India Market Update: Tailwinds Driving Nifty's Upward Momentum

Table of Contents

Strong Domestic Economic Fundamentals

India's robust domestic economy is a cornerstone of the Nifty's impressive performance. Strong consumption, investment growth, and a healthy services sector are key drivers of this upward trajectory.

Robust Consumption

Consumer spending in India is booming, reflecting a surge in disposable incomes and positive consumer sentiment. Retail sales figures consistently exceed expectations, indicating a vibrant consumer market.

- FMCG Sector Growth: The fast-moving consumer goods (FMCG) sector is experiencing significant growth, driven by increased demand for essential and non-essential items.

- Durable Goods Sales Surge: Sales of durable goods, such as automobiles and consumer electronics, are also rising, indicating increased consumer confidence and purchasing power.

- Rising Disposable Incomes: Factors such as wage growth and government initiatives aimed at boosting rural incomes are contributing to the rise in disposable incomes.

Investment Growth

Capital expenditure is experiencing a significant upswing, fueled by both public and private sector investments. This surge reflects a renewed confidence in India's economic prospects.

- Infrastructure Development: Massive investments in infrastructure projects, including roads, railways, and ports, are creating significant employment opportunities and stimulating economic activity. The government's ambitious infrastructure development plans are a key driver here.

- Government Initiatives: Various government initiatives aimed at encouraging private sector investment are proving highly effective, leading to a significant increase in capital expenditure.

- Robust FDI Inflows: Foreign Direct Investment (FDI) inflows are consistently high, further bolstering investment growth and demonstrating global confidence in the Indian economy.

Healthy Services Sector

India's services sector, a significant contributor to the nation's GDP, continues to exhibit impressive resilience and growth. This sector acts as a major engine for job creation and economic expansion.

- IT Sector Boom: The IT sector remains a powerhouse, driven by global demand for software services and technological innovation.

- BFSI Sector Strength: The Banking, Financial Services, and Insurance (BFSI) sector is thriving, supported by increasing financial inclusion and a growing middle class.

- Tourism Sector Revival: The tourism sector, after a period of disruption, is witnessing a strong recovery, contributing significantly to economic growth and employment.

Positive Global Sentiment Towards India

The global community increasingly views India favorably, significantly impacting investor sentiment and FPI flows. This positive global outlook further strengthens the Nifty's upward momentum.

Favorable Geopolitical Factors

India's strategic geopolitical positioning and its growing relationships with various countries contribute to a positive global perception.

- Strategic Partnerships: India's strategic partnerships with key global players are enhancing its geopolitical influence and attracting foreign investment.

- Diversified Trade Relations: India's efforts to diversify its trade relations, reducing reliance on specific countries, contribute to its economic stability and resilience.

