Dow Futures And Dollar Decline Following Moody's Rating Cut

Table of Contents

Impact on Dow Futures

The Moody's downgrade had an immediate and significant negative effect on Dow Futures contracts. The Dow futures experienced a sharp percentage decline, reflecting a widespread sell-off driven by uncertainty and negative investor sentiment. Trading volume surged as investors reacted swiftly to the news.

- Factors contributing to the decline: Investor concerns about increased borrowing costs for the US government, potential inflationary pressures, and a general erosion of confidence in the US economy all contributed to the sell-off. The uncertainty surrounding the economic outlook led many investors to adopt a risk-averse strategy, triggering a wave of selling.

- Comparison with previous market reactions: While market reactions to credit rating downgrades vary, this event showed a stronger correlation with similar past events, indicating a heightened sensitivity to such news in the current economic climate. The magnitude of the decline in Dow futures surpassed that seen in some previous instances of credit rating adjustments.

- Short-term and long-term implications for the Dow Jones Industrial Average: The short-term impact is clearly a decline in the Dow Jones Industrial Average, but the long-term implications remain uncertain. Sustained negative investor sentiment could lead to further corrections, while a swift policy response might help mitigate the damage.

- Key sectors most affected: The financial sector and government bond markets were particularly hard hit by the downgrade. Financial institutions face increased borrowing costs, and the yields on government bonds fell, reflecting decreased demand.

