Financial Planning For Homeownership With Existing Student Loans

Table of Contents

Assessing Your Current Financial Situation

Before embarking on the exciting journey of homeownership, you need a clear understanding of your current financial standing. This involves evaluating your student loan debt, assessing your credit score, and creating a realistic budget.

Understanding Your Student Loan Debt

Knowing the specifics of your student loan debt is crucial. This includes identifying the loan types (federal or private), understanding the interest rates, and familiarizing yourself with your repayment plan (standard, income-driven, etc.). Understanding these details will help you determine your monthly payments and total interest paid over the life of the loans.

- Gather your information: Log in to your loan servicer websites to access your loan details and obtain official statements. Many servicers offer online portals with detailed information.

- Use online calculators: Several free online tools can help you calculate your monthly payments and the total interest you’ll pay over the life of your loans. This allows you to accurately project your future cash flow.

Evaluating Your Credit Score

Your credit score plays a vital role in securing a mortgage and obtaining favorable interest rates. A higher credit score typically translates to better loan terms and lower monthly payments.

- Check your credit score: Several free resources, including many credit card websites and annualcreditreport.com, allow you to check your credit score.

- Factors impacting your credit score: Your payment history, debt utilization (the amount of credit you're using compared to your total available credit), length of credit history, and new credit applications are all key factors that influence your score. Aim for responsible credit management to improve your score.

Creating a Realistic Budget

Developing a comprehensive budget is essential to track your income, expenses, and savings progress toward homeownership. This will help you determine how much you can realistically afford to spend on a mortgage.

- Budgeting methods: Consider methods like the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) or zero-based budgeting (allocating every dollar to a specific category).

- Budgeting tools: Numerous free budgeting tools and apps are available to simplify the process and track your spending effectively.

Developing a Homeownership Savings Plan

With a clear picture of your financial situation, it's time to develop a targeted savings plan for homeownership. This involves determining affordability, prioritizing debt reduction, and diligently saving for a down payment.

Determining Affordability

Before house hunting, it's vital to determine how much you can realistically afford. Consider not only the mortgage payment but also property taxes, homeowner's insurance, and potential maintenance costs. Your debt-to-income ratio (DTI), which is the percentage of your gross monthly income that goes towards debt payments, is a crucial factor lenders consider.

- Use online mortgage calculators: Many online calculators can help you estimate your monthly mortgage payments based on different loan amounts, interest rates, and loan terms.

- Get pre-qualified for a mortgage: Pre-qualification doesn't guarantee loan approval but provides a realistic estimate of how much you can borrow, giving you a better idea of your budget.

Prioritizing Debt Reduction

Strategically managing your student loan debt while saving for a down payment requires a well-defined plan. Consider these options:

- Accelerated repayment plans: Making extra payments on your student loans can significantly reduce the principal balance and interest paid, freeing up more money for your down payment.

- Refinancing options: If your credit score has improved, refinancing your student loans at a lower interest rate could reduce your monthly payments.

- Loan forgiveness programs: Explore whether you qualify for any federal student loan forgiveness programs that could reduce your overall debt burden.

Saving for a Down Payment

A substantial down payment is crucial for securing a mortgage with favorable terms. A larger down payment often means lower monthly payments and potentially a lower interest rate.

- High-yield savings accounts: Maximize your savings by placing funds in high-yield savings accounts to earn interest on your savings.

- Investment accounts: Consider investing a portion of your savings in low-risk investment accounts to potentially increase your savings faster.

- Automated savings: Utilize budgeting apps that offer automated savings features, transferring a set amount from your checking account to your savings account regularly.

Navigating the Mortgage Process

Once you’ve made progress on your savings and debt reduction goals, it's time to navigate the mortgage process. This involves choosing the right mortgage, improving your creditworthiness, and working with a reputable lender.

Choosing the Right Mortgage

Several mortgage types are available, each with its own advantages and disadvantages.

- Fixed-rate mortgages: These offer consistent monthly payments over the life of the loan.

- Adjustable-rate mortgages (ARMs): These have interest rates that adjust periodically, potentially leading to fluctuating payments.

