U.S. Fed Rate Decision: Balancing Inflation And Unemployment Risks

Table of Contents

Current Inflationary Pressures and the Fed's Mandate

The current inflation rate remains a significant concern for the U.S. economy. Several factors contribute to this persistent inflationary pressure. Supply chain disruptions, lingering from the pandemic, continue to constrain the availability of goods, pushing prices higher. Soaring energy prices, exacerbated by geopolitical instability, have added further fuel to the inflationary fire. Robust consumer demand, fueled by pent-up savings and a strong labor market, also contributes to upward pressure on prices.

The Fed's mandate is twofold: price stability and maximum employment. This creates a challenging balancing act. Aggressive interest rate hikes can curb inflation by cooling down demand, but they also risk triggering a recession and significantly increasing unemployment.

- Recent inflation data: The Consumer Price Index (CPI) and Producer Price Index (PPI) are key indicators closely watched by the Fed. Sustained increases in these indices signal persistent inflationary pressures.

- Geopolitical impact: The war in Ukraine and other global conflicts significantly impact energy prices and supply chains, contributing to inflationary pressures beyond the Fed's direct control.

- Monetary policy's role: The Fed uses monetary policy tools, primarily interest rate adjustments, to influence inflation. Raising interest rates makes borrowing more expensive, reducing spending and investment, thereby cooling the economy and curbing inflation.

The Unemployment Landscape and Potential Recessionary Risks

The U.S. unemployment rate currently sits at a historically low level, reflecting a strong labor market. However, the risk of increased unemployment due to aggressive rate hikes is a serious concern for policymakers. Raising interest rates too sharply could stifle business investment, leading to job losses and a potential recession.

- Labor market resilience: While the unemployment rate is low, there are signs of softening in certain sectors. This suggests that the labor market may be more vulnerable to interest rate increases than it initially appears.

- Impact on business investment and hiring: Higher borrowing costs discourage businesses from investing and expanding, which can lead to reduced hiring and even layoffs.

- Recessionary indicators: Factors like an inverted yield curve (where short-term interest rates exceed long-term rates) and slowing economic growth are often considered leading indicators of a potential recession.

