Instability: The ongoing conflict in Ukraine continues to create uncertainty in the global energy landscape. Sanctions on Russian oil exports, coupled with concerns about potential disruptions to supply chains, contributed to price volatility. The impact was quantified by [Mention specific analysis or report showing quantifiable impact, e.g., a research paper showing a X% price increase due to the war].

- Economic Data: Positive economic data from [Mention specific country/region, e.g., the US] indicating strong GDP growth boosted demand forecasts, pushing oil prices upward. Conversely, rising inflation rates in [Mention specific country/region] tempered the bullish sentiment, contributing to price fluctuations.

The correlation between global economic growth and oil demand is strong. As economies expand, industrial activity increases, leading to higher energy consumption and consequently, increased demand for crude oil. Conversely, economic slowdowns or recessions typically translate into lower oil demand.

Short-Term and Long-Term Price Predictions

Predicting oil prices with certainty is challenging, given the market's inherent volatility. However, based on current trends and expert opinions, we can offer some cautious predictions:

- Short-Term (Next 3 Months): Several analysts, including [Mention reputable sources, e.g., Goldman Sachs, etc.], predict a price range of [Price Range] for Brent crude, driven by [mention driving factors]. This range accounts for potential seasonal demand increases and any unforeseen geopolitical developments.

- Long-Term (Next 12 Months): The long-term outlook is subject to greater uncertainty. The transition to renewable energy and potential changes in OPEC+ policy could significantly affect prices. Predictions range from [Price Range], with [Mention key uncertainties impacting the long-term forecast].

OPEC+ and its Impact on the Oil Market

Recent Decisions and their Implications

The OPEC+ alliance plays a crucial role in shaping the oil market. Recent decisions have had a significant impact on global oil supply and prices.

- Production Quotas: OPEC+'s decision to [Mention the specific decision regarding production quotas] directly impacts the global oil supply. This decision, explained by [Mention the reason provided by OPEC+], is expected to [Explain the predicted effect on oil prices and global supply].

- Market Share: The alliance's strategy influences the market share of different producing countries, potentially leading to competition and price adjustments.

Geopolitical Considerations and OPEC+ Strategy

Geopolitical factors significantly influence OPEC+'s strategies and the subsequent impact on oil prices.

- Geopolitical Tensions: The ongoing conflict in Ukraine and other geopolitical tensions often influence OPEC+'s decisions on production levels. The alliance may adjust its strategy to address potential supply disruptions or maintain market stability in response to these tensions.

- Member Dynamics: Internal dynamics within the OPEC+ alliance, including disagreements among member countries, can also affect production decisions and market outcomes.

Alternative Energy Sources and their Influence

Growth of Renewable Energy

The rise of renewable energy sources, such as solar and wind power, poses a significant challenge to the oil industry.

- Renewable Energy Adoption: The increasing adoption of renewable energy technologies is progressively reducing the reliance on fossil fuels for electricity generation. This transition is further driven by government incentives and technological advancements, leading to a potential decrease in oil demand.

- Impact on Oil Consumption: The International Energy Agency (IEA) estimates that [insert IEA data or other relevant data] showcasing the gradual decrease in oil consumption due to renewable energy adoption.

The Transition to a Low-Carbon Economy

The global push toward a low-carbon economy is fundamentally reshaping the energy landscape and presents both challenges and opportunities for the oil industry.

- Government Policies: Many governments are implementing policies to reduce carbon emissions, including carbon taxes and regulations on fossil fuel use. These policies aim to accelerate the adoption of renewable energy and potentially reduce the demand for oil.

- Corporate Sustainability Initiatives: Major corporations are increasingly incorporating sustainability initiatives into their operations. This includes investing in renewable energy, reducing their carbon footprint, and aligning their strategies with the transition to a low-carbon economy.

Conclusion

The oil market on May 16th showcased its inherent complexity, with price fluctuations influenced by OPEC+ decisions, geopolitical events, and economic data. The growth of renewable energy and the global push for a low-carbon economy are exerting increasing pressure on the oil industry, influencing long-term price predictions and the overall market landscape. Understanding these interconnected factors is crucial for navigating this dynamic market.

