Understanding Stretched Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Key Findings on Overvalued Stocks

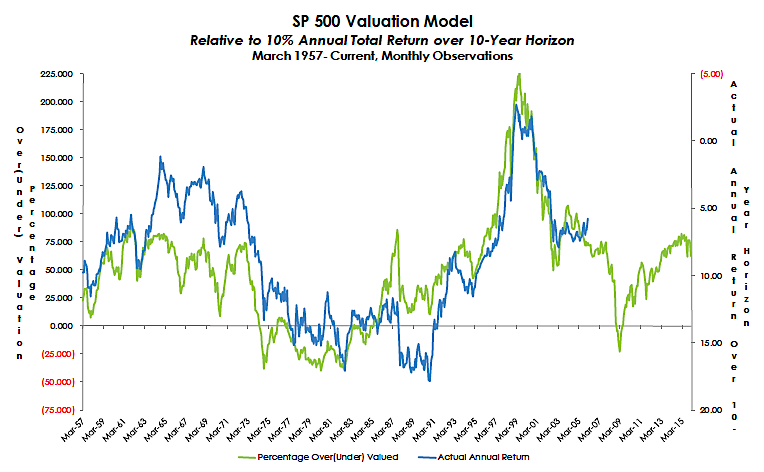

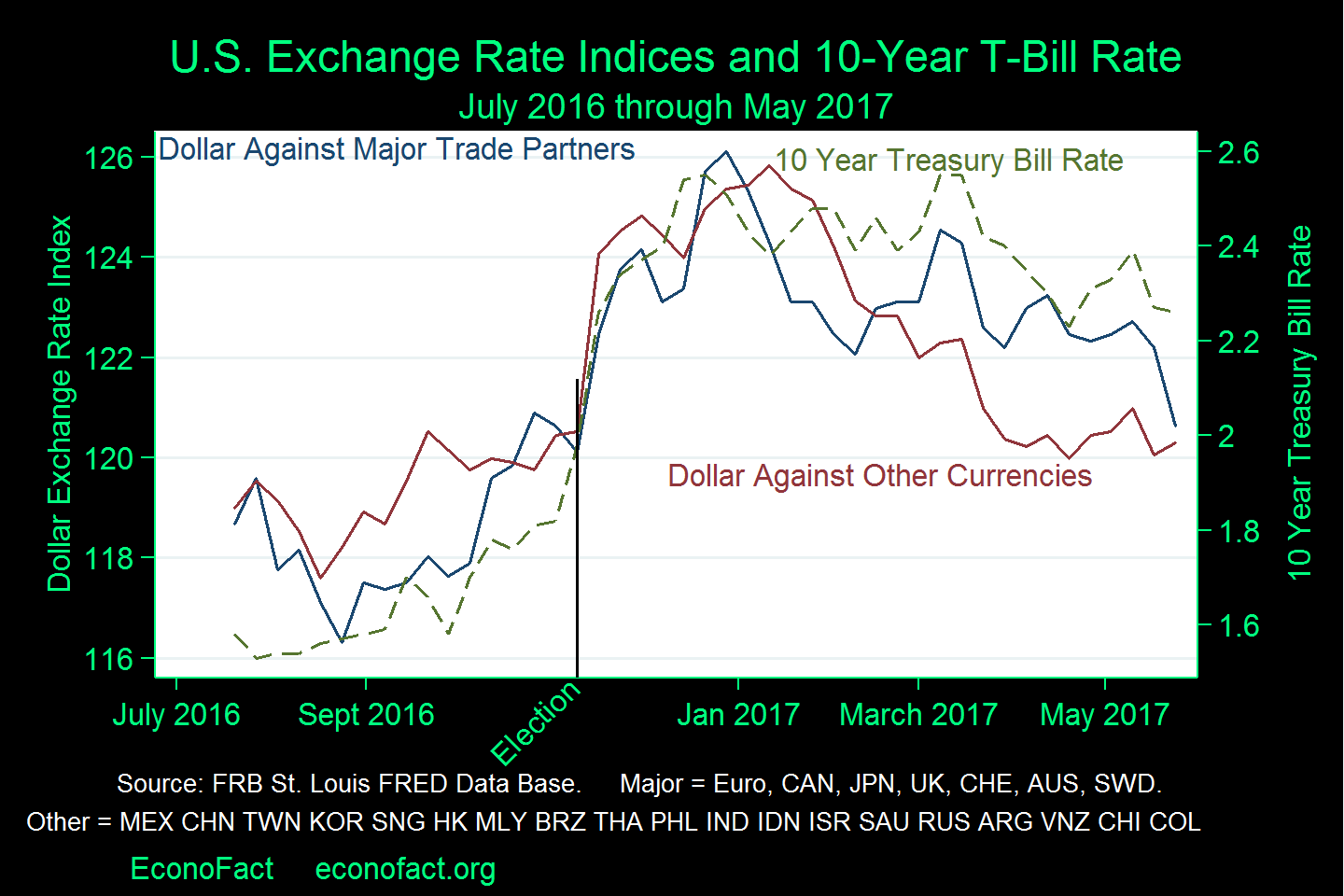

BofA Global Research has published several reports recently expressing concern about current market valuations. Their analysis utilizes various metrics, including price-to-earnings ratios (P/E), price-to-sales ratios (P/S), and other valuation multiples, to assess the overall health and potential risks within the market.

