Uber's Robotaxi Gamble: Will It Drive Stock Prices Higher?

Table of Contents

The Potential Upsides of Uber's Robotaxi Investment

Uber's investment in self-driving cars presents several significant potential advantages that could boost its bottom line and, consequently, its stock prices.

Reduced Operational Costs

One of the most significant potential benefits of transitioning to a robotaxi fleet is the dramatic reduction in operational costs. Currently, a substantial portion of Uber's expenses goes towards driver salaries, insurance premiums, and accident-related costs. Self-driving cars promise to drastically alter this equation.

- Lower driver salaries: Eliminating the need for human drivers represents a massive cost saving.

- Reduced insurance premiums: Autonomous vehicles, with their advanced safety systems, could lead to significantly lower insurance premiums.

- Fewer accidents: Improved safety systems in self-driving cars have the potential to dramatically reduce the frequency and severity of accidents, minimizing associated costs.

Industry analysts project that the shift to autonomous vehicles could save ride-sharing companies billions of dollars annually. These savings could translate directly into increased profitability and a more attractive valuation for Uber stock.

Increased Efficiency and Scalability

Autonomous vehicles offer the potential for unparalleled efficiency and scalability. Unlike human drivers, self-driving cars can operate 24/7, maximizing vehicle utilization and minimizing downtime.

- Higher fleet utilization: Autonomous vehicles can operate continuously, leading to a much higher utilization rate compared to human-driven vehicles.

- Shorter wait times for riders: Increased availability of vehicles translates to shorter wait times for riders, improving customer satisfaction and potentially attracting more business.

- Expansion into new markets: The lower operational overhead associated with autonomous vehicles could allow Uber to expand into new markets with lower upfront investment and operational risk.

Furthermore, the ability to dynamically adjust pricing based on real-time demand and fleet availability, something easily managed with autonomous fleets, could optimize revenue streams and significantly boost profitability.

Enhanced Customer Experience

Beyond cost savings and efficiency, robotaxis offer the potential to enhance the customer experience. A consistent, safe, and potentially cheaper ride could significantly improve customer satisfaction.

- Improved safety features: Advanced safety systems built into autonomous vehicles could lead to a safer ride for passengers.

- Consistent driverless experience: Eliminating the variability associated with human drivers could create a more predictable and comfortable ride.

- Potential for personalized in-car entertainment: Self-driving cars provide opportunities for personalized in-car entertainment and enhanced comfort features.

Uber could also potentially offer premium robotaxi services with added features and amenities, catering to a higher-paying customer segment. This would create multiple revenue streams and enhance the overall value proposition.

The Challenges and Risks Facing Uber's Robotaxi Strategy

While the potential upsides are significant, Uber's robotaxi initiative also faces numerous challenges and risks that could negatively impact its stock price.

Technological Hurdles and Development Costs

Developing reliable and safe self-driving technology is an incredibly complex and expensive undertaking.

- High R&D expenses: The cost of research, development, and testing of autonomous vehicle technology is substantial.

- Software bugs and glitches: Unforeseen software bugs and glitches could lead to accidents and negatively impact public perception.

- Regulatory hurdles and approvals: Obtaining regulatory approvals for autonomous vehicles is a lengthy and complex process.

The time it takes to achieve widespread deployment of reliable autonomous vehicles is uncertain and could significantly impact the timeline for realizing the potential cost savings and revenue increases.

Public Perception and Safety Concerns

Public perception and safety concerns regarding autonomous vehicles remain a significant hurdle.

- Addressing safety concerns: Overcoming public skepticism and fear requires demonstrably safe technology and robust safety testing.

- Overcoming consumer trust issues: Building public trust in autonomous vehicles is crucial for widespread adoption.

- Potential negative publicity related to accidents: Any accidents involving autonomous vehicles could generate negative publicity and severely damage public confidence.

Robust safety testing, transparent communication, and effective public education campaigns are essential to address these concerns.

Competition and Market Saturation

The autonomous vehicle sector is becoming increasingly competitive.

- Competition from other tech giants: Uber faces competition from other tech giants like Google's Waymo and Tesla.

- Established automakers: Established automakers are also heavily investing in autonomous vehicle technology.

- Startups: Numerous startups are vying for a piece of the autonomous vehicle market.

The potential for market saturation and price wars could squeeze profit margins and limit the potential return on Uber's investment.

Analyzing the Impact on Uber's Stock Price

Uber's robotaxi gamble will undoubtedly impact its stock price, but predicting the extent and direction of this impact is challenging.

Investor Sentiment and Market Reaction

Investor sentiment towards Uber's robotaxi initiative will significantly influence its stock price.

- Positive news driving up stock prices: Positive developments, such as successful trials and regulatory approvals, could boost investor confidence and drive up the stock price.

- Negative news causing dips: Negative news, such as accidents or delays in development, could cause stock prices to fall.

- Overall market conditions affecting stock performance: General market conditions will also play a role in determining Uber's stock performance.

Monitoring news related to Uber's robotaxi program and analyzing investor sentiment is crucial for understanding potential stock price fluctuations.

Long-Term Investment Potential

The long-term investment potential of Uber's robotaxi venture depends on several factors, including the successful development and deployment of reliable self-driving technology, favorable regulatory environments, and the ability to overcome public safety concerns.

- Potential for exponential growth: Successful implementation of robotaxis could lead to exponential growth in Uber's revenue and market share.

- Significant return on investment (ROI): The potential ROI on Uber's investment in autonomous vehicles could be substantial if the technology proves successful.