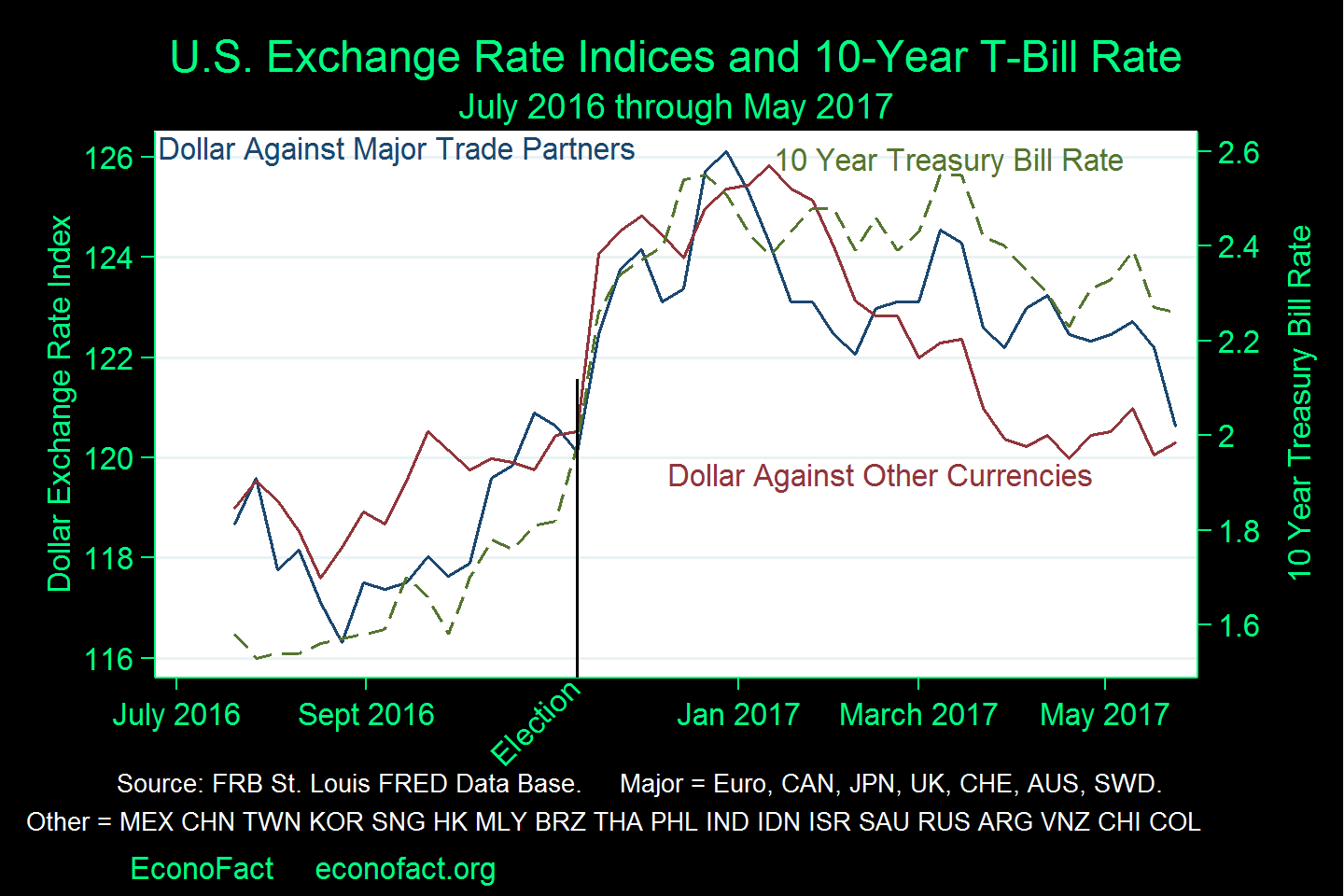

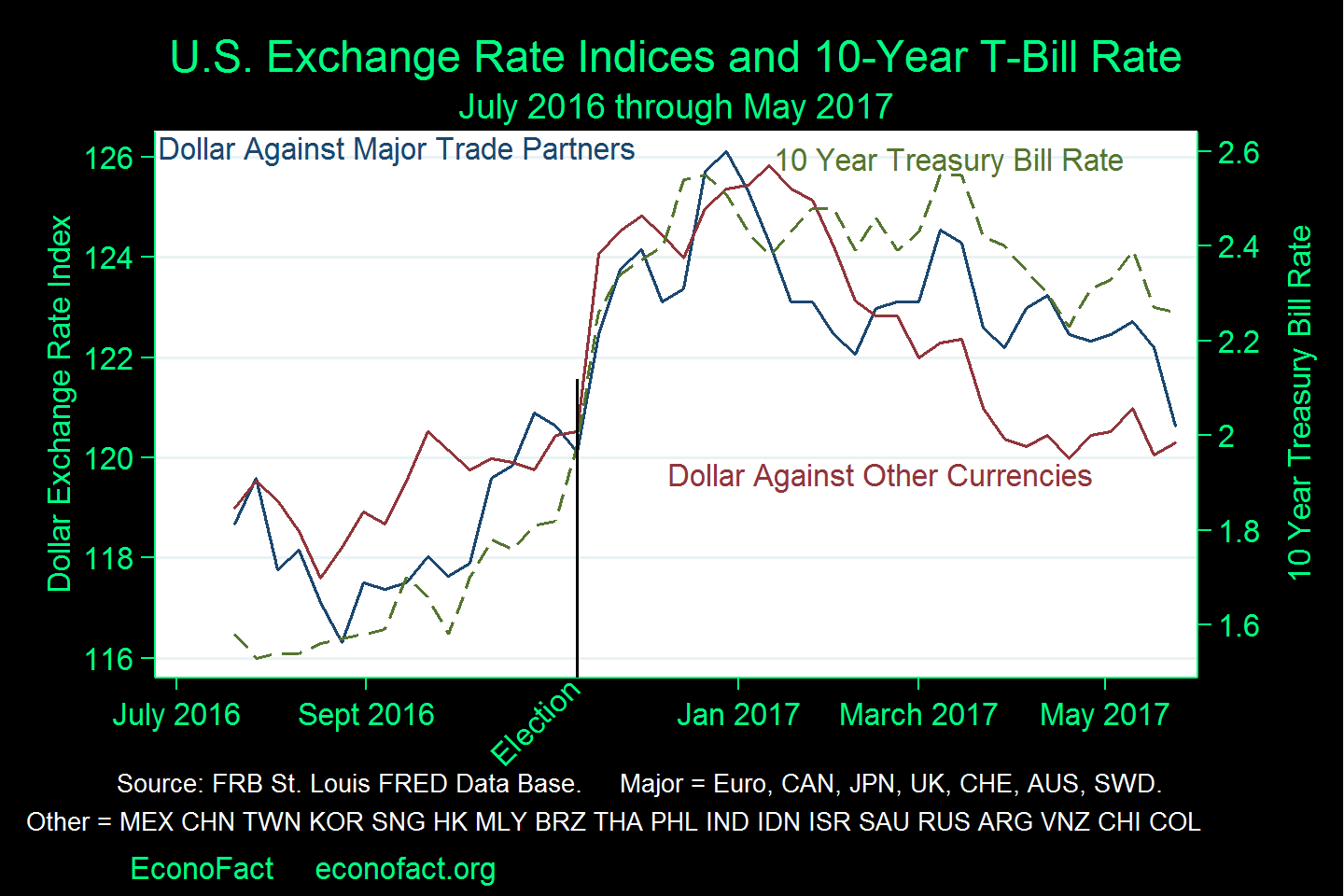

The Weakening US Dollar

The correlation between Moody's downgrade and the decline in the US dollar's value is undeniable. A credit rating downgrade reduces investor confidence in the US economy, making dollar-denominated assets less attractive. This leads to a decreased demand for the dollar in the foreign exchange market, driving down its value against other currencies.

- Impact on international trade and investment: A weaker dollar makes US exports more competitive, but it also increases the cost of imports. This can impact inflation and the trade balance. Foreign investment in the US might decrease due to the perceived higher risk.

