Understanding The Bitcoin Rebound: Is This A Long-Term Trend?

Table of Contents

Analyzing the Recent Bitcoin Price Surge

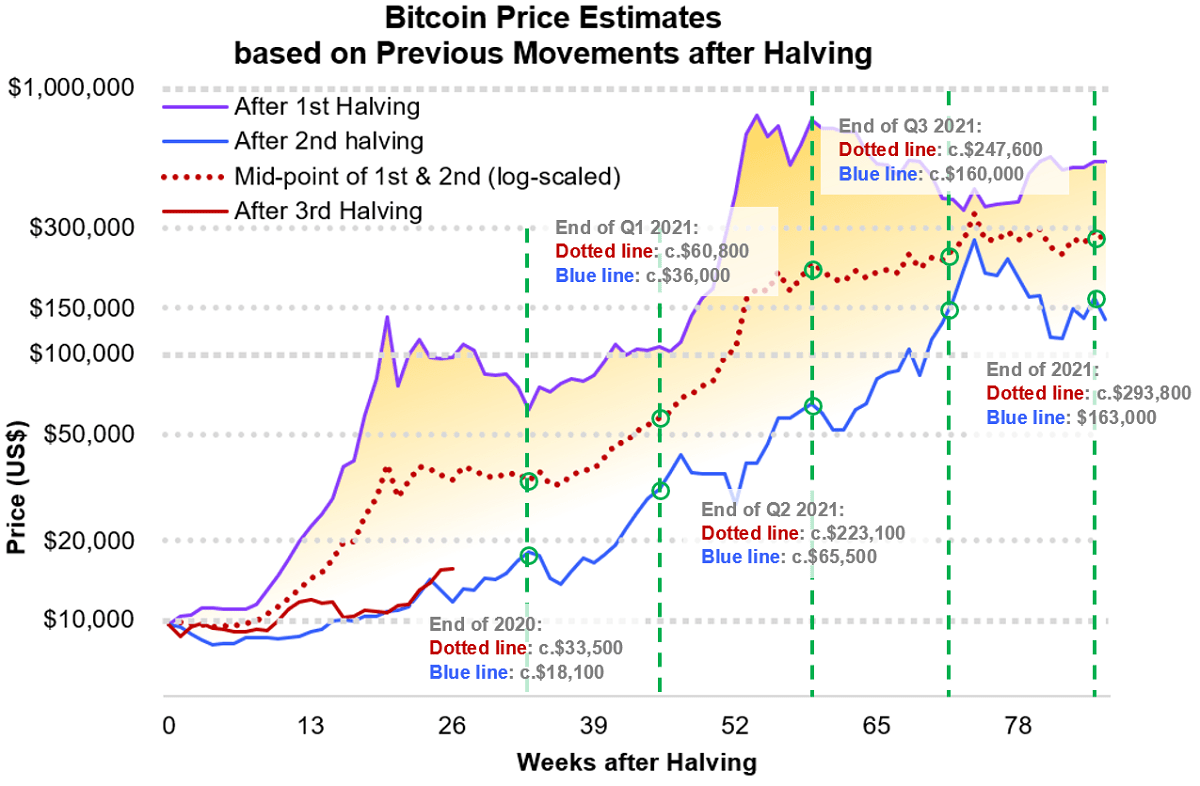

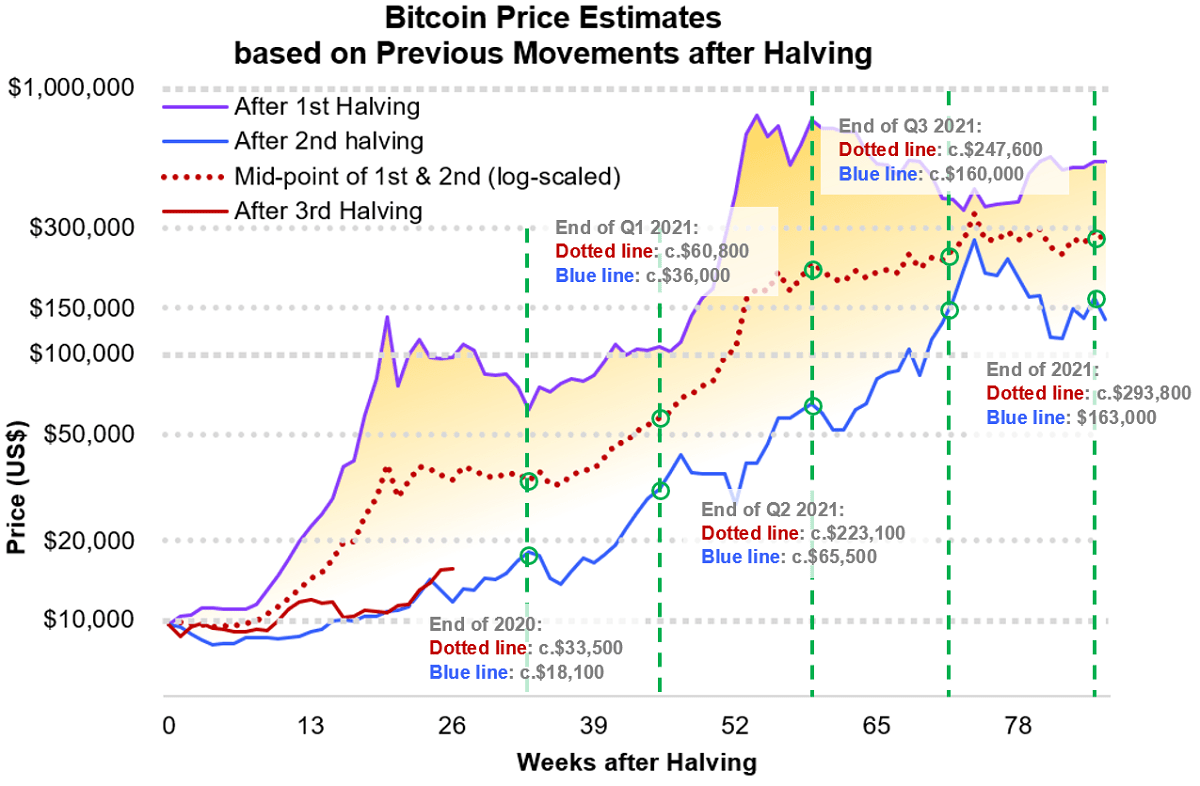

The Bitcoin price witnessed a remarkable rebound, climbing from approximately $25,000 to over $30,000 within a week. This represents a significant percentage increase in a relatively short timeframe. (A graph showing the Bitcoin price chart from the relevant period should be inserted here). This Bitcoin price chart clearly illustrates the magnitude of the recent surge. Analyzing this Bitcoin price analysis alongside the Bitcoin market cap provides a broader understanding of the market's overall health.

- Significant contributing factors: The rebound can be attributed to several factors, including increased institutional investment, positive regulatory developments in certain jurisdictions, and a generally improving market sentiment fueled by renewed confidence in the cryptocurrency sector.

- Triggering events: Specific events, such as announcements of new Bitcoin ETFs or positive statements from influential figures in the finance world, can often act as catalysts for such price increases.

- Comparison to previous fluctuations: Comparing this rebound to previous Bitcoin price fluctuations reveals similarities in terms of the speed and magnitude of the price movement, suggesting that these rapid gains are not entirely unprecedented.

Factors Contributing to a Potential Long-Term Bitcoin Trend

Several factors suggest that this Bitcoin rebound might be part of a longer-term upward trend.

-

Macro-economic factors: Concerns about inflation and the instability of traditional financial markets continue to drive investors towards Bitcoin as a potential hedge against inflation. Bitcoin's decentralized nature and limited supply make it an attractive alternative asset.

-

Institutional adoption: The growing acceptance of Bitcoin by institutional investors is a strong indicator of its increasing legitimacy and potential for long-term growth. Large-scale investments from companies and financial institutions provide a significant level of support for the Bitcoin price.