Stay tuned for our next oil market analysis, providing further insights into this ever-evolving sector. Continue learning about the oil market by visiting [website/link] for regular updates and deeper analysis of oil prices and related news. Understand the oil market better to make informed decisions.

Featured Posts

-

Srbi Kupuju Stanove U Inostranstvu Popularne Destinacije I Trendovi

May 17, 2025

Srbi Kupuju Stanove U Inostranstvu Popularne Destinacije I Trendovi

May 17, 2025 -

Financial Planning For Homeownership With Existing Student Loans

May 17, 2025

Financial Planning For Homeownership With Existing Student Loans

May 17, 2025 -

New York Daily News Back Pages May 2025 Archives

May 17, 2025

New York Daily News Back Pages May 2025 Archives

May 17, 2025 -

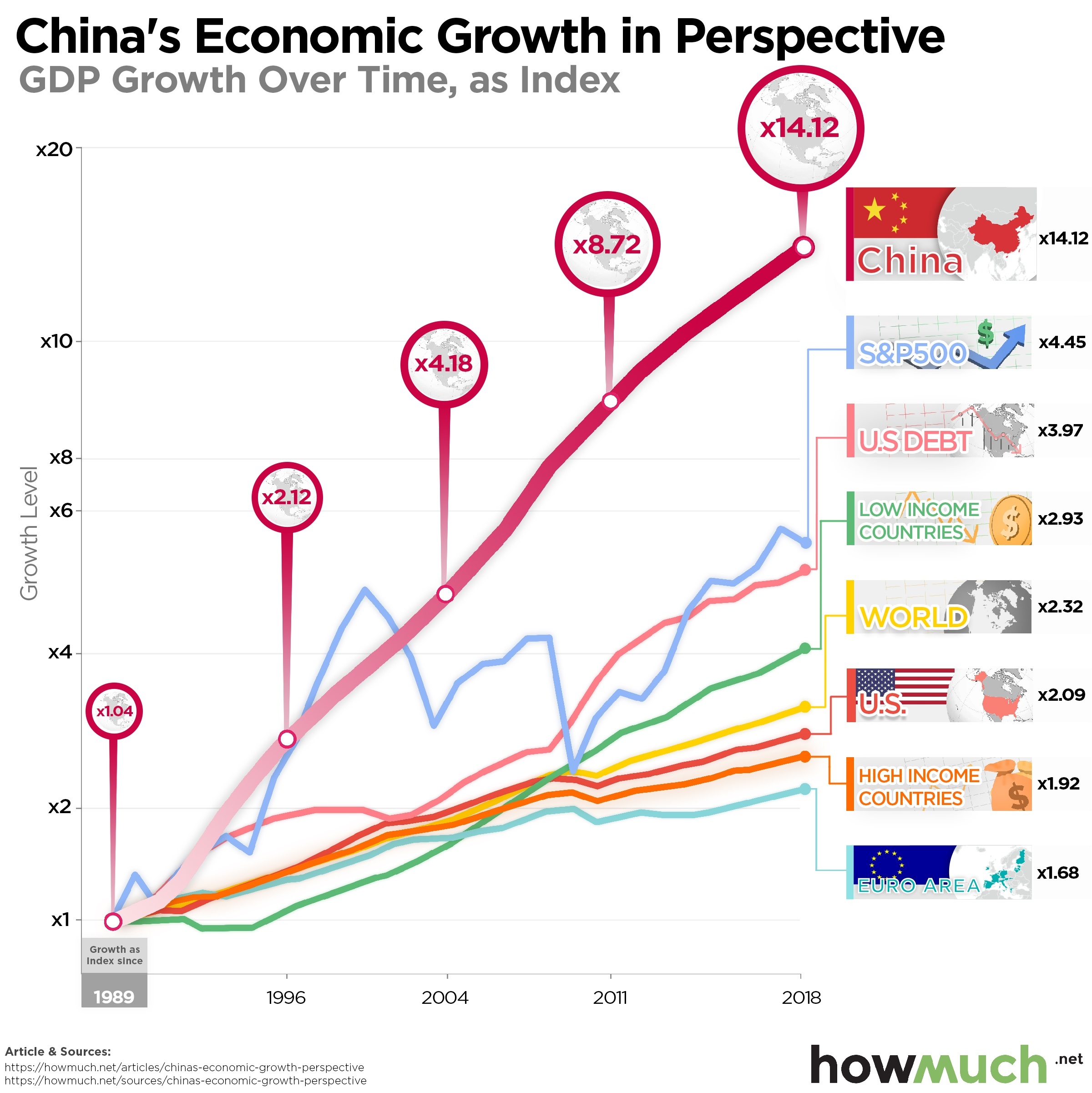

Bmw And Porsches China Challenges A Growing Trend

May 17, 2025

Bmw And Porsches China Challenges A Growing Trend

May 17, 2025 -

Deuda Estudiantil El Departamento De Educacion Toma Medidas Drasticas

