The China Factor: How It Affects BMW, Porsche, And Other Automakers

Table of Contents

H2: China as a Massive Market for Luxury Automakers

H3: Unmatched Sales Volume and Growth Potential

China represents the world's largest automotive market, with particularly strong demand for luxury vehicles. BMW and Porsche, among others, see a substantial portion of their global revenue generated from Chinese sales. The continued growth in Tier 1 and Tier 2 cities, coupled with a burgeoning middle class, fuels continued expansion opportunities for these brands.

- BMW's sales in China in 2022: [Insert data - requires research]. This represented [percentage]% of their global sales.

- Porsche's sales in China in 2022: [Insert data - requires research]. This contributed significantly to their overall profitability.

- Projected Growth: Analysts predict [Insert data - requires research] growth in luxury car sales in China over the next five years.

H3: Unique Consumer Preferences and Demands

Chinese consumers have distinct preferences regarding vehicle features, styling, and technology. Understanding these nuances is paramount for product localization and successful marketing campaigns. The rise of digital marketing and online sales channels is transforming how luxury brands engage with this sophisticated consumer base.

- Preference for SUVs: SUVs consistently dominate sales in the Chinese luxury market.

- Technological Sophistication: Chinese consumers highly value advanced driver-assistance systems (ADAS), connectivity features, and in-car entertainment.

- Emphasis on Brand Image: Luxury brands need to maintain a strong and positive brand image to resonate with Chinese consumers.

- Digital Marketing Dominance: WeChat, Alibaba's Tmall, and other digital platforms are crucial for reaching and engaging potential buyers.

H2: China's Impact on the Automotive Supply Chain

H3: Sourcing Components and Manufacturing

Many automakers, including BMW and Porsche, rely heavily on Chinese suppliers for various components and parts. Manufacturing in China offers cost advantages and proximity to the vast domestic market. However, geopolitical risks and trade tensions can significantly disrupt these intricate supply chains.

- Battery Components: A significant portion of EV battery components are sourced from China.

- Electronics and Semiconductors: China is a major producer of electronic components crucial for modern vehicles.

- Raw Materials: China plays a significant role in the supply of various raw materials used in automotive manufacturing.

- Supply Chain Diversification: Automakers are increasingly looking to diversify their supply chains to mitigate risks associated with reliance on a single region.

H3: Navigating Trade Regulations and Tariffs

Understanding and adapting to China's evolving trade regulations is crucial for automakers. Tariffs, import duties, and other trade policies directly impact profitability and pricing strategies. Negotiating favorable trade agreements is essential for maintaining competitiveness in this dynamic market.

- Compliance with Chinese Regulations: Meeting stringent environmental and safety standards is mandatory for operating in China.

- Import Tariffs: Import tariffs on vehicles and components can significantly increase the cost of doing business in China.

- Government Incentives: The Chinese government offers various incentives to promote domestic manufacturing and the adoption of electric vehicles.

- Trade Agreements: Understanding and leveraging bilateral and multilateral trade agreements is vital for successful operations.

H2: The Rise of Chinese Electric Vehicle (EV) Manufacturers

H3: Increased Competition and Technological Innovation

The rapid emergence of Chinese EV manufacturers like BYD, NIO, and Xpeng poses a significant competitive challenge to established international players like BMW and Porsche. These companies are rapidly innovating in battery technology, autonomous driving, and other key areas. This intensified competition forces BMW and Porsche to accelerate their own EV strategies and enhance their technological capabilities.

- Market Share Growth: Chinese EV manufacturers are rapidly gaining market share both domestically and internationally.

- Technological Advancements: Chinese EV companies are pioneering advancements in battery technology, fast charging, and autonomous driving.

- Pricing Strategies: Competitive pricing strategies from Chinese manufacturers put pressure on established brands.

- Government Support: The Chinese government provides substantial support to the domestic EV industry, accelerating its growth.

H3: Impact on Investment and Research & Development

Automakers are investing heavily in electric vehicle development and infrastructure in China. Collaboration with Chinese technology companies and research institutions is becoming increasingly prevalent. The supportive policies of the Chinese government towards EVs are accelerating market adoption and technological advancements.

- Investment in Manufacturing Facilities: Significant investments are being made to establish manufacturing facilities and expand production capacity in China.

- Joint Ventures and Partnerships: Collaborations with Chinese companies are enabling access to technology and local expertise.

- R&D Spending: Increased R&D spending is focused on developing EVs tailored to the Chinese market and global demands.

- Charging Infrastructure: Investments in charging infrastructure are crucial for supporting the widespread adoption of EVs.