-

Store of value: Bitcoin's increasing acceptance as a store of value, alongside gold and other traditional assets, strengthens its position in the broader investment landscape. This perception contributes significantly to the long-term demand for Bitcoin.

- Regulatory clarity: Increasing regulatory clarity in various jurisdictions fosters stability and reduces uncertainty within the cryptocurrency market, making it more attractive to institutional and retail investors.

- Technological advancements: Technological improvements such as the Lightning Network enhance Bitcoin's scalability and transaction speed, addressing some previous limitations and improving its usability.

- Retail investor demand: The growing number of retail investors entering the market further contributes to the increased demand for Bitcoin.

Potential Risks and Challenges to Sustaining the Rebound

Despite the positive signals, several factors could hinder the sustainability of the Bitcoin rebound.

-

Market volatility: The cryptocurrency market remains inherently volatile, subject to significant price swings driven by speculation, news events, and market sentiment. This Bitcoin volatility poses a considerable risk.

-

Regulatory hurdles: Changes in government regulations, or a lack of clear regulatory frameworks, can significantly impact Bitcoin's price and market stability. The threat of tighter Bitcoin regulation remains a concern for some.

-

Market manipulation: The risk of market manipulation and speculative trading remains a significant concern, potentially leading to artificial price increases and subsequent corrections.

- Market corrections: The possibility of a market correction or downturn, even after a significant price surge, remains a realistic prospect.

- Negative news events: Negative news, such as security breaches or regulatory crackdowns, can trigger sharp price drops.

- Competition from altcoins: The competition from other cryptocurrencies (altcoins) vying for market share can put downward pressure on Bitcoin's price.

Predicting the Future of Bitcoin: Long-Term Outlook

Predicting Bitcoin's future price with certainty is impossible. Various models exist, but they all have limitations. However, a balanced perspective considers both positive and negative factors.

-

Price prediction models: While price prediction models offer potential insights, their accuracy is limited by the inherent volatility of the market and the complexity of the factors influencing Bitcoin's price.

-

Expert opinions: While expert opinions and market forecasts can be informative, it's crucial to consider their potential biases and the limitations of their predictive capabilities.

- Positive factors: Continued institutional adoption, growing regulatory clarity, and increasing demand from both institutional and retail investors all suggest a potential for sustained long-term growth.

- Negative factors: The potential for regulatory crackdowns, market manipulation, and competition from other cryptocurrencies pose significant risks.

- Potential price targets: Providing specific price targets is highly speculative; however, considering the current market trends and the factors discussed above, a cautious optimistic long-term outlook might be warranted.

Conclusion: Understanding the Bitcoin Rebound – What's Next?

The recent Bitcoin rebound presents a complex picture. While positive factors such as increased institutional investment and growing regulatory clarity suggest a potential for long-term growth, the inherent volatility of the market and the potential for negative events remain significant risks. Whether this rebound signals a sustained upward trend or a temporary surge remains to be seen. To understand the Bitcoin market better and navigate the complexities of the Bitcoin rebound, further research is crucial. Learn more about the Bitcoin rebound by exploring reputable sources and staying informed on market developments. Consider investing wisely in Bitcoin only after thorough research and understanding of the associated risks.