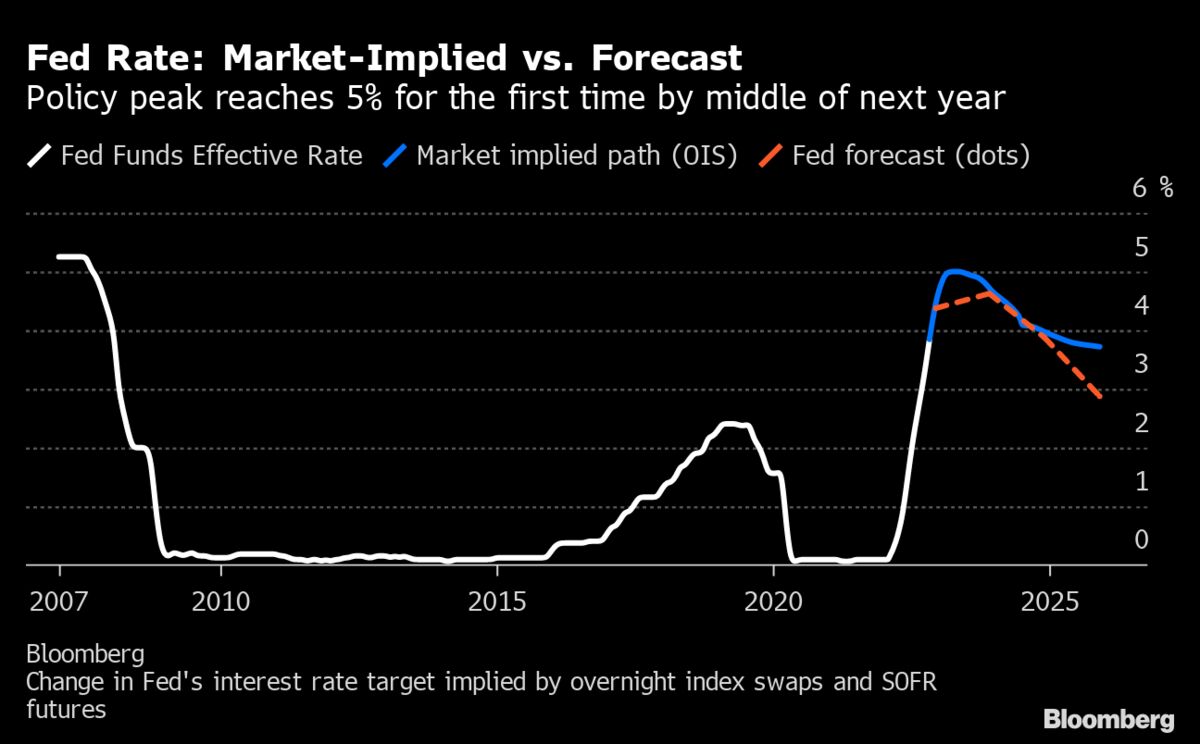

Analyzing the Fed's Potential Rate Hike Scenarios

The Fed's upcoming rate decision presents several possibilities. A 25 basis point hike is one scenario, representing a measured approach. A pause in rate hikes is another possibility, suggesting that the Fed believes inflation is under control or that the risks of further tightening outweigh the benefits. Alternatively, a larger increase, such as 50 basis points, could signal a more aggressive approach to tackling inflation.

- Market expectations: Financial markets closely monitor Fed statements and economic data to anticipate the central bank’s actions. Market expectations can significantly influence the actual impact of the rate decision.

- Future rate hikes: The current rate decision is unlikely to be the last. The Fed's future actions will depend on incoming economic data and the effectiveness of previous rate hikes in curbing inflation.

- Soft landing vs. recession: The Fed aims for a "soft landing"—slowing economic growth enough to tame inflation without triggering a recession. However, achieving this is notoriously difficult.

Impact on Different Sectors of the Economy

The Fed's rate decision will have a ripple effect across various sectors of the economy. The housing market, highly sensitive to interest rates, is likely to experience further cooling. Higher borrowing costs will make mortgages more expensive, reducing demand and potentially leading to price declines. Manufacturing and consumer spending will also be affected, as higher interest rates reduce business investment and consumer borrowing.

- Housing market impact: Higher mortgage rates will directly impact affordability, reducing demand and potentially leading to a decline in housing prices.

- Corporate profits and investment: Reduced consumer spending and higher borrowing costs will likely squeeze corporate profits, leading to decreased investment and potential job cuts.

- Consumer borrowing and spending: Higher interest rates on credit cards and loans will reduce consumer spending, potentially dampening economic growth.

Conclusion

The U.S. Fed rate decision is a pivotal moment demanding careful consideration of the complex interplay between inflation and unemployment. The Fed’s actions will have far-reaching consequences for the American economy, impacting various sectors and the lives of millions. While controlling inflation is paramount, the risk of triggering a recession through overly aggressive rate hikes must be carefully managed. Understanding the nuances of this decision requires close monitoring of economic indicators and an awareness of the potential implications for both consumers and businesses. Stay informed about the upcoming U.S. Fed rate decision and its impact on your financial well-being. Continue to monitor developments related to the U.S. Fed rate decision to make informed financial choices. Understanding the intricacies of the U.S. Fed rate decision is crucial for navigating the current economic climate.

Featured Posts

-

Tensions Flare Joanna Pages Confrontation With Wynne Evans On Bbc

May 10, 2025

Tensions Flare Joanna Pages Confrontation With Wynne Evans On Bbc

May 10, 2025 -

Anchor Brewing Company Closes After 127 Years The End Of An Era

May 10, 2025

Anchor Brewing Company Closes After 127 Years The End Of An Era

May 10, 2025 -

Chinas Steel Production Cuts Implications For The Iron Ore Market

May 10, 2025

Chinas Steel Production Cuts Implications For The Iron Ore Market

May 10, 2025 -

Stephen Kings Comments Comparing Stranger Things To It

May 10, 2025

Stephen Kings Comments Comparing Stranger Things To It

May 10, 2025 -

Weston Cage Accused Amidst Fathers Lawsuit Dismissal

May 10, 2025

Weston Cage Accused Amidst Fathers Lawsuit Dismissal

May 10, 2025