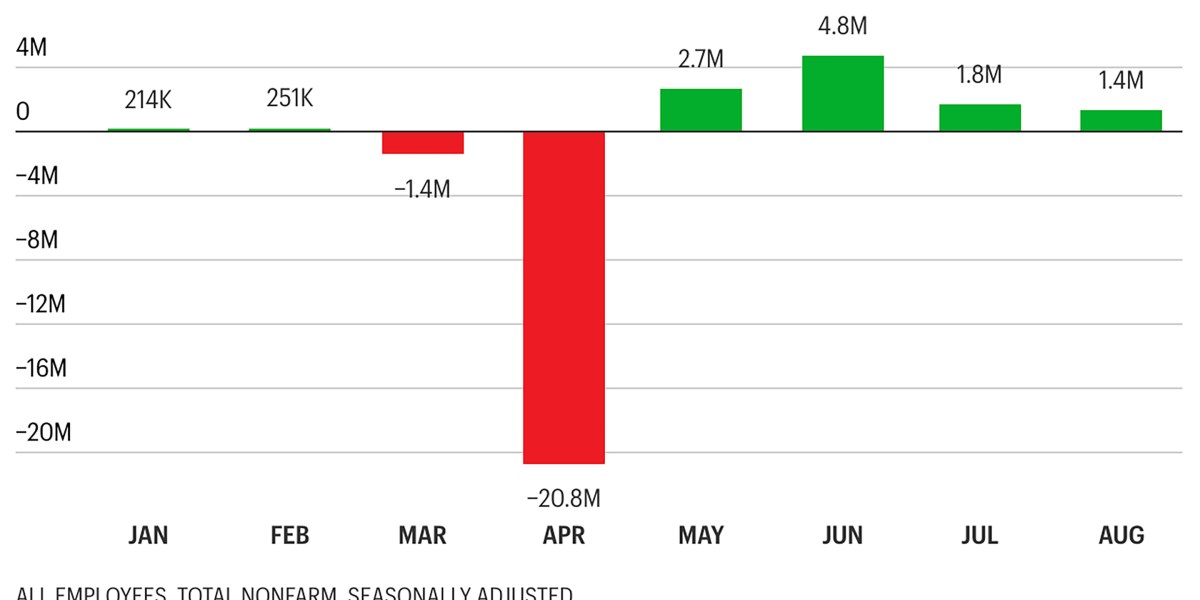

U.S. Economy Adds 177,000 Jobs In April; Unemployment Rate Unchanged At 4.2%

Table of Contents

Job Growth Breakdown: Sector-Specific Analysis

The 177,000 jobs added in April weren't evenly distributed across all sectors. Understanding this sectoral performance provides a more comprehensive view of the U.S. employment landscape.

Which sectors contributed most to job growth in April?

-

Professional and Business Services: This sector saw significant employment gains, adding approximately 60,000 jobs. This growth reflects continued demand for consulting, management, and administrative support services. The increase suggests a robust expansion in various businesses and industries needing professional expertise.

-

Leisure and Hospitality: This sector added around 40,000 jobs, showing a continued recovery from the pandemic's impact. Increased travel, tourism, and entertainment spending fueled this employment growth. This is a positive indicator of consumer confidence and economic activity.

-

Healthcare: The healthcare sector continued its steady growth trend, adding approximately 30,000 jobs. This reflects the ongoing demand for medical professionals and support staff. This sustained growth highlights the importance of the healthcare industry and the consistent need for skilled workers.

Industries experiencing job losses or slow growth.

While many sectors experienced growth, some faced challenges:

-

Technology: Several tech companies announced layoffs in April, leading to a net decline in employment in the tech sector. This slowdown was partly due to economic uncertainty and a correction in the tech industry after years of rapid expansion.

-

Manufacturing: Manufacturing saw only modest job growth, reflecting global economic headwinds and supply chain disruptions that persist in some areas. This points to ongoing challenges related to global trade and the complexities of modern manufacturing.

Unemployment Rate Remains Stable at 4.2%

The unemployment rate remained unchanged at 4.2% in April, signifying a relatively stable labor market. However, a deeper dive into the data reveals important nuances.

Analysis of the unemployment rate's stability.

-

Labor Force Participation Rate: The relatively stable unemployment rate might be partly due to a consistent labor force participation rate, meaning the percentage of the working-age population actively employed or seeking work stayed relatively the same. This factor is crucial in understanding the overall health of the labor market.

-

Job Openings and Skills Match: The persistent job openings in certain sectors indicate a potential skills mismatch. Businesses might be struggling to find qualified candidates for available positions, which could contribute to the overall unemployment picture.

Discussion of the labor force participation rate.

The labor force participation rate remains below pre-pandemic levels. Several factors contribute to this, including demographic shifts and workforce re-evaluation. Understanding this trend is crucial for policymakers and businesses to adapt to future labor market needs. Analyzing the employment-to-population ratio provides further insight into the overall engagement of the workforce.

Wage Growth and Inflationary Pressures

Wage growth remains a key factor influencing both consumer spending and inflationary pressures.

Average hourly earnings and their implications.

Average hourly earnings increased by 0.5% in April, which is a moderate increase. This rate, while positive for workers, also fuels concerns about inflation. The Federal Reserve carefully monitors wage growth to guide its monetary policy decisions, aiming to balance economic growth with price stability. The cost of living continues to be a major concern, necessitating careful consideration of these statistics.

Impact on consumer spending and economic outlook.

The interplay between wage growth and inflation heavily impacts consumer spending. Moderate wage increases, if not outpacing inflation, can support consumer spending and boost economic growth. However, significant wage growth exceeding inflation could further fuel price increases, leading to potentially detrimental economic consequences. This requires ongoing monitoring of GDP growth and its relation to these factors.