- FHA and VA loans: These government-backed loans often have more lenient requirements but may come with additional fees. Consider your specific needs and financial situation when making your choice.

Improving Your Credit Score Before Application

Before applying for a mortgage, take steps to improve your creditworthiness.

- On-time payments: Consistent on-time payments are crucial for a good credit score.

- Pay down high credit utilization: Keep your credit card balances low relative to your credit limit.

- Correct credit report errors: Check your credit reports for any errors and dispute them if necessary.

Working with a Mortgage Lender

Finding a reputable mortgage lender is vital for a smooth homebuying process.

- Shop around for rates: Compare interest rates and fees from multiple lenders before committing.

- Get pre-approved: Pre-approval demonstrates your financial readiness to lenders and strengthens your offer when making a purchase.

Conclusion

Achieving homeownership while managing student loan debt requires meticulous financial planning, disciplined saving, and strategic debt management. By carefully assessing your financial situation, developing a robust savings plan, and navigating the mortgage process strategically, you can turn your homeownership dreams into a reality. Remember, it's a marathon, not a sprint. Consistent effort and smart financial choices will pave the way to success. Start your homeownership journey today! Begin by assessing your current financial situation and creating a realistic budget using a free budgeting app. Plan your financial future with confidence and master your finances for successful homeownership! [Link to a mortgage calculator or budgeting app].

Featured Posts

-

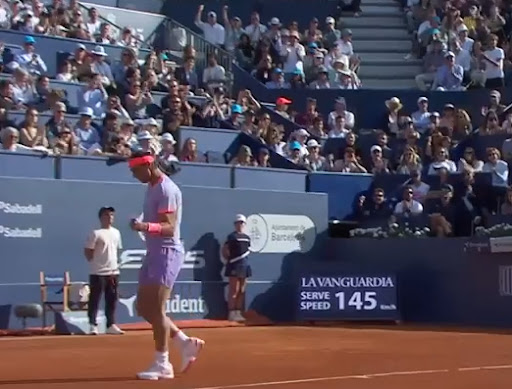

La Victoria De Alcaraz En Montecarlo Una Explosion De Alegria

May 17, 2025

La Victoria De Alcaraz En Montecarlo Una Explosion De Alegria

May 17, 2025 -

Phone Battery Costs Soar A Direct Result Of Trump Tariffs

May 17, 2025

Phone Battery Costs Soar A Direct Result Of Trump Tariffs

May 17, 2025 -

Network18 Media And Investments Stock Price Charts And Forecasts For April 21 2025

May 17, 2025

Network18 Media And Investments Stock Price Charts And Forecasts For April 21 2025

May 17, 2025 -

Ryujinx Emulator Development Halted Nintendos Impact

May 17, 2025

Ryujinx Emulator Development Halted Nintendos Impact

May 17, 2025 -

Jackbit A Leading Crypto Casino For 2025 And Beyond

May 17, 2025

Jackbit A Leading Crypto Casino For 2025 And Beyond

May 17, 2025

Latest Posts

-

Rune Osvaja Barselonu Alkarasova Povreda U Prvom Planu

May 17, 2025

Rune Osvaja Barselonu Alkarasova Povreda U Prvom Planu

May 17, 2025 -

Barselona Finale Rune Trijumfuje Nad Povredenim Alkarasom

May 17, 2025

Barselona Finale Rune Trijumfuje Nad Povredenim Alkarasom

May 17, 2025 -

Alkaras Vs Rune Detaljna Analiza Finala Barselone

May 17, 2025

Alkaras Vs Rune Detaljna Analiza Finala Barselone

May 17, 2025 -

I Megaloprepis Teleti Ypodoxis Tramp Stin Saoydiki Aravia

May 17, 2025

I Megaloprepis Teleti Ypodoxis Tramp Stin Saoydiki Aravia

May 17, 2025 -

Rune Pobeda U Barseloni Alkarasov Povratak Ugrozen

May 17, 2025

Rune Pobeda U Barseloni Alkarasov Povratak Ugrozen

May 17, 2025