- Long-term competitive advantage: A successful robotaxi strategy could provide Uber with a significant long-term competitive advantage.

Based on various scenarios, the long-term impact on Uber's stock price is uncertain. However, the potential for significant long-term growth makes it a high-risk, high-reward investment proposition.

Conclusion

Uber's robotaxi gamble is a high-stakes endeavor with both substantial potential upsides and considerable risks. While the reduction in operational costs, increased efficiency, and enhanced customer experience offered by self-driving cars are highly attractive, significant challenges remain in overcoming technological hurdles, addressing public safety concerns, and navigating intense competition. The impact on Uber's stock price will depend heavily on the successful development and deployment of this technology, favorable regulatory outcomes, and positive public perception. Analyzing Uber's robotaxi gamble requires a careful assessment of these factors. Understanding the risks and rewards of Uber's self-driving car initiative is crucial for investors considering its long-term investment potential. Further research into Uber's autonomous vehicle strategy is essential to make informed decisions about its stock.

Featured Posts

-

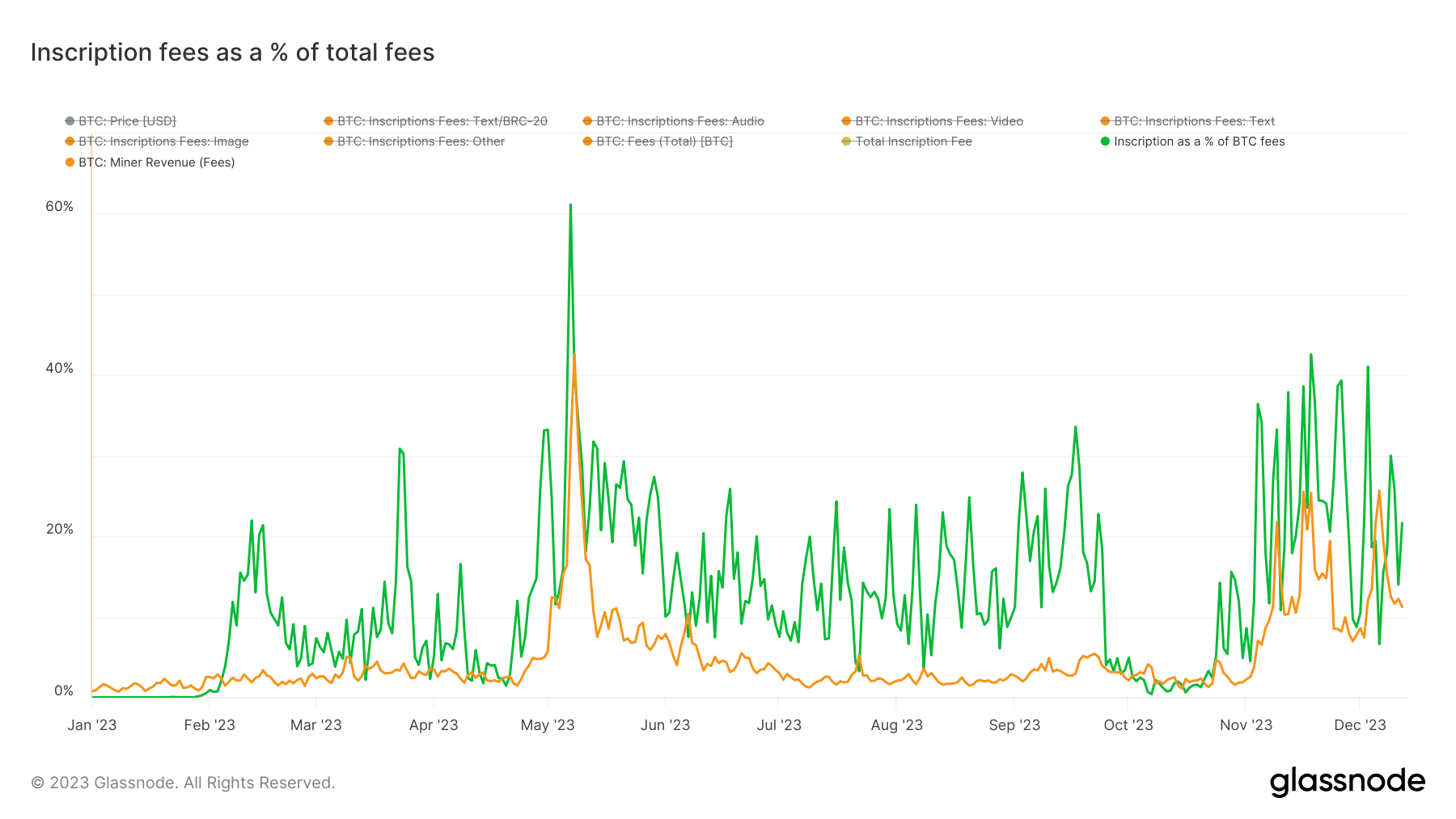

Why Bitcoin Miner Revenue Soared This Week

May 08, 2025

Why Bitcoin Miner Revenue Soared This Week

May 08, 2025 -

Arsenal News Analyzing The Dembele Injury Situation

May 08, 2025

Arsenal News Analyzing The Dembele Injury Situation

May 08, 2025 -

Arrascaeta Brilla El Flamengo Celebra El Triunfo En La Taca Guanabara

May 08, 2025

Arrascaeta Brilla El Flamengo Celebra El Triunfo En La Taca Guanabara

May 08, 2025 -

New Superman Sneak Peek Kryptos Unexpected Attack

May 08, 2025

New Superman Sneak Peek Kryptos Unexpected Attack

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025