- Comparison to other currencies: The US dollar's decline was observed against various major currencies like the Euro and the Yen, reflecting a global shift in investor preference towards perceived safer havens.

- Potential flight to safety in other currencies: Investors often seek safety in times of uncertainty, leading to capital flows towards currencies of countries perceived as more stable. This flight-to-safety phenomenon contributed to the weakening of the US dollar.

- Long-term consequences for the US dollar's global role: The long-term impact on the US dollar's dominance in the global financial system remains to be seen, but the downgrade certainly raises questions about its future stability and attractiveness as a reserve currency.

Investor Sentiment and Market Volatility

Following the downgrade, a palpable sense of uncertainty gripped the financial markets. Investor sentiment turned sharply negative, leading to increased volatility across various asset classes. Risk aversion became the dominant theme, prompting many investors to shift their portfolios towards safer investments.

- Analysis of investor behavior: Investors reacted by reducing their exposure to riskier assets, such as equities, and increasing their holdings in safer havens. Hedging strategies became more prevalent as investors sought to protect their portfolios from potential losses.

- Discussion of safe-haven assets: Demand for safe-haven assets like gold and government bonds surged as investors sought refuge from the increased market uncertainty.

- Potential for further market corrections: The market remains volatile, and the possibility of further corrections cannot be ruled out until investor confidence is restored.

- Significant shifts in market sentiment: The Moody's downgrade significantly altered market sentiment, highlighting the critical role of credit ratings in shaping investor behavior and market dynamics.

Potential Economic Consequences of the Downgrade

The Moody's rating cut has significant implications for the US economy, extending beyond the immediate impact on markets. Increased borrowing costs, reduced consumer and business confidence, and potential policy responses from the Federal Reserve are all potential ramifications.

- Effects on government borrowing costs: Higher borrowing costs for the US government will limit its ability to finance its budget deficit and could lead to reduced government spending or tax increases.

- Impact on consumer and business confidence: The downgrade could negatively impact consumer and business confidence, leading to reduced spending and investment, further slowing economic growth.

- Potential policy responses from the Federal Reserve: The Federal Reserve might respond by adjusting interest rates or implementing other monetary policies to mitigate the economic consequences. The exact response will depend on evolving economic data and the overall economic outlook.

- Long-term effects on US economic stability: The long-term implications for US economic stability depend largely on the effectiveness of policy responses and the ability of the US government to address the underlying factors that led to the downgrade.

Conclusion: Understanding the Dow Futures and Dollar Decline After Moody's Rating Cut

The Moody's credit rating downgrade clearly had a significant and immediate impact on Dow futures, causing a sharp decline. Concurrently, the US dollar weakened, reflecting a global shift in investor sentiment and a flight to safety in other currencies. This event highlights the interconnectedness of credit ratings, market dynamics, and broader economic conditions. The increased market volatility and uncertainty underscore the need for investors and policymakers to carefully consider the ramifications of this downgrade. To stay informed about Dow Jones Industrial Average future trends and the US dollar forecast, regularly check market updates and subscribe to reliable financial news sources. Further research into the long-term implications of Moody's credit rating implications on the US economy and the global financial system is crucial for understanding the evolving landscape of global finance.

Featured Posts

-

F1 Kaoset Hamilton Och Leclerc Diskvalificerade Vad Haende

May 20, 2025

F1 Kaoset Hamilton Och Leclerc Diskvalificerade Vad Haende

May 20, 2025 -

Conference De Presse 15eme Edition Du Salon International Du Livre D Abidjan

May 20, 2025

Conference De Presse 15eme Edition Du Salon International Du Livre D Abidjan

May 20, 2025 -

Kaellmanin Ja Hoskosen Puola Ura Paeaettyi

May 20, 2025

Kaellmanin Ja Hoskosen Puola Ura Paeaettyi

May 20, 2025 -

Ferrari And Leclerc Addressing The Issues Before Imola

May 20, 2025

Ferrari And Leclerc Addressing The Issues Before Imola

May 20, 2025 -

Tadi Osu U E Napad Na Detsu Shmit I Odgovornost Za Sukobe U Bi Kh

May 20, 2025

Tadi Osu U E Napad Na Detsu Shmit I Odgovornost Za Sukobe U Bi Kh

May 20, 2025

Latest Posts

-

Jalkapallo Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025 -

Huuhkajataehtien Kaellmanin Ja Hoskosen Seuraura Paeaettyy Puolassa

May 20, 2025

Huuhkajataehtien Kaellmanin Ja Hoskosen Seuraura Paeaettyy Puolassa

May 20, 2025 -

Kaellman Ja Hoskonen Puolalaisura Paeaettynyt

May 20, 2025

Kaellman Ja Hoskonen Puolalaisura Paeaettynyt

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025