Uber Stock (UBER): Is It Worth The Investment?

Table of Contents

Uber's Current Financial Performance and Market Position

Analyzing Uber's financial health and market standing provides a crucial foundation for evaluating its investment potential. Let's examine key metrics and trends.

Revenue Growth and Profitability

Uber's revenue growth has been significant, but profitability remains a key area of focus for investors. Examining key financial ratios provides further insight.

- Year-over-Year Revenue Growth: Uber has consistently demonstrated strong year-over-year revenue growth, though the rate of growth may fluctuate depending on economic conditions and competitive pressures. Analyzing specific figures from their financial reports is essential for a complete understanding. For example, a comparison of Q1 2023 to Q1 2022 reveals [insert actual data here, citing the source].

- Profitability Improvements/Challenges: While Uber has shown revenue growth, achieving consistent profitability remains a challenge. Factors impacting profitability include high operating expenses, driver compensation, and intense competition. Analyzing metrics such as gross profit margin, operating income, and net income is crucial to assessing their progress towards profitability. [Insert relevant data and analysis here].

- Impact of Competition and Market Share: Uber faces stiff competition from Lyft and other ride-sharing services, impacting its market share and pricing strategies. Analyzing market share data and competitive landscape helps determine Uber's ability to maintain its leading position and pricing power. [Insert market share data and competitive analysis here]

Market Capitalization and Stock Price Analysis

Understanding Uber's market capitalization and stock price trends is essential for any investment consideration.

- Key Stock Price Movements: Uber's stock price has experienced significant volatility since its IPO. Analyzing historical trends, including major highs and lows, helps understand market sentiment and investor behavior. [Include a chart illustrating stock price fluctuations].

- Significant Events Impacting Stock Price: Earnings reports, regulatory changes, and major announcements (e.g., new partnerships, service launches) all significantly impact Uber's stock price. Analyzing these events and their impact is crucial. [Discuss specific examples of these events and their effect].

- Comparison to Competitor Stock Performance: Comparing Uber's stock performance to its main competitor, Lyft, provides valuable context. This allows investors to assess relative performance and market sentiment within the ride-sharing sector. [Include a comparison chart of Uber and Lyft stock performance].

Future Growth Potential and Opportunities

Uber's future prospects depend on its ability to expand into new markets and services, and leverage technological innovation.

Expansion into New Markets and Services

Uber's growth strategy hinges on expansion and diversification.

- Expansion Plans and Progress: Uber continues to expand geographically, targeting new markets with high growth potential. Tracking their progress in these markets is essential. [Detail their expansion plans and achievements].

- Impact of New Services on Revenue Growth: Uber Eats and Uber Freight represent significant diversification efforts, contributing to revenue growth beyond the core ride-sharing business. Analyzing the performance of these segments is vital. [Include data on the contribution of these services to overall revenue].

- Competitive Landscape in New Markets: The competitive landscape varies across different geographical markets. Analyzing the level of competition in new target markets is crucial for assessing the potential for success. [Discuss the competitive landscape in specific regions].

Technological Innovation and Competitive Advantages

Technological advancements are crucial for Uber's competitive advantage.

- Key Technologies and Innovations: Uber's ride-sharing app, driverless car initiatives, and other technological investments differentiate it from competitors. [Highlight key technologies and their impact].

- Comparison to Competitors' Technology: Evaluating Uber's technology compared to Lyft and other competitors highlights its strengths and weaknesses in the technological race. [Provide a comparative analysis of technologies].

- Patents and Intellectual Property: Uber's intellectual property portfolio contributes to its competitive moat. Analyzing the strength and scope of its patents provides valuable insight. [Discuss significant patents and their implications].

Risks and Challenges Facing Uber

Despite its growth potential, Uber faces numerous challenges and risks.

Regulatory Hurdles and Legal Battles

The regulatory environment for ride-sharing is constantly evolving, posing significant challenges.

- Key Regulatory Challenges in Different Regions: Uber faces varying regulatory hurdles across different countries and cities. Analyzing these challenges provides insight into potential operational and financial risks. [Discuss regulatory challenges in key markets].

- Ongoing or Potential Lawsuits: Legal battles related to driver classification, safety regulations, and other issues pose significant financial and reputational risks. [Highlight important legal cases and their potential impact].

- Impact of Regulations on Profitability and Growth: Regulatory changes can impact profitability and growth prospects. Analyzing the potential impact of these changes is critical. [Discuss the potential impact of specific regulations].

Competition and Market Saturation

Intense competition and potential market saturation pose significant risks.

- Key Competitors and Market Share: Analyzing the market share of Uber and its main competitors provides context for assessing its competitive position. [List key competitors and their respective market shares].

- Impact of Price Wars and Competitive Strategies: Price wars and intense competitive pressure can negatively impact profitability. Analyzing these dynamics is essential. [Discuss the impact of competitive pricing strategies].

- Potential for Market Consolidation: The ride-sharing market might undergo consolidation in the future. Analyzing the potential for mergers and acquisitions is crucial. [Discuss the possibility of future market consolidation].