May 17, 2025

Deuda Estudiantil El Departamento De Educacion Toma Medidas Drasticas

May 17, 2025

Latest Posts

-

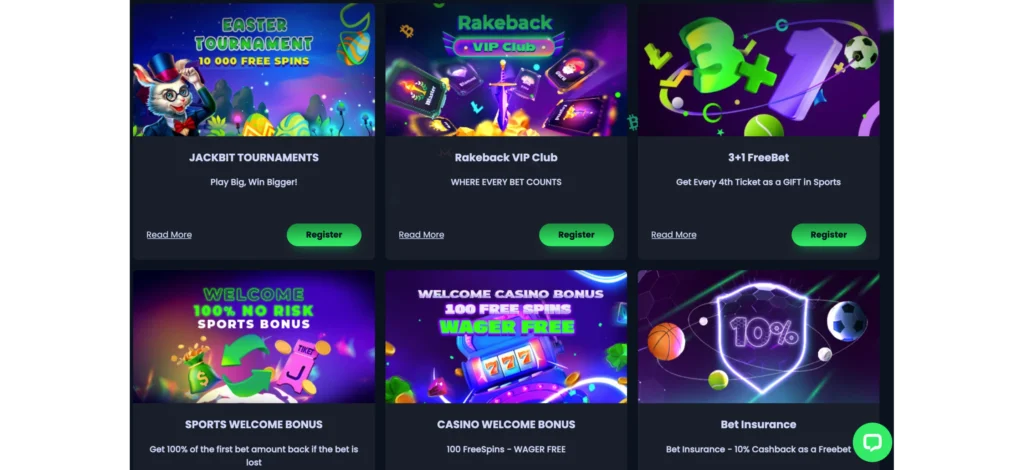

Jack Bit Casino A Detailed Review Of Its Bitcoin Withdrawal Process

May 17, 2025

Jack Bit Casino A Detailed Review Of Its Bitcoin Withdrawal Process

May 17, 2025 -

Best Crypto Casinos 2024 Jack Bits Instant Withdrawal Feature

May 17, 2025

Best Crypto Casinos 2024 Jack Bits Instant Withdrawal Feature

May 17, 2025 -

Jack Bit Review Top Bitcoin Casino With Instant Withdrawals

May 17, 2025

Jack Bit Review Top Bitcoin Casino With Instant Withdrawals

May 17, 2025 -

Laporan Keuangan Alat Penting Untuk Pengambilan Keputusan Bisnis Yang Efektif

May 17, 2025

Laporan Keuangan Alat Penting Untuk Pengambilan Keputusan Bisnis Yang Efektif

May 17, 2025 -

Panduan Lengkap Mengelola Dan Menganalisis Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025

Panduan Lengkap Mengelola Dan Menganalisis Laporan Keuangan Untuk Bisnis Kecil Dan Menengah

May 17, 2025