- Specific P/E ratios cited by BofA for various sectors: BofA's recent reports have highlighted significantly elevated P/E ratios across various sectors, particularly in technology and consumer discretionary. Some sectors show P/E ratios exceeding historical averages by a considerable margin, indicating potentially overvalued stocks.

- Comparison of current valuations to historical averages: BofA's analysis compares current valuation multiples to historical averages over the past several decades. This comparison reveals that many sectors are trading at levels rarely seen except during periods of significant market exuberance preceding corrections.

- Mention of any specific companies identified as overvalued: While BofA typically avoids naming individual companies publicly as "overvalued," their reports often cite specific sectors and industry trends which indirectly point to potentially overvalued companies within those groups. This approach focuses on broad market trends rather than individual stock picking.

- Summary of BofA's overall assessment of market risk: BofA's overall assessment consistently points to a heightened level of market risk due to these stretched valuations. They emphasize the increased potential for a market correction or even a more significant downturn.

The implications of these high valuations are significant for investors. High valuation multiples suggest that the market is pricing in substantial future growth, and any disappointment in earnings or economic growth could lead to a sharp decline in stock prices. BofA's methodology relies on rigorous quantitative analysis combined with qualitative assessments of macroeconomic conditions and industry trends to arrive at its conclusions.

Factors Contributing to Stretched Valuations

Several macroeconomic factors have contributed to these stretched valuations. The interplay of these factors creates a complex market environment that requires careful consideration.

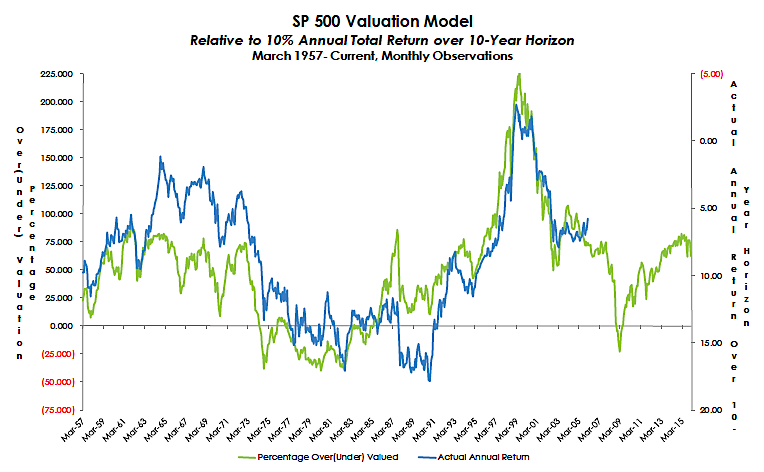

- Low interest rates and their impact on equity valuations: Historically low interest rates have made borrowing cheaper for companies and pushed investors towards higher-yielding assets like equities, thus driving up stock prices. This "search for yield" phenomenon contributes significantly to inflated valuations.

- The role of quantitative easing (QE) and other monetary policies: Central banks' policies, including quantitative easing, have injected significant liquidity into the financial system, further fueling demand for stocks and pushing up valuations. This artificial boost to liquidity can inflate asset bubbles, increasing the risk of a subsequent correction.

- Impact of strong corporate earnings (or lack thereof): While corporate earnings have played a role, the extent to which earnings justify current valuations is a key point of debate. In some sectors, strong earnings growth has been a primary driver, while in others, valuations have outpaced earnings growth significantly.

- Influence of technological advancements and growth stocks: The rapid growth of technology companies and the allure of disruptive innovation have driven substantial investment in growth stocks, boosting valuations even further. High valuations in this sector influence the overall market perception.

- Investor sentiment and speculation: Positive investor sentiment and increased speculation have contributed to higher stock prices, pushing valuations beyond levels supported by fundamental analysis. This speculative element increases the market's vulnerability to negative news or shifts in investor sentiment.

The combination of these factors has created a market environment characterized by high valuations and increased risk.

Potential Risks and Opportunities in a High-Valuation Market

Investing in a market with stretched valuations presents significant risks.