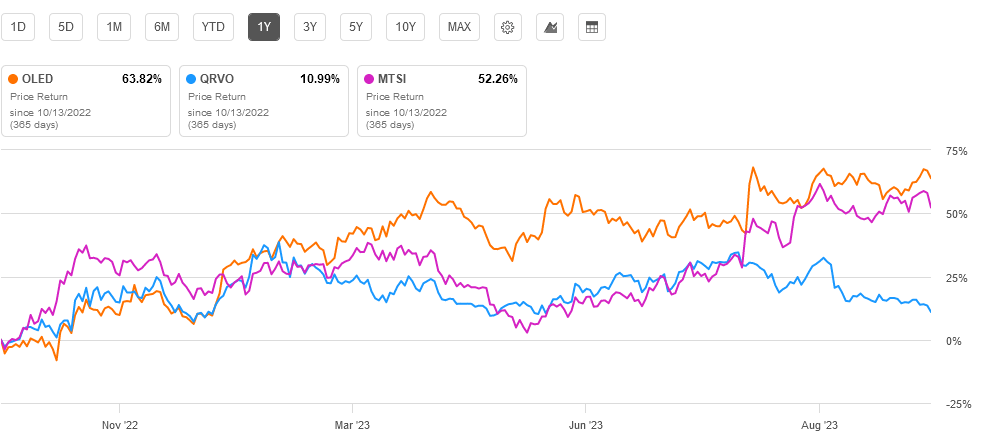

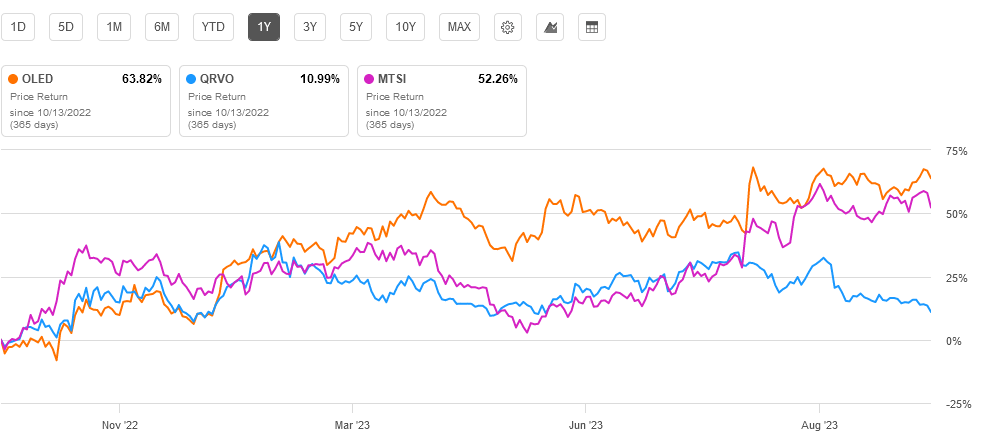

Increased Foreign Portfolio Investment (FPI)

Significant inflows of Foreign Portfolio Investment (FPI) are pouring into the Indian stock market, bolstering the Nifty's performance.

- Attractive Valuations: Attractive valuations compared to other emerging markets make India an attractive investment destination.

- Positive Economic Outlook: The positive economic outlook for India further encourages increased FPI inflows.

- Data on FPI Inflows: Recent data clearly shows a substantial rise in FPI inflows, directly impacting the Nifty's upward trajectory.

Manufacturing Sector Growth

India's manufacturing sector is experiencing robust growth, contributing significantly to overall economic expansion and strengthening the Nifty's performance.

- Make in India Initiative: The "Make in India" initiative is successfully attracting foreign investment and promoting domestic manufacturing.

- Automotive Sector Growth: The automotive sector is a significant driver of manufacturing growth, with increasing domestic demand and exports.

- Pharmaceutical Sector Expansion: The pharmaceutical sector is expanding rapidly, benefiting from both domestic demand and global exports.

Government Policies and Reforms

Pro-growth government policies and reforms are playing a crucial role in fostering economic growth and positively impacting the stock market, contributing significantly to the Nifty's upward momentum.

Pro-Growth Reforms

Several crucial reforms introduced by the government are streamlining the business environment and fostering economic growth.

- Tax Reforms: Recent tax reforms have simplified the tax structure, making it more attractive for businesses to operate in India.

- Ease of Doing Business Initiatives: Government initiatives to improve the ease of doing business are attracting significant foreign investment.

- Regulatory Reforms: Various regulatory reforms across multiple sectors are enhancing efficiency and competitiveness.

Infrastructure Development

The government's strong focus on infrastructure development is creating a positive ripple effect across various sectors, significantly boosting economic activity and market sentiment.

- Road and Rail Network Expansion: Massive investments in expanding India's road and rail networks are improving logistics and connectivity.

- Port Modernization: Modernization of ports is enhancing trade efficiency and reducing transportation costs.

- Digital Infrastructure Development: Investment in digital infrastructure is boosting productivity and facilitating economic growth.

Conclusion: Sustaining the Upward Momentum of the Nifty

In summary, the Nifty's upward momentum is a result of a powerful combination of strong domestic fundamentals, positive global sentiment, and supportive government policies. While external risks always exist, the current trajectory points towards continued growth in the Indian market. However, it’s essential to maintain a balanced perspective and acknowledge potential challenges.

To stay abreast of the evolving dynamics of the Indian market and continue monitoring the factors driving the Nifty's upward momentum, stay tuned for our next India market update. Subscribe to our newsletter for regular updates and in-depth analysis to make informed investment decisions.

Featured Posts

-

Wildfire Gambling A Reflection Of Our Times The La Case Study

Apr 24, 2025

Wildfire Gambling A Reflection Of Our Times The La Case Study

Apr 24, 2025 -

Tesla Q1 Earnings Significant Decrease Linked To Musks Controversies

Apr 24, 2025

Tesla Q1 Earnings Significant Decrease Linked To Musks Controversies

Apr 24, 2025 -

Ohio Derailment Aftermath Toxic Chemical Contamination In Buildings For Months

Apr 24, 2025

Ohio Derailment Aftermath Toxic Chemical Contamination In Buildings For Months

Apr 24, 2025 -

Od Djevojcice Do Ljepotice Nevjerojatan Razvoj Kceri Johna Travolte

Apr 24, 2025

Od Djevojcice Do Ljepotice Nevjerojatan Razvoj Kceri Johna Travolte

Apr 24, 2025 -

People Betting On La Wildfires A Disturbing Trend

Apr 24, 2025

People Betting On La Wildfires A Disturbing Trend

Apr 24, 2025