Economic Factors and External Risks

Macroeconomic factors and external risks can significantly impact Uber's business.

- Potential Economic and External Risks: Economic downturns, inflation, pandemics, and geopolitical events can all negatively affect Uber's performance. [Identify and analyze potential economic and external risks].

- Company's Resilience to These Risks: Assessing Uber's ability to withstand these risks is crucial for evaluating its long-term viability. [Discuss Uber's strategies for mitigating these risks].

Conclusion

Investing in Uber stock (UBER) presents a complex scenario with both significant growth potential and substantial risks. While Uber has demonstrated strong revenue growth and expansion into new markets and services, challenges remain regarding profitability, regulatory hurdles, and intense competition. Its future success will depend heavily on its ability to navigate these challenges and capitalize on emerging opportunities in autonomous driving and other technological advancements. The stock's volatility also necessitates a careful evaluation of your personal risk tolerance before considering any investment.

Call to Action: This analysis provides a comprehensive overview, but thorough due diligence is essential before investing in Uber stock (UBER) or any other security. Consider consulting with a qualified financial advisor to assess your personal financial goals and risk tolerance. Further research into Uber's financial statements, industry reports, and competitor analysis will help you make an informed investment decision. Remember to always prioritize diversification within your investment portfolio.

Featured Posts

-

End Of An Era Ryujinx Emulator Shuts Down Due To Nintendo

May 08, 2025

End Of An Era Ryujinx Emulator Shuts Down Due To Nintendo

May 08, 2025 -

March 29th Nba Game Thunder Vs Pacers Injury Report And Analysis

May 08, 2025

March 29th Nba Game Thunder Vs Pacers Injury Report And Analysis

May 08, 2025 -

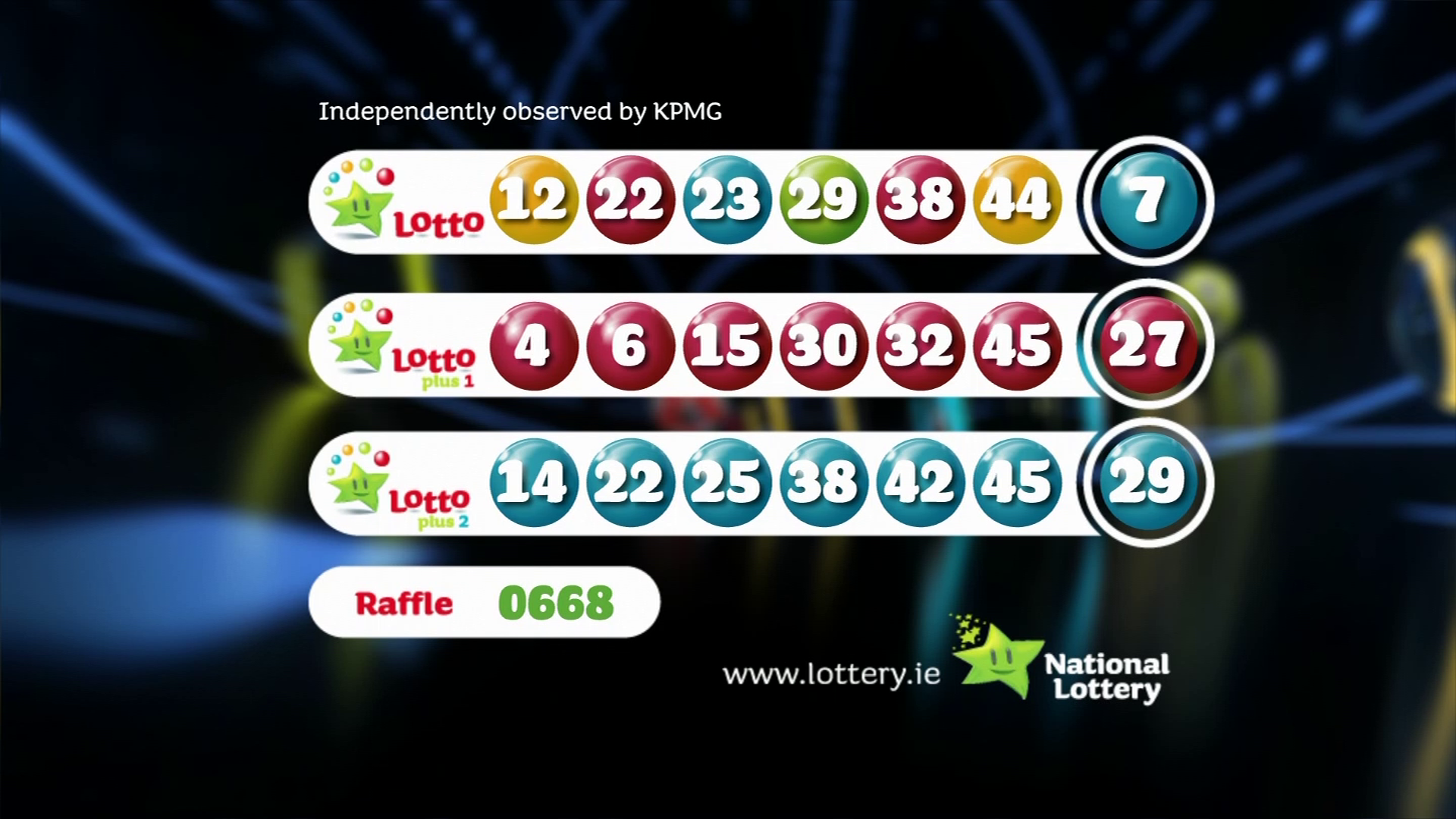

Saturday April 12th Lotto Draw Winning Numbers Announced

May 08, 2025

Saturday April 12th Lotto Draw Winning Numbers Announced

May 08, 2025 -

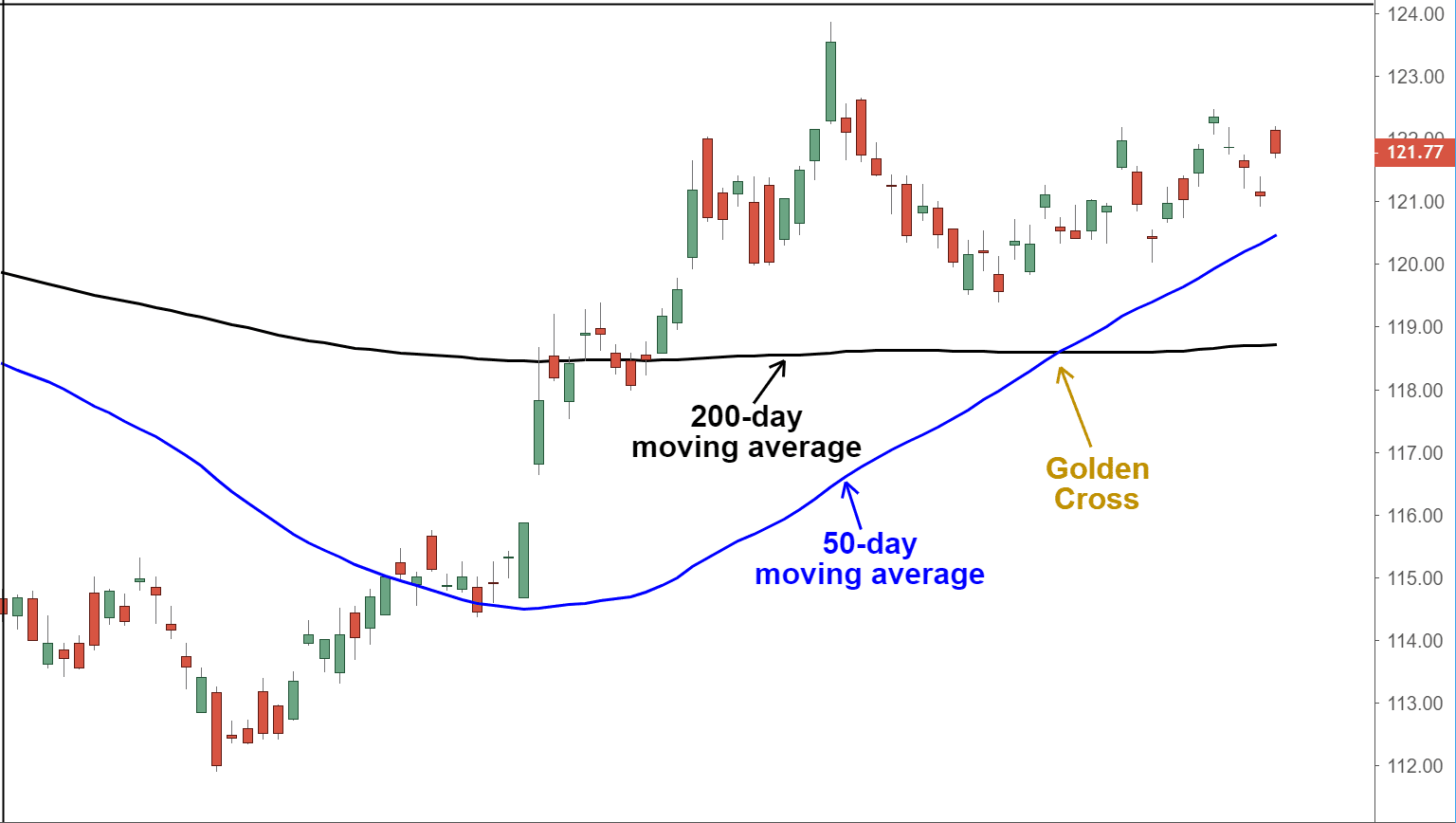

Understanding Bitcoins Golden Cross Market Predictions And Analysis

May 08, 2025

Understanding Bitcoins Golden Cross Market Predictions And Analysis

May 08, 2025 -

Check The Lotto Numbers Saturday April 12th Draw Results

May 08, 2025

Check The Lotto Numbers Saturday April 12th Draw Results

May 08, 2025