- Risk of a market correction or crash: The higher the valuations, the greater the potential for a sharp market correction or even a crash if investor sentiment shifts or unexpected economic events occur.

- Increased volatility and potential for significant losses: A market with stretched valuations is inherently more volatile, meaning that the potential for both gains and losses is magnified.

- Difficulty in identifying undervalued stocks: In a generally overvalued market, it becomes more challenging to identify truly undervalued stocks that offer attractive risk-adjusted returns.

- The impact of rising interest rates: Rising interest rates can reduce the attractiveness of equities relative to bonds, potentially leading to a decline in stock prices. This is a particular concern in a high-valuation market.

- Potential for inflation to erode returns: Inflation can erode the purchasing power of investment returns, further reducing the attractiveness of equities in a high-valuation environment.

However, opportunities still exist for savvy investors. Risk mitigation strategies are crucial. This might involve focusing on companies with strong fundamentals and a history of consistent earnings growth, even if their valuations are not exceptionally low. Diversification across different asset classes and sectors can also help to reduce overall portfolio risk. Alternative investments, such as real estate or commodities, could provide a hedge against market volatility.

BofA's Recommendations for Investors

BofA typically advises a cautious approach in a high-valuation market.

- Suggestions for portfolio diversification: BofA strongly recommends diversification across different asset classes (stocks, bonds, alternatives) and sectors to reduce overall portfolio risk.

- Recommendations on asset allocation: They advise investors to carefully consider their risk tolerance and adjust their asset allocation accordingly. This may involve reducing equity exposure in favor of more conservative investments.

- Advice on sector-specific investments: BofA might suggest focusing on sectors that are less overvalued or that offer better prospects for future growth, even if valuations are still relatively high.

- Cautions against speculative investing: Given the heightened risk, BofA cautions against speculative investments in highly volatile stocks or sectors.

BofA's recommendations are tailored to specific investor profiles and risk tolerances. They usually emphasize the importance of a long-term investment horizon and a well-defined investment strategy.

Conclusion

BofA's analysis highlights the significant risks associated with stretched stock market valuations. Factors such as low interest rates, quantitative easing, and strong investor sentiment have contributed to inflated valuations across many sectors. While opportunities may exist for skilled investors, the potential for a market correction or crash is substantial. BofA recommends a cautious approach, emphasizing portfolio diversification, appropriate asset allocation, and a focus on companies with strong fundamentals. Understanding stretched stock market valuations is crucial for making informed investment decisions. Stay informed about BofA's ongoing research and analysis to navigate the complexities of this market and make sound investment choices. Consider consulting a financial advisor to develop a personalized investment strategy tailored to your risk tolerance and financial goals in this environment of potentially stretched stock market valuations.

Featured Posts

-

Michael Schumacher Helicoptero Privado De Mallorca A Suiza Por Su Nieta

May 20, 2025

Michael Schumacher Helicoptero Privado De Mallorca A Suiza Por Su Nieta

May 20, 2025 -

Get To Know The Eurovision Song Contest 2025 Participants

May 20, 2025

Get To Know The Eurovision Song Contest 2025 Participants

May 20, 2025 -

8 Mars A Biarritz Programme Des Evenements Parcours De Femmes

May 20, 2025

8 Mars A Biarritz Programme Des Evenements Parcours De Femmes

May 20, 2025 -

Dow Futures And Dollar Decline Following Moodys Rating Cut

May 20, 2025

Dow Futures And Dollar Decline Following Moodys Rating Cut

May 20, 2025 -

Understanding The Countrys Evolving Business Landscape Key Growth Areas

May 20, 2025

Understanding The Countrys Evolving Business Landscape Key Growth Areas

May 20, 2025

Latest Posts

-

Analyzing The Controversy Wayne Gretzkys Loyalty And His Relationship With Trump

May 20, 2025

Analyzing The Controversy Wayne Gretzkys Loyalty And His Relationship With Trump

May 20, 2025 -

The Wayne Gretzky Loyalty Debate Examining The Impact Of Trumps Policies On Canada Us Relations

May 20, 2025

The Wayne Gretzky Loyalty Debate Examining The Impact Of Trumps Policies On Canada Us Relations

May 20, 2025 -

Trumps Tariffs Gretzkys Loyalty A Canada Us Hockey Debate

May 20, 2025

Trumps Tariffs Gretzkys Loyalty A Canada Us Hockey Debate

May 20, 2025 -

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025 -

Trumps Trade Policies And Gretzkys Allegiance A Look At The Stirred Debate

May 20, 2025

Trumps Trade Policies And Gretzkys Allegiance A Look At The Stirred Debate

May 20, 2025