3. Conclusion:

The "China Factor" is undeniably reshaping the global automotive industry. For automakers like BMW and Porsche, success in the Chinese market is not just about maximizing sales but also navigating complex supply chains, understanding unique consumer preferences, and competing with increasingly innovative Chinese rivals. The future of the automotive industry is inextricably linked to China’s continued growth and influence.

Call to Action: Understanding the China factor is no longer optional; it's essential for survival and growth in the global automotive market. Stay informed about the latest developments in the Chinese automotive industry and adapt your strategies accordingly to leverage the opportunities and mitigate the challenges presented by this powerful China factor. Ignoring the implications of the China factor could prove detrimental to the long-term success of any global automaker.

Featured Posts

-

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 22, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Issue

Apr 22, 2025 -

Bank Of Canada Holds Rates What Economists At Fp Video Say

Apr 22, 2025

Bank Of Canada Holds Rates What Economists At Fp Video Say

Apr 22, 2025 -

New Business Hot Spots Across The Country An Interactive Map

Apr 22, 2025

New Business Hot Spots Across The Country An Interactive Map

Apr 22, 2025 -

Google Breakup A Real Possibility Examining The Antitrust Concerns

Apr 22, 2025

Google Breakup A Real Possibility Examining The Antitrust Concerns

Apr 22, 2025 -

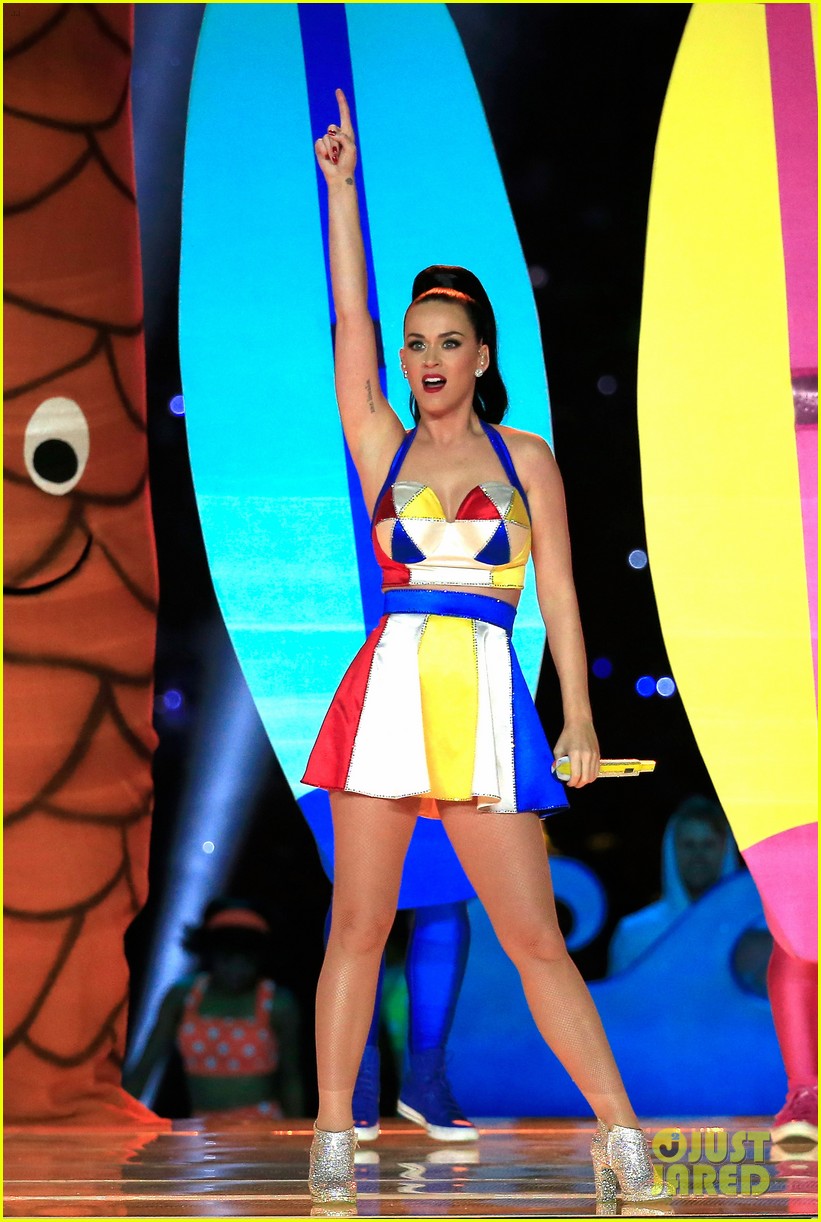

Jeff Bezos Blue Origin A Bigger Flop Than Katy Perrys Super Bowl

Apr 22, 2025

Jeff Bezos Blue Origin A Bigger Flop Than Katy Perrys Super Bowl

Apr 22, 2025