Interpreting the April U.S. Jobs Report: What's Next for the Economy?

The April U.S. jobs report reveals a mixed picture. The addition of 177,000 jobs indicates continued growth, albeit at a moderate pace. The stable unemployment rate at 4.2% suggests resilience in the labor market. However, sectoral variations and wage growth's impact on inflation warrant close monitoring. Potential risks include persistent inflation and global economic uncertainty. Opportunities exist in addressing skills mismatches and fostering growth in key sectors.

Stay tuned for the next U.S. jobs report to understand the continuing evolution of the U.S. economy's employment landscape and the ongoing impact of the U.S. employment numbers on the broader economy. Analyzing future U.S. employment data will be key to understanding the future trajectory of the U.S. jobs market.

Featured Posts

-

Singapore Votes Assessing The Oppositions Chances Against The Pap

May 05, 2025

Singapore Votes Assessing The Oppositions Chances Against The Pap

May 05, 2025 -

Cocaines Global Surge The Role Of Potent Powder And Narco Submarines

May 05, 2025

Cocaines Global Surge The Role Of Potent Powder And Narco Submarines

May 05, 2025 -

Norways Sovereign Wealth Fund And The Trump Tariff Challenge Nicolai Tangens Actions

May 05, 2025

Norways Sovereign Wealth Fund And The Trump Tariff Challenge Nicolai Tangens Actions

May 05, 2025 -

The Return Of Bob Baffert A Look At The Controversies Surrounding His Kentucky Derby Comeback

May 05, 2025

The Return Of Bob Baffert A Look At The Controversies Surrounding His Kentucky Derby Comeback

May 05, 2025 -

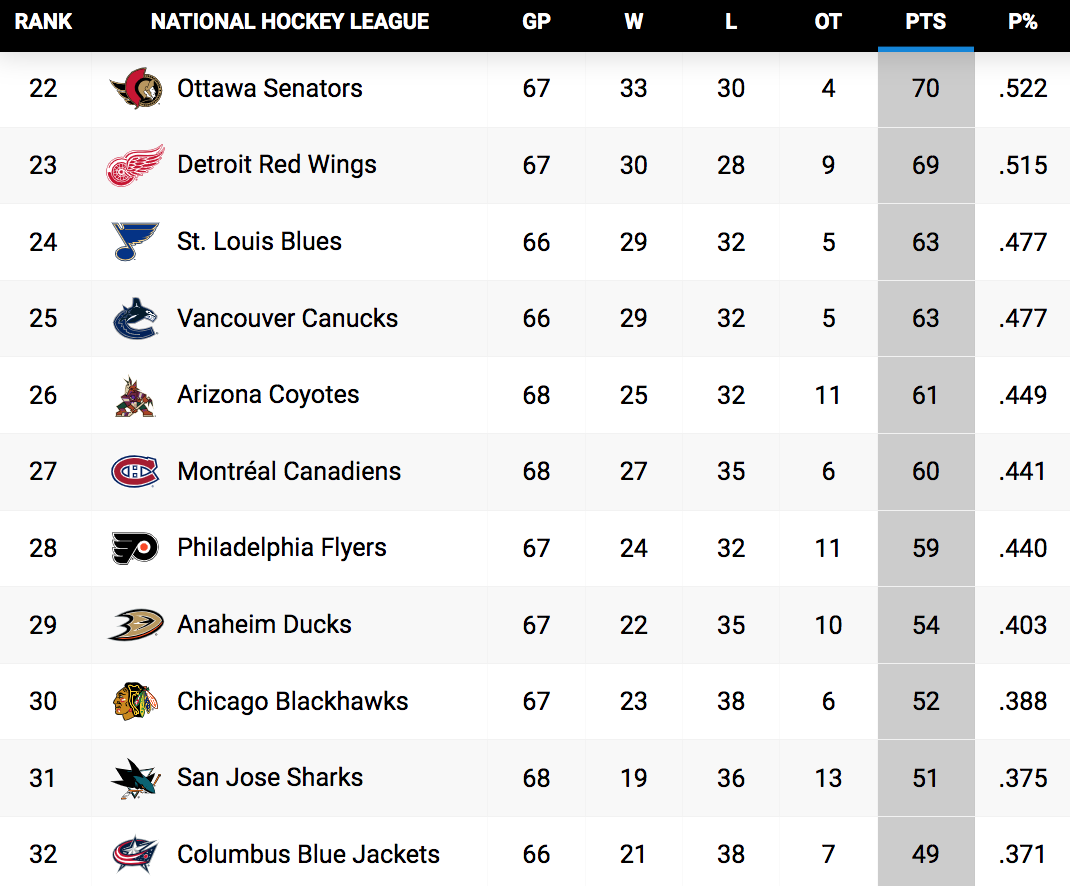

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025

Latest Posts

-

Ufc 314 Winner Paddy Pimblett Throws Lavish Yacht Party

May 05, 2025

Ufc 314 Winner Paddy Pimblett Throws Lavish Yacht Party

May 05, 2025 -

Paddy Pimbletts Post Ufc 314 Yacht Party Exclusive Details

May 05, 2025

Paddy Pimbletts Post Ufc 314 Yacht Party Exclusive Details

May 05, 2025 -

Ufc 314 What To Expect From The Volkanovski Vs Lopes Main Event

May 05, 2025

Ufc 314 What To Expect From The Volkanovski Vs Lopes Main Event

May 05, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Betting Odds

May 05, 2025

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Betting Odds

May 05, 2025 -

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025