Featured Posts

-

La Historia Se Escribe En Verde El Betis Historico

May 08, 2025

La Historia Se Escribe En Verde El Betis Historico

May 08, 2025 -

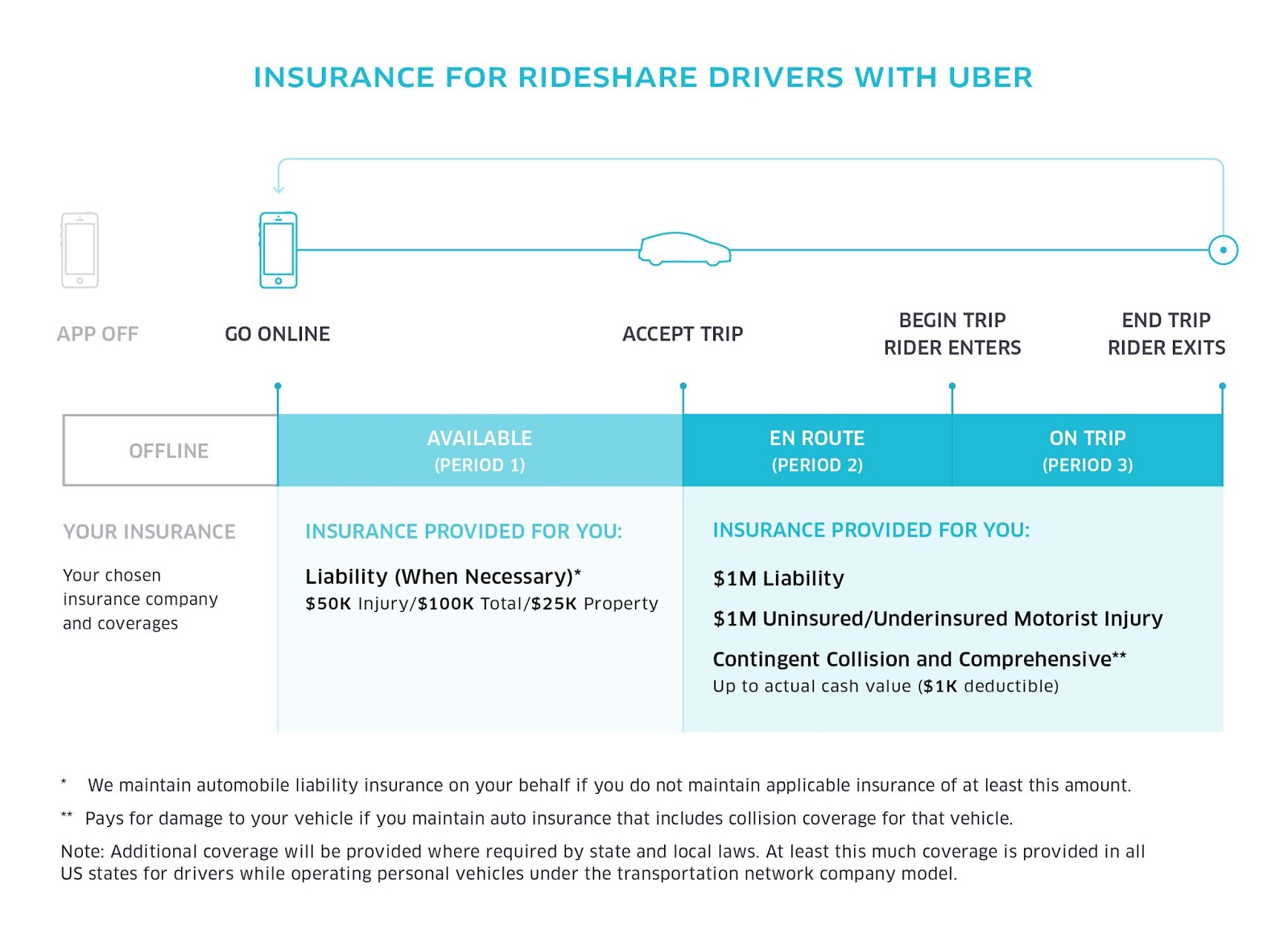

How Ubers New Driver Subscription Plan Works

May 08, 2025

How Ubers New Driver Subscription Plan Works

May 08, 2025 -

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025 -

Bitcoin And Ethereum Options Expiration Billions At Stake Expect Market Swings

May 08, 2025

Bitcoin And Ethereum Options Expiration Billions At Stake Expect Market Swings

May 08, 2025 -

Superman My Reaction To The New Footage Krypto And A Shocking Twist

May 08, 2025

Superman My Reaction To The New Footage Krypto And A Shocking Twist